The Europe Shrimp market is set to grow from an estimated USD 20,321.9 million in 2025 to USD 40,126.0 million by 2035, with a compound annual growth rate (CAGR) of 7.0% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 20,321.9 million |

| Projected Europe Value (2035F) | USD 40,126.0 million |

| Value-based CAGR (2025 to 2035) | 7.0% |

The shrimp market in Europe is expected to continue growing mainly because of the increased seafood consumption, sustainable aquaculture practices, and the high demand for processed and value-added shrimp products.

Shrimp is mainly consumed in restaurants and supermarkets and remains one of the supermarkets and one of the most consumed products in Europe. The increased nutrient-rich, low-fat seafood choices in the region have resulted in changes in the consumer preferences of shrimp over time.

Organic and eco-certified shrimp farming is the driver of the market as it is beyond compliance with the European Union (EU) sustainability criteria. Major manufacturers are investing in up-to-date mechanics such as frozen, canned, and breaded shrimp processing that is necessary to facilitate longer preservation and meet the needs of the convenience food sector.

Besides, the production of shrimp products in pharmaceutical, cosmetic, and biotechnology areas has initiated creative sources of income and driven the market development further.

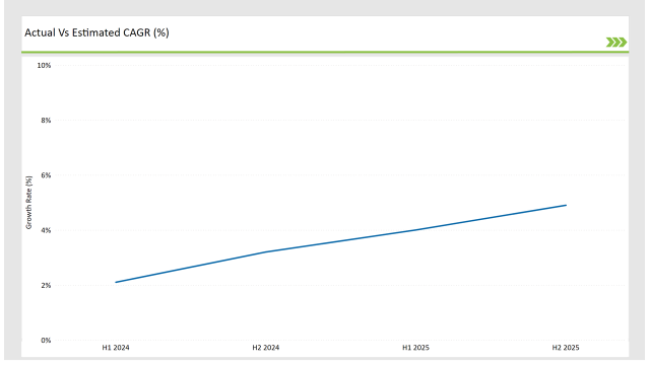

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Shrimp market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 2.1% (2024 to 2034) |

| H2 2024 | 3.2% (2024 to 2034) |

| H1 2025 | 4.0% (2025 to 2035) |

| H2 2025 | 4.9% (2025 to 2035) |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Shrimp market, the sector is predicted to grow at a CAGR of 2.1% during the first half of 2024, with an increase to 3.2% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 4.0% in H1 but is expected to rise to 4.9% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| April-24 | Sustainability Initiatives - Danish shrimp supplier Royal Greenland expanded its eco-certified shrimp sourcing program, ensuring compliance with EU sustainability regulations. |

| March-24 | Product Innovation - Iceland Seafood International introduced premium frozen peeled shrimp varieties, targeting high-end European retailers. |

| February-24 | Processing Expansion - Spanish seafood processor Nueva Pescanova upgraded its value-added shrimp production lines, increasing capacity for breaded and ready-to-cook products. |

| January-24 | Market Expansion - Seafrost Europe launched a direct-to-consumer online shrimp retail platform, improving accessibility to premium shrimp products across European countries. |

Sustainability and Responsible Aquaculture Driving Market Growth

The shrimp industry in Europe is witnessing a huge transition to sustainable and responsible aquaculture as the eco-certified seafood demand from customers is on the rise. The European Union has introduced strict measures to address shrimp farming, wild shrimp capture, and import standards, thus making sure that environmental and ethical fishing practices are being followed.

Royal Greenland, a leading shrimp supplier along with Nueva Pescanova, has been putting money into the sustainable sourcing program that includes eco-certified shrimp farms and traceability programs to establish that they are meeting the Marine Stewardship Council (MSC) and Aquaculture Stewardship Council (ASC) criteria.

As people are getting more anxious about the effects of overfishing and habitat destruction, Europe is reversing the traditional way of shrimp sourcing, and now it is farmed organically and harvested responsibly.

Other than responsible sourcing, recirculating aquaculture systems (RAS) and low-impact shrimp farming are the techniques that farmers are now focusing on since they have proven to reduce water consumption and to have a positive effect on feed efficiency.

Broaden Processed and Value-Added Shrimp Products

The increasing consumption of ready-to-eat seafood and improved living conditions are responsible for the growth of processed and value-added shrimp products in Europe. Seafood processors are committed to research and development to improve quality, taste, and shelf life with busy lifestyles and an increasing preference for frozen, canned, and pre-cooked shrimp, not to mention technological advancements in shrimp processing.

Iceland Seafood International and Nueva Pescanova are among the companies that have added premium frozen shrimp, canned varieties, and breaded shrimp options to their product portfolios. Retail sales of peeled, cooked, and, frozen shrimp, which are now more available to consumers looking for quick seafood meal solutions, have been driven by the at-home dining trend rise following the pandemic.

The rapid development of private-label shrimp brands in European supermarkets has also intensified rivalry in the processed shrimp sector. Big buyers like Tesco, Carrefour, and Aldi are stocking up on the sustainably farmed and traceable shrimp.

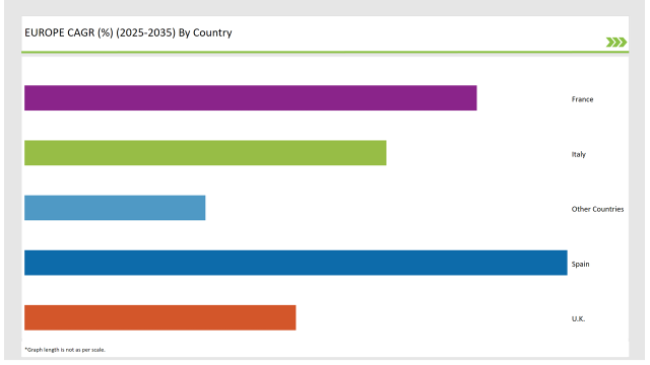

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Spain | 30% |

| Italy | 20% |

| UK | 15% |

| France | 25% |

| Other Countries | 10% |

The outlook of shrimp in Europe places Spain among the most vital markets, not forgetting the increasing consumer trend toward consuming environment-friendly and organic seafood products. The Spanish retail and food service outlets have stringent sustainability measures implemented, therefore the shrimp suppliers are forced to adhere to eco-label certifications such as MSC and ASC.

Organic shrimp demand is in escalation, and the priority of Spanish customers is to get shrimp without chemicals, antibiotics, and responsibly farmed. The elite like Royal Greenland and Seafrost who are the top suppliers of organic shrimp to retailers in Europe are benefiting from this transformation especially while the population adopts environment-friendly seafood consumption.

Moreover, the success of Spain as a frozen food market has been a crucial factor influencing the increase in sales of peeled, cooked, and frozen shrimp in supermarkets. With the increasing number of vegan and flexitarian consumers, seafood is being introduced again as a protein alternative, which in turn, has benefited the high-protein shrimp snacks and meal kits market segment in the retail sector of Spain.

France has seafood as a primary feature of its culture, where shrimp is one of the major components in every kind of shrimp dish, including gourmet shrimp platters, and menus in fine dining restaurants. The market for premium and processed shrimp versions has expanded with the influx of fine dining restaurants and the growing consumer wish for gourmet seafood products.

The main companies processing seafood in France, including Nueva Pescanova, are concentrating on shrimp value-added products like marinated, pre-cooked, and frozen peeled shrimp which respond to the demand for fast yet quality meals among the French. Another factor is the introduction of shrimp-based finger foods, salads, and kits for cooking that have a positive impact on both retail and food service sales.

French pharmaceutical and cosmetics companies also use shrimp-based compounds like chitosan in the products that are used on the skin and in the medical field, thereby expanding the area of shrimp derivatives that are used outside the food industry.

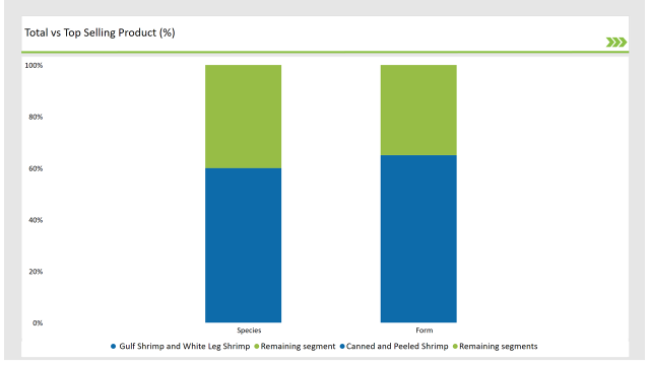

% share of Individual Categories Form and End-Use Application in 2025

| Main Segment | Market Share (%) |

|---|---|

| Species (Gulf Shrimp and White Leg Shrimp) | 60% |

| Remaining segments | 40% |

Gulf shrimp keeps its title as the most preferred wild-caught shrimp species in the area. These shrimp have their backs as strong texture and plentiful flavour features, so they tend to be ordered more in high-end restaurants and gourmet seafood preparations compared to other available options.

Farmed white-leg shrimp comes in second, its expansion is the result of the sponge aquaculture method that enables the company to remove algae annually and have non-stop production of high-quality summer crops. Royal Greenland and Iceland Seafood International, among other firms, are launching white leg shrimp farming initiatives while following EU sustainability requirements.

| Main Segment | Market Share (%) |

|---|---|

| Form (Canned and Peeled Shrimp) | 65% |

| Remaining segments | 35% |

Canned shrimp is the market leader due to its long-lasting shelf life and practicality. The need for faster seafood also resulted in a sharp increase in sales of canned and processed shrimp mainly in places where fresh seafood is hard to come by.

Peeled shrimp ranks second and it is the most preferred option due to its simple cooking methods and versatile meals. In addition to this, low-calorie, high-protein peeled shrimp is being used in meal prep and diet plans all over Europe with the rise of health-conscious consumer choices.

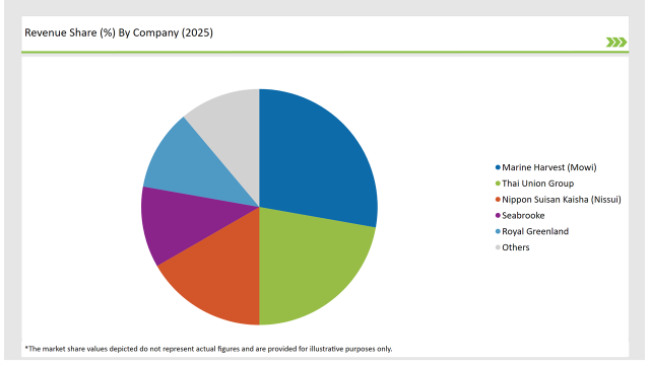

2025 Market share of Europe Shrimp manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Marine Harvest (Mowi) | 25% |

| Thai Union Group | 20% |

| Nippon Suisan Kaisha (Nissui) | 15% |

| Seabrooke | 10% |

| Royal Greenland | 10% |

| Others | 10% |

Note: The above chart is indicative in nature

The European shrimp market experiences a medium level of merger and acquisition activity, with firms like Royal Greenland, Nueva Pescanova, Seafrost Europe, and Iceland Seafood International driving the industry forward. These firms are oriented toward sustainable shrimp farming, value-added processing, and digital retail expansion.

EU has maintained very tight standards in terms of importing seafood, and organizations have come up with traceability solutions and responsible aquaculture certifications as a way of getting on board the law.

Improving online platforms for seafood and the raw use of shrimp in industries like pharmaceuticals and cosmetics has resulted in new market growth channels thus making Europe competitive for a seafood consumer's market.

As per Species, the industry has been categorized into Gulf Shrimps, Farmed White Leg Shrimps, Banded Coral Shrimps, Royal Red Shrimp, Giant Tiger Shrimps, Blue Shrimps, and Ocean Shrimps

As per Form Type, the industry has been categorized into Canned, Breaded, Peeled, Cooked & Peeled, Shell-On, and Frozen.

As per Source, the industry has been categorized into Organic, and Conventional.

As per Application, the industry has been categorized into Food, Pharmaceutical, Cosmetics, Industrial, and Biotechnology.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

The Europe Shrimp market is projected to grow at a CAGR of 7.0% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 40,126.0 million.

Key Key factors driving the European shrimp market include increasing consumer demand for seafood due to its health benefits and the growing popularity of shrimp in various cuisines. Additionally, sustainability concerns and advancements in aquaculture practices are enhancing supply and meeting regulatory standards.

Spain, France, and Italy are the key countries with high consumption rates in the European Shrimp market.

Leading manufacturers include Marine Harvest (Mowi), Thai Union Group, Nippon Suisan Kaisha (Nissui), Seabrooke, and Royal Greenland known for their innovative and sustainable production techniques and a variety of product lines.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Western Europe Shrimp Market Analysis by Species, Source, Form, Sales Channel, Application, and Country Through 2035

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA