The Europe Animal Feed Alternative Protein market is set to grow from an estimated USD 3,354.2 million in 2025 to USD 9,979.6 million by 2035, with a compound annual growth rate (CAGR) of 11.5% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 3,354.2 million |

| Projected Europe Value (2035F) | USD 9,979.6 million |

| Value-based CAGR (2025 to 2035) | 11.5% |

The increasing focus on more sustainable, innovative protein sources by the animal feed alternative proteins market of Europe has become obvious in recent years. Animal feed is traditionally reliant upon conventional sources in the form of soy, corn, and fishmeal but is evolving with this trend to concerns over environmental pollution by such resources and rising calls for ethical sourcing.

The sustainability of the protein sources, scalability, and nutritional profile from other alternative proteins such as plant-based proteins, insect-based proteins, microbial proteins, and animal by-product proteins have increased at a rapid pace.

In this market, major players are focusing on creating sustainable and innovative protein sources through plant-based and microbial sources to be added to the growing pool of sustainable feedstock. Some of the key players in the market include ADM, Roquette, and Ynsect. These major players have consolidated their bases with significant investments in R&D and partnerships to scale up production and optimize the processes of protein extraction.

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Animal Feed Alternative Protein market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 6.1% |

| H2 (2024 to 2034) | 7.2% |

| H1 (2025 to 2035) | 8.5% |

| H2 (2025 to 2035) | 39.4% |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Animal Feed Alternative Protein market, the sector is predicted to grow at a CAGR of 6.1% during the first half of 2024, with an increase to 7.2% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 8.5% in H1 but is expected to rise to 9.4% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| April-2024 | Launch of Plant-Based Protein Concentrates : Companies like Roquette have introduced a new line of plant-based protein concentrates for animal feed applications, designed to enhance the nutritional value while maintaining sustainability. |

| March-2024 | Insect Protein for Aquaculture: Ynsect announced a strategic partnership with several European aquaculture firms to develop sustainable insect protein for use in fish feed, offering an alternative to traditional fishmeal sources. |

| January-2024 | Microbial Proteins for Livestock: A new microbial protein formulation has been launched by ADM to provide a highly digestible protein source for poultry and swine feed, enhancing growth performance while reducing environmental impact. |

Increased demand for plant-based proteins in livestock feed

The high demand is created by rising animal welfare, concern over the ecological footprint of fishmeal and soy, and strategies for feeding more sustainably; thus, providing space for sources of protein derived from peas, lentils, and soybeans. Such proteins provide essential amino acids and possess a much smaller environmental footprint as compared to more traditional sources of animal-based proteins.

The plant-based proteins also happen to be more climate resilient and less affected by the shockwaves in the global supply chain caused by diversified agriculture in their production regions.

Lastly, with consumers increasingly asking for sustainable feedstuffs in meat and dairy products, there has been greater consolidation in a shift toward the use of these plant-based alternatives. In these lines, in animal feed formulating as an active ingredient for plant protein concentration, Roquette takes the vanguard among numerous other companies doing similar work.

Increasing demand for insect-based proteins

One of the most promising trends regarding European animal feed alternative proteins comprises insect-based proteins. Black soldier flies, mealworms, and crickets increasingly become more viable sources of proteins and are highly nutritious, making them present elements in the formulation of animal feed at a rapid pace.

Being composed of proteins, fats, and micronutrients, insects constitute an excellent alternative to traditional sources of proteins. They are also very resource-efficient, taking a very negligible amount of water, land, and resources during production. Insect-based proteins can easily fit into poultry, swine, and aquaculture feeds.

They are increasingly adopted because they add value to the nutritional qualities of animal feeds. For instance, companies like Ynsect and Protix innovate in the large-scale production of insect protein by leaning on innovative biotechnologies applied for the rearing of insects at scale.

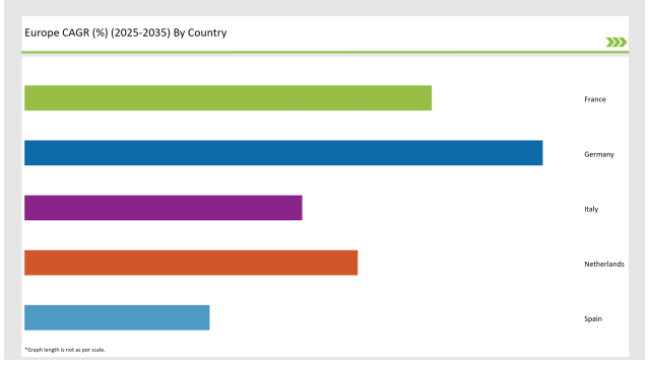

The following table shows the estimated growth rates of the top fourmarkets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Country | Market Share (%) |

|---|---|

| Germany | 28% |

| France | 22% |

| Netherlands | 18% |

| Italy | 15% |

| Spain | 10% |

The United Kingdom is one of the leaders in Europe in terms of alternative protein uptake in the animal feed market. It has seen vast growth in demand from environmental points of view to nutrition demands of a growing livestock sector for sustainable and innovative protein sources.

The significant agriculture industry of the UK and the governmental efforts toward sustainable agriculture made a perfect landscape for alternative protein development. In the past years, innovation has been focused on plant-based proteins, insect-based proteins, and microbial proteins.

Another significant contribution of the UK's advanced research infrastructure plus investment in food technology contributed to the sector of alternative protein. Indeed, it isn't just start-ups; in some cases, the alternative protein itself comes from amongst some of the big, mainstream players, for example, firms such as Bug Farm Foods. This one focuses primarily on insect-based proteins for use in animal feed.

France has also been another significant contributor to the market of European alternative proteins, especially in the development and commercialization of plant-based proteins. This country has traditionally played a key role in agricultural innovation, with commitments towards sustainability and food security that have fostered an increased interest in the use of alternative protein sources as feeds for animals. French companies are always at the helm of research and development in plant-based proteins.

They are enhancing the quality and availability of these protein-rich crops, such as peas, fava beans, and rapeseed. Companies such as Avril Group and Roquette have been the first movers in innovating the way plant-based proteins are developed for France and engaging in high-end technologies that push the frontiers of extraction techniques and processing further.

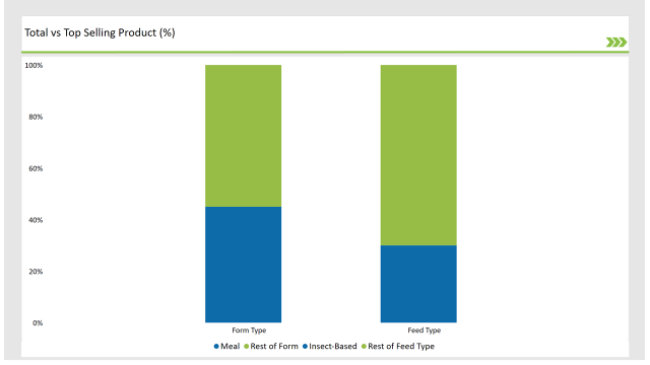

| Main Segment | Market Share (%) |

|---|---|

| Form Type (Meal) | 45% |

| Remaining segments | 55% |

Growth can be primarily attributed to the demand for low-cost feed with the best possible nutrition content to further enhance the health and productivity of livestock. Meal-based alternative proteins, mostly from soy and other legumes like peas, have an interesting profile of essential amino acids that is quite attractive to farmers who would want to advance optimal animal nutrition.

The meal-based products can easily be assimilated into most feed formulations containing different species, such as poultry, swine, and ruminants. Higher pushes for sustainable agriculture offer more than a few convincing rationales for switching to meal-based proteins, primarily because, for the most part, the negative environmental footprint stemming from these types of products tends to be minimal compared to conventionally produced animal-based feeds.

| Main Segment | Market Share (%) |

|---|---|

| Feed Type (Insect-Based) | 30% |

| Remaining segments | 70% |

Insect-based proteins are among the most recent and sustainable sources of protein in animal feed. Some of the insects used for the generation of protein include black soldier flies, mealworms, and crickets, whose nutritional benefits are highly nutritious with a balanced profile of amino acids, fats, and micronutrients.

Insects have a remarkable feed conversion ratio, meaning that relatively fewer resources are required to produce them compared with the traditionally raised livestock. They may therefore serve as an ideal solution to the potential rising demand for protein in animal feed, specifically considering the increasing world population and concerns over food security.

Insects are also very versatile and can be fed on a wide variety of organic waste materials, thereby contributing to the circular economy in that they turn waste into valuable protein. Some companies that have led in this aspect are Ynsect and Protix; they have come to spearhead the mass rearing of insects as a mode of innovative farming.

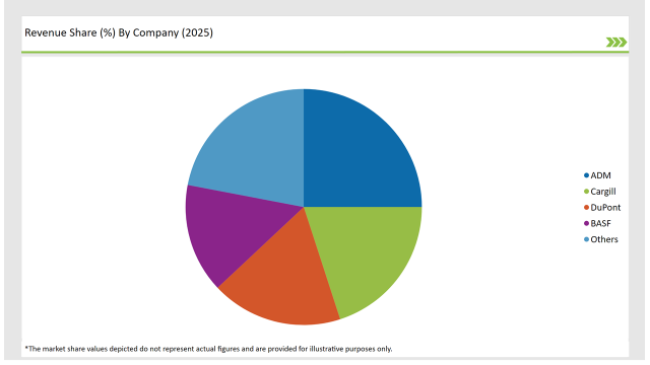

2025 Market share of Europe Animal Feed Alternative Proteinmanufacturers

| Manufacturer | Market Share (%) |

|---|---|

| ADM | 25% |

| Cargill | 20% |

| DuPont | 18% |

| BASF | 15% |

| Alltech | 10% |

| Others | 12% |

Note: The above chart is indicative in nature

European markets for animal feed alternative proteins have a three-tiered structure. Major players, regional companies, and smaller innovators occupy different levels of market concentration. Tier 1 major players involve firms such as ADM and Roquette, at the forefront when it comes to innovation and trends in developing and commercializing alternative protein sources.

Some companies have a higher global market share, own relevant R&D facilities, and therefore can scale up mass production to meet the increasing demand for sustainable ingredients for animal feeding.

Tier 2 companies are regional players; for instance, Protix and Bug Farm Foods latter two having niche market exposures, offering targeted protein sources. They have solid supply chain relationships and customers so that they can service the requirements of local farmers raising livestock in their respective geographies.

Tier 3 companies are small-sized, regional-based ones that often target localized markets through customized solutions and niche applications targeted at small farms and specialty application areas. Not as strong in the market as Tier 1 and Tier 2 companies, it is however critically important for diversity and innovation within the alternative protein market.

As per Feed Type, the industry has been categorized into Insect Based Protein, Plant based Protein, Fish Meal Alternative, Single-cell proteins, and Others.

As per Livestock, the industry has been categorized into Poultry, Swine, Cattle, Equine, and Aquaculture.

As per Form Type, the industry has been categorized into Meal, Pellets, Liquid, and Freeze-dried.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

The Europe Animal Feed Alternative Protein market is projected to grow at a CAGR of 11.5 % from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 9,979.6 million.

Key factors driving the alternative protein market in Europe include the increasing demand for sustainable and environmentally friendly animal feed solutions in response to consumer preferences and regulatory pressures. Additionally, advancements in technology and innovation in protein sources, such as insect and plant-based proteins, are enhancing feed efficiency and nutritional value for livestock.

Germany, France, and Netherlands are the key countries with high consumption rates in the European Animal Feed Alternative Protein market.

Leading manufacturers include ADM, Cargill, DuPont, BASF, and Alltech known for their innovative and sustainable production techniques and a variety of product lines.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Animal Feed Alternative Protein Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

A detailed global analysis of Brand Share Analysis for Animal Feed Alternative Protein Industry

UK Animal Feed Alternative Protein Market Growth – Trends, Demand & Innovations 2025–2035

ASEAN Animal Feed Alternative Protein Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Animal Feed Alternative Protein Market Report – Size, Share & Innovations 2025-2035

Latin America Animal Feed Alternative Protein Market Analysis – Growth & Forecast 2025–2035

Europe Animal Feed Additives Market Insights – Size, Trends & Forecast 2025–2035

Protein Hydrolysate For Animal Feed Application Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Hydrolysate For Animal Feed And Pet Food Applications Market Size and Share Forecast Outlook 2025 to 2035

Animal Feed Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Animal Feed Minerals Market Analysis - Size, Growth, and Forecast 2025 to 2035

Animal Feed Protease Market

Animal Feed Additives Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Animal Feed Probiotic Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Analyzing Animal Feed Additives Market Share & Industry Leaders

Animal Feed Sweetener Market – Growth, Innovations & Market Demand

Animal Feed Prebiotics Market – Growth, Livestock Nutrition & Demand

Animal Feeds Microalgae Market Size and Share Forecast Outlook 2025 to 2035

Animal Feed Antibiotics Market - Size, Share, and Forecast Outlook 2025 to 2035

Animal Feed Ingredients Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA