The Europe Non-Alcoholic Malt Beverages market is set to grow from an estimated USD 10,468.3 million in 2025 to USD 18,564.0 million by 2035, with a compound annual growth rate (CAGR) of 5.9% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 10,468.3 million |

| Projected Europe Value (2035F) | USD 18,564.0 million |

| Value-based CAGR (2025 to 2035) | 5.9% |

The demand for Non-Alcoholic Malt Beverages in Europe has shot up over the last few years. Non-alcoholic malt beverages are typically produced using barley and other grains, thereby becoming an alternative option for conventional alcoholic beverages. These drinks appeal to those customers who seek low-calorie refreshments and healthy alternatives to soda, beer, and energy drinks.

The shift of consumer preferences among European people to healthier products has affected the market of non-alcoholic variants, which still have beer qualities. As per the market analysis, the rise in demand in the European market for non-alcoholic malt beverages is projected to be constant for the next four years and will be influenced by more lifestyles as well as the adoption of low-sugar and functional drinks.

The industry is highly competitive with leading brands such as Heineken, Carlsberg, and AB InBev allocating finances to projects that increase their research and innovation in a bid to capture the lucrative market segment.

Besides, these businesses are also broadening their product scope with a variety of non-alcoholic drinks that not only taste like beer but also use additional flavours that include, citrus, ginger, and herbs which in turn offer more choices thus appealing to different consumer tastes. Also, there is a shift from the use of sugars to the introduction of functional benefits with added vitamins, minerals, and electrolytes, which is a focus on health benefits.

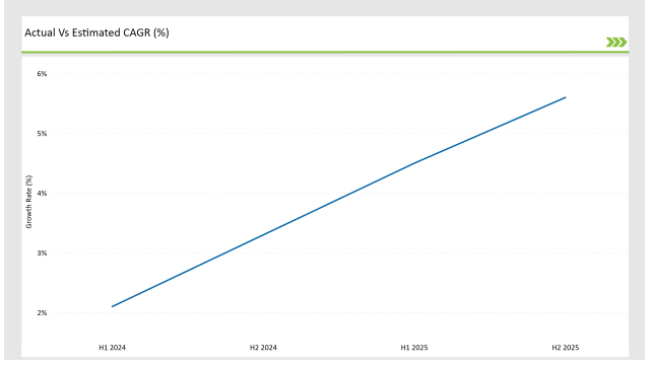

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Non-Alcoholic Malt Beverages market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1(2024 to 2034) | 2.1% |

| H2(2024 to 2034) | 3.3% |

| H1(2025 to 2035) | 4.5% |

| H2(2025 to 2035) | 5.6% |

H1 signifies period from January to June, H2 Signifies period from July to December. For the European Non-Alcoholic Malt Beverages market, the sector is predicted to grow at a CAGR of 2.1% during the first half of 2024, with an increase to 3.3% in the second half of the same year.

In 2025, the growth rate is anticipated to slightly decrease to 4.5% in H1 but is expected to rise to 5.6% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| April-2024 | Product Launches: In April 2024, Heineken expanded its non-alcoholic malt beverage range with the launch of a new citrus-flavored variant designed to appeal to younger, health-conscious consumers. |

| March-2024 | Market Expansion: Carlsberg announced the opening of a new production facility in Poland focused solely on the production of non-alcoholic malt beverages to meet growing consumer demand in Eastern Europe. |

| February-2024 | Strategic Partnerships: AB InBev entered a partnership with a European retail giant to increase distribution of its non-alcoholic malt beverages across supermarkets and convenience stores in major European markets. |

Diversification in flavour profiles to Appeal to Diverse Consumer Tastes

Whereas the older versions of non-alcoholic malt beverages were beer-like in taste only, the recent market guides have observed the addition of fruity, herbal, and exotic flavours. This is the opposite of traditional them, which are beer-like.

For example, Heineken had a bottling line in which only non-alcoholic beverages were mixed with citrus and ginger flavours, whereas Carlsberg had pineapple and other tropical fruits mixed with spices for their new range. Even though these kinds of drinks are mostly related to young people who are looking to be modern and are in search of something new, the fact that they are better for health makes them appealing.

They differ from the usual options like sugary sodas and high-calorie drinks and thus are positioned as the only health-conscious beverages available. The non-alcoholic malt beverage market is thus available for those who seek to drink what other people drink but without alcohol as well as those who would like to try quenchers different from carbonated drinks and fruit juices. This series of steps is still progress in the market innovative reshaping and the trade for such drinks is driven all over Europe.

Environment Sustainability and Eco-Friendly Packaging Cuts

The increase in demand for alcohol-free malt drinks calls for the producers' consent for manufacturers to run their operations more sustainably. In Europe, the trend of eco-friendly packaging solutions is growing related to consumers' care about the single-use plastic environmental impact.

AB InBev and Heineken are the frontiers in sustainability through product formulations and packaging innovations. For example, Heineken's beverages now are in fully recyclable cans, in line with this move, Carlsberg has proposed bottles that are paper-based as a means of tackling plastic waste.

They not only adopt environmentally friendly solutions through their product offerings but also innovate in the packing sector. Recycling packaging is an attractive selling proposition for environmentally conscious European shoppers, who are eager for brands that sustain their values through sustainability and climate awareness.

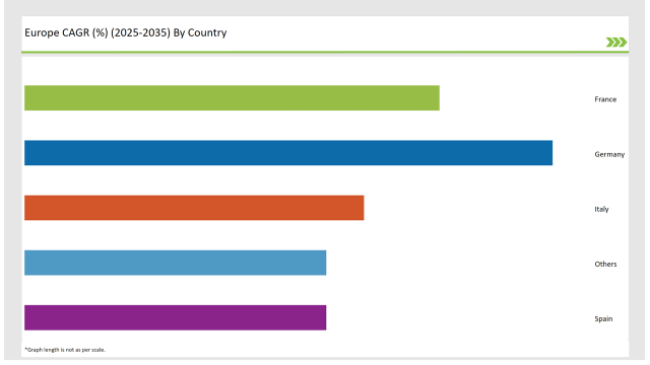

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Country | Market Share (%) |

|---|---|

| Germany | 28% |

| France | 22% |

| Italy | 18% |

| Spain | 16% |

| Others | 16% |

Germany is the strongest beer consumer market, and in recent years has increasingly adopted non-alcoholic alternatives. Against this backdrop, growing healthy tendencies and a declining trend of alcohol consumption have made the non-alcoholic malt beverage market grow. The major players, Bitburger and Krombacher, among other German breweries, have diversified their product portfolios to cater to the demand by introducing a wide range of non-alcoholic beers and flavoured malt drinks.

Moreover, the increasing fitness trend and low-sugar diet popularity among Germans have increased their demand for low-alcohol products that can match their lifestyle. Non-alcoholic malt beverages are readily available in many retail outlets and food service channels, an attribute that will expand the market by easy access to the ultimate consumer. This has also triggered innovation, as many companies keep developing new and unique flavour profiles to differentiate their products from those of competitors.

In the UK, there is a massive shift in consciousness towards health-conscious drinking habits that has led to an enormous growth in demand for non-alcoholic malt beverages. The fitness culture gaining momentum and the low-calorie dieting culture along with an increased awareness of the negative health effects of overindulgence in alcoholic drinks is driving the UK consumer to look for a non-alcoholic alternative to traditional beer and sugary sodas.

As a result, British breweries, including BrewDog and Camden Town Brewery, have set up lines offering some pretty innovative non-alcoholic malt beverages, merging old-school malt flavours with innovative refreshing elements with citrus, tropical fruits, or herbs. Interestingly, these emerging trends are more prominent among younger consumers, who prefer low-calorie or functional beverages.

The UK is one of the fastest-growing markets for non-alcoholic malt beverages in Europe, with this sector expected to expand exponentially over the next few years. Furthermore, non-alcoholic versions are increasingly available in pubs and bars, restaurants, and retail outlets.

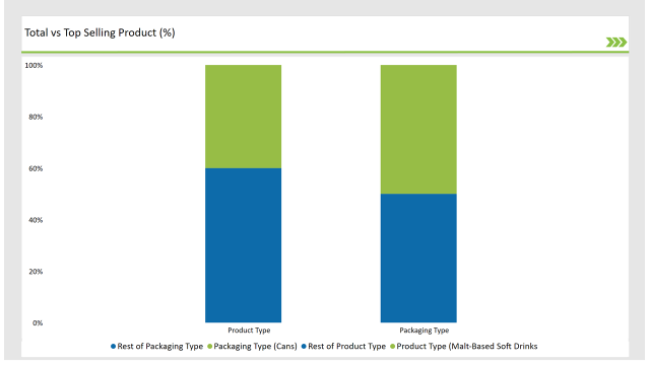

% share of Individual Categories Product Type and Packaging Type in 2025

| Main Segment | Market Share (%) |

|---|---|

| Product Type (Malt-Based Soft Drinks) | 40% |

| Remaining segments | 60% |

The malt-based soft drinks category is the most rapidly growing in the European non-alcoholic malt beverages market. These drinks are gaining popularity because of their appealing taste profiles and the perception of being a healthier alternative to traditional soft drinks. As consumers become more health-conscious, there is a growing demand for functional beverages that provide not only refreshment but also nutritional benefits, which malt-based soft drinks provide, focused on natural ingredients and lower sugar content.

This innovation not only appeals to a more conscious group of health-conscious consumers, especially from the youth target audience, but also flavour innovations by offering organic and premium options. Brands are also using marketing tactics that play off the characteristics of malt-based soft drinks as glamorous and classy refreshers for social events.

| Main Segment | Market Share (%) |

|---|---|

| Packaging Type (Cans) | 50% |

| Remaining segments | 50% |

Cans have become popular in recent times, as they offer convenience, are portable, and lightweight, perfect for on-the-go consumption. The trend of more time outdoors and more social get-togethers led to increased demand for malt beverages in cans as carry able easy items are currently being demanded by consumers. For premium and craft malt beverages, bottles are still preferred as bottles convey some form of quality and class.

The glass bottle packaging is usually associated with premium products, and customers looking for a more premium drinking experience would appreciate such a product. Moreover, with the growing number of environmentally conscious consumers, companies are shifting toward sustainable packaging options, which include recyclable materials and lesser use of plastic.

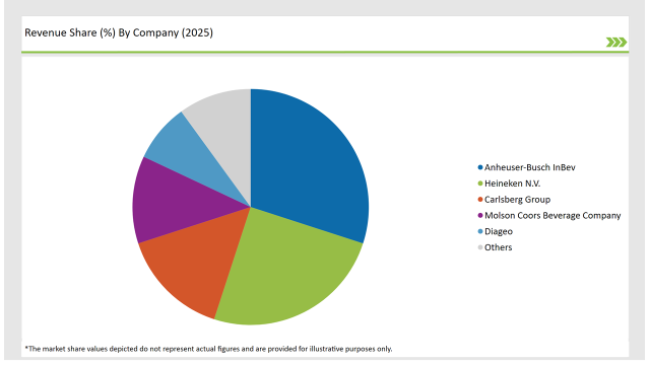

2025 Market share of Europe Non-Alcoholic Malt Beverages manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Anheuser-Busch InBev | 30% |

| Heineken N.V. | 25% |

| Carlsberg Group | 15% |

| Molson Coors Beverage Company | 12% |

| Diageo | 8% |

| Others | 10% |

The European non-alcoholic malt beverages market is highly competitive, with global and regional players in the fray. Tier 1 companies such as Heineken, Carlsberg, and AB InBev have large shares and great brand recognition, making them leaders in the market. They did so through their broader portfolio of soft drinks and also the extension of product lines in a healthy consuming segment. These include some excellent examples in the portfolio by Heineken and the "Peach Lager" in the portfolio by Carlsberg.

BrewDog and Camden Town Brewery, being Tier 2 brewers, pursue niche product lines with more innovation for healthy and young consumers, who are expected to have a new taste and a fresh experience while drinking. This regional company focuses on differentiation through flavor innovation and sustainable production methods.

Tier 3 companies are smaller, more localized players producing products targeted at a local or regional scale and have more limited ranges, but might target niche demands with an artisanal approach. Even though Tier 3 companies have a lower market presence, they have still been critical for localized innovation as well as providing more niche products for a smaller but loyal customer base.

As per Product Type, the industry has been categorized into Malt Beers, Malt-based Soft Drinks, Malt Extracts, and Others.

As per Flavour, the industry has been categorized into Original/Plain, Flavoured (e.g., Fruit, Spices), Herbal.

As per Packaging Type, the industry has been categorized into Cans, Bottles, Pouches, Others.

As per Distribution Channel, the industry has been categorized into B2B (HoReCa), B2C, Hypermarkets/Supermarkets, Convenience Stores, Online Retail, Others.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

The Europe Non-Alcoholic Malt Beverages market is projected to grow at a CAGR of 5.9 % from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 18,564.0 million.

Key factors driving the non-alcoholic malt beverage market in Europe include increasing health consciousness among consumers seeking low-calorie and alcohol-free options, and the growing trend of moderation in alcohol consumption, particularly among younger demographics. Additionally, innovative product offerings and effective marketing strategies are enhancing consumer interest and accessibility.

Germany, Switzerland, and UK are the key countries with high consumption rates in the European Non-Alcoholic Malt Beverages market.

Leading manufacturers include Anheuser-Busch InBev, Heineken N.V., Carlsberg Group, Molson Coors Beverage Company, and Diageo known for their innovative and sustainable production techniques and a variety of product lines.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Europe Pet Food Market Analysis by Nature, Product Type, Source, Pet Type, Packaging, Distribution Channel, and Country - Growth, Trends, and Forecast through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA