The Europe Bakery Mixes market is set to grow from an estimated USD 1,170.9 million in 2025 to USD 2,026.0 million by 2035, with a compound annual growth rate (CAGR) of 5.6% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Europe Industry Size (2025E) (USD million) | USD 1,170.9 million |

| Projected Europe Value (2035F) (USD million) | USD 2,026.0 million |

| Value-based CAGR (2025 to 2035) | 5.6% |

The European market for bakery mix experienced high growth which was rooted in changing demand as consumers wanted a convenient method and premium baked goods products while incorporating innovative product forms. It would be quite handy for house-bakers, even commercial, through a straightforward simplification by collecting various ingredient matters into just one package; so this increased and became convenient with the life-balance desires among European customers on fresh homesteading.

The arrival of the COVID-19 pandemic heightened an important inflection point for the European bakery mixes market. Lockdowns created a boon in home baking as consumers, while looking for hobbies, sought to bake at home to be sure that the end product was fresh and of acceptable quality.

There is also an increasing demand for specific dietary products. Gluten-free, organic, vegan, allergen-free, and non-GMO mixes are picking up because more and more consumers in Europe want healthier and cleaner options in alignment with personal preferences or health requirements.

Major players, including Dr.Oetker, General Mills, and Barry Callebaut, are investing in research and development (R&D) to create specialized mixes that cater to health-conscious consumers. Besides the conventional, companies are innovating with alternative ingredients to formulate products suitable for the gluten intolerance diet, lactose-free diet, or vegan diet.

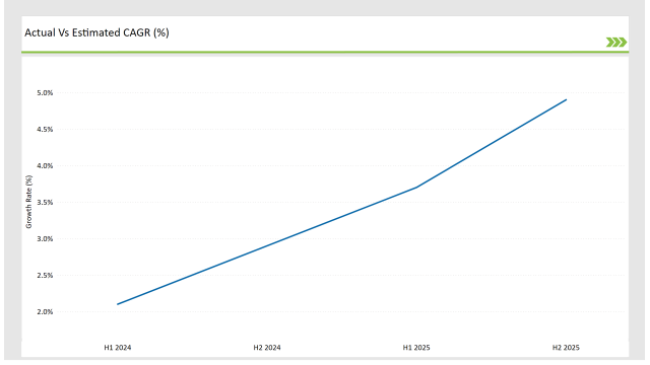

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Bakery Mixes market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 2.1% (2024 to 2034) |

| H2 | 2.9% (2024 to 2034) |

| H1 | 3.7% (2025 to 2035) |

| H2 | 34.9% (2025 to 2035) |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Bakery Mixes market, the sector is predicted to grow at a CAGR of 2.1% during the first half of 2024, with an increase to 2.9% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 3.7% in H1 but is expected to rise to 4.9% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2023 to the first half of 2024, followed by an increase of 20 basis points in the second half of 2024 compared to the second half of 2023.

| Date | Development/M&A Activity & Details |

|---|---|

| April 2024 | Product Launch : A major bakery mix brand introduced an organic range of cake mixes targeting consumers looking for clean-label, organic ingredients in Europe. The range includes vegan, gluten-free, and sugar-free options. |

| March 2024 | Strategic Partnership : A bakery ingredient supplier entered into a partnership with a leading plant-based company to develop a new line of vegan-friendly bread and muffin mixes to cater to the increasing demand for plant-based diets in Europe. |

| February 2024 | Sustainability Initiative : A well-known bakery mix brand launched new packaging made from 100% recyclable materials, aligning with growing consumer demand for environmentally sustainable packaging solutions. |

Rise of Health-Conscious Bakery Mixes in Europe

This is a mixed market for bakery products in Europe that has significantly experienced growth underpinned by consumer preferences. In this sense, consumers seek more convenient bakery goods, quality bakery products, and new ways to formulate such baked goods. Mixing bakery makes baking easier in terms of gathering several ingredients into a package. Indeed, this simplicity appeals to most Europeans who enjoy work and lifestyle at the same time with home products.

Europe is rich in diverse baking traditions and continues to remain one of the top markets at the global level for bakery mixes. Commercial and industrial bakery sectors further add to the market size. Bakery mixes in commercial establishments such as in-store bakeries, food service chains, and industrial bakeries help large quantities of consistent quality baked goods and a wide range of products with constant flavour profiles and textures.

Technological Innovations in Bakery Mixes for Enhanced Convenience

Companies in the European bakery mixes market are highly focused on product innovation and differentiation to meet the changing demands of consumers. The major players, such as Dr.Oetker, General Mills, and Barry Callebaut, are investing in R&D to create specialty mixes that appeal to health-conscious consumers.

In addition to classic ingredients, organizations are also testing other ingredients so that they produce products that appeal to various food restrictions, which include gluten sensitivity, lactose-free, and vegan diets.

Convenience and health claims are key drivers of the market, but consumer preferences for cleaner, more sustainable ingredients also play a role in product innovation. Bakery mix manufacturers are increasingly facing pressure to produce clean-label products with minimal, recognizable ingredients as concerns about food safety, sustainability, and traceability continue to grow.

The following table shows the estimated growth rates of the top fourmarkets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Country | Market Share (%) |

|---|---|

| Germany | 25% |

| Italy | 10% |

| UK | 15% |

| France | 20% |

| Other Countries | 30% |

Germany stands amongst the top players in the bakery mixes market in Europe. It is specifically driven by the high demand for gluten-free, organic and health-conscious bakery products. One of the countries with the most gluten-sensitive individuals, Germany shows a remarkable increase in the need for gluten-free bakery mixes.

Such products even enable people suffering from celiac disease or gluten intolerance to consume their favourite traditional pastries without the associated health hazards of gluten.

The launch of gluten-free foods, besides, has coincided with the surge in the embrace of organic bakery mixes among people. Throughout the years, Koreans have shifted to organic foods with consumers choosing foods free from synthetics, pesticides, and genetic modification (GMO). In this regard, leading German companies such as Dr.Oetker in particular have seen an increase in their brands to add organic bakery mixes that cater for this segment.

In France, the must-markets for bakery mixes are those whitetops at home and businesses that jump on board in the usage of premixes. The French bakery sector is recognized for its superior and artisan quality, therefore, the horizontal expansion to commercial bakeries to sell premixes still upholds the quality of traditional French pastry.

Premixes are a great advantage for companies, especially those in the foodservice sector, as their use entails efficiency and cost-effectiveness. The consistent level of quality in products such as baguettes, croissants, and pastries that are produced in the company's large scale bakery is assured through premixes that are used quickly and in high capacity without taste or texture compromise.

| Main Segment | Market Share (%) |

|---|---|

| Product Type (Gluten-free mix) | 15% |

| Remaining segments | 85% |

Gluten-free bakery mixes are one of the top-selling sections in the European bakery mixes market. The increasing rate of gluten intolerance and celiac disease, as well as the worldwide transition toward gluten-free eating as a health and lifestyle remedy, are the major drivers of this upturn. Gluten-free people are actively looking for products that they can use to indulge themselves in baked goods they want without the side effects that come with the usage of gluten.

Germany, the UK, and Italy are countries where the demand for gluten-free bakery mixes is extremely strong. Gluten-related health issues are not only widely known but also of the major concerns in these countries. Food manufacturers have taken the challenge and are now creating a range of gluten-free products including sandwiches, cakes, muffins, and biscuits, with alternative flours like rice, almond, and tapioca.

| Main Segment | Market Share (%) |

|---|---|

| End User (Home Baking /Household) | 35% |

| Remaining segments | 65% |

The household sector is now the fastest-growing area in the European bakery mixes market, mostly thanks to the home baking craze and an interest in kitchen experimentation. As consumers become more interested in the convenience and quality of the products, the demand for simple-to-use mixes has increased.

The target audience in this sector includes families, single professionals, and baking professionals who are ready to use products found in grocery stores that shorten the preparation time without sacrificing the baking quality.

Another factor that has contributed to the increase of this trend is the rise of social media platforms; home bakers post their food, gain popularity on these platforms, and other people learn from them how to bake. Consequently, the companies started taking on their board to develop a variety of bakery mixes to target a wide range of customers with different dietary needs and lifestyles such as gluten-free, organic, and specialty ones.

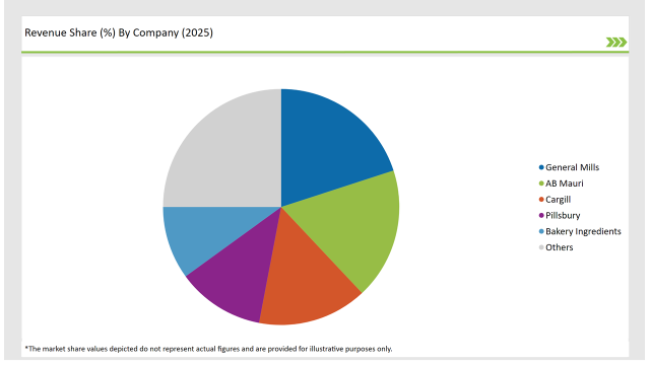

2025 Market share of Europe Bakery Mixesmanufacturers

| Manufacturer | Market Share (%) |

|---|---|

| General Mills | 20% |

| AB Mauri | 18% |

| Cargill | 15% |

| Pillsbury | 12% |

| Bakery Ingredients | 10% |

| Others | 25% |

Note: The above chart is indicative in nature

The European bakery mixes business is classically compassed by the biggest multinationals and quite a few local actors who together create a competitive and dynamic industry environment. The market's biggies with the advantage of a wide variety of products and well-established distribution networks occupy a big part of the market.

These companies are very well off and are mainly concerned with the big share of the growth in the bakery mixes sector due to consumers' interest in convenience and specialty products that have a positive acceptance among them in the European market.

For instance, Dr.Oetker is one of the closest to being a superstar in the European bakery mixes market. As a brand name that is recognized in most of the European countries, it is a must for every retailer and it is a great support for restaurants and hotels as well.

At the time, Dr.Oetker even came up with new product developments such as skipping gluten flour, using organic, and offering vegan options. As a result of the company's ability to innovate and, at the same time, the production of traditional, high-quality products has been giving the brand a leader's position.

General Mills is the brand Betty Crocker consisting of some of the most important companies in the market. The extensive range of bakery mixes covering cake, cookie, and brownie mixes gives Betty Crocker a significant advantage in various European countries. The firm has been a pioneer in the health sector with the introduction of mixes tailored to particular dietary demands like being gluten-free or having lower sugar content.

As per Product Type, the industry has been categorized into Cake Mixes, Bread Mixes, Pastry Mixes, Cookie Mixes, and Others.

As per End Use, the industry has been categorized into Household, Commercial, Food Service Providers, Retail Chains, and Others

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

The Europe Bakery Mixes market is projected to grow at a CAGR of 5.6 % from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 2,026.0 million.

Key factors driving the European bakery mixes market include the increasing demand for convenient and ready-to-use baking solutions among consumers and the growing trend of home baking fueled by social media influences. Additionally, the rise in health-conscious eating has led to a demand for specialty mixes, such as gluten-free and organic options.

Germany, France, and Italy are the key countries with high consumption rates in the European Bakery Mixes market.

Leading manufacturers General Mills, AB Mauri, Cargill, Pillsbury, and Bakery Ingredients known for their innovative and sustainable production techniques and a variety of product lines.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Europe Pet Food Market Analysis by Nature, Product Type, Source, Pet Type, Packaging, Distribution Channel, and Country - Growth, Trends, and Forecast through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA