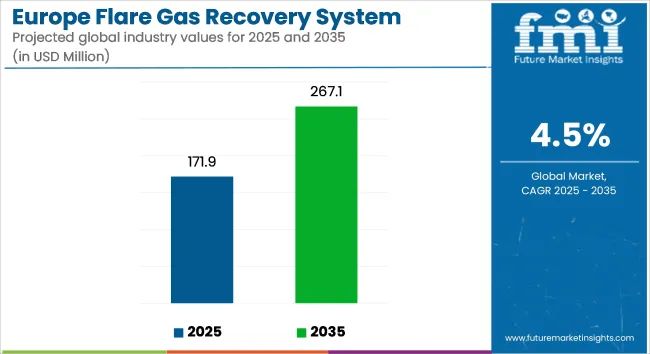

The Europe flare gas recovery system (FGRS) market is estimated at USD 171.9 million in 2025 and is projected to reach USD 267.1 million by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period. Demand for flare gas recovery systems has been shaped by evolving EU regulatory standards targeting methane and carbon emissions from upstream and midstream energy operations.

The enforcement of the Industrial Emissions Directive (IED) and supporting national frameworks has driven the installation of flare gas recovery units across oil & gas production, refining, and petrochemical facilities. As outlined in the European Commission’s technical study on GHG venting and flaring, operators have been required to implement recovery mechanisms to reduce waste gas volumes and report emissions data through standardized protocols. The directive has also promoted upgrades at legacy sites, particularly in Western Europe, to comply with sector-specific flare rate thresholds.

Advances in modular system design have facilitated equipment deployment. In 2024, recovery solutions incorporating heat-integrated screw compressors and automated control modules were introduced in onshore installations, where space and infrastructure allowed for easier integration.

Offshore facilities in the North Sea have selected compact liquid-ring compressor units engineered to meet deck space constraints and operational variability caused by harsh marine environments. These installations have supported emissions reductions while enabling internal gas reuse for power generation and reinjection processes.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 171.9 million |

| Projected Market Size in 2035 | USD 267.1 million |

| CAGR (2025 to 2035) | 4.5% |

Documented project outcomes have confirmed system effectiveness. At a gas processing site in the Netherlands, the deployment of a flare gas recovery skid in 2024 resulted in a reported 65% reduction in flared volume. The same project logged a decrease in carbon dioxide emissions by over 12,000 tons annually. Similar outcomes were observed on North Sea platforms, where heat-integrated units reduced the reliance on diesel-powered generation during maintenance-related flaring.

Flare gas recovery system manufacturers have enhanced product offerings by bundling real-time analytics, remote diagnostics, and predictive maintenance features. This has enabled operators to meet both operational and environmental requirements with fewer disruptions. Service contracts now commonly include regulatory data preparation aligned with EU inspection standards.

With infrastructure readiness in mature energy markets and pressure to decarbonize production, the adoption of flare gas recovery systems is expected to continue steadily across Europe.

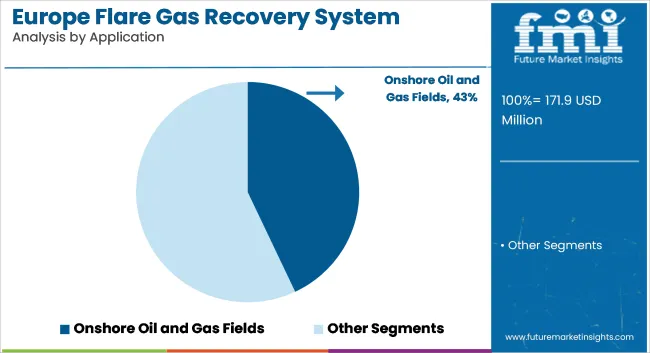

Onshore oil and gas fields are estimated to hold approximately 43% of the Europe flare gas recovery system market share in 2025 and are projected to grow at a CAGR of 3.9% through 2035. This dominance is driven by tightening EU methane emission regulations and national mandates across countries like Norway, the Netherlands, and Germany targeting zero-routine flaring.

Onshore operators increasingly deploy recovery systems to capture associated gas for reuse in fuel, reinjection, or power generation, reducing both environmental impact and operational losses. Infrastructure availability and ease of integration with compression and processing units further support widespread adoption.

As Europe’s oil and gas industry transitions toward decarbonization, flare gas recovery onshore emerges as a strategic investment aligned with ESG compliance and emissions trading schemes.

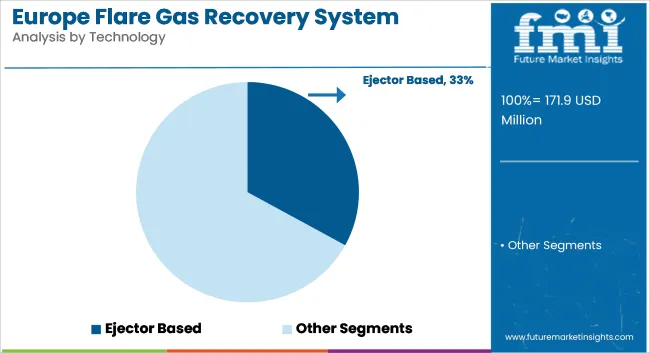

Ejector-based flare gas recovery systems are projected to account for nearly 33% of the market share in 2025 and are expected to grow at a CAGR of 4.5% through 2035. These systems operate using motive gas to compress flare gases without moving parts, offering reliability, low maintenance, and cost efficiency ideal for continuous operation in oil and gas installations.

Operators in Europe prefer ejector-based systems for their compact design and suitability in recovering low-pressure gas streams, particularly in mature onshore fields and small-scale production facilities. Manufacturers are optimizing ejector geometry and control mechanisms to improve recovery rates and system responsiveness under variable gas compositions.

As operators seek cost-effective solutions to meet emission reduction targets, ejector-based technology is positioned as a practical option in both retrofits and greenfield projects.

Challenges: Environmental Compliance and Technological Integration

Among the main challenges facing the European market for flare gas recovery systems is incorporating state-of-the-art technology into existing oil and gas infrastructure. Part of the refineries and oil fields are not inherently built for flare gas recovery, and retrofitting these units in order to include space for FGRS is a costly and time-consuming process. In addition, such systems have a significant initial cost, which may turn out to be a barrier to some smaller operators or areas that have limited funds.

Besides, meeting the stricter environmental standards for flaring of gas is another major challenge. The compliance percentage is always higher, and oil and gas companies will have to overcome these to remain in line without incurring a penalty. As environmental regulations continue to become stricter, companies will also face increasing pressure to incorporate innovative technologies along with designing operations sustainably.

Opportunities: Technological Advantages and Incentives in Legislation

On the other hand, there are immense opportunities in the European flare gas recovery market. Technological developments are leading to more efficient and cost-effective systems that can recover and process flare gas better. Modular system development, improved gas separation technologies, and IoT-based systems for real-time monitoring are helping operators recover more gas and reduce emissions more effectively.

European governments are also offering incentives to encourage the utilization of flare gas recovery technologies. These incentives, such as grants, tax rebates, and subsidies, are designed to make it easier for businesses to invest in clean technologies. As the systems improve and become cheaper, barriers to entry for smaller businesses will decline, and usage will become more common.

The environmental sustainability of Norway has seen the extensive use of flare gas recovery systems. Norway's tough regulation on gas flaring and strong oil and gas industry have spurred investment in improved recovery technology.

Norwegian operators are champions of the use of capture and use of flare gas systems, which has reduced emissions and increased energy efficiency. As the Norwegian government continues to encourage technological innovation within the oil and gas industry, there is good potential for flare gas recovery systems to grow.

| Country | CAGR (2025 to 2035) |

|---|---|

| Norway | 4.5% |

The Netherlands is one of the most active oil and gas activity hubs in Europe. Flare gas recovery systems are being invested in by Dutch organizations to meet national and EU environmental regulations. The strategic positioning of the country, coupled with its sophisticated technological infrastructure, positions it as a suitable market for flare gas recovery system installations.

The Netherlands is also at the forefront of embracing renewable energy technology, which aligns with efforts to implement cleaner, more efficient recovery of natural gas and oil production energy.

| Country | CAGR (2025 to 2035) |

|---|---|

| Netherlands | 4.8% |

Italy's petroleum and gas industry is undergoing modernization, with emphasis on reducing environmental impact. Italian businesses are more and more using flare gas recovery systems in order to comply with EU regulations and maximize operating efficiency.

Use of these systems is consistent with Italy's overall approach to sustainable energy policy. Through the EU initiative for curbing emissions and maximizing energy efficiency, Italy stands to gain from the application of flare gas recovery technologies in the years to come.

| Country | CAGR (2025 to 2035) |

|---|---|

| Italy | 4.5% |

Spain has taken the forefront in the application of environmental standards to limit gas flaring. Spanish oil and gas operators are investing capital in flare gas recovery systems in order to meet the standards and obtain maximum energy utilization.

Economic imperatives as well as sustainability sentiment drive the implementation of such systems. Spain is determined to continue at the top when it comes to energy efficiency and environmental protection, and flare gas recovery systems play a fundamental part in achieving this goal.

| Country | CAGR (2025 to 2035) |

|---|---|

| Spain | 4.7% |

European market growth of flare gas recovery systems is induced by enhanced environmental conservation regulations and operation efficiency demands within the oil and gas sector. Industry professionals are focusing on modular and skid-mounted options that present flexible, plug-and-play configurations to meet individual requirements of oil, gas, and biogas operators.

The most recent developments in screw compressor and liquid ring system technologies are making it more reliable and cost-effective for flare gas recovery systems. In the meantime, many industry players are giving more focus to developing ejector-based systems to exploit increasing opportunities in non-electric flare gas recovery applications.

The overall market size for the Europe flare gas recovery system market was USD 171.9 million in 2025.

The Europe flare gas recovery system market is expected to reach USD 267.1 million in 2035.

The increasing pressure on oil & gas companies to reduce flaring and minimize their environmental impact, along with strict government regulations and emission standards, is expected to drive the demand for flare gas recovery systems during the forecast period.

The top 5 countries driving the development of the Europe flare gas recovery system market are Russia, the United Kingdom, Germany, the Netherlands, and Italy.

On the basis of application, the oil & gas segment is expected to command a significant share over the forecast period.

Table 01: Market Size (US$ Million) Analysis and Forecast By Flow Rate, 2018 to 2033

Table 02: Market Size (US$ Million) Analysis and Forecast By Operating Pressure, 2018 to 2033

Table 03: Market Size (US$ Million) Analysis and Forecast By Configuration, 2018 to 2033

Table 04: Market Size (US$ Million) Analysis and Forecast By Technology, 2018 to 2033

Table 05: Market Size (US$ Million) Analysis and Forecast By Application, 2018 to 2033

Table 06: Market Size Value (Units) Analysis and Forecast By Region, 2018 to 2033

Table 07: Germany Market Size (US$ Million) Analysis and Forecast By Flow Rate, 2018 to 2033

Table 08: Germany Market Size (US$ Million) Analysis and Forecast By Operating Pressure, 2018 to 2033

Table 09: Germany Market Size (US$ Million) Analysis and Forecast By Configuration, 2018 to 2033

Table 10: Germany Market Size (US$ Million) Analysis and Forecast By Technology, 2018 to 2033

Table 11: Germany Market Size (US$ Million) Analysis and Forecast By Application, 2018 to 2033

Table 12: Italy Market Size (US$ Million) Analysis and Forecast By Flow Rate, 2018 to 2033

Table 13: Italy Market Size (US$ Million) Analysis and Forecast By Operating Pressure, 2018 to 2033

Table 14: Italy Market Size (US$ Million) Analysis and Forecast By Configuration, 2018 to 2033

Table 15: Italy Market Size (US$ Million) Analysis and Forecast By Technology, 2018 to 2033

Table 16: Italy Market Size (US$ Million) Analysis and Forecast By Application, 2018 to 2033

Table 17: France Market Size (US$ Million) Analysis and Forecast By Flow Rate, 2018 to 2033

Table 18: France Market Size (US$ Million) Analysis and Forecast By Operating Pressure, 2018 to 2033

Table 19: France Market Size (US$ Million) Analysis and Forecast By Configuration, 2018 to 2033

Table 20: France Market Size (US$ Million) Analysis and Forecast By Technology, 2018 to 2033

Table 21: France Market Size (US$ Million) Analysis and Forecast By Application, 2018 to 2033

Table 22: United Kingdom Market Size (US$ Million) Analysis and Forecast By Flow Rate, 2018 to 2033

Table 23: United Kingdom Market Size (US$ Million) Analysis and Forecast By Operating Pressure, 2018 to 2033

Table 24: United Kingdom Market Size (US$ Million) Analysis and Forecast By Configuration, 2018 to 2033

Table 25: United Kingdom Market Size (US$ Million) Analysis and Forecast By Technology, 2018 to 2033

Table 26: United Kingdom Market Size (US$ Million) Analysis and Forecast By Application, 2018 to 2033

Table 27: Spain Market Size (US$ Million) Analysis and Forecast By Flow Rate, 2018 to 2033

Table 28: Spain Market Size (US$ Million) Analysis and Forecast By Operating Pressure, 2018 to 2033

Table 29: Spain Market Size (US$ Million) Analysis and Forecast By Configuration, 2018 to 2033

Table 30: Spain Market Size (US$ Million) Analysis and Forecast By Technology, 2018 to 2033

Table 31: Spain Market Size (US$ Million) Analysis and Forecast By Application, 2018 to 2033

Table 32: Belgium Market Size (US$ Million) Analysis and Forecast By Flow Rate, 2018 to 2033

Table 33: Belgium Market Size (US$ Million) Analysis and Forecast By Operating Pressure, 2018 to 2033

Table 34: Belgium Market Size (US$ Million) Analysis and Forecast By Configuration, 2018 to 2033

Table 35: Belgium Market Size (US$ Million) Analysis and Forecast By Technology, 2018 to 2033

Table 36: Belgium Market Size (US$ Million) Analysis and Forecast By Application, 2018 to 2033

Table 37: Netherlands Market Size (US$ Million) Analysis and Forecast By Flow Rate, 2018 to 2033

Table 37: Netherlands Market Size (US$ Million) Analysis and Forecast By Operating Pressure, 2018 to 2033

Table 38: Netherlands Market Size (US$ Million) Analysis and Forecast By Configuration, 2018 to 2033

Table 39: Netherlands Market Size (US$ Million) Analysis and Forecast By Technology, 2018 to 2033

Table 40: Netherlands Market Size (US$ Million) Analysis and Forecast By Application, 2018 to 2033

Table 41: Luxembourg Market Size (US$ Million) Analysis and Forecast By Flow Rate, 2018 to 2033

Table 42: Luxembourg Market Size (US$ Million) Analysis and Forecast By Operating Pressure, 2018 to 2033

Table 43: Luxembourg Market Size (US$ Million) Analysis and Forecast By Configuration, 2018 to 2033

Table 44: Luxembourg Market Size (US$ Million) Analysis and Forecast By Technology, 2018 to 2033

Table 45: Luxembourg Market Size (US$ Million) Analysis and Forecast By Application, 2018 to 2033

Table 46: Russia Market Size (US$ Million) Analysis and Forecast By Flow Rate, 2018 to 2033

Table 47: Russia Market Size (US$ Million) Analysis and Forecast By Operating Pressure, 2018 to 2033

Table 48: Russia Market Size (US$ Million) Analysis and Forecast By Configuration, 2018 to 2033

Table 49: Russia Market Size (US$ Million) Analysis and Forecast By Technology, 2018 to 2033

Table 50: Luxembourg Market Size (US$ Million) Analysis and Forecast By Application, 2018 to 2033

Table 51: Rest of Market Size (US$ Million) Analysis and Forecast By Flow Rate, 2018 to 2033

Table 52: Rest of Market Size (US$ Million) Analysis and Forecast By Operating Pressure, 2018 to 2033

Table 53: Rest of Market Size (US$ Million) Analysis and Forecast By Configuration, 2018 to 2033

Table 54: Rest of Market Size (US$ Million) Analysis and Forecast By Technology, 2018 to 2033

Table 55: Rest of Market Size (US$ Million) Analysis and Forecast By Application, 2018 to 2033

Figure 01: Market (US$ Million) Analysis

Figure 02: Market Share Analysis

Figure 03: Market Historical Value (US$ Million), 2018 to 2022

Figure 04: Market Value (US$ Million) Forecast, 2023 to 2033

Figure 05: Market Absolute $ Opportunity, 2023 to 2033

Figure 06: Market Share and BPS Analysis By Flow Rate, 2023 to 2033

Figure 07: Market Y-o-Y Growth Projections By Flow Rate, 2023 to 2033

Figure 08: Market Attractiveness Analysis By Flow Rate, 2023 to 2033

Figure 09: Market Absolute $ Opportunity by 100 to 250 MSCFD Segment, 2018 to 2033

Figure 10: Market Absolute $ Opportunity by 250 to 500 MSCFD Segment, 2018 to 2033

Figure 11: Market Absolute $ Opportunity by 500 to 750 MSCFD Segment, 2018 to 2033

Figure 12: Market Absolute $ Opportunity by 750 to 1000 MSCFD Segment, 2018 to 2033

Figure 13: Market Share and BPS Analysis By Operating Pressure, 2023 to 2033

Figure 14: Market Y-o-Y Growth Projections By Operating Pressure, 2023 to 2033

Figure 15: Market Attractiveness Analysis By Operating Pressure, 2023 to 2033

Figure 16: Market Absolute $ Opportunity by 10 to 20 bar (Large) Segment, 2018 to 2033

Figure 17: Market Absolute $ Opportunity by 20 to 60 bar (Very Large) Segment, 2018 to 2033

Figure 18: Market Absolute $ Opportunity 5 to 10 bar (Medium) Segment, 2018 to 2033

Figure 19: Market Absolute $ Opportunity by Upto 5 bar (Small) Segment, 2018 to 2033

Figure 20: Market Share and BPS Analysis By Configuration, 2023 to 2033

Figure 21: Market Y-o-Y Growth Projections By Configuration, 2023 to 2033

Figure 22: Market Attractiveness Analysis By Configuration, 2023 to 2033

Figure 23: Market Absolute $ Opportunity by Modular Segment, 2018 to 2033

Figure 24: Market Absolute $ Opportunity by Skid Mounted Segment, 2018 to 2033

Figure 25: Market Share and BPS Analysis By Technology, 2023 to 2033

Figure 26: Market Y-o-Y Growth Projections By Technology, 2023 to 2033

Figure 27: Market Attractiveness Analysis By Technology, 2023 to 2033

Figure 28: Market Absolute $ Opportunity by Compressor Segment, 2018 to 2033

Figure 29: Market Absolute $ Opportunity by Ejector Based Segment, 2018 to 2033

Figure 30: Market Share and BPS Analysis By Application, 2023 to 2033

Figure 31: Market Y-o-Y Growth Projections By Application, 2023 to 2033

Figure 32: Market Attractiveness Analysis By Application, 2023 to 2033

Figure 33: Market Absolute $ Opportunity by Onshore Oil and Gas Fields Segment, 2018 to 2033

Figure 34: Market Absolute $ Opportunity by Offshore Platforms Segment, 2018 to 2033

Figure 35: Market Absolute $ Opportunity by Remote standard gas fields Segment, 2018 to 2033

Figure 36: Market Absolute $ Opportunity by Biogas and Land fill Gas Application Based Segment, 2018 to 2033

Figure 37: Market Share and BPS Analysis By Region, 2023 to 2033

Figure 38: Market Y-o-Y Growth Projections By Region, 2023 to 2033

Figure 39: Market Attractiveness Analysis By Region, 2023 to 2033

Figure 40: Germany Market Absolute $ Opportunity by North America Segment, 2018 to 2033

Figure 41: Italy Market Absolute $ Opportunity by Latin America Segment, 2018 to 2033

Figure 42: France Market Absolute $ Opportunity by North America Segment, 2018 to 2033

Figure 43: United Kingdom Market Absolute $ Opportunity by Latin America Segment, 2018 to 2033

Figure 44: Spain Market Absolute $ Opportunity by North America Segment, 2018 to 2033

Figure 45: Belgium Market Absolute $ Opportunity by Latin America Segment, 2018 to 2033

Figure 46: Netherlands Market Absolute $ Opportunity by North America Segment, 2018 to 2033

Figure 47: Luxembourg Market Absolute $ Opportunity by Latin America Segment, 2018 to 2033

Figure 48: Russia Market Absolute $ Opportunity by North America Segment, 2018 to 2033

Figure 49: Rest of Market Absolute $ Opportunity by Latin America Segment, 2018 to 2033

Figure 50: Germany Market Share and BPS Analysis By Flow Rate, 2023 to 2033

Figure 51: Germany Market Y-o-Y Growth Projections By Flow Rate, 2023 to 2033

Figure 52: Germany Market Attractiveness Analysis By Flow Rate, 2023 to 2033

Figure 53: Germany Market Share and BPS Analysis By Operating Pressure, 2023 to 2033

Figure 54: Germany Market Y-o-Y Growth Projections By Operating Pressure, 2023 to 2033

Figure 55: Germany Market Attractiveness Analysis By Operating Pressure, 2023 to 2033

Figure 56: Germany Market Share and BPS Analysis By Configuration, 2023 to 2033

Figure 57: Germany Market Y-o-Y Growth Projections By Configuration, 2023 to 2033

Figure 58: Germany Market Attractiveness Analysis By Configuration, 2023 to 2033

Figure 59: Germany Market Share and BPS Analysis By Technology, 2023 to 2033

Figure 60: Germany Market Y-o-Y Growth Projections By Technology, 2023 to 2033

Figure 61: Germany Market Attractiveness Analysis By Technology, 2023 to 2033

Figure 62: Germany Market Share and BPS Analysis By Application, 2023 to 2033

Figure 63: Germany Market Y-o-Y Growth Projections By Application, 2023 to 2033

Figure 64: Germany Market Attractiveness Analysis By Application, 2023 to 2033

Figure 65: Italy Market Share and BPS Analysis By Flow Rate, 2023 to 2033

Figure 66: Italy Market Y-o-Y Growth Projections By Flow Rate, 2023 to 2033

Figure 67: Italy Market Attractiveness Analysis By Flow Rate, 2023 to 2033

Figure 68: Italy Market Share and BPS Analysis By Operating Pressure, 2023 to 2033

Figure 69: Italy Market Y-o-Y Growth Projections By Operating Pressure, 2023 to 2033

Figure 70: Italy Market Attractiveness Analysis By Operating Pressure, 2023 to 2033

Figure 71: Italy Market Share and BPS Analysis By Configuration, 2023 to 2033

Figure 72: Italy Market Y-o-Y Growth Projections By Configuration, 2023 to 2033

Figure 73: Italy Market Attractiveness Analysis By Configuration, 2023 to 2033

Figure 74: Italy Market Share and BPS Analysis By Technology, 2023 to 2033

Figure 75: Italy Market Y-o-Y Growth Projections By Technology, 2023 to 2033

Figure 76: Italy Market Attractiveness Analysis By Technology, 2023 to 2033

Figure 77: Italy Market Share and BPS Analysis By Application, 2023 to 2033

Figure 78: Italy Market Y-o-Y Growth Projections By Application, 2023 to 2033

Figure 79: Italy Market Attractiveness Analysis By Application, 2023 to 2033

Figure 80: France Market Share and BPS Analysis By Flow Rate, 2023 to 2033

Figure 81: France Market Y-o-Y Growth Projections By Flow Rate, 2023 to 2033

Figure 82: France Market Attractiveness Analysis By Flow Rate, 2023 to 2033

Figure 83: France Market Share and BPS Analysis By Operating Pressure, 2023 to 2033

Figure 84: France Market Y-o-Y Growth Projections By Operating Pressure, 2023 to 2033

Figure 85: France Market Attractiveness Analysis By Operating Pressure, 2023 to 2033

Figure 86: France Market Share and BPS Analysis By Configuration, 2023 to 2033

Figure 87: France Market Y-o-Y Growth Projections By Configuration, 2023 to 2033

Figure 88: France Market Attractiveness Analysis By Configuration, 2023 to 2033

Figure 89: France Market Share and BPS Analysis By Technology, 2023 to 2033

Figure 90: France Market Y-o-Y Growth Projections By Technology, 2023 to 2033

Figure 91: France Market Attractiveness Analysis By Technology, 2023 to 2033

Figure 92: France Market Share and BPS Analysis By Application, 2023 to 2033

Figure 93: France Market Y-o-Y Growth Projections By Application, 2023 to 2033

Figure 94: France Market Attractiveness Analysis By Application, 2023 to 2033

Figure 95: United Kingdom Market Share and BPS Analysis By Flow Rate, 2023 to 2033

Figure 96: United Kingdom Market Y-o-Y Growth Projections By Flow Rate, 2023 to 2033

Figure 97: United Kingdom Market Attractiveness Analysis By Flow Rate, 2023 to 2033

Figure 98: United Kingdom Market Share and BPS Analysis By Operating Pressure, 2023 to 2033

Figure 99: United Kingdom Market Y-o-Y Growth Projections By Operating Pressure, 2023 to 2033

Figure 100: United Kingdom Market Attractiveness Analysis By Operating Pressure, 2023 to 2033

Figure 101: United Kingdom Market Share and BPS Analysis By Configuration, 2023 to 2033

Figure 102: United Kingdom Market Y-o-Y Growth Projections By Configuration, 2023 to 2033

Figure 103: United Kingdom Market Attractiveness Analysis By Configuration, 2023 to 2033

Figure 104: United Kingdom Market Share and BPS Analysis By Technology, 2023 to 2033

Figure 105: United Kingdom Market Y-o-Y Growth Projections By Technology, 2023 to 2033

Figure 106: United Kingdom Market Attractiveness Analysis By Technology, 2023 to 2033

Figure 107: United Kingdom Market Share and BPS Analysis By Application, 2023 to 2033

Figure 108: United Kingdom Market Y-o-Y Growth Projections By Application, 2023 to 2033

Figure 109: United Kingdom Market Attractiveness Analysis By Application, 2023 to 2033

Figure 110: Spain Market Share and BPS Analysis By Flow Rate, 2023 to 2033

Figure 111: Spain Market Y-o-Y Growth Projections By Flow Rate, 2023 to 2033

Figure 112: Spain Market Attractiveness Analysis By Flow Rate, 2023 to 2033

Figure 113: Spain Market Share and BPS Analysis By Operating Pressure, 2023 to 2033

Figure 114: Spain Market Y-o-Y Growth Projections By Operating Pressure, 2023 to 2033

Figure 115: Spain Market Attractiveness Analysis By Operating Pressure, 2023 to 2033

Figure 116: Spain Market Share and BPS Analysis By Configuration, 2023 to 2033

Figure 117: Spain Market Y-o-Y Growth Projections By Configuration, 2023 to 2033

Figure 118: Spain Market Attractiveness Analysis By Configuration, 2023 to 2033

Figure 119: Spain Market Share and BPS Analysis By Technology, 2023 to 2033

Figure 120: Spain Market Y-o-Y Growth Projections By Technology, 2023 to 2033

Figure 121: Spain Market Attractiveness Analysis By Technology, 2023 to 2033

Figure 122: Spain Market Share and BPS Analysis By Application, 2023 to 2033

Figure 123: Spain Market Y-o-Y Growth Projections By Application, 2023 to 2033

Figure 124: Spain Market Attractiveness Analysis By Application, 2023 to 2033

Figure 125: Belgium Market Share and BPS Analysis By Flow Rate, 2023 to 2033

Figure 126: Belgium Market Y-o-Y Growth Projections By Flow Rate, 2023 to 2033

Figure 127: Belgium Market Attractiveness Analysis By Flow Rate, 2023 to 2033

Figure 128: Belgium Market Share and BPS Analysis By Operating Pressure, 2023 to 2033

Figure 129: Belgium Market Y-o-Y Growth Projections By Operating Pressure, 2023 to 2033

Figure 130: Belgium Market Attractiveness Analysis By Operating Pressure, 2023 to 2033

Figure 131: Belgium Market Share and BPS Analysis By Configuration, 2023 to 2033

Figure 132: Belgium Market Y-o-Y Growth Projections By Configuration, 2023 to 2033

Figure 133: Belgium Market Attractiveness Analysis By Configuration, 2023 to 2033

Figure 134: Belgium Market Share and BPS Analysis By Technology, 2023 to 2033

Figure 135: Belgium Market Y-o-Y Growth Projections By Technology, 2023 to 2033

Figure 136: Belgium Market Attractiveness Analysis By Technology, 2023 to 2033

Figure 136: Belgium Market Share and BPS Analysis By Application, 2023 to 2033

Figure 137: Belgium Market Y-o-Y Growth Projections By Application, 2023 to 2033

Figure 138: Belgium Market Attractiveness Analysis By Application, 2023 to 2033

Figure 139: Netherlands Market Share and BPS Analysis By Flow Rate, 2023 to 2033

Figure 140: Netherlands Market Y-o-Y Growth Projections By Flow Rate, 2023 to 2033

Figure 141: Netherlands Market Attractiveness Analysis By Flow Rate, 2023 to 2033

Figure 142: Netherlands Market Share and BPS Analysis By Operating Pressure, 2023 to 2033

Figure 143: Netherlands Market Y-o-Y Growth Projections By Operating Pressure, 2023 to 2033

Figure 144: Netherlands Market Attractiveness Analysis By Operating Pressure, 2023 to 2033

Figure 145: Netherlands Market Share and BPS Analysis By Configuration, 2023 to 2033

Figure 146: Netherlands Market Y-o-Y Growth Projections By Configuration, 2023 to 2033

Figure 147: Netherlands Market Attractiveness Analysis By Configuration, 2023 to 2033

Figure 148: Netherlands Market Share and BPS Analysis By Technology, 2023 to 2033

Figure 149: Netherlands Market Y-o-Y Growth Projections By Technology, 2023 to 2033

Figure 151: Netherlands Market Share and BPS Analysis By Application, 2023 to 2033

Figure 152: Netherlands Market Y-o-Y Growth Projections By Application, 2023 to 2033

Figure 153: Netherlands Market Attractiveness Analysis By Application, 2023 to 2033

Figure 154: Luxembourg Market Share and BPS Analysis By Flow Rate, 2023 to 2033

Figure 155: Luxembourg Market Y-o-Y Growth Projections By Flow Rate, 2023 to 2033

Figure 156: Luxembourg Market Attractiveness Analysis By Flow Rate, 2023 to 2033

Figure 157: Luxembourg Market Share and BPS Analysis By Operating Pressure, 2023 to 2033

Figure 158: Luxembourg Market Y-o-Y Growth Projections By Operating Pressure, 2023 to 2033

Figure 159: Luxembourg Market Attractiveness Analysis By Operating Pressure, 2023 to 2033

Figure 160: Luxembourg Market Share and BPS Analysis By Configuration, 2023 to 2033

Figure 161: Luxembourg Market Y-o-Y Growth Projections By Configuration, 2023 to 2033

Figure 162: Luxembourg Market Attractiveness Analysis By Configuration, 2023 to 2033

Figure 163: Luxembourg Market Share and BPS Analysis By Technology, 2023 to 2033

Figure 164: Luxembourg Market Y-o-Y Growth Projections By Technology, 2023 to 2033

Figure 165: Luxembourg Market Attractiveness Analysis By Technology, 2023 to 2033

Figure 166: Luxembourg Market Share and BPS Analysis By Application, 2023 to 2033

Figure 167: Luxembourg Market Y-o-Y Growth Projections By Application, 2023 to 2033

Figure 168: Luxembourg Market Attractiveness Analysis By Application, 2023 to 2033

Figure 169: Russia Market Share and BPS Analysis By Flow Rate, 2023 to 2033

Figure 170: Russia Market Y-o-Y Growth Projections By Flow Rate, 2023 to 2033

Figure 171: Russia Market Attractiveness Analysis By Flow Rate, 2023 to 2033

Figure 172: Russia Market Share and BPS Analysis By Operating Pressure, 2023 to 2033

Figure 173: Russia Market Y-o-Y Growth Projections By Operating Pressure, 2023 to 2033

Figure 174: Russia Market Attractiveness Analysis By Operating Pressure, 2023 to 2033

Figure 175: Russia Market Share and BPS Analysis By Configuration, 2023 to 2033

Figure 176: Russia Market Y-o-Y Growth Projections By Configuration, 2023 to 2033

Figure 177: Russia Market Attractiveness Analysis By Configuration, 2023 to 2033

Figure 178: Russia Market Share and BPS Analysis By Technology, 2023 to 2033

Figure 179: Russia Market Y-o-Y Growth Projections By Technology, 2023 to 2033

Figure 180: Russia Market Attractiveness Analysis By Technology, 2023 to 2033

Figure 181: Russia Market Share and BPS Analysis By Application, 2023 to 2033

Figure 182: Russia Market Y-o-Y Growth Projections By Application, 2023 to 2033

Figure 183: Russia Market Attractiveness Analysis By Application, 2023 to 2033

Figure 184: Rest of Europe Market Share and BPS Analysis By Flow Rate, 2023 to 2033

Figure 185: Rest of Europe Market Y-o-Y Growth Projections By Flow Rate, 2023 to 2033

Figure 186: Rest of Europe Market Attractiveness Analysis By Flow Rate, 2023 to 2033

Figure 187: Rest of Europe Market Share and BPS Analysis By Operating Pressure, 2023 to 2033

Figure 188: Rest of Europe Market Y-o-Y Growth Projections By Operating Pressure, 2023 to 2033

Figure 189: Rest of Europe Market Attractiveness Analysis By Operating Pressure, 2023 to 2033

Figure 190: Rest of Europe Market Share and BPS Analysis By Configuration, 2023 to 2033

Figure 191: Rest of Europe Market Y-o-Y Growth Projections By Configuration, 2023 to 2033

Figure 192: Rest of Europe Market Attractiveness Analysis By Configuration, 2023 to 2033

Figure 193: Rest of Europe Market Share and BPS Analysis By Technology, 2023 to 2033

Figure 194: Rest of Europe Market Y-o-Y Growth Projections By Technology, 2023 to 2033

Figure 195: Rest of Europe Market Attractiveness Analysis By Technology, 2023 to 2033

Figure 196: Rest of Europe Market Share and BPS Analysis By Application, 2023 to 2033

Figure 197: Rest of Europe Market Y-o-Y Growth Projections By Application, 2023 to 2033

Figure 198: Rest of Europe Market Attractiveness Analysis By Application, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Cruise Industry Size and Share Forecast Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Europe Pet Food Market Analysis by Nature, Product Type, Source, Pet Type, Packaging, Distribution Channel, and Country - Growth, Trends, and Forecast through 2025 to 2035

Europe's Golden Generation Travel Market Size and Share Forecast Outlook 2025 to 2035

Europe Winter Tourism Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA