The Europe Lactase market is set to grow from an estimated USD 792.5 million in 2025 to USD 1,262.9 million by 2035, with a compound annual growth rate (CAGR) of 4.8% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 792.5 million |

| Projected Europe Value (2035F) | USD 1,262.9 million |

| Value-based CAGR (2025 to 2035) | 4.8% |

The last few years have been of high growth for the European lactase market, which is mainly attributed to the increased demand for lactose-free dairy products, an increasing number of lactose intolerant people, and a trend towards plant-based and vegan options.

Lactase, the enzyme that breaks down lactose, is the most sought-after ingredient in the products being sold to people who are lactose intolerant. Numerous sources of lactase can be classified under the different types of microbial, fungal, yeast-derived, animal-derived, and plant-based. Lactase-based products are on a roll due to the rise in health-conscious consumers who look forward to a well-balanced diet and who do not want to inconvenience the consumption of lactose.

The greatest demand for lactase is exhibited by the food and beverages sector as it is the biggest volume manufacturer of milk substitutes containing milk, yogurt, cheese, and ice cream free of lactose. The pharmaceutical segment also started needing lactase in its dietaries prepared for patients who suffered from lactose intolerance.

European market leaders among the lactase manufacturers include DSM, DuPont, and Chr. Hansen is heavily investing in R&D on their innovative and efficient lactase enzymes, which would meet the increasing demand in the market. Companies would focus on increasing the product portfolio, new formulation products, and alternative sources of lactase.

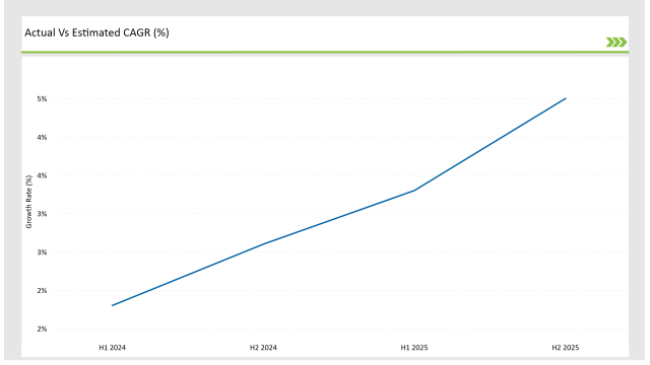

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Lactase market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 1.8% (2024 to 2034) |

| H2 2024 | 2.6% (2024 to 2034) |

| H1 2025 | 3.3% (2025 to 2035) |

| H2 2025 | 4.5% (2025 to 2035) |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Lactase market, the sector is predicted to grow at a CAGR of 1.8% during the first half of 2024, with an increase to 2.6% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 3.3% in H1 but is expected to rise to 4.5% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| April-2024 | Product Launch - DuPont introduced a new plant-based lactase enzyme formulation aimed at increasing the digestibility of dairy products without compromising taste and texture. |

| March-2024 | Strategic Acquisition - Chr. Hansen acquired a regional player in the enzyme production market, expanding its portfolio of lactase products and enhancing its position in the European market. |

| February-2024 | Product Innovation - DSM launched a new microbial-derived lactase enzyme that improves lactose hydrolysis efficiency in dairy processing, catering to the growing demand for lactose-free dairy products. |

Novel Sources of Lactase and Its Impact on the Market

Growing demand for lactose-free and plant-based dairy alternatives triggered intense innovation within the market of lactase. A critical scope of innovation involved diversifying lactase enzyme sources from microbial to fungal, from yeast-derived through animal-derived as well as into plant-based sources of lactase.

In recent years, interest in microbial as well as in fungal lactases has been substantial, and highly effective at a cost much less as compared to industrial-scale productions. These enzymes are produced through fermentation processes using microorganisms such as Aspergillus oryzae and Kluyveromyces lactis.

A further factor is the growing desire for plant-based diets, and this is making a case for the use of plant-derived lactase. DuPont is among companies that have now focused on manufacturing new plant-based lactase enzymes for use in the formulation of dairy-free drinks, cheeses, and yogurts.

Sustainability of Lactase Enzymes in the Food and Beverage Industry

Sustainability is a very important factor in the growth and development of the lactase market, especially in Europe, where consumers and manufacturers are increasingly focusing on environmentalism and sustainability. The traditional animal-derived lactase enzymes are being gradually replaced by microbial and fungal alternatives, which have environmental and ethical advantages.

With a shift towards microbial and fungal-derived lactase, the carbon footprint in the production of enzymes has drastically reduced without compromising efficacy. There is more attention towards the sustainable production of enzymes, particularly fermentation processes, that are not only energy and environment-friendly.

Demand for plant-based lactase adds another dimension to sustainability; resources are more meagre with plant-based sources, with very minimal impacts on the environment than the alternative based on animal products. This is in line with the general direction of the European market towards more sustainable food production. The two major players are DSM and Chr. For example, Hansen is ensuring that lactase enzymes are sustainably sourced and the environment is conserved.

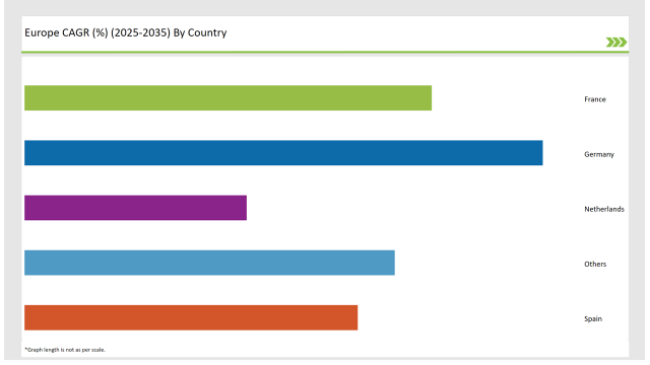

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Germany | 28% |

| France | 22% |

| Spain | 18% |

| Netherlands | 12% |

| Others | 20% |

Germany has emerged as one of the most important and fastest-growing lactase markets in Europe. As cases of lactose intolerance are growing, coupled with demand for alternative dairy products, growth in this market is currently being led by Germany. Most of the global leaders have set up their manufacturing facilities in Germany. The market for lactose-free milk, yogurt, and cheese happens to be a mammoth market supported by a large number of consumers wanting to avoid digestive discomfort caused by lactose.

A major reason why GMO-free and certified products exist is because of strong government regulation and quality control to ensure that food safety standards are maintained. This enhances the same rate as well as the consumption rate in the market due to lactase.

A significant amount of investment is there from key players like DuPont, Chr. Hansen, and DSM in the German market for a wide range of lactase enzyme solutions to cater to the diversified needs of both lactose-intolerant consumers and those searching for plant-based alternatives.

Another major marketplace for lactase in the European marketplace is France, where demand is rapidly expanding as a result of changes in consumer behaviour and increased knowledge regarding lactose intolerance.

Consumers have started becoming health conscious and seek now more lactose-free dairy products that would promote their digestive wellness. Demand for lactose-free milk and cheese, as well as other dairy food substitutes, has been rising in the past years, which in turn increases the usage rate of lactase enzymes in processing. France is increasing the demand for plant-based products, along with plant-based milk and alternative dairy.

And this has significantly increased demand for plant-based lactase-based solutions. Thus, the French manufacturers responded by formulating new and bespoke formulations of the lactase enzyme produced using some of the state-of-the-art fermentation and biotechnology methodologies.

This is quite an interesting product line from the no-lactose products that both the domestic and international companies have invested their research and development to improve the activity of the enzyme as well as lower the cost of production.

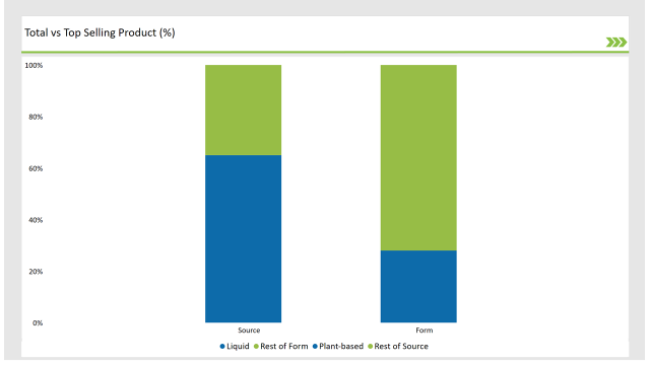

% share of Individual Categories Form and Source in 2025

| Main Segment | Market Share (%) |

|---|---|

| Form (Liquid) | 28% |

| Remaining segments | 72% |

Liquid Lactase as a Growing Market Segment

Liquid lactase is the rapidly growing segment in the European market for lactase. Such products are versatile and easy to use, therefore not very resource-costly in processing food. One of the significant reasons is the fact that liquid lactase is extensively used in producing lactose-free dairy products simply because it is much more convenient for the manufacturer can easily add this into the process of production.

Very small amounts of the formulation could be used for breaking lactose in dairy products. In the case of large-scale production, it is extremely cost-effective. The liquid format also aids the more precise dosing of the enzymes involved, and fine-tuning can be done about lactose hydrolysis by the manufacturer based on the product under manufacture.

Leading European producers such as DuPont and Chr. Hansen has invested considerably to develop liquid lactase formulations for better quality and cost-effectiveness of product manufacture. The adoption of liquid lactase enzymes is not just limited to traditional dairy products, but it also extends to plant-based and vegan alternatives, contributing to the market's growth further.

| Main Segment | Market Share (%) |

|---|---|

| Source (Plant-based) | 65% |

| Remaining segments | 35% |

Plant-based lactase is catering to the increasing cases of veganism and plant-based diets

With this, increasing demand for plant-based diets, more important vegan alternatives, and dairy-free solutions continue to fuel increased demand for such lactase across Europe. That said, with increasingly large groups adopting the vegan way of life, increases in plant-based sources for lactase have been more pronounced since consumers would also tend to eschew this ingredient, made from animal resources. Since plant-based microorganisms such as fungi and some types of yeast are used in the production of plant-based lactase, it is an ethical and allergen-free solution for lactose intolerance.

The manufacturers are now capitalizing on the trend of increasing demand for plant-based diets by introducing plant-based lactase solutions for application in products, including plant-based milk, yogurt, cheese, and ice cream. DuPont and DSM companies have made plant-based lactase products available in the market to meet the increased consumer demand for dairy-free and vegan-friendly dairy alternatives.

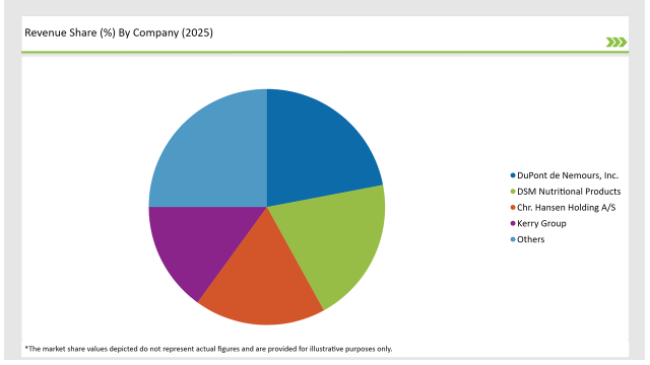

2025 Market share of Europe Lactase manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| DuPont de Nemours, Inc. | 22% |

| DSM Nutritional Products | 20% |

| Chr. Hansen Holding A/S | 18% |

| Kerry Group | 15% |

| Lactalis Ingredients | 10% |

| Others | 15% |

Note: The above chart is indicative in nature

The market for lactase in the European market is highly competitive and dynamic in terms of industry structure. Global players are strengthened by other regional players and local innovators. The Tier 1 companies have the strongest hold in the market, which has a large portfolio of products with a strong global presence.

The market leaders were concluded, including DuPont, DSM, and Chr. Hansen. These conducted research and used cutting-edge technologies in enzyme production to lead the market with comprehensive ranges of lactase enzyme products. They spend a lot on R&D developing new formulations of lactase in line with emerging trends, like plant-based diets and sustainable production of enzymes.

Tier 2 companies, Lonza and Sabinsa, operate regionally to service niche areas through specific applications, including specialized lactase in pharmaceutical and dietary supplement markets. Regional players often focus on improving enzyme efficiency, cost-effective solutions, and local bases.

Tier 3 companies, by comparison, are smaller in scale and more regional; they are niche players in Europe, where demand for lactose-free products is less marked. Traditionally, Tier 3 competencies are niche custom lactase solutions customized to the preferences and regional needs of intake in diets.

As per Form Type, the industry has been categorized into Powder, and Liquid.

As per Source, the industry has been categorized into Fungi, Yeast, Bacteria.

As per Application, the industry has been categorized into Dairy Products Manufacturing, Infant Formula Production, Beverage Processing.

As per Grade, the industry has been categorized into Food-grade, Feed-grade.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

The Europe Lactase market is projected to grow at a CAGR of 4.8% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 1,262.9 million.

Key factors driving the European lactase market include the rising prevalence of lactose intolerance among consumers, leading to increased demand for lactose-free products, and the growing trend towards healthier eating habits that favor digestive-friendly alternatives. Additionally, innovations in food technology and the expansion of dairy alternatives further enhance market growth.

Germany, France, and UK are the key countries with high consumption rates in the European Lactase market.

Leading manufacturers include DuPont de Nemours, Inc., DSM Nutritional Products, Chr. Hansen Holding A/S, Kerry Group, and Lactalis Ingredients known for their innovative and sustainable production techniques and a variety of product lines.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Europe Pet Food Market Analysis by Nature, Product Type, Source, Pet Type, Packaging, Distribution Channel, and Country - Growth, Trends, and Forecast through 2025 to 2035

Europe's Golden Generation Travel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA