The Europe Non-Dairy Creamers market is set to grow from an estimated USD 792.1 million in 2025 to USD 1,496.7 million by 2035, with a compound annual growth rate (CAGR) of 6.6% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 792.1 million |

| Projected Europe Value (2035F) | USD 1,496.7 million |

| Value-based CAGR (2025 to 2035) | 6.6% |

Europe is poised for tremendous growth between 2025 and 2035 due to growing consumer interest in plant-based diets, lactose-free alternatives, and convenient food products. Versatile, with long shelf lives, non-dairy creamers are becoming a highly popular substitute for dairy creamers across beverage applications, desserts, and baked goods.

Increasing demand for clean-label formulations based on innovative European ingredients like Nordic oats, Mediterranean almonds, and regional coconuts along with unique flavors tailored to local tastes such as hazelnut mocha and vanilla chai would contribute to growth led by innovation in the market.

Growing awareness of dietary restrictions such as lactose intolerance would add to the increasing demand for vegan and allergen-free products.

Key manufacturers in Europe are putting significant investments in research and development to create a product that not only replicates the texture of traditional dairy creamers but also tastes like one while catering to health and wellness trends.

Integration of functional ingredients like protein, vitamins, and minerals will be a growth promoter for the market.

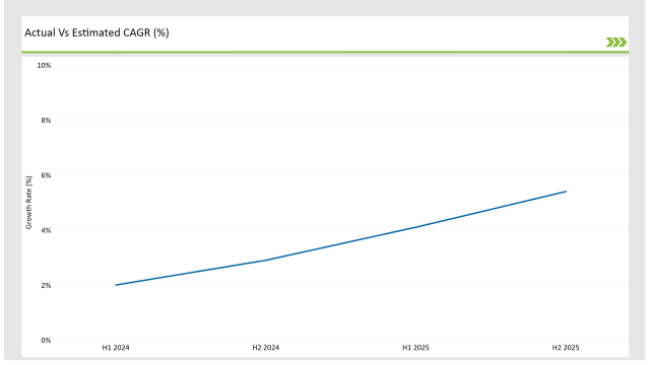

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Non-Dairy Creamers market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1(2024 to 2034) | 2.0% |

| H2(2024 to 2034) | 2.9% |

| H1(2025 to 2035) | 4.1% |

| H2(2025 to 2035) | 5.4% |

H1 signifies period from January to June, H2 Signifies period from July to December. For the European Non-Dairy Creamers market, the sector is predicted to grow at a CAGR of 1.8% during the first half of 2024, with an increase to 2.6% in the second half of the same year.

In 2025, the growth rate is anticipated to slightly decrease to 3.3% in H1 but is expected to rise to 4.5% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| February | New Product Launches- Nestlé Professional launched an oat-based non-dairy creamer tailored for barista-style coffee in the European market. |

| January | Functional Product Innovations - Oatly developed a fortified oat creamer enriched with calcium and vitamin D to cater to health-conscious consumers across Europe. |

Plant-based diets are driving non-dairy creamer consumption

The rapid transition toward plant-based nutrition all over Europe has had a huge impact on the non-dairy creamers market. As consumers increasingly are looking toward plant-based food due to health, ethical, and environmental reasons, demand for oat, almond, soy, and coconut-based non-dairy creamers is thus driven.

The countries in the lead with this trend of consuming plant-based food products are Germany, the United Kingdom, and the Netherlands, which concentrate on sustainable and allergen-free food products.

There has also been a rise in demand by the health-conscious consumer, due to the availability of fortified non-dairy creamers with calcium and vitamin D as added nutrients. The increased interest in veganism and flexitarian diets in Europe is the main reason for this growth of the non-dairy creamer market, which is why plant-based options are no longer the second-fastest.

Several Innovations in Flavoured Non-Dairy Creamers

Many consumer groups who aim for creatively defined flavours in the drinks and their desserts prefer using flavoured non-dairy creamers. Flavours like vanilla, hazelnut, caramel, and mocha drive the trend from across Europe. Consumers look for flavoured creamers in premium coffee choices that can enhance an overall sensory flavour. Manufacturers nowadays are launching innovative flavoured offerings that are supposed to be for consumers with heterogeneous tastes.

The use of natural flavours and clean-label ingredients is the primary move for many companies willing to increase their portion of the flavoured non-dairy creamer market. Furthermore, producing through advanced methodologies that maintain flavour authenticity and longer shelf life has emerged as a differentiating factor for the manufacturers.

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Country | Market Share (%) |

|---|---|

| Germany | 28% |

| Italy | 12% |

| UK | 25% |

| France | 20% |

| Netherlands | 5% |

| Other Countries | 10% |

The European non-dairy creamers market is dominated by Germany, owing to the increased focus on plant-based and vegan products. In the German region, manufacturers are adopting high-tech techniques such as emulsification and homogenization in order to make better and more stable non-dairy creamers, especially in barista-style coffee.

Additionally, the integration of functional ingredients like probiotics and adaptogens into non-dairy creamers is gaining traction in Germany, catering to consumers seeking health benefits beyond basic nutrition. The country’s well-established coffee culture and preference for organic and clean-label products make it a hub for innovative non-dairy creamer formulations.

The United Kingdom is always the first to approach innovation in terms of flavoured and sustainable non-dairy creamers. The manufacturers have successfully innovated flavoured and sustainable non-dairy creamers.

Introducing innovative packaging solutions, including plant-based PLA (polylactic acid) films and water-soluble materials, that manufacturers like Alpro reduce environmental impact while ensuring the freshness of products, aligning with region-specific production practices the country has adopted, such as localized sourcing of oats and almonds that ensure minimal carbon footprints.

New and differing flavours such as chai spice, salted caramel, and seasonal pumpkin spice are creating novelty in the UK market. Such innovations tap into the varied tastes of the adventurous consumer in the UK and will sustain the growth curve for the non-dairy creamer segment.

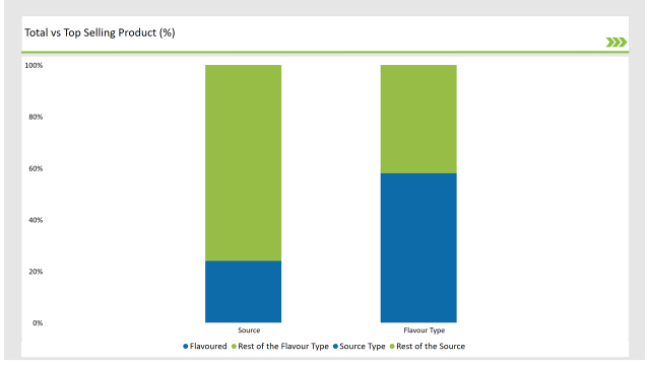

% share of Individual Categories Source and Flavour Type in 2025

| Main Segment | Market Share (%) |

|---|---|

| Source Type | 24% |

| Remaining segments | 76% |

The most elevated market share and a faster growth rate were reported by plant-based creamers in the European non-dairy creamers market. With oat, almond, soy, and coconut bases, these creamers are fulfilling the growing demand for vegan and lactose-free products.

Among the highly popular oat-based creamers that consumers can use in virtually every application, it is the smooth texture and neutral flavour of oat-based creamers that account for their rapidly growing popularity. The presence of functional ingredients like protein and fibre has improved the appeal of plant-based creamers even for the health-conscious consumer.

| Main Segment | Market Share (%) |

|---|---|

| Flavour Type (Flavoured) | 58% |

| Remaining segments | 12% |

A trend that is quickly becoming popular in the European market is flavoured creamers which can be regarded as a symbol of premium and indulgent taste experiences. The preferences of the consumers are overwhelming, with vanilla, hazelnut, caramel, and mocha as the top picks for coffee lovers.

Manufacturers are now using natural, clean-label, locally sourced ingredients simply to distinguish their products by unique flavour profiles and high-quality formulations from their competitors.

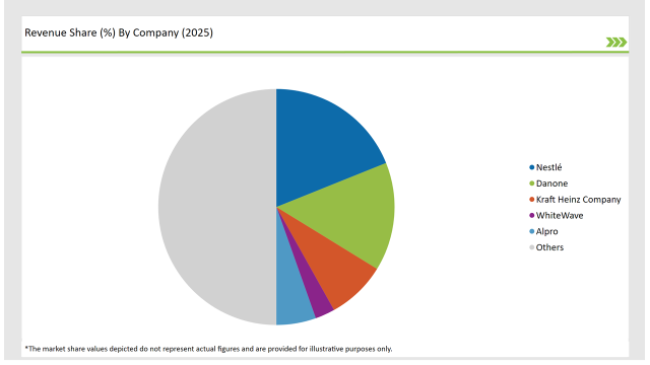

2025 Market share of Europe Non-Dairy Creamers manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Nestlé | 28% |

| Danone | 22% |

| Kraft Heinz Company | 12% |

| WhiteWave | 4% |

| Alpro | 8% |

| Others | 74% |

The European non-dairy creamers market is moderately consolidated in nature, where companies like Nestlé, Danone, and Friesl and Campina dominate the market with great shares. The company offers innovative products through extensive distribution networks and advanced R&D capabilities, which support evolving consumer preferences.

Strategic initiatives, such as capacity expansions, product launches, and sustainability-focused practices, have enabled these players to strengthen their market positions.

Regional players are now gaining ground because they offer innovative, uncommon, and locally sourced products. For example, small manufacturers in the Netherlands and Scandinavia are producing high-end plant-based creamers for a niche market.

As demand for non-dairy creamers continues to rise, the market is expected to witness increased competition and innovation, driving growth across all segments.

As per Form Type, the industry has been categorized into Powder / Granules, and Liquid.

As per Source Type, the industry has been categorized into Coconut, Almond, Soy, Corn, and Others.

As per Packaging Type, the industry has been categorized into Sachets / Pouches, Bags, Canisters, and Bottles.

As per Distribution Channel, the industry has been categorized Food Service Channels, Hypermarkets / Supermarkets, Convenience Stores, Grocery Stores, Specialty Stores, and Online Retail.

As per Flavour Type, the industry has been categorized into Unflavoured (40%), French Vanilla (22%), Chocolate, Coconut, Hazelnut, and Others.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

The Europe Non Dairy Creamers market is projected to grow at a CAGR of 6.6% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 1,496.7 million.

Key factors driving the European non-dairy creamers market include the increasing demand for plant-based and lactose-free alternatives among health-conscious consumers and the growing popularity of coffee and tea beverages that utilize creamers. Additionally, innovations in product formulations and flavors are enhancing consumer interest and expanding market reach.

Germany, and UK are the key countries with high consumption rates in the European Non Dairy Creamers market.

Leading manufacturers include Nestlé, Danone, and Kraft Heinz Company known for their innovative and sustainable production techniques and a variety of product lines.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Western Europe Non-Dairy Creamer Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Europe Pet Food Market Analysis by Nature, Product Type, Source, Pet Type, Packaging, Distribution Channel, and Country - Growth, Trends, and Forecast through 2025 to 2035

Europe's Golden Generation Travel Market Size and Share Forecast Outlook 2025 to 2035

Europe Automotive Night Vision System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA