The Europe Pulses market is set to grow from an estimated USD 19,705.9 million in 2025 to USD 30,602.6 million by 2035, with a compound annual growth rate (CAGR) of 4.5% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 19,705.9 million |

| Projected Europe Value (2035F) | USD 30,602.6 million |

| Value-based CAGR (2025 to 2035) | 4.5% |

The European pulses market, as per the forecast, will be able to grow steadily due to the rise in consumer preferences for plant-derived proteins, the presence of clean-label ingredients, and the need for dietary diversification.

Pulses, which comprise chickpeas, lentils, yellow peas, and pigeon peas, have been rapidly penetrating the market, primarily for their nutritional benefits, ecological stability, and multiple usages in food.

The European region's emphasis on environment-friendly practices, functional foods, and protein-rich commodities is the main reason for the increment in demand for pulse-based flour, protein isolates, and new food products.

Furthermore, the inclusion of pulses into vegan and vegetarian diets, gluten-free baking, and meat substitutes based on pulses has turned them into known food brands. Nutrition programs that are sponsored by the government promoting plant-based dietary patterns also add to the market success, along with the additional demand from hospitals, schools, and catering services.

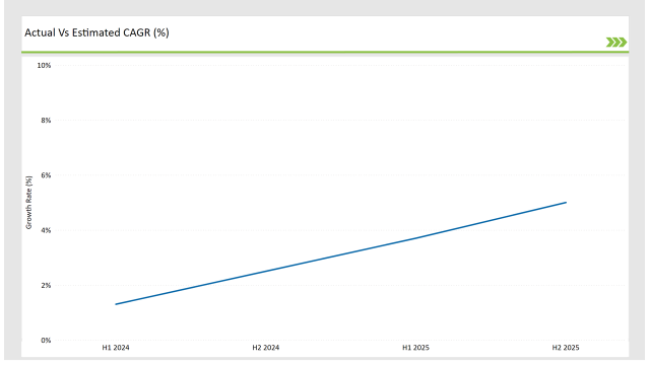

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Pulses market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 1.3% (2024 to 2034) |

| H2 2024 | 2.5% (2024 to 2034) |

| H1 2025 | 3.7% (2025 to 2035) |

| H2 2025 | 5.0% (2025 to 2035) |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Pulses market, the sector is predicted to grow at a CAGR of 1.3% during the first half of 2024, with an increase to 2.5% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 3.7% in H1 but is expected to rise to 5.0% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| April-24 | Product Innovation - Roquette launched a new lentil protein concentrate for use in plant-based dairy and protein bars. |

| March-24 | Expansion of Processing Facilities - Emsland Group announced the expansion of its pea protein and pulse flour production unit in Germany. |

| February-24 | Strategic Partnerships - Bühler Group collaborated with European food manufacturers to enhance pulse processing efficiency and sustainability. |

| January-24 | Sustainability Initiatives - Nestlé increased its sourcing of organic chickpeas and lentils, focusing on sustainable farming practices. |

Vegetable Protein Ingredients Guiding in the Era of Innovative Food

The requirement for functional and protein-rich plant-based raw materials has made the need for pulse-based product innovation in Europe. Pulses are not only used as staples but are also being remodelled into various ingredients such as pulse flours, grits, flakes, and protein concentrates, which can be retrieved for use in bakery, dairy alternatives, and plant-based meats.

Among the food manufacturers in Europe who are taking the endeavour are Roquette and Emsland Group. These companies are proactively taking issues into their own hands by investing in modern milling and fractionation methods that improve the functionality, solubility, and taste of pulse-based ingredients.

With mainly lentils and chickpeas leading the sector, pulse-derived isolates are now a mainstay in sports nutrition products, high-fibre foods, and functional foods that promote gut health.

Furthermore, fermentation and enzyme modification techniques are reducing the digestion power of pulse proteins and removing their flavour side effects, hence they are becoming more and more attractive to food companies.

As more and more consumers look for clean labels and allergy-free proteins, it is anticipated that burst-based ingredients will be used more in commercial food processing and home-based cooking.

Rise in Consumption of Meat and Dairy Alternatives Based on Pulses

The swiftly growing vegan and flexitarian population in Europe has directly caused a large increase in the demand for pulse-based dairy and meat substitutes. Top brands are developing chickpea and lentil-based cheeses, pea-based yogurts, and plant-based burger patties enriched with pulse proteins.

Prominent companies like Nestlé and Beyond Meat are both integrating pulse-derived proteins into their plant-based product lines. This meets the urgent need for meat substitutes that are true to their texture as well as have a high protein content.

Chickpea and pea proteins, in particular, are being supplemented with vitamins, iron, and calcium the most, making them great options for vegetarians and lactose-intolerant consumers.

Plus, variations such as hybrid meat-where pulse protein and animal protein go together to decrease the consumption of meat-are gaining popularity. This kind of hybrid product, in innovative ways, allows flexitarians to enjoy savoury meals and manifests their intentions in greening meat intake by blending meat with pulse proteins.

With a continuous flow of funds into the research and development of plant-based protein and food innovations in Europe, the continent is likely to turn into a pulse-based food innovation centre.

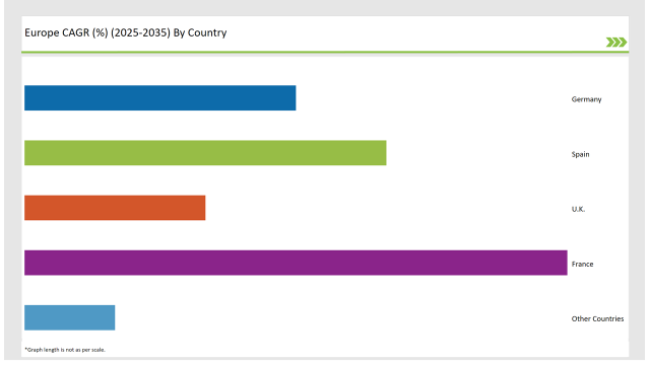

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Germany | 15% |

| Spain | 20% |

| UK | 10% |

| France | 30% |

| Other Countries | 5% |

Germany emerges as a leader in the march of pulse-based food with a broad range of high-nutrition foods that are on the rise including pulse flours, gluten-free baked goods, and high-protein meal solutions.

The country has a strong food chain that has been developing for many years and is a hub for entrepreneurs who care about health which has been the main reason for manufacturers to use pulses in such a variety of products in the bakery and processed food categories.

Companies such as Emsland Group and GoodMills Innovation are focusing on lentil and chickpea flour formulations that are gluten-free, which are becoming major ingredients instead of traditional wheat flour in bakery products. On top of that, Germany's sports nutrition area has seen a large rise in the use of pulse proteins in products such as meal replacement shakes, intake bars, and spaghetti.

In France, the growth of consumer interest in premium and organic pulse-based products is enormous, with chickpeas and lentils as the central players in gourmet food preparations and easy-to-cook meal kits.

French catering's tendency to plant-based nutrition and the promotion of protein are also new solutions that painin the everyday vegetables-based diet. It causes a thirst for pulse-based sauces, dips, and spreads.

Bonduelle and Danone are the star brands leading their organic pulse range expansion by introducing ready-to-eat lentil bowls, different types of hummus, plus chickpea-based dairy alternatives. Moreover, the demand for natural and less processed ingredients is boosting the interest in whole and split pulse varieties mostly in the premium food retail and the gourmet cooking segments.

% share of Individual Categories Product Type and End-Use Application in 2025

| Main Segment | Market Share (%) |

|---|---|

| Product Type (Chickpeas and Lentils) | 70% |

| Remaining segments | 30% |

Chickpeas remain the largest market shareholder of the market, due to their manifold use in food processing, high protein, and the ability to replace conventional ingredients in plant-based applications. The accelerating use of chickpea flour in gluten-free bakery products, chickpea-based dairy alternatives, and protein fortification in energy bars is fuelling its demand.

Advanced chickpea milling and protein extraction technologies are receiving investments from firms like Roquette and Bonduelle to meet the soaring demand in functional food and health-conscious dietary trends.

Lentils mainly owing to their broad application in ready-to-eat meals, high-protein snacks, and gourmet culinary preparations. The progress of lentil-based pasta, protein-laden lentil soups, and lentil protein isolates further established lentils as a fundamental part of European plant-based diets. Corporations like Nestlé and Danone are set for lentil-imbuing goods with deficiency vitamins and improvable health aspects as their main focus.

| Main Segment | Market Share (%) |

|---|---|

| Application Type (B2B and Household Retail Sectors) | 80% |

| Remaining segments | 20% |

In Europe, B2B is not only the strongest segment in the pulses market but also the one to push food manufacturers and ingredient processors as well as industrial-scale bakeries to incorporate pulse-based ingredients in their products. This segment’s growth is largely due to the increased consumption of pulse-based protein isolates, gluten-free flours, and plant-based meat formulations.

In the sphere of pulse fractionation and milling innovation, Bühler Group and Roquette are the innovators and the two are maintaining the same trend by ensuring steady supply and higher functional performance in the processed food applications. Bakery companies are also making this promise given the increased use of pulse-based protein isolates, gluten-free foods

The household retail sector is incrementing, on account of more consumers using pulses as a basic food in the plant-based diet. Higher supermarket market shares have been reported from sales of bulk and split pulses, pulse-based flours, and pre-cooked lentil and chickpea meal kits.

A wave of innovative ready-to-eat products has appeared on the market from PaulD food like Lentils, Bean&kale, and Bonduelle which are prompt to cater to consumers who are looking for healthy, nutritious, and fast-to-make meals.

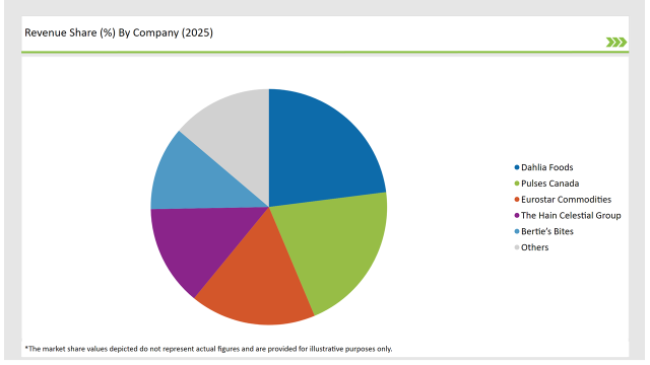

2025 Market share of Europe Pulses manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Dahlia Foods | 20% |

| Pulses Canada | 18% |

| Eurostar Commodities | 15% |

| The Hain Celestial Group | 12% |

| Bertie’s Bites | 10% |

| Others | 12% |

Note: The above chart is indicative in nature

The pulses market in Europe is a bit concentrated and the main ones in this industry are Roquette, Emsland Group, Bonduelle, and Bühler Group marking the innovative and mass production of pulses. Such businesses are adopting modern processing technologies like wet milling, extrusion, and protein isolation, in pursuit of the enhancement of the pulse functional properties for application in food and beverage.

Along with the expansion of the consumer appetite for high-protein plant alternatives, new companies mostly come into the market with and market. For example, niche products like organic pulses, fortified pulse-based foods, and customized protein blends.

New brands are being regional sourced, are organically certified, and are premium positioned, with a particular focus on exclusive selling to gourmet retail and targeting health-conscious customers.

With the advancement of food innovation and compliance with the regulations concerning plant-based proteins, the European pulse processors are expected to further diversification of their product assortments, expansion of their processing capacities, as well as investment in novel food applications, thus they are ensuring the market is continuing to expand.

As per Product Type, the industry has been categorized into Chickpea, Lentils, Yellow Peas, and Pigeon Peas.

As per Form Type, the industry has been categorized into Whole, Split, Flour, Grits, and Flakes.

As per End Use Application, the industry has been categorized into Business to Business, Household Retail, Food Service, and Institutional.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

The Europe Pulses market is projected to grow at a CAGR of 4.5% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 30,602.6 million.

Key factors driving the European pulses market include the increasing consumer demand for plant-based protein sources as part of healthier and more sustainable diets. Additionally, growing awareness of the environmental benefits of pulses, such as lower carbon footprints and reduced water usage, is further propelling market growth.

Italy, France, and Spain are the key countries with high consumption rates in the European Pulses market.

Leading manufacturers include Dahlia Foods, Pulses Canada, Eurostar Commodities, The Hain Celestial Group, and Bertie’s Bites known for their innovative and sustainable production techniques and a variety of product lines.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Europe Pet Food Market Analysis by Nature, Product Type, Source, Pet Type, Packaging, Distribution Channel, and Country - Growth, Trends, and Forecast through 2025 to 2035

Europe's Golden Generation Travel Market Size and Share Forecast Outlook 2025 to 2035

Europe Automotive Night Vision System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA