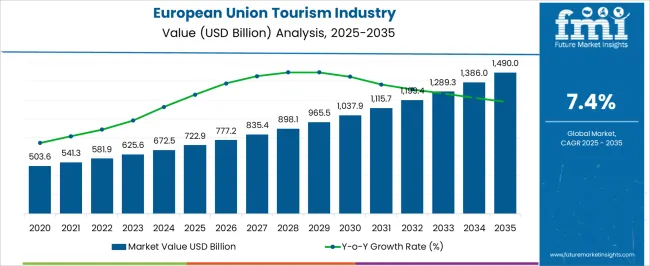

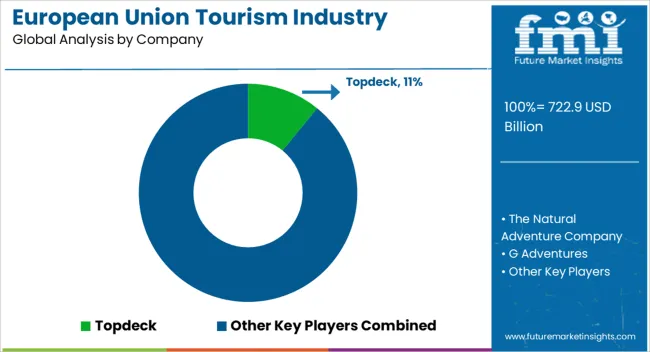

The European Union Tourism Industry is estimated to be valued at USD 722.9 billion in 2025 and is projected to reach USD 1490.0 billion by 2035, registering a compound annual growth rate (CAGR) of 7.4% over the forecast period.

| Metric | Value |

|---|---|

| European Union Tourism Industry Estimated Value in (2025 E) | USD 722.9 billion |

| European Union Tourism Industry Forecast Value in (2035 F) | USD 1490.0 billion |

| Forecast CAGR (2025 to 2035) | 7.4% |

The European Union tourism industry continues to grow, driven by rising intra-regional travel, digital adoption, and supportive government policies promoting cultural and leisure tourism. The industry benefits from the strong presence of historic attractions, diverse travel offerings, and advanced infrastructure supporting seamless mobility.

Post-pandemic recovery has accelerated the shift toward digital booking platforms, reflecting consumer demand for convenience and customization. The market is also shaped by changing demographics, with younger age groups and urban populations showing higher travel frequency and discretionary spending.

Sustainability-focused tourism initiatives and cross-border collaborations are reinforcing long-term competitiveness. As digital ecosystems integrate artificial intelligence and mobile-first experiences, the outlook remains promising with an emphasis on personalized, value-driven travel experiences.

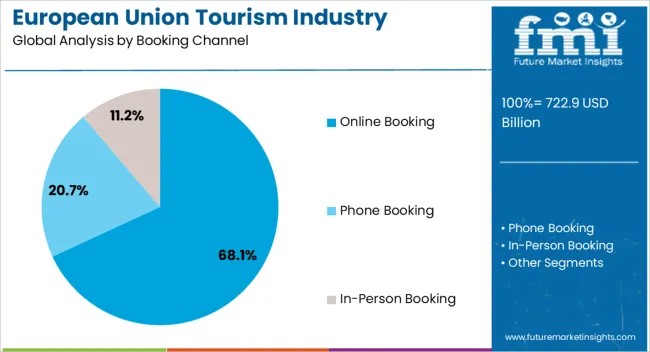

The online booking segment dominates the booking channel category with approximately 68.1% share, underscoring the digital transformation of travel planning in the European Union. Convenience, price transparency, and widespread smartphone penetration have made online platforms the preferred choice for travelers.

The segment’s growth is supported by aggregator websites, mobile applications, and direct airline and hotel booking platforms offering instant confirmations and dynamic pricing. Integration of AI-driven recommendations and loyalty programs further strengthens consumer engagement.

With younger travelers exhibiting a strong preference for digital-first interactions, online booking is expected to retain its leadership, supported by continuous advancements in user experience and secure payment systems.

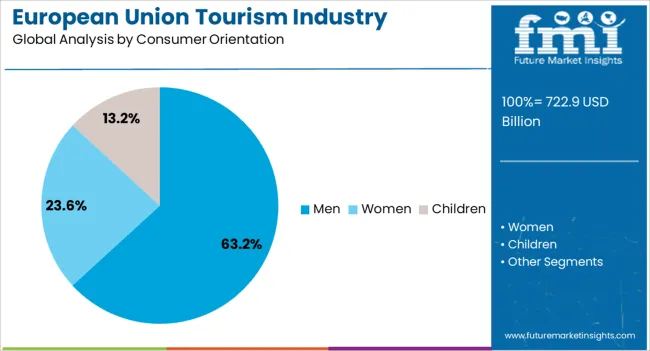

The men segment holds approximately 63.2% share in the consumer orientation category of the tourism industry in the European Union. This segment’s dominance is linked to higher reported participation in international and leisure travel among men, driven by employment-related mobility and discretionary spending.

Male travelers often exhibit a higher inclination toward adventure tourism, sports-related trips, and international travel packages. The segment also benefits from loyalty to digital booking platforms and structured travel itineraries.

With stable income patterns and greater engagement in business-related tourism, the men category is expected to sustain its leading share over the forecast horizon.

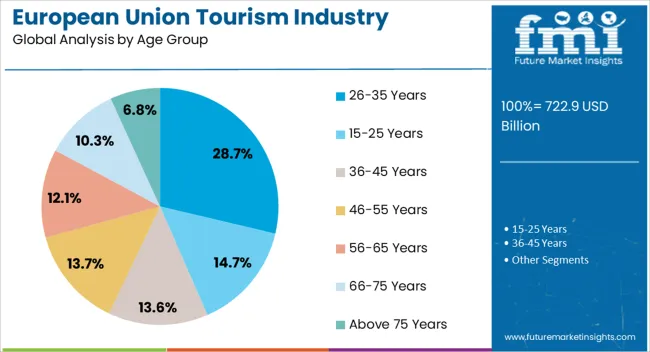

The 26–35 years segment accounts for approximately 28.7% share of the age group category, reflecting its significant influence on tourism trends across the European Union. This age group is characterized by higher disposable incomes, strong digital adoption, and a preference for experiential travel.

Frequent use of online platforms, combined with greater flexibility for short-haul and long-haul trips, has boosted demand from this demographic. The segment also demonstrates strong interest in adventure, cultural, and wellness tourism, aligning with evolving industry offerings.

With technology-driven travel solutions increasingly tailored to younger travelers, the 26–35 years age group is anticipated to remain a key driver of growth in the EU tourism market.

Cultural Kaleidoscope Propelling the European Union Tourism Boom

The European Union tourism sector is its rich cultural diversity and historical heritage. The European Union boasts a wealth of iconic landmarks, museums, and UNESCO World Heritage Sites, attracting millions of visitors each year.

From the ancient ruins of Rome to the vibrant art scene in Paris, the cultural offerings of European Union member states appeal to tourists seeking immersive experiences. The cultural allure serves as a powerful magnet, drawing travelers from around the world and contributing significantly to the industrial growth and sustainability of the tourism sector.

Sustainable Surge in Transformation of the European Union Tourism Landscape

The surge of sustainable and responsible travel practices where travelers are widely prioritizing eco-friendly accommodations, supporting local communities, and seeking authentic cultural experiences while minimizing the environmental impact.

The trend is fueled by growing awareness of environmental issues and a desire for more meaningful travel experiences. European Union destinations are responding by promoting sustainable tourism initiatives, such as eco-tours, green certifications for accommodations, and conservation efforts in natural areas.

As sustainability becomes a central focus, the tourism landscape is reshaping in the European Union, offering both environmental benefits and enriching experiences for travelers.

Striking a Balance by Tackling Overtourism in the European Union

Cities like Venice, Barcelona, and Amsterdam face overcrowding issues, leading to environmental degradation, strain on infrastructure, and negative impacts on the quality of life for residents. Overtourism also threatens the preservation of cultural heritage and authenticity in the destinations.

The sector contributes to an upsurge in housing costs and displacement of residents, exacerbating social inequalities. Addressing overtourism requires sustainable tourism management strategies, including crowd control measures, diversification of tourism offerings, and efforts to promote less-visited destinations within the European Union.

The European Union's tourism landscape has experienced steady growth from 2020 to 2025, reflected in the historical CAGR of 4.5%. The growth can be attributed to an upsurge in disposable income, improved transportation infrastructure, and marketing efforts to promote European Union destinations. The growth rate during the period can be characterized as moderate compared to other regions or industries.

Looking ahead to the forecast period from 2025 to 2035, the European Union tourism industry is expected to enter a phase of accelerated expansion, with a projected CAGR of 7.5%. Advancements in technology and digitalization are expected to enhance the overall travel experience, making the sector more convenient and accessible for tourists.

The future of tourism investment in the European Union in emerging ecosystems, particularly in Asia and Africa, is anticipated to drive a surge in international tourism to European Union destinations. Efforts promoting sustainable tourism practices and cultural exchange initiatives attract a broader range of travelers seeking authentic and responsible experiences.

External factors such as geopolitical tensions, natural disasters, and health crises can impact travel demand and consumer behavior unpredictably. The landscape must navigate sustainability concerns, including over-tourism in popular destinations and environmental conservation efforts.

To capitalize on the projected growth, stakeholders in the European Union tourism sector must prioritize strategic investments in infrastructure, sustainable tourism initiatives, and marketing efforts to promote lesser-known destinations and ensure inclusive growth across regions.

The table represents the top five countries ranked by revenue, with Spain holding the top position. The industry is led significantly by sales of the European Union tourism industry in Spain, the United Kingdom, and France. Western Europe region emerges as a key industry at a global level.

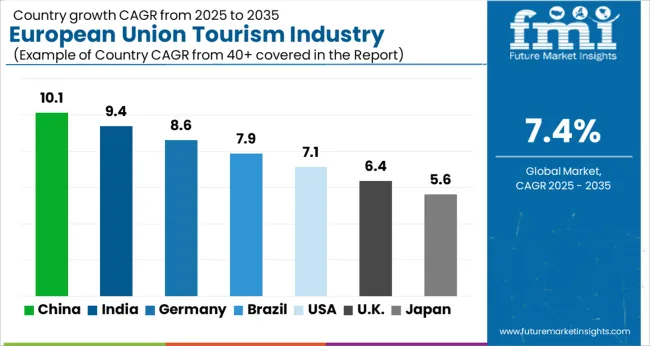

The Forecast CAGRs from 2025 to 2035

Spain's tourism sector serves as a cornerstone of its economy, contributing significantly to GDP, employment, and regional development. The country's diverse attractions, including historic landmarks, vibrant culture, and sun-soaked beaches, draw millions of visitors each year.

In Spain, tourism is deeply ingrained in the fabric of society, with iconic destinations like Barcelona, Madrid, and Andalusia attracting international travelers seeking rich cultural experiences. The allure of Spanish cuisine, renowned for its tapas, paella, and world-class wines, further enhances the tourism appeal.

Spain's natural beauty, from the rugged landscapes of the Pyrenees to the pristine beaches of the Balearic Islands, offers a plethora of outdoor activities for nature enthusiasts and adventure seekers.

The tourism ecosystem in Spain also plays a vital role in regional development, with coastal areas like the Costa del Sol and the Canary Islands heavily reliant on tourism for economic prosperity.

In the United Kingdom, tourism is a multifaceted ecosystem that encompasses cultural heritage, urban attractions, and natural landscapes. Iconic landmarks like Buckingham Palace, the Tower of London, and Stonehenge attract visitors from around the globe, contributing to the United Kingdom's status as a top tourist destination.

London, the capital city, stands out as a cultural and economic hub, drawing tourists with its world-class museums, theaters, and shopping districts. The rich history and cultural heritage of the United Kingdom, exemplified by Shakespearean theater, medieval castles, and picturesque villages, provide a unique draw for international tourists seeking immersive experiences.

The sector benefits from its status as a financial center, attracting business travelers and facilitating MICE (Meetings, Incentives, Conferences, and Exhibitions) tourism.

Visa and immigration policies within the EU play an important role in shaping the ease of travel for tourists in France. As a Schengen member state, France benefits from the Schengen Agreement's visa-free travel for citizens of many countries, simplifying entry procedures for tourists.

Fluctuations in EU visa policies, such as changes in visa requirements or stricter border controls, can impact tourist flows. Streamlined visa processes and consistent immigration policies within the EU are essential to maintaining France's attractiveness as a tourist destination.

The section contains information about the leading segments in the industry. Based on consumer orientation, the men segment is estimated to account for a share of 63.2% by 2035. By tour type, the independent traveler category is projected to dominate by holding a share of 43.8% in 2035.

| Attribute | Details |

|---|---|

| Consumer Orientation | Men |

| Industrial Share in 2025 | 63.2% |

Based on the consumer orientation, the men’s segment is accounted to hold an industrial share of 63.2% in 2025.

Changing societal norms may result in more men participating in leisure travel independently or in groups. Targeted marketing strategies tailored to male preferences and interests could also play a role in attracting a larger share of male travelers.

Understanding the specific needs and desires of male tourists, for cultural experiences, sports events, or wellness retreats, will be crucial for businesses and destinations looking to capitalize on this consumer segment's dominance.

| Attribute | Details |

|---|---|

| Tour Type | Independent Traveler |

| Industrial Share in 2025 | 43.8% |

Based on tour type, the independent traveler segment is accounted to hold an industrial share of 43.8% in 2025.

Independent travelers seek to explore destinations, allowing for greater immersion in local culture, interactions with residents, and off-the-beaten-path discoveries. Technological advancements, such as online booking platforms, mobile apps, and digital guides, have empowered travelers to plan and manage such trips independently, further fueling the growth of this segment.

The surge of remote work and digital nomadism has enabled more people to embark on extended independent travel adventures, blurring the lines between leisure and work-related tourism.

The competitive outlook of the European Union tourism industry is marked by a dynamic landscape characterized by both traditional players and innovative startups. Established tourism businesses, including hotels, airlines, and tour operators, compete alongside emerging startups leveraging technology to disrupt the ecosystem.

The startups often focus on niche segments, such as sustainable travel, experiential tourism, or peer-to-peer accommodation platforms, challenging incumbents and reshaping consumer preferences.

Mergers and acquisitions play a significant role in the competitive dynamics of the sector, with larger companies acquiring startups to expand offerings or gain access to new sectors. Startups may merge to consolidate resources and scale such operations more efficiently.

Industry Updates

The industry is classified into phone booking, online booking and in-person booking.

The report consists of key sourcing, such as men, women and children.

The segment comprises of 15-25 years, 26-35 years, 36-45 years, 46-55 years, 56-65 years and 66-75 years.

In terms of tour type, the industry is divided into independent traveler, tour group, and package traveller.

A few of the important tourist types are domestic and international.

Analysis of the ecosystem has been carried out in key countries of the United Kingdom, Germany, Italy, France and Spain.

The global European Union tourism industry is estimated to be valued at USD 722.9 billion in 2025.

The market size for the European Union tourism industry is projected to reach USD 1,490.0 billion by 2035.

The European Union tourism industry is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in European Union tourism industry are online booking, phone booking and in-person booking.

In terms of consumer orientation, men segment to command 63.2% share in the European Union tourism industry in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Trends Driving Positive Growth in European Quillaia Extract Sales

European Union Cross-Border Healthcare Market Analysis 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Syringe and Needle in GCC Size and Share Forecast Outlook 2025 to 2035

Industry Analysis Non-commercial Acrylic Paint in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Medical Device Packaging in Southeast Asia Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Paper Bag in North America Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Lidding Film in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Last-mile Delivery Software in Japan Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Automotive Lightweight Body Panel in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Japan Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Korea Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Western Europe Size and Share Forecast Outlook 2025 to 2035

Industry 4.0 Market

Europe Second-hand Apparel Market Growth – Trends & Forecast 2024-2034

DOAS Industry Analysis in the United States Forecast and Outlook 2025 to 2035

FIBC Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Pectin Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Mezcal Industry Analysis in Japan - Consumer Demand & Industry Trends in 2025

Mezcal Industry Analysis in Korea – Trends, Demand & Industry Growth

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA