The Europe Cruise Industry is experiencing significant growth driven by increasing demand for luxury and experiential travel among diverse tourist groups. The future outlook for this market is shaped by rising disposable incomes, growing preference for personalized travel experiences, and expanding connectivity across European ports. Cruise operators are investing in innovative ships with advanced amenities, which are enhancing passenger experiences and attracting new travelers.

The industry is also benefiting from digital transformation, with online booking platforms and targeted marketing campaigns enabling easier access to cruise offerings and improved customer engagement. Sustainability initiatives and environmental compliance are further influencing the market, as operators adopt eco-friendly vessels and practices, meeting regulatory requirements and traveler expectations.

Additionally, the growing trend of short-duration cruises and themed itineraries is driving repeat bookings and higher occupancy rates As Europe remains a preferred destination for both domestic and international tourists, the cruise industry is positioned to maintain robust growth, supported by strong infrastructure, diverse routes, and an increasing focus on tailored travel experiences.

| Metric | Value |

|---|---|

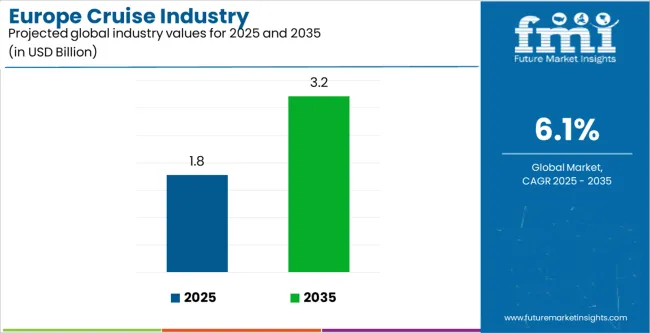

| Europe Cruise Industry Estimated Value in (2025 E) | USD 1.8 billion |

| Europe Cruise Industry Forecast Value in (2035 F) | USD 3.2 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

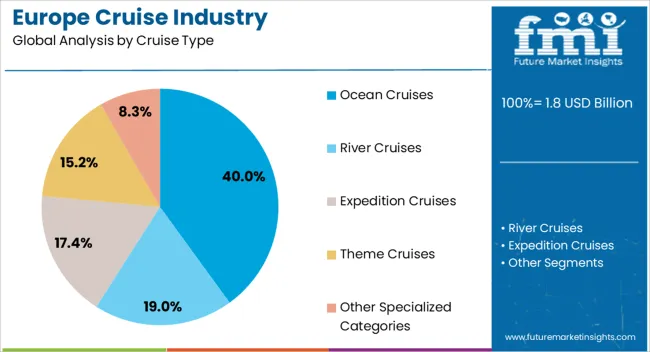

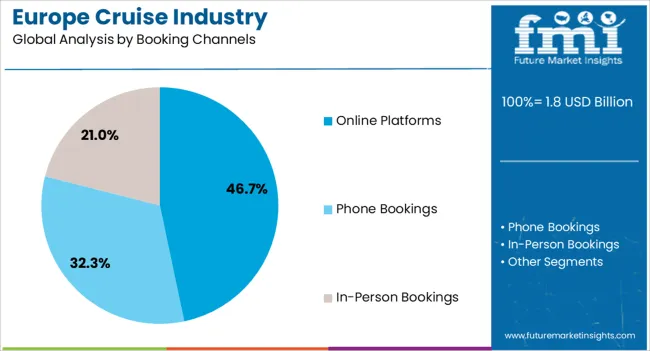

The market is segmented by Cruise Type, Booking Channels, Tourist Type, and Age Group and region. By Cruise Type, the market is divided into Ocean Cruises, River Cruises, Expedition Cruises, Theme Cruises, and Other Specialized Categories. In terms of Booking Channels, the market is classified into Online Platforms, Phone Bookings, and In-Person Bookings. Based on Tourist Type, the market is segmented into Domestic Tourists and International Tourists. By Age Group, the market is divided into 26-35 Years, 15-25 Years, 36-45 Years, 46-55 Years, 56-65 Years, and 66-75 Years. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ocean cruises segment is projected to hold 40.00% of the Europe Cruise Industry revenue share in 2025, making it the leading cruise type. This dominance is primarily due to the ability of ocean cruises to offer extensive itineraries across multiple countries and ports, providing travelers with a comprehensive and immersive experience.

High-quality onboard amenities and entertainment options further enhance passenger satisfaction, encouraging repeat travel. The segment has also benefited from significant investments in larger vessels that improve capacity and operational efficiency.

Consumer preference for luxurious and longer-duration cruises has reinforced the popularity of ocean cruises, while innovations in ship design and service offerings continue to attract diverse tourist demographics The segment’s growth is further supported by strong marketing efforts by cruise operators, targeting high-income travelers and enhancing brand visibility across Europe.

The online platforms booking channel segment is expected to capture 46.70% of the Europe Cruise Industry revenue share in 2025, establishing it as the leading booking method. The growth of this segment has been driven by the convenience and accessibility offered by digital booking solutions, allowing travelers to compare itineraries, pricing, and services in real time.

Online platforms also provide personalized recommendations, discounts, and loyalty benefits, which increase consumer engagement and conversion rates. The expansion of mobile applications and digital payment solutions has further facilitated seamless booking experiences, catering to tech-savvy travelers.

Additionally, the ability to access reviews, virtual tours, and customer feedback has reinforced trust in online booking, making it the preferred channel for a significant portion of cruise passengers.

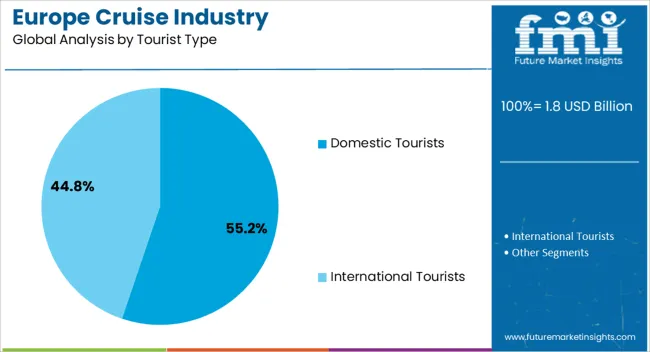

The domestic tourist segment is anticipated to account for 55.20% of the Europe Cruise Industry revenue in 2025, making it the dominant tourist type. The growth of this segment is influenced by increasing awareness of cruise travel options within individual countries, coupled with rising disposable incomes and a preference for short-distance travel.

Domestic travelers are attracted by the convenience of local itineraries, lower travel costs, and flexible scheduling. Cruise operators are tailoring offerings to meet the needs of domestic tourists, including themed cruises, family-friendly services, and culturally relevant experiences.

Marketing campaigns targeting local populations and promotions highlighting nearby ports have further boosted domestic participation As domestic tourism continues to recover and expand in Europe, the segment remains a key driver of overall cruise industry growth.

European River Cruises Are Experiencing an Adventure Resurgence

Major travel companies are adding thrilling excursions to their selectively designed itineraries-such as kayaking and cycling adventures-to reshape the landscape of European river cruises. This exciting evolution responds to a rapidly growing demographic of travelers looking for more active modes of exploration while still experiencing the unsurpassed comfort and access to culture that define river cruising.

Intimate Popularity Surges in European Cruising

A leading trend in Europe’s cruise industry is the continuous growth in the popularity of small-ship cruises. They are small and intimate vessels, able to cruise into delightful ports and secluded coves where larger ships cannot get. This translates into a more personal experience for passengers, fostering a deeper connection with the destinations and fellow travelers.

Sustainable Practices Outline Europe's Cruise Future

The cruise industry in Europe is very environmentally conscious, and most of the cruise lines in Europe are all for sustainable practices for a better tomorrow. It includes the use of cleaner fuel options to keep emissions low, plus the use of meticulously detailed waste reduction strategies, keeping the natural European seascape pure for the future.

European Cruises Set Sail for Solo Travelers

Such solo cruising around Europe, a daunting prospect some years ago, is coming into more normal reach. Cruise lines in Europe offer specially designed cabins, sociable activities, and good solo dining alternatives because they realize that many people of all ages are single travelers. This new focus on the solo traveler ensures everybody a smooth and enriching cruise experience.

A Culinary Voyage: European Waterways Set Their Sights on Foodie Delights

The cruise industry in Europe has embarked on a culinary adventure with the fabulous, delectable undertakings of locally sourced menus that best represent the culinary tapestry of the regions. Passengers can now immerse in the cultural landscape through an experience with tastes of the destination that go beyond the plate.

European Cruises Embrace the Digital Age

The technological revolution has changed the ways in which people are able to cross the world, and European cruises are not an exception. Mobile platform applications unite the entire stream of the cruise experience, from shore excursion booking to contactless on-board payments, in silence. This means easy convenience, with power to the passenger to tailor a journey to their satisfaction.

Wellness On European Cruises, The Holistic Way To Travel

Wellness approach is truly paying off in European cruises. Vessels are prepared with onboard yoga studios, healthy and delicious dining options, and even shore excursions that are designed to specifically boost mindfulness. The integration of wellness practices allows passengers to return from their journeys feeling rejuvenated and invigorated.

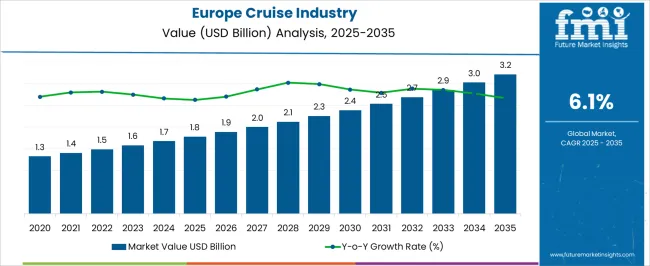

The sales analysis of cruises in Europe between 2020 and 2025 shows a CAGR of 5.6%, which is a very healthy sign for the industry during this period. Increased post-recession travel, intense marketing, and new cruise destinations captured the minds of many. The industry embraced technological benefits and improved the operational efficiency and experience of customers.

The industry is on a bullish trajectory climbing at a CAGR of 6.1% through 2035. The reasons for such a projection include. Firstly, the cruise industry is entering new territories, that of Asia and Africa.

Secondly, the cruise industry's effort to provide sustainable and green cruise packages is appealing to an entirely new audience of the environmentally-conscious traveling public. To in-source luxury cruise amenities or develop more highly personalized experiences may further add to an upward trend in spending per customer.

Europe cruise industry is poised for continued growth, with the potential to outpace previous forecasts. The industry’s effort to improve the health and security of the passengers, particularly in light of global health issues, is likely to inspire greater faith in cruise travel.

Besides, the incorporation of digital technologies for booking and onboard experiences of the passengers as well as the development of smart ships, is expected to be another factor that could contribute to the growth of the market.

The United Kingdom, Germany, and Italy in Europe’s cruise industry are witnessing a steady surge in cruise demand. Meanwhile, France and Spain are forecast to offer lucrative prospects to the players eying for expansion.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United Kingdom | 5.8% |

| Germany | 5.8% |

| Italy | 5.3% |

| France | 6.3% |

| Spain | 7.4% |

The United Kingdom cruise industry is likely to continue growing more gradually, at a sluggish pace of 5.8% CAGR over 2035. Indeed, the UK cruise industry is saturated with history and culture, which continues to tempt consumers to have land-based tours to learn more about these treasures.

A travel industry already busy with staycations and short-break holidays in the UK might be more influenced by this option than many think as the cruise industry doesn't stand still. With the recognition of these preferences, the cruise lines are beginning to model their offerings in a way that would appeal to British sensibilities.

This is in effect from itineraries based on historical exploration, allowing passengers a visit to the rich heritage offered at European destinations. This is also shown through scenic coastal cruises and shorter voyage options developed to focus on travelers with limited vacation times, therefore making cruises more accessible and attractive to the UK market.

Germany mirrors the UK's anticipated growth pattern in the cruise industry, with a projected CAGR of 5.8% from 2025 to 2035. The only exception is that Germany is strongly characterized by domestic tourism, just as is the case with the UK, so the competition for cruises comes from such popular travel options that are going to be covered by vacation budgets.

Germany takes a very similar, unique twist, though. Unlike the UK's focus on land-based exploration, river cruises are particularly popular among German travelers. These are intimate journeys into culture, as passengers cruise on Europe's scenic waterways en route to charming towns and historical sites that dot the riverbanks.

Cruise lines have taken notice by developing exciting new river cruise itineraries that explore the iconic Rhine, Danube, and other European waterways. These journeys cater to the German desire for a more personalized and culturally rich travel experience.

Spain is projected to record a CAGR of 7.4% from 2025 to 2035 and is likely to lead in the Europe cruise industry. Spain's bright sunshine, coastline with charming towns, and strategic location on the Iberian Peninsula lend to its being one of the most wanted destinations for discovering and cruising.

Being in this unique position, the cruise lines offer a vast variety of itineraries catering to the varied interests of their clients. These could be the exciting culture, the amazing culinary arts, and the landmarks of Spain or any other interesting destination that lies on the shoreline of the Mediterranean.

Spain's tourism industry is increasingly becoming more appealing to both locals and foreigners. This synergy between the tourism infrastructure of Spain and the evolution of the cruise industry continues to see sustained growth and leadership in Europe's cruise sector.

By booking channels, the industry is dominated by online booking due to the rise in e-commerce popularity and preference. By tourist type, domestic tourists mark a significant increase securing dominance in 2025.

| Segment | Online Booking (Booking Channel) |

|---|---|

| Value Share (2035) | 46.7% |

Europe's cruise industry is currently amid a digital revolution with the increase in the availability of online booking channels. This can be attributed to the confluence of factors. Rising smartphone ownership and wide access to the internet empower travelers to easily research and book cruises from literally anywhere.

Online booking provides numerous benefits, including a wide selection of cruises from different operators, competitive pricing options for the budget traveler, and potential in-depth comparison of itineraries and amenities. This convenience, transparency, and accessibility are bringing about a remarkable change in consumer behavior.

| Segment | Domestic (Tourist Type) |

|---|---|

| Value Share (2035) | 55.2% |

Domestic tourists are expected to remain dominant in Europe’s cruise industry. This can be attributed to several factors. First, the convenience of embarking on cruises from local ports eliminates the need for complex international travel arrangements, making cruise vacations more accessible.

The increase in disposable income throughout Europe makes it possible for the inhabitants to uncover the rich tapestry of their continent easily, conveniently, and without any hassle on cruises.

Finally, cruise lines are putting home-targeted plans in place by constructing itineraries where the interest at home is on delighting in European charm and deep cultural immersion. This is also essential for the same reason as above and strengthens the Europe cruise sector, as there is a spike in demand for easy holiday options close to home for locals.

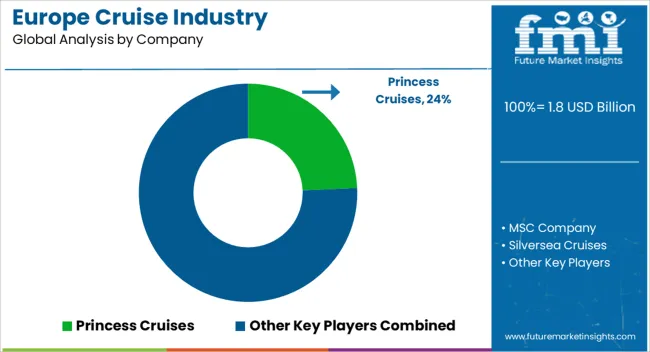

Established giants such as Carnival Corporation & plc and Royal Caribbean Group, facing a new wave of competitors, are expected to continue to take up a dominant share of the industry. The new entrants are often regional cruise lines, which take advantage of increasing demand for more personalized and niche experiences.

These target specific passenger demographics and offer itineraries focused on unique themes, such as cultural immersion, adventure travel, or culinary exploration. Also, ferry companies are waking up to the fact that the cruise industry can be rather lucrative and, hence, entering the fray with shorter, more pocket-friendly options aimed at local and regional travelers.

Established cruise lines have to develop a multi-pronged strategy to cut through these competitive waters. Constant innovation in itinerary design is of utmost importance. Offers in terms of exclusive and rich experiences that cater to a variety of passenger interests, from adventure seekers to history buffs, are key to gaining and retaining customers.

From advanced technologies and smart amenities that improve comfort and convenience to interaction in entertainment, all these facilities could be a must onboard ships for attracting the attention of tech-savvy travelers, especially younger consumers.

Strong commitments to sustainable practices are likely to resonate increasingly with European vacationers who are environmentally conscious. Adopting cleaner fuels, environmentally friendly waste management, and efforts to reduce the environmental impacts of cruise operations, will not just be a responsible practice but also a key differentiator in a competitive market.

It therefore follows that established cruise lines are likely to use such strategies to make sure they maintain their success amid a developing industry.

Industry Updates

The segmentation by cruise type includes ocean cruises, river cruises, expedition cruises, theme cruises, and other specialized categories.

Regarding booking channels, tourists can book their cruises through phone bookings, online platforms, or in-person bookings at travel agencies or cruise terminals.

The classification by tourist type distinguishes between domestic tourists and international tourists.

Age group segmentation ranges from 15 to 75 years, covering distinct demographics such as 15-25 years, 26-35 years, 36-45 years, 46-55 years, 56-65 years, and 66-75 years.

The countries included in Europe cruise industry are the United Kingdom, Germany, Italy, France, and Spain.

The global europe cruise industry is estimated to be valued at USD 1.8 billion in 2025.

The market size for the europe cruise industry is projected to reach USD 3.2 billion by 2035.

The europe cruise industry is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in europe cruise industry are ocean cruises, river cruises, expedition cruises, theme cruises and other specialized categories.

In terms of booking channels, online platforms segment to command 46.7% share in the europe cruise industry in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Cruise Safari Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Europe Pet Food Market Analysis by Nature, Product Type, Source, Pet Type, Packaging, Distribution Channel, and Country - Growth, Trends, and Forecast through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA