The Europe Food Service Equipment market is set to grow from an estimated USD 11,518.8 million in 2025 to USD 13,317.3 million by 2035, with a compound annual growth rate (CAGR) of 2.4% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Europe Industry Size (2025 E) | USD 11,518.8 million |

| Projected Europe Value (2035 F) | USD 13,317.3 million |

| Value-based CAGR (2025 to 2035) | 2.4% |

The European food service equipment market is anticipated to exhibit remarkable growth mainly due to the hospitality sector's expansion, the changes in consumer dining preferences, and advancements in kitchen appliances.

Food service equipment that includes commercial ovens and refrigerators as well as automated dishwashing systems and precision cooking devices is a must-have in the quest for efficiency, operational safety, and the consistent level of quality in the numerous end-user segments. The shift towards green and energy-efficient products by the region manufacturers is also marking the market trend, as they implant sustainable materials and digital solutions in their products.

Major players are proceeding with cutting-edge devices for particular domains, for instance, bakeries, compact dishwashers for commercial kitchens, and automated solutions for institutional canteens. Companies are targeting high-performance ovens, compact dishwashers, and automated solutions.

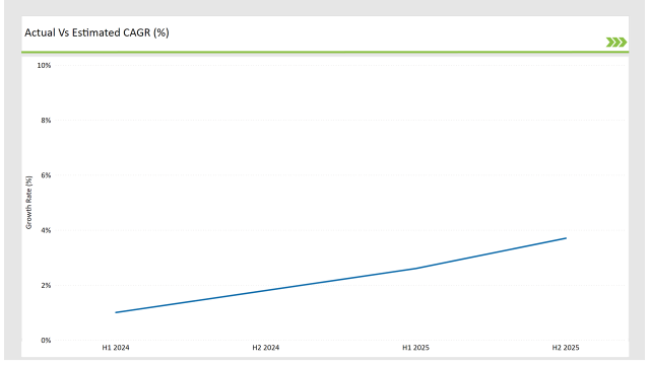

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Food Service Equipment market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1(2024 to 2034) | 1.0% |

| H2(2024 to 2034) | 1.8% |

| H1(2025 to 2035) | 2.6% |

| H2(2025 to 2035) | 3.7% |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Food Service Equipment market, the sector is predicted to grow at a CAGR of 1.0% during the first half of 2024, with an increase to 1.8% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 2.6% in H1 but is expected to rise to 3.7% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| April -24 | Sustainability Initiatives - Hobart launched an eco-friendly dishwasher line that reduces water and energy consumption by 40%, catering to sustainability-focused clients. |

| March -24 | Product Launches- Rational AG introduced a new range of multi-functional combi ovens with integrated IoT capabilities for commercial kitchens. |

| February -24 | Expansion of Manufacturing Facilities- Winterhalter expanded its production facility in Germany to cater to increasing demand for commercial dishwashing equipment. |

| January-24 | Strategic Partnerships- Electrolux partnered with hotel chains across Europe to supply energy-efficient refrigeration units and cooking appliances. |

Rise of Energy-Efficient Devices in Commercial Kitchens

The prominent tendency toward sustainability and energy efficiency has been a main propellant for the growth of the food service equipment sector. Commercial kitchens, especially in hotels, fast-food restaurants, and catering services, have recently turned to the use of high-performance energy-efficient appliances to cut operating expenses and lower their environmental impact.

Companies like Rational AG and Electrolux have launched their cooking and refrigeration products, which not only save energy but also deliver better performance. IoT-enabled smart appliances are gaining more popularity in commercial kitchens. Such systems can help a business, for instance in the food and beverage industry, to realize remote monitoring, predictive maintenance, and optimization of energy consumption through various devices.

This would surely result in having a streamlined operation process and consistency in product quality. For instance, Rational'sIoT-integrated combi ovens allow for monitoring the cooking processes in real-time, which in turn increases productivity and reduces food waste.

State-of-the-art Innovations Fuelling the Automation and Precision

Automated food service equipment is one of the cutting-edge technologies benefitting Europe's top automation, precision, and connectivity focus. Commercial kitchens and institutional kitchens are looking for more automatic systems in cooking, robotic imitation chefs, and self-cleaning machines. The innovations cut costs by improving operational efficiency, while simultaneously addressing the problem of labour shortages.

Winterhalter’s automatic dishwashing systems, for example, mechanically operate at full capacity with only a few workers, which is best for mass catering. Electrolux, with the same aim in mind, produced precision cooking appliances, like sous vide machines and induction cooktops, which would reward the cooks with the quality they want and also increased speed. These breakthroughs are set to spearhead the transformation of the food service sector to meet the demand.

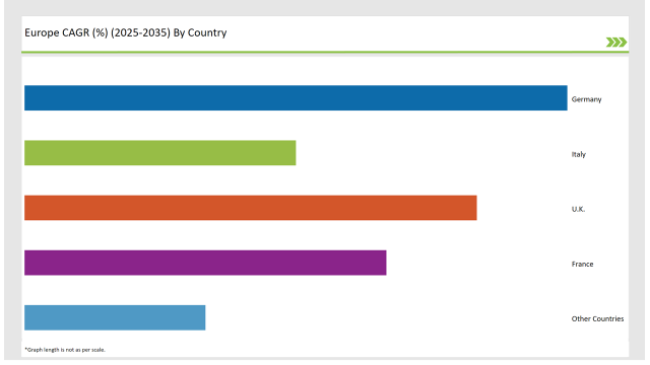

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Germany | 30% |

| Italy | 15% |

| UK | 25% |

| France | 20% |

| Other Countries | 10% |

Germany is a major market for food service equipment within Europe, as it has one of the healthiest hospitality and catering sectors. Hotels and fast-food chains are embracing the high adoption of IoT-enabled and energy-saving appliances.

Rational AG, a German company, is ahead of others in developing smart kitchen technology involving multi-functional ovens, intelligent refrigeration systems, and automatic dishwashing, each of which is tailored for commercial kitchens.

Additionally, the sustainability promises made by Germany are leading to increased green appliances throughout its canteens and cafeterias. Winter halter is a firm working with the catering services of Germany to create environmentally friendly energy-consuming dishwashing facilities to meet their environmental standards. This makes Germany the innovation capital for sustainable food service equipment.

France is a food service equipment market with rich gastronomy, particularly for fine dining and bakery operations. Restaurants, bakeries, and hotels invest in high-performance ovens, precision cooking appliances, and refrigeration units to ensure quality and authenticity. Electrolux has formed strategic partnerships with French hospitality groups that have helped them develop solutions suited to the distinct needs of French cuisine.

Besides the gastronomic advantages, institutional canteens and cafeterias in France also implement automated and IoT-enabled equipment to increase the efficiency of operations. Smart technologies like predictive maintenance and energy monitoring increase productivity and save costs in many food service locations.

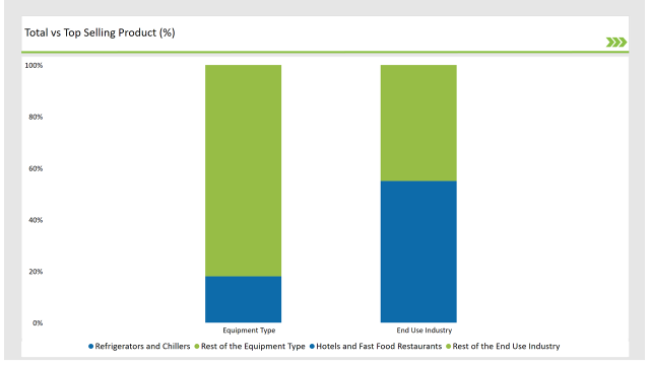

% share of Individual Categories End Use Industry and Equipment Type in 2025

| Main Segment | Market Share (%) |

|---|---|

| End Use Industry ( Hotels and Fast Food Restaurants ) | 55% |

| Remaining segments | 45% |

Hotels and fast-food restaurants are the preeminent consumers of food service equipment in Europe, as these industries have the need for the most efficient and high-performance appliances. For different cooking requirements, hotels depend on multi-purpose cooking and refrigeration systems, whereas for fast-food restaurants speed, consistency, and energy efficiency are the main priority.

Commonly used in these industries are Rational AG's multi-functional ovens and Electrolux's energy-efficient refrigeration units, both of which not only replace old equipment but also deliver better performance.

The quest for automation in the fast-food sector also has its share, with fryers, and conveyor belt ovens that are being brought into the picture to mechanize the food preparation processes. With this advancing of technologies, the sector reveals technology's vital part in dealing with constantly changing needs in the hospitality business.

Image to be created by Power BI

| Main Segment | Market Share (%) |

|---|---|

| Equipment Type ( Refrigerators and Chillers ) | 18% |

| Remaining segments | 82% |

The major part of the food service equipment market in Europe is covered by refrigerators and chillers, which are the prime instruments for food safety and extending the shelf life of products containing perishable ingredients. These devices are necessary for the whole spectrum of industries such as hotels, fast food joints, institutional canteens, etc.

The latest innovation of refrigerators includes the creation of IoT technology which is a unique selling point, in conjunction with sensors, they allow a real-time check of the temperature and the amount of energy used.

Electrolux also launched chillers that use less energy and are compliant with the strict regulations of the EU while providing ideal conditions for bulk food storage. The combination of smart features in refrigerators and chillers is elevating their quality, reducing energy expenditure, and even food wastage, thereby they are highly valuable in present-day commercial kitchens.

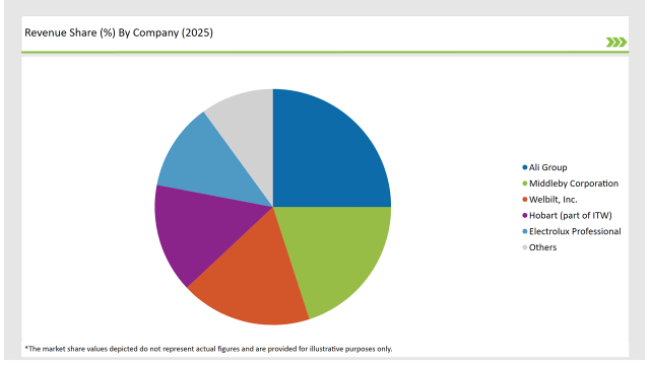

2025 Market share of Europe Food Service Equipment manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Ali Group | 25% |

| Middleby Corporation | 20% |

| Welbilt, Inc. | 18% |

| Hobart (part of ITW) | 15% |

| Electrolux Professional | 12% |

| Others | 10% |

Note: The above chart is indicative in nature

The European food service equipment market is not very concentrated and has a major market share held by Rational AG, Electrolux, Winterhalter, and Hobart. These corporations are using their expertise in innovation and sustainability to develop advanced solutions that appeal to the diverse needs of the food service sectors in Europe.

For example, Rational AG has developed a series of smart kitchen appliances for multi-functional use, while Electrolux has concentrated on energy-efficient solutions for hotels and fine dining establishments.

Winterhalter's growth in Germany shows its commitment to the need for automated and environmentally friendly dishwashing systems. Hobart has emphasized sustainability and released water- and energy-efficient dishwashers, positioning the company as a leader in environmentally conscious food service equipment.

Regional players are also gaining prominence by catering to niche segments such as artisanal bakeries and private-label food service providers. Competitive innovation continues to lead to strategic alliances, as well as sustainable themes that thus ensure continued growth in the European food service equipment market.

As per End Use Industry, the industry has been categorized into Hotels, Fast Food Restaurants, Commercial Kitchens (Catering), Institutional Canteens and Cafeteria, Bakery, Travel Retail Services (Airways, Ships, Railways), Household.

As per Equipment Type, the industry has been categorized into Food and Drink Preparation Equipment, Cooking Equipment, Heating and Holding Equipment, Dishwasher and Sanitation Equipment, Refrigerators and Chillers, Baking Equipment, Food Packaging and Wrapping Equipment.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

The Europe Food Service Equipment market is projected to grow at a CAGR of 2.4% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 13,317.3 million.

Key factors driving the European food service equipment market include the growing demand for efficient and innovative kitchen solutions in the hospitality and restaurant sectors, as well as the increasing focus on food safety and hygiene standards. Additionally, the rise of food delivery services and the expansion of the food and beverage industry further contribute to market growth.

Germany, and UK are the key countries with high consumption rates in the European Food Service Equipment market.

Leading manufacturers include Ali Group, Middleby Corporation, Welbilt, Inc., Hobart (part of ITW), and Electrolux Professional known for their innovative and sustainable production techniques and a variety of product lines.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Europe's Golden Generation Travel Market Size and Share Forecast Outlook 2025 to 2035

Europe Automotive Night Vision System Market Size and Share Forecast Outlook 2025 to 2035

Europe Winter Tourism Market Size and Share Forecast Outlook 2025 to 2035

Europe Bulk Bags Market Size and Share Forecast Outlook 2025 to 2035

Europe Fine Chemical Market Analysis - Growth, Applications & Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA