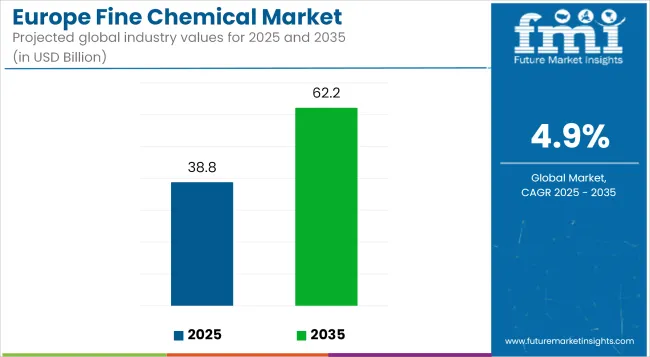

The Europe fine chemical market is estimated at USD 38.82 billion in 2025 and forecasted to account for value of USD 62.19 billion by 2035, representing a compound annual growth rate (CAGR) of 4.9%.

| Metrics | Key Values |

|---|---|

| Industry Size (2025E) | USD 38.82 billion |

| Industry Value (2035F) | USD 62.19 billion |

| CAGR | 4.9% |

Growth is likely to be supported by increased investments in bio-based manufacturing, energy transition, and specialty chemical innovation across pharmaceutical and agrochemical value chains.

In 2024, the European fine chemicals industry encountered operational constraints due to reduced production volumes, elevated input costs, and competitive imports. Capacity utilization across several production sites declined to 75.2%, well below the long-term average of 81.4%. Oversupply in intermediates such as isopropanol and acetone, coupled with subdued end-market consumption, placed downward pressure on pricing. Purchasing decisions remained conservative, reflecting macroeconomic uncertainty and tight credit conditions.

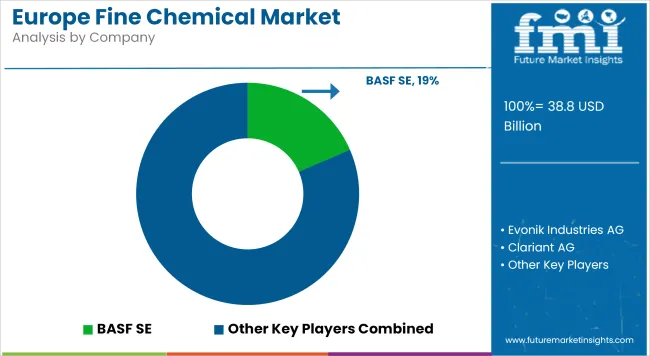

Key market participants including BASF and Brenntag reported declines in profitability. Strategic responses included operational restructuring, site rationalization, and workforce reductions. Mergers and acquisitions within the sector remained limited during the year, primarily due to valuation mismatches and unfavorable financing conditions, despite latent consolidation opportunities.

Looking forward, moderate growth is expected to emerge as over 75 planned projects focused on circular and low-carbon chemical production reach commissioning by 2025. These initiatives are being supported by EU-wide policy frameworks promoting carbon neutrality, advanced recycling, and substitution of petrochemical-based inputs.

However, the industry is expected to continue facing challenges related to regulatory compliance, rising energy and labor costs, and persistent global competition, particularly from regions with lower operating overheads. In response, a pivot toward high-purity, performance-oriented fine chemicals and custom synthesis is being observed, with an emphasis on digital process optimization, automation, and waste minimization.

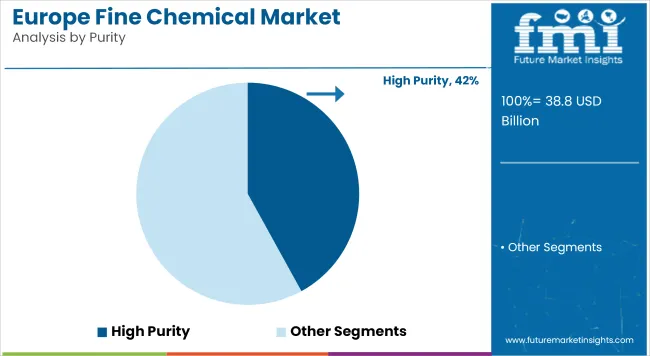

The high purity segment is projected to account for approximately 42% of the Europe fine chemicals market share in 2025 and is expected to grow at a CAGR of 5.2% through 2035. These chemicals meet stringent specifications required in pharmaceuticals, nutraceuticals, and electronics manufacturing. High purity levels are essential for minimizing contamination and ensuring performance in drug synthesis, semiconductor fabrication, and advanced material development. Europe’s pharmaceutical hubs in Switzerland and Germany, as well as expanding microelectronics activity in countries like the Netherlands and France, are key drivers for sustained demand in this segment. Regulatory compliance, batch traceability, and investment in cleanroom production environments further reinforce the preference for high-purity offerings.

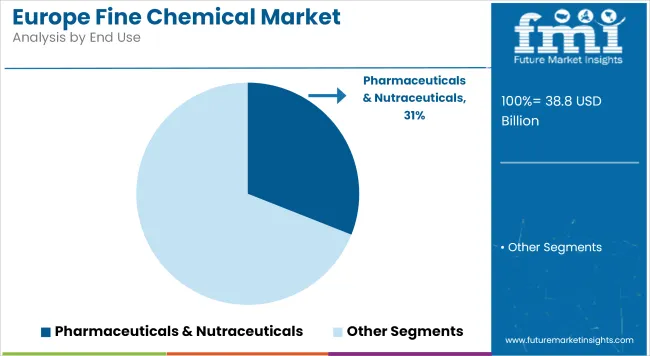

The pharmaceuticals and nutraceuticals segment is estimated to hold approximately 31% of the Europe fine chemicals market share in 2025 and is projected to grow at a CAGR of 5.3% through 2035. Fine chemicals are used in the formulation of APIs, excipients, bioactives, and encapsulation materials, supporting both prescription and over-the-counter product categories. Europe’s focus on chronic disease management, biologic therapies, and preventive care supplements is driving continuous innovation in this segment. Growth in CDMO partnerships and investments in GMP-compliant production are expected to further support fine chemical consumption, particularly in Germany, Ireland, and the Nordic countries.

Germany is the largest player in the European fine chemical industry, driven by its advanced industrial base and strong demand from the automotive, pharmaceuticals, and agriculture sectors. The country has a well-established regulatory framework, with strict adherence to REACH and Seveso-III regulations, influencing the industry's operational practices. The shift toward sustainable and bio-based chemicals is evident, especially in the chemical production process. German firms are investing in green chemistry and automation to remain competitive.

A growing focus on R&D and high-end chemical formulations for precision agriculture and specialty pharmaceuticals will further strengthen industry growth. The increasing pressure to reduce carbon emissions, coupled with EU Green Deal mandates, is likely to drive innovation and investment in environmentally friendly production technologies.

FMI opines that Germany's fine chemical sales are likely to expand at a CAGR of 5.2% during the forecast period between 2025 and 2035.

Italy's fine chemical industry is driven by strong demand in the pharmaceutical and cosmetic sectors, with a growing emphasis on high-quality, specialized chemicals. The country is focusing on improving its production capabilities through innovation and automation, especially for the cosmetics and agrochemical industries.

Italy faces challenges with rising material costs, but its strong tradition in organic chemicals and intermediates helps mitigate risks. Furthermore, Italy is an early adopter of circular economy principles, with several firms adopting sustainable practices. Regulatory pressures such as REACH and the Seveso-III Directive continue to shape the industry's operations. With a focus on product quality and cost-effectiveness, Italy is set to strengthen its position in the fine chemical industry.

FMI opines that Italy's fine chemical sales are likely to expand at a CAGR of 4.8% during the forecast period between 2025 and 2035.

France’s fine chemical industry is supported by a diversified industry base, including pharmaceutical intermediates, specialty chemicals, and agrochemicals. The country’s strong regulatory environment, including REACH and its strict adherence to EU sustainability goals, shapes its production landscape. A key factor driving growth is the rise in biopharmaceutical demand, which has led to an increased need for high-quality fine chemicals.

France has invested significantly in R&D for green chemistry and is adopting more eco-friendly production processes. French companies are also responding to increasing global competition by enhancing their automation and digitalization efforts in fine chemical manufacturing, ensuring they remain innovation leaders.

FMI opines that France's fine chemical sales are likely to expand at a CAGR of 5.1% during the forecast period between 2025 and 2035.

The UK fine chemical industry is experiencing a shift due to Brexit, where the introduction of UK REACH has created new challenges for exporters, particularly for those supplying across the EU. However, the UK’s pharmaceutical and biotech sectors are significant drivers of demand for high-end fine chemicals, particularly in drug discovery and development.

The industry is seeing strong growth in high-value fine chemicals used in the production of personalized medicine. The UK government’s focus on green chemistry and sustainability is pushing the adoption of more environmentally friendly practices in production. Automation and digital transformation are also key trends, as companies seek to enhance efficiency and reduce costs.

FMI opines that the United Kingdom's fine chemical sales are likely to expand at a CAGR of 5.0% during the forecast period between 2025 and 2035.

Spain’s fine chemical industry is growing steadily, supported by strong demand for agriculture, food, and personal care products. The increasing importance of sustainable and natural chemical alternatives has driven investment in green and bio-based chemicals. Spanish firms are focusing on the production of specialty chemicals for the food and beverage industry, including preservatives and flavor enhancers.

The adoption of digital technologies such as IoT for process monitoring is expanding, which helps improve operational efficiency. Regulatory pressures, especially those related to environmental sustainability, are influencing production methods. The pharmaceutical sector, though smaller than other European countries, is also a key contributor to growth.

FMI opines that Spain's fine chemical sales are likely to expand at a CAGR of 4.7% during the forecast period between 2025 and 2035.

The Benelux region is highly influential in the European fine chemical industry, particularly due to the Netherlands' strategic position as a logistics hub for chemical products. The fine chemical sector here benefits from a strong presence of global pharmaceutical, food, and agriculture companies.

Sustainability is a key driver, with a focus on reducing carbon emissions and increasing the use of bio-based feedstocks. Belgium is particularly active in the development of high-value intermediates for pharmaceutical production, while Luxembourg focuses on specialty chemicals for high-tech industries. The region is also home to numerous international research and development centers, supporting continuous innovation in the fine chemical sector.

FMI opines that the BENELUX region's fine chemical sales are likely to expand at a CAGR of 4.9% during the forecast period between 2025 and 2035.

The fine chemical industry in Russia faces challenges due to political instability and international sanctions that have affected both domestic production and trade. Despite these hurdles, Russia has a strong industrial base for basic chemicals, which supports its fine chemical sector. The country remains heavily reliant on traditional petrochemical products, but there is a growing focus on developing high-value chemicals for agriculture and pharmaceuticals.

The government has been investing in the domestic production of fine chemicals to reduce dependency on imports. However, the industry is constrained by regulatory complexities and the high cost of compliance with EU-level environmental standards.

FMI opines that Russia's fine chemical sales are likely to expand at a CAGR of 4.5% during the forecast period between 2025 and 2035.

The rest of Europe, including Eastern and Southern European countries, is seeing steady growth in the fine chemical industry, driven by increasing demand for high-performance chemicals in the agriculture, automotive, and electronics sectors.

Countries like Poland, Hungary, and the Czech Republic are becoming key players in manufacturing fine chemicals due to lower operational costs and skilled labor availability. The adoption of green chemistry is also increasing, with more companies focusing on environmentally friendly alternatives. However, challenges such as regulatory barriers, the lack of sufficient infrastructure, and limited R&D investment remain key obstacles to growth in the region.

FMI opines that the Rest of Europe's fine chemical sales are likely to expand at a CAGR of 4.6% during the forecast period between 2025 and 2035.

The competitive landscape is likely to evolve with increased emphasis on localized supply chains and value-added partnerships. Firms able to integrate renewable feedstocks, leverage green chemistry platforms, and achieve vertical process efficiencies will be better positioned to sustain margins. Public-private collaboration in research and infrastructure, especially in industrial clusters across Germany, France, and the Netherlands, will be instrumental in driving regional resilience and long-term value creation.

Key categories include pharmaceuticals, agrochemicals, construction chemicals, specialty polymers, and pigments and dyes.

Sustainability is driving the shift toward green chemistry and bio-based feedstocks to reduce environmental impact.

The largest consumers are pharmaceuticals, agriculture, food and beverages, cosmetics, and petrochemicals.

The prevalent models are captive (in-house production) and merchant (third-party production).

Growth is driven by advancements in pharmaceuticals, demand for sustainability, and increasing investments in R&D and automation.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fine Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Refinery Process Chemical Market Size and Share Forecast Outlook 2025 to 2035

Refinery and Petrochemical Filtration Market Analysis by Filter Type, Application, End-User and Region 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Chemical Hydraulic Valves Market Size and Share Forecast Outlook 2025 to 2035

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Chemical Vapor Deposition Market Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Chemical Recycling Service Market Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Chemical Dosing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Chemical Filling System Market Size and Share Forecast Outlook 2025 to 2035

Fine Bubble Diffuser Market Size and Share Forecast Outlook 2025 to 2035

Chemical Absorbent Pads Market Size and Share Forecast Outlook 2025 to 2035

Chemical Indicator Inks Market Size and Share Forecast Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA