The Europe Lactose market is set to grow from an estimated USD 963.3 million in 2025 to USD 1,611.5 million by 2035, with a compound annual growth rate (CAGR) of 5.3% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 963.3 million |

| Projected Europe Value (2035F) | USD 1,611.5 million |

| Value-based CAGR (2025 to 2035) | 5.3% |

The European lactose market is experiencing constant growth, which is mainly attributed to its large number of end-user industries like food and beverage, pharmaceuticals, and animal feed.

The lactose-based excipients market driven by the pharmaceutical industry, alongside the increasing preference for the use of lactose-derived sugars in food processing, is the major force behind the unfolding change in the market. Moreover, lactose is widely used in infant nutrition supplements and sports nutrition products which, in turn, increases its consumption.

Among the major trends in this field is the growing attention paid to lactose-derived alternative sweeteners such as tagatose which is popular because of its low-caloric value and similarity to sucrose in taste and texture. Even with the potential for growth lactose intolerance among European consumers is a significant problem.

Nevertheless, the innovative aspect of enzymatic lactose hydrolysis and the development of lactose-free dairy segments have reduced this constraint partially, therefore the constant usage of lactose in a range of applications has been ensured.

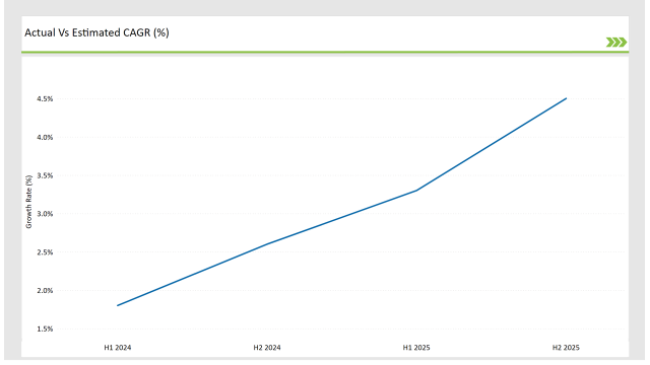

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Lactose market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 1.8% (2024 to 2034) |

| H2 2024 | 2.6% (2024 to 2034) |

| H1 2025 | 3.3% (2025 to 2035) |

| H2 2025 | 4.5% (2025 to 2035) |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Lactose market, the sector is predicted to grow at a CAGR of 1.8% during the first half of 2024, with an increase to 2.6% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 3.3% in H1 but is expected to rise to 4.5% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| April-24 | Product Innovation - FrieslandCampina introduced a high-purity lactose monohydrate for infant nutrition and pharmaceutical applications. |

| March-24 | Strategic Expansion - Meggle expanded its pharmaceutical lactose excipient production facilities in Europe to meet increasing demand. |

| February-24 | Sustainability Initiatives - Arla Foods launched a low-emission lactose processing facility to enhance environmental sustainability. |

| January-24 | New Formulation Development - Kerry Group developed a functional lactose-based sweetener blend for reduced sugar bakery applications. |

Increased lactose recovery and sustainability initiatives driving the expansion of the market

The European lactose market is experiencing a new trend regarding production methods, which is mainly happening due to the adoption of sustainable practices and the development of technologies to recover lactose from whey streams.

Dairy processors are instrumental in optimizing resource utilization, i.e., reducing waste, by adapting the whey processing modes further. Once considered a waste by-product, the recycling of lactose from cheese whey is one of the major contributors to the volume of high-quality lactose available on the market today.

Manufacturers such as FrieslandCampina and Arla Foods are implementing advanced filtration and crystallization technologies to improve lactose recovery efficiency, thereby supporting the product requirements of the pharmaceutical and food industries.

Lactose-based Functional Ingredients Growth in Infant Nutrition and Sports Supplements

The European lactose market is reaping the benefits of increased demand for lactose-based functional ingredients, especially in the infant nutrition and sports supplement sectors. Lactose is a major carbohydrate source in infant formula, thus it more closely resembles the composition of breast milk. The reformulated lactose is currently in demand with, besides, the GOS prebiotic that supports gut health coming from rice and soy proteins.

The top infant formula brands, like Danone and Nestlé, are adding in their products the lactose-derived prebiotics as a way of helping infants better digest and strengthen their immune systems.

Also, the sports nutrition industry is taking more and more advantages from lactose-derived compounds, being incorporated in energy-boosting and muscle recovery formulations. Lactose-based protein mixes and special carbohydrates are in demand particularly with athletes and fitness practitioners since they facilitate faster post-exercise recovery.

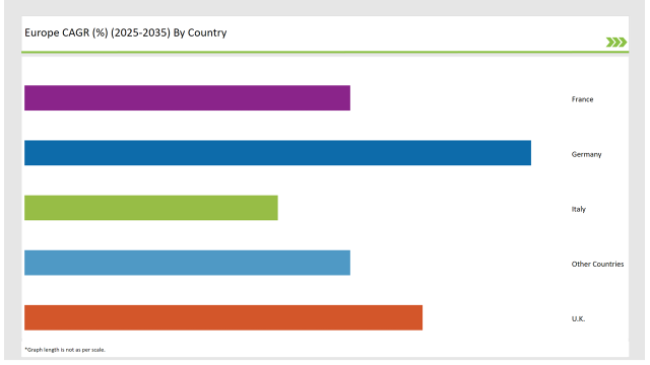

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Germany | 28% |

| Italy | 14% |

| UK | 22% |

| France | 18% |

| Other Countries | 18% |

Germany, which is a country that looks to be the biggest player in the European lactose market, is driven by its strong dairy processing and pharmaceutical industries. The use of the country’s advanced dairy infrastructure makes it possible to extract lactose from the goods very efficiently and so the food, pharmaceutical, and specialty applications have a steady supply of it.

The German pharmaceutical sector is the second biggest in Europe and its production of products, for example, tablets is dependent on the use of lactose as a filler.

Companies such as BASF and Meggle have invested heavily in the production of pharmaceutical-grade lactose to meet the demand for these types of excipients. Germany’s dairy cooperatives are playing a vital role in the lactose production spiral. The regulatory support for dairy farming sustainability and the promotion of lactose recovery have again comprehensively backed the country’s position in the market in Europe.

The demand for lactose-derived functional ingredients is soaring in France, especially in infant nutrition, functional food, and nutraceutical sectors. The country is home to a strong dairy sector that can provide high-quality lactose for different uses. The well-known French dairy enterprises Lactalis and Roquette are also increasing their production of lactose that is to be used in lactose-based prebiotics, galactose, and lactulose.

On the contrary, the food sector is under the influence of the fact that lactose long ago entered the formulations for gut health and wellness products. Lactulose and tagatose, especially, are of much interest in the functional food industry due to their possible low-energy calorie facts and prebiotic effects.

Moreover, the regulatory framework in France is very stable and promotes the development of new formulations that are based on lactose, and are steering the production of new lactose derivatives for health-conscious consumers.

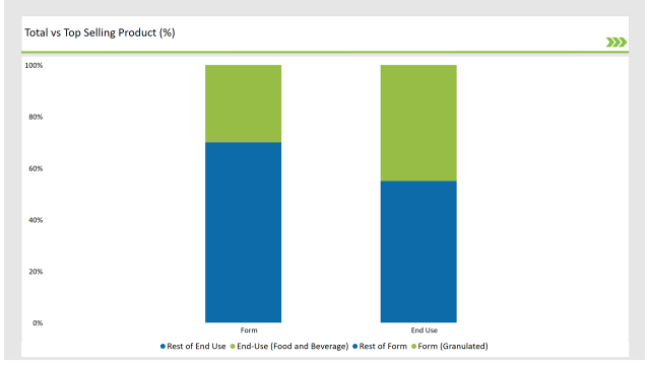

% share of Individual Categories Form and End-Use in 2025

| Main Segment | Market Share (%) |

|---|---|

| Form (Granulated) | 30% |

| Remaining segments | 70% |

The Granulated Lactose Segment Observing Higher Adoption in the Pharmaceutical and Specialty Food Sectors

Granulated lactose, for its part, has been capturing an ever-growing proportion of the market, mainly due to its excellent flowability and compaction characteristics, which make it the best choice for pharmaceutical formulations. Granulated lactose, unlike powdered lactose, has the added benefit of better compressibility and binding properties, which besides that, are the main reasons for it to be a popular material in direct compression tablet formulations.

More pharmaceutical manufacturers embrace granulated lactose owing to the benefits of drug uniformity and the changed dissolution rates, particularly in preparations for controlled-release drugs. Some of the most important professionals such as Meggle and Kerry Group are putting their emphasis on research and development of high-quality granulated lactose variants, which are in line with the current needs of the pharmaceutical industry and the requirements of the regulatory bodies in place in Europe.

| Main Segment | Market Share (%) |

|---|---|

| End-Use (Food and Beverage) | 45% |

| Remaining segments | 55% |

Lactose in the Food and Beverage Sector is Greatly Valued for Dairy and Bakery Applications

Lactose is a lively player in the food and beverage sector whose functional property, including mild sweetness, solubility, and ability to improve texture, explains why it is a trendy ingredient in dairy products, confectionery, and baked goods. The utilization of lactose in the dairy sector is pivotal in food items such as cheese, yogurt, and flavoured milk which gives the product the required flavour and the right amount of consistency.

European manufacturers who have made it their goal to deliver consumers the high-protein functional dairy products they desire are employing lactose to enhance their product formulations. The FrieslandCampina and Arla Foods companies are readying themselves for the technological leap forward with the processing of advanced lactose in the production of specialty dairy ingredients that suit evolving consumer needs.

The bakery industry is also finding it feasible to add more lactose to their recipes, as it promotes browning, moisture retention, and flavour enhancement. It is a common practice in bread, biscuits, and pastries to gain the desired consistency and colour. Moreover, lactose is making its mark as a bulking substitute in sugar-free baked items that cater to people who care about their health and are looking for fewer calories without giving up on flavour.

2025 Market share of Europe Lactose manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Lactalis Ingredients | 20% |

| Fonterra Co-operative Group | 18% |

| Arla Foods | 15% |

| Glanbia plc | 12% |

| FrieslandCampina | 10% |

| Others | 25% |

Note: The above chart is indicative in nature

The Europe Lactose Sector is more or less consolidated; the industry has a few key players controlling most of the production and supply. Companies such as FrieslandCampina Domo, Meggle, Kerry Group, and Lactalis are on top of their best-in-class supply chains and high-tech processing.

These companies are always pouring money into product innovation, capacity expansion, and other sustainability-oriented initiatives for the purpose of making their presence in the European lactose market even stronger.

The market is getting more and more newcomers, mostly in special sectors where lactose goes to rare sugars produced like tagatose and lactulose. These new enterprises bring lactose-based solutions, which are designed for health-conscious consumers and the development of the pharmaceutical sector.

With the rapid advancement of technology and the onset of competition, the European market for lactose is expected to experience more merger and acquisition cases, which further lead to good quality products high supply chain efficiency, and innovative lactose ingredients.

As per Form, the industry has been categorized into Powder, and Granule.

As per End Use, the industry has been categorized into Food and Beverage, Pharmaceutical, Animal Feed, and Others.

As per Derivative Type, the industry has been categorized into Lactose Monohydrate, Galactose, Lactulose, Tagatose, Others.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

The Europe Lactose market is projected to grow at a CAGR of 5.3% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 1,611.5 million.

Key factors driving the Europe lactose market include the increasing demand for lactose-free products among health-conscious consumers and those with lactose intolerance, leading to a rise in lactose-free dairy alternatives. Additionally, the growing use of lactose in various food applications, such as infant formula and nutritional supplements, is further propelling market growth.

Germany, Netherlands, and UK are the key countries with high consumption rates in the European Lactose market.

Leading manufacturers include Lactalis Ingredients, Fonterra Co-operative Group, Arla Foods, Glanbia plc, and FrieslandCampina known for their innovative and sustainable production techniques and a variety of product lines.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Europe Pet Food Market Analysis by Nature, Product Type, Source, Pet Type, Packaging, Distribution Channel, and Country - Growth, Trends, and Forecast through 2025 to 2035

Europe's Golden Generation Travel Market Size and Share Forecast Outlook 2025 to 2035

Europe Automotive Night Vision System Market Size and Share Forecast Outlook 2025 to 2035

Europe Winter Tourism Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA