Europe sports drinks industry will expand from an estimated size of USD 9.9 billion in the year 2025 to USD 16.3 billion by the year 2035 with a compound annual growth rate (CAGR) of 5.1% during the forecasting period 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 9.9 billion |

| Projected Europe Value (2035F) | USD 16.3 billion |

| Value-based CAGR (2025 to 2035) | 5.1% |

Demand pushers to a breaking point are increasing memberships at gyms, sports competition, and well-being and health programs lauding the merits of hydration in order to maintain performance and stamina. Increasing demand for naturals like coconut water, sea salt electrolytes, and adaptogens is dictating direction to the marketplace.

To remain competitive, businesses are seeking low-sugar, zero-calorie, and vitamin-sprayed alternatives that are designed to drive performance as well as lifestyle needs. Functional benefits in terms of muscle repair, energy replenishment, and immunity are also driving product format and consumer shopping.

Pack formats like PET bottle recyclables, aluminum cans, and Tetra Paks are growing with sustainability as a buyer driver. Availability and visibility in supermarket, gym, vending, and internet channel saleability also result in being there and visible. Strategic alliance with sport activities and sportsman endorsement are commanding volumes of test and consumer trust.

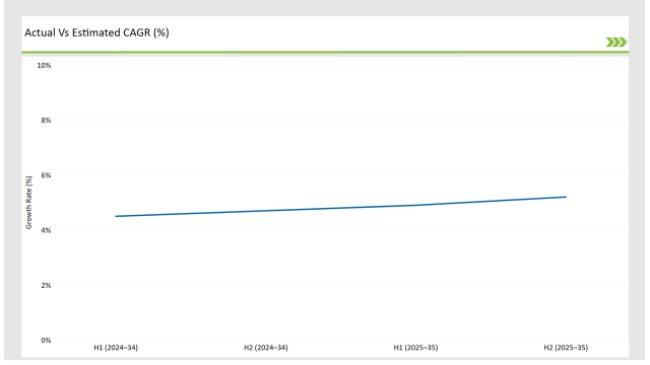

Above said table is indicative of the half a year base change comparative overview valuation of the compound annual growth rate (CAGR) base year 2023 and current year 2024 individually separately alone only of the market for sports drinks of Europe. This report-half examines a significant shift in the market trends and reports realization revenue trends, providing a better picture of the year's growth trend to the stakeholders. H1 is January to June, and H2 is July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

For the European sports drink industry, CAGR was increased from 4.5% for H1 2023 to 4.7% for H2 2023, indicating early recovery and increasing product uptake across the continent.

H1 2024 was 4.9%, but H2 2024 was upgraded to 5.2%, driven by growing distribution, clean-label innovation across hydrating products, and increasing consumer availability through fitness personalities and wellbeing activities. The 20 basis point H1-H2 2024 pick-up is further strengthening market optimism, all of which is in the direction of the probability of sustained growth to 2035.

| Date | Development/Event & Details |

|---|---|

| May 2024 | Health & Wellness Trends: Consumer understanding of the sports drink's health advantages, including enhanced hydration and energy replenishment, fuels demand in all segments. |

| June 2024 | Product Trends: Functional ingredient- and low-sugar-formulated beverages are the new packaging on which firms are putting sports drinks as they seek to reach diverse consumers. |

| July 2024 | Regulatory Trends: New sport drink consumption health claims have been supported by the European Food Safety Authority (EFSA) in an effort to encourage the genuineness of the products while ensuring the customers are convinced of the same. |

| September 2024 | Sustainability Initiatives: Businesses are turning to greener strategies such as green packaging and green sourcing of ingredients to meet the customer needs for environmentally friendly products. |

| March 2025 | Technology Advances: Formulation technological advances are enhancing the performance of sports drinks, and their consumption by professional and recreationally active consumers is expanding. |

Increased Emphasis on Hydration and Performance

Western European sport drink demand has increased more significantly, driven by increasing consumer demand for performance and hydration during physical activity.With increasingly more fitness trends that are gaining traction nationwide, especially among millennials and health enthusiasts, sports drinks are also becoming the athlete's new best friend and the gym rat's sweetheart.

These beverages, which were intended to give off electrolytes and boost stamina, are no longer merely being guzzled in a state of maximum exertion but are now quickly turning into a way of life. Increases in fitness clubs, gyms, and sports participation outdoors have led directly to higher consumption of sports drinks as individuals seek easy methods for fluid replenishment and performance improvement.

Shift Toward Health-Conscious and Functional Options

Since health-oriented Western European consumers persist, other sports drinks with added values such as lower sugar, organic, and vitamins are also gravitating toward healthier and functional classes. Clean-label items have also had significant effects in the market as consumers are demanding ingredient labeling and are increasingly worried about artificial preservatives and additives.

With this comes great trend towards natural and plant-based sports drinks with items emphasizing organic sources of electrolytes and nutrients. It is one of wider trends in beverage and food as consumers increasingly seek more sustainable, more functional, and more product-driven solutions for overall health. Sport drink makers thus look to innovation for such uses and launch products that cater to an increasingly strong trend towards well-being and green-products.

Germany is the most prominent market for Western Europe's sports drink industry because of increased interest in fitness and health in Germany.Sports beverages are becoming an indispensable component in individuals lives by customers for enhanced hydration, performance, and recovery.

Increased usage of health clubs, outdoor activities, and sporting events also drives demand. Business-to-business products are responding to the trend by introducing diversified products including low-sugar, natural, and functional products in a bid to capture the consumer market with a health emphasis.

United Kingdom is experiencing the expansion of the sports drink market at a rapid rate because there are more wellness and performance-driven consumers.Growth of the fitness culture and the popularity of fitness has made individuals embrace products with recovery help as well as hydration more actively.

Companies are surfing this tide by launching new products with fresh solutions that also offer additional functionality, i.e., additional electrolytes, vitamins, and natural ingredients. Economies are shifting towards green packaging options that reap the benefits of the increasing global awareness for nature.

% Individual Categories Market Share by Product Type and Form in 2025

Isotonic beverages have the highest market share in Europe due to the perfectly equilibrium concentration of carbs and electrolytes. They are mainly consumed by amateur and professional players in Germany, Italy, and France.

Energy drinks, in contrast, are increasingly popular among non-competitive users like working professionals and students as a quick solution for physical as well as mental energy. Electrolyte-and-botanical-based energy drinks are very popular in Central Europe and Eastern Europe.

RTD category dominates nearly two-thirds of the European market due to its unparalleled convenience and widespread accessibility. RTD sport beverages are traditionally being put into on-the-go pack sizes in urban centers, mainly the UK, Netherlands, and Nordic nations. Drink mixes are also becoming popular among fitness trainers and home-gym enthusiasts who want to adjust concentration levels or taste profiles.

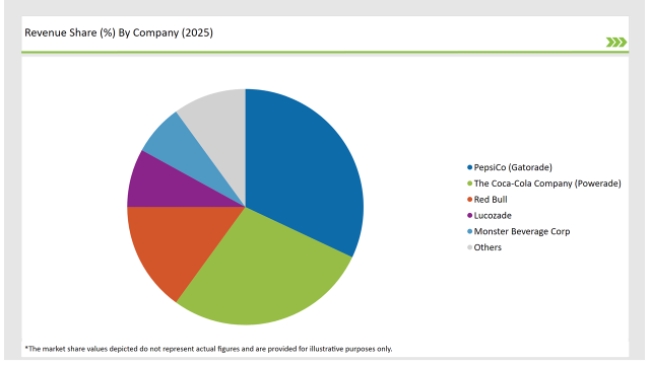

The relatively high concentration European sport beverage market is dominated by multinational beverage companies with significant market shares. PepsiCo, The Coca-Cola Company, Red Bull, Lucozade, and Monster Beverage Corp are the leaders who dominate the market through the use of extensive distribution channels, brand distribution, and product innovation in a bid to gain competitive edge.

They will roll out low-sugar, functional, and botanical offerings in their portfolios so that they can cash in on the health-aware consumption base being formed across the world.

The sports drink market is segmented into hypotonic drinks, hypertonic drinks, isotonic drinks, electrolyte drinks, and energy drinks, each designed to meet specific hydration and performance needs.

Available in ready-to-drink, drink mixes, and tablet formats, offering convenience and flexibility for both on-the-go consumption and tailored preparation.

Distributed through modern trade, convenience stores, specialty stores, pharmacy stores, online retail, sports retail stores, grocery stores, and other sales channels, ensuring broad market penetration across both physical and digital platforms

The Europe sports drink market is projected to grow at a CAGR of 5.1% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 16.3 billion.

The market is driven by the rising demand for functional beverages, an increased emphasis on performance and recovery, the expanding popularity of active lifestyles, and the growing awareness of the need for hydration during exercise.

France is set for a spike in sports-drinks consumption.

Leading manufacturers include Red Bull, PepsiCo, The Coca-Cola Company, Lucozade, and Monster Beverage Corp, known for their innovative and high-quality sports drink products.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sports Drink Industry Analysis in USA - Size and Share Forecast Outlook 2025 to 2035

Sports Drink Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Europe Sports Nutrition Market Analysis – Growth, Demand & Forecast 2025-2035

UK Sports Drink Market Analysis – Size, Share & Innovations 2025-2035

ASEAN Sports Drink Market Trends – Growth, Demand & Forecast 2025-2035

Australia Sports Drink Market Insights – Trends, Demand & Growth 2025-2035

Latin America Sports Drink Market Analysis – Demand, Size & Forecast 2025–2035

Non-GMO Verified Sports Drink Market - Growth & Demand 2025 to 2035

Sports Medicine Sutures Market Size and Share Forecast Outlook 2025 to 2035

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Sports Betting Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Sports Wearables Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA