The Europe Chitosan market is set to grow from an estimated USD 447.9 million in 2025 to USD 1,465.50 million by 2035, with a compound annual growth rate (CAGR) of 12.6% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Europe Industry Size (2025) | USD 447.9 million |

| Projected Europe Value (2035) | USD 1,465.50 million |

| Value-based CAGR (2025 to 2035) | 12.6% |

The European chitosan market has shown relatively good growth in demand, which is mainly fuelled by the growing consumer interest in natural health products. Chitosan, a biopolymer from shrimps has been a hot trend in a variety of industries such as food processing, nutraceuticals, cosmetics, and pharmaceuticals. The European market is influenced by various factors, such as the growing tendency of consumers to choose natural products, technological advancements in formulating chitosan, and increasing awareness about the benefits of natural ingredients.

The market structure is highly fragmented, with a plethora of players from large multinationals to smaller, niche players. The major players in the market capitalize on their long-standing reputation to diversify their product lines and fortify their sales channels. Companies such as Kitozyme and Primex, which are global leaders in chitosan, are mainly focused on carrying out extensive research and development to come up with new and viable solutions for the environment.

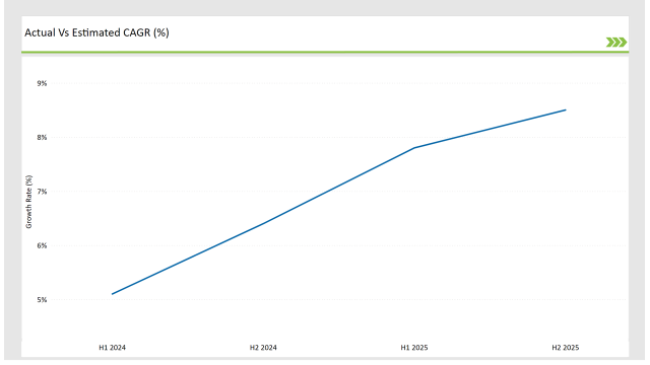

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Chitosan market. This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 5.1% |

| H2 (2024 to 2034) | 6.4% |

| H1 (2025 to 2035) | 7.8% |

| H2 (2025 to 2035) | 8.5% |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Chitosan market, the sector is predicted to grow at a CAGR of 5.1% during the first half of 2024, with an increase to 6.4% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 7.8% in H1 but is expected to rise to 8.5% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| April 2024 | Product Launches: A leading player in the market introduced a new line of chitosan-based dietary supplements aimed at weight management. |

| March 2024 | Expansion of Distribution Networks: A significant partnership was formed between a major chitosan supplier and a global pharmaceutical distributor to increase market reach. |

| February 2024 | Regulatory Approvals: A European biotech company received approval for its innovative chitosan-based food preservative, increasing its market competitiveness. |

Chitosan as a Sustainable Ingredient for Cosmetics and Personal Care Applications

Chitosan is increasingly in demand due to its natural origin and multi-functionality as a versatile ingredient in the European cosmetics and personal care markets. Companies are increasingly including chitosan in facial masks, body lotions, and hair care formulations. It is considered a valued polysaccharide due to its ability to preserve moisture in the skin, act as a natural preservative, and stimulate regenerating skin properties.

The trend towards more natural ingredients is very strong in Europe, with consumers increasingly seeking products that have fewer synthetic chemicals.

This drives cosmetic companies to look for more sustainable alternatives such as chitosan, thereby reducing the carbon footprint of their products. Leaders are investing in research to optimize the extraction process of chitosan, maintaining high purity and efficacy while sustaining the standards of sustainability. Additionally, because of its biocompatibility with skin, chitosan is useful for sensitive skin formulations and supports its usage in high-end cosmetic products in the European market.

This has led the European packaging industries to experience new growth in interest in green eco-friendly materials as more people fight the issue of plastic waste within their environment and the world at large. Companies that manufacture in Europe have been scouting for biodegradable materials following the increased growth in plastic use in the markets. Chitosan is widely studied and currently used for application in packaging industries, especially on food products because it is fully biodegradable.

Innovative packaging solutions made from chitosan help reduce the impact of packaging on the environment but also provide functionality, such as better food preservation. Chitosan-based films and coatings can be used for the extension of shelf life with quality maintenance for food products. Some companies are now starting to use chitosan in biodegradable bags, containers, and wraps that can be an alternative to non-biodegradable packaging materials of consumer goods.

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Germany | 28% |

| Italy | 15% |

| UK | 18% |

| France | 22% |

| Other Countries | 17% |

Italy, a country with rich food culture, is embracing chitosan as an essential element in both aquaculture and functional foods. There are increasing companies in Italy that are applying chitosan-based products to enhance animal feed, especially in the aquaculture industry. Chitosan has antimicrobial properties that prevent the growth of disease-causing bacteria in fish farming, maintaining water quality, and enhancing nutritional value in feed.

Italy is currently integrating chitosan into functional foods, mainly in the area of digestive health and weight management, within the food sector. Gluten-free, organic, and functional food products are increasingly in demand, and chitosan has a place in these formulations. Italian manufacturers have been interested in using chitosan as a natural preservative to keep the freshness of the food and to extend its shelf life, particularly in dairy and meat products.

The United Kingdom is a growing market for chitosan, particularly in personal care and pharmaceutical applications. UK consumers are increasingly looking for products that contain natural ingredients, thus adopting chitosan more in skincare and hair care formulations. Chitosan is valued for its moisturizing and antimicrobial properties, making it an ideal ingredient for a wide range of beauty and personal care products.

Due to its fat binding and digestive wellness properties, attention has been seen in the pharma sector as UK-based firms are using the feature to bring new nutraceutical products in the market.

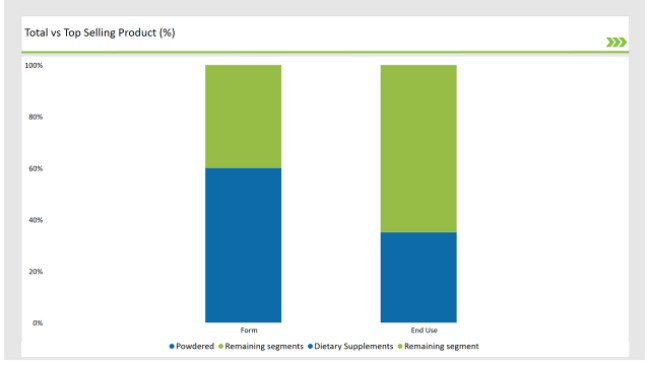

% share of Individual Categories Form and End-Use in 2025

| Main Segment | Market Share (%) |

|---|---|

| Form (Powdered) | 60% |

| Remaining segments | 40% |

The powdered chitosan market is the fastest-growing segment of the European market, primarily because of its versatility and wide scope of application in various industries. Among the other forms, powdered chitosan is, in particular, in demand due to the ease of use in formulations. It finds a good market in the food, pharmaceutical, and cosmetic sectors. The sustainable requirements concerning biocompatibility and biodegradability further boost this feature.

In the food industry, powdered chitosan is increasingly utilized as a natural preservative and fat replacer, catering to the growing consumer demand for healthier food options. In addition, since it can complex fats and low cholesterol levels, it is always in demand among dietary supplements associated with weight and cardiovascular management.

The pharmaceutical industries also increase their demand for powder chitosan because of their extensive usage in drug delivery systems and wound-healing applications are non-toxic and biocompatible.

| Main Segment | Market Share (%) |

|---|---|

| End Use (Dietary Supplements) | 35% |

| Remaining segments | 65% |

European nutraceutical markets have seen great growth over the past few years, where most consumers prefer a natural and functional health supplement. Chitosan, due to its properties regarding weight management and cholesterol-lowering, has gained importance in dietary supplements as a key ingredient. Its binding fat in the digestive system helps a person lose weight, thus creating a growing market for this nutrient.

Chitosan also is attaining attention to health benefits relating to digestive care, joint and cardiovascular well-being. With greater consciousness among consumers regarding health along with the necessity for preventive lifestyles in Europe, demand for health supplements based on chitosan will increase significantly. Additionally, chitosan has the attribute of flexibility to suit any formulated type of preparation as part of personal nutrition planning, thus supporting health solutions by offering custom supplements.

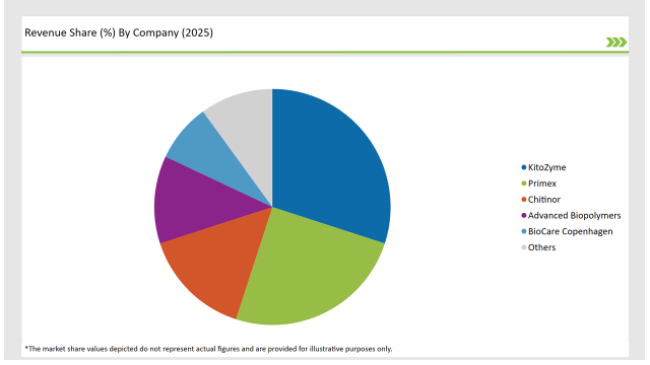

2025 Market share of Europe Chitosan manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| KitoZyme | 30% |

| Primex | 25% |

| Chitinor | 15% |

| Advanced Biopolymers | 12% |

| BioCare Copenhagen | 8% |

| Others | 10% |

Note: The above chart is indicative in nature

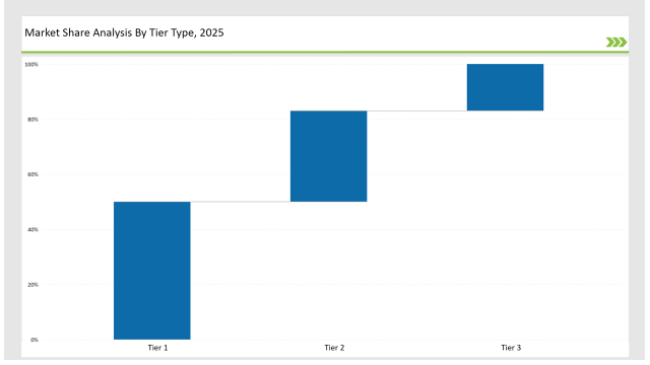

The European chitosan market is highly diversified. From multinational companies to regional smaller firms, there is a wide variety of suppliers involved. While at the top of the market are Tier 1 companies such as Kitozyme, Primex, and Chitinor, the prominent groups across Europe, the innovation is displayed at the top. These producers are mainly concentrated on the food, pharmaceuticals, and cosmetic applications of quality chitosan products. Their significant R&D budgets allow them the luxury of seeking chitosan-based new applications, and they remain at the top of the industry.

Biophrame and Euro Chitosan, among Tier 2 regional players, concentrate on niche markets with new innovative formulation acceptance. Regional companies have recently been actively focused on product developments for specific niches using chitosan: organic food processing, and veterinary usage, for specific consumer demands within the European marketplace.

Tier 3 companies, including smaller manufacturers and regional players, mainly cater to local markets and operate in the specific geographic region.

As per Form, the industry has been categorized into Liquid, Powder.

As per Source, the industry has been categorized into Shrimp, Crab, and Lobster.

As per End Use, the industry has been categorized into Food Additive, Dietary Supplements, Pharmaceutical, and Cosmetics.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

The Europe Chitosan market is projected to grow at a CAGR of 12.6% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 1,465.50 million.

Key factors driving the European chitosan market include the increasing demand for natural and biodegradable ingredients in food, pharmaceuticals, and cosmetics, as consumers prioritize sustainability and health. Additionally, the growing awareness of chitosan's health benefits, such as weight management and cholesterol reduction, is further propelling market growth.

Germany, France, and UK are the key countries with high consumption rates in the European Chitosan market.

Leading manufacturers include KitoZyme, Primex, Chitinor, Advanced Biopolymers, and BioCare Copenhagen known for their innovative and sustainable production techniques and a variety of product lines.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA