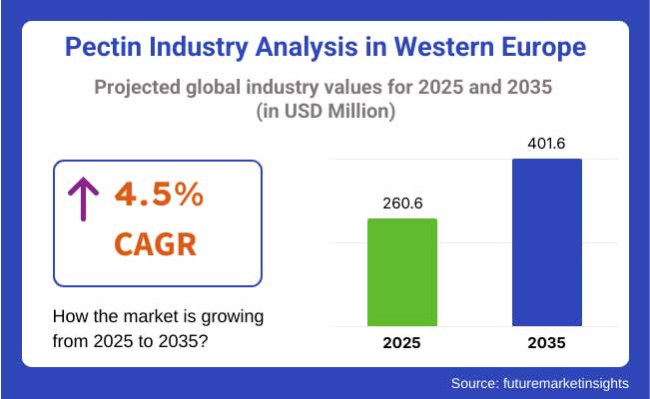

The Western Europe pectin market is poised to register a valuation of USD 260.6 million in 2025. The industry is slated to grow at 4.5% CAGR from 2025 to 2035, witnessing USD 401.6 million by 2035.

The industryis witnessing tremendous growth with several factors keeping pace with shifting consumer trends and food industry evolution. One such key driver is the growing use of natural ingredients in food and beverages. Since consumers are health-conscious, they are gravitating towards products perceived as healthier and more natural.

Pectin, a fruit-derived natural gelling agent, especially from citrus fruits and apples, is becoming increasingly popular as a clean label ingredient. This is part of the larger food industry trend towards reducing artificial additives and preservatives, which are commonly used in most processed foods.

The growing demand for vegetable and vegetarian offerings is propelling the industry. The product finds significant application in plant-based and veggie products in the form of a natural thickener and gelling agent for use in products such as jams, jellies, and other products. With an increase in Western European consumers adapting to plant-based diets, the industry is gaining a boost.

The medical advantages of the product are also driving the industry. It is high in fiber, and fiber helps in digestion as well as maintaining a healthy gut. As consumers increasingly prioritize health and wellness, pectin products are picking up pace. Moreover, the product's prebiotic nature is motivating its application in functional foods, which have additional health benefits apart from general nutrition.

The industry is differentiated by varied trends and buying specifications in various end-use segments with their respective requirements and demands. The food and beverage sector has been the major driver for industry trends. In this sector, the product is widely applied in jam, jelly, confectionery, and fruit-based applications where it is favored for its clean-label, natural appeal. Customers' demand for natural ingredients, less processing, and openness in food labeling is forcing manufacturers to employ the product over artificial gelling agents.

The movement towards healthier, cleaner products has resulted in increased demand for the product in reduced-sugar and low-calorie foods. In addition, as the plant-based trend continues to expand, the product is becoming increasingly popular as a vegan-friendly substitute for gelatin, further increasing its use in dairy alternatives, candies, and desserts.

Businesses in the industry value an equilibrium between quality, price, and regulatory compliance. The need for sustainably produced and organic products has also increased traction, with businesses valuing ethical sourcing and environmental footprint as buying considerations. This means suppliers providing certified organic and non-GMO products are especially alluring to food companies and consumers that increasingly value sustainability when making their purchases.

Between 2020 and 2024, the Western European industry experienced dramatic changes in response to changing consumers' preferences, rising health awareness, and a need for clean-label, plant-based products. The growing interest in healthier lifestyles and functional foods supported the demand for the product, particularly in reduced-sugar, low-calorie, and high-fiber products.

As consumers increasingly shunned synthetic additives, pectin became more central to food formulation, especially in jellies, jams, and fruit snacks, where it was used as a natural gelling agent. Another significant increase in the plant-based trend also supported its popularity as a vegan gelatin alternative. Also, the urge for sustainability and ethical sourcing resulted in most manufacturers opting to procure organic and non-GMO products to suit the rising need for ecologically friendly and socially responsible products.

Looking ahead to 2025 to 2035, the industry is anticipated to continue growing with future trends shifting to innovation and new applications. As plant-based products and functional foods become increasingly popular, the product will remain a critical ingredient in plant-based dairy alternative formulations, confectioneries, and functional beverages. The shift towards personalization in food could also result in customized pectin-based products for particular health requirements, enhancing its demand even further.

Additionally, technological and processing innovations may enhance the efficiency of product processing and extraction, which may lower costs and enhance its use in various food and beverage categories. Sustainability will continue to be a major driver, with growing demand for environmentally friendly, organic, and ethically produced products, as consumers and brands increasingly focus on sustainability in their purchasing choices. As consumers look for cleaner, clearer labels, the position of the product in clean-label formulations will only be reinforced, which will further consolidate its leading industry position.

Comparative Industry Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The market experienced an increase in demand for pectin-based products like sugar-reduced and high- fiber food products. Consumers who are health-conscious propelled the industry growth, especially for products such as jams, fruit snacks, and functional foods. | The quest to acquire eco-friendly and sustainably sourced products will increase, as consumers and brands become increasingly concerned about ethical sourcing procedures and minimizing environmental footprints. Organic, non-GMO products will become increasingly valuable. |

| There was growing demand for vegan and plant-based products that saw the growth of the product as a substitute for animal-based substances such as gelatin , particularly in confectionery and milk substitutes. | In the coming decade, more attention will be given to creating new uses for the product , especially in functional drinks, protein bars, and customized food products designed for addressing certain health requirements. |

| As consumers became increasingly concerned with artificial additives, clean-label products gained more prominence. The product was popular due to its natural origin, and thus it became a key ingredient for open food labeling . | With digestive health becoming ever more significant, the product 's prebiotic properties will be more widely marketed in the creation of gut-health foods, supplements, and fortified drinks. Its use as a digestive wellness support will propel its popularity. |

| Greater efficiency in the methods of the product extraction resulted in reduced costs of production, making the ingredient more widely available to be used in a greater range of applications. | With the increasing demand for individualized nutrition, there will be a trend towards products formulated for particular health outcomes, including weight management, gut well-being, and immune function. |

The industryis exposed to a number of risks that may affect its growth path. Supply chain vulnerabilities are one of the major challenges. The product production is dependent on agricultural raw materials like citrus peels and apple pomace. These are prone to seasonal fluctuations and climatic changes.

Severe weather conditions, like droughts, floods, and others, may interfere with the supply of these raw materials, resulting in supply shortages and price instability. Moreover, disruptions in global supply chains, like those experienced during the COVID-19 pandemic, may slow down the procurement of raw materials or disrupt the production and distribution of the product, creating industry instability.

Fluctuations in the prices of raw materials are another threat to the business. The product's raw materials, for example, citrus fruits and apples, can be subject to fluctuations in their prices based on harvest yields. When yields are poor due to bad weather or infestation by pests, the prices of these raw materials increase greatly. This volatility is likely to result in price instability for the product producers, hence higher costs of production.

High methoxyl (HM) pectin is utilized more in Western Europe than itslow methoxyl(LM) counterpart, mainly because of its varied uses in a broad spectrum of food products, particularly jams, jellies, and fruit preserves. This product is greatly sought after for its capacity to produce firm, stable gels upon being mixed with sugar and acid, and it is best suited for fruit products where texture is important. With many traditional Western European recipes still dependent on high sugar content, it remains the go-to product for manufacturers who are involved in the production of jams, marmalades, and other fruit preserves.

In addition, its high performance at lower concentrations and consistent gelling behavior make it an ideal ingredient for commercial production on a large scale. In Europe, where there is a strong confection industry, high methoxyl pectin finds extensive application in confectionery, sweets, and other gelled confectioneries where there is a need for consistency of texture.

The major use of the product in Western Europe is for jams and jellies. This is because it is used to provide the proper texture and gelling characteristics needed for fruit preserves. Jams and jellies are ingrained in the cooking tradition of Western Europe, where they are commonly consumed as a breakfast spread, used as a pastry filling, or as a component of other baked foods. The need for high-quality, shelf-stable fruit preserves has been consistently strong, so jams and jellies have been the predominant use of the product in the region.

Methoxyl high pectin, especially, is popular due to its strength to form rigid, stable gels when used in combination with sugar and acid, which are the main constituents in classic jam and jelly formulas. As demand from Western Europe continues to tilt in favor of fruit-based fruit spreads, product use continues to stay strong. Also, the popularity of homemade or artisanal jellies and jams, in which texture and natural ingredients are emphasized, also fuels itsconsumption insuch products.

The Western European industry is strongly competitive with the presence of several multinational firms as well as dedicated players competing in the industry. Key global brands like Tate & Lyle LLC, Koninklijke DSM N.V., and Cargill Incorporated dominate the industry through the presence of strong product portfolios marketed across a broad range of applications like food, beverages, and pharmaceuticals.

These companies are joined by the larger businesses, but operate with smaller firms such as Silvateam S.p.A., Compañía Española de Algas Marinas S.A (CEAMSA), and Lucid Colloids Ltd., serving niches of markets with distinctive formulations or sustainably oriented products that are picking up momentum in Western Europe. These businesses play an important role in propelling the ongoing growth of the industry by fulfilling customers' demands for healthier, natural, and higher quality food ingredients.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| Tate & Lyle LLC | 12-15% |

| Koninklijke DSM N.V. | 10-13% |

| CP Kelco | 8-10% |

| Silvateam S.p.A. | 6-8% |

| Compañía Española de Algas Marinas S.A (CEAMSA) | 4-6% |

| Cargill Incorporated | 7-9% |

| Ingredion Incorporated | 5-7% |

| Naturex | 3-5% |

| Lucid Colloids Ltd. | 2-4% |

| DowDupont | 3-5% |

| Company Name | Key Company Offerings and Activities |

|---|---|

| Tate & Lyle LLC | Offers top-quality pectin solutions as a major use in jams and confection ery . Concentrates on clean-label, sustainable solutions to address healthy food product demands. |

| Koninklijke DSM N.V. | Provides premium-grade products for food and beverages for health functions. Concentrates on solutions for addressing health-conscious trends, with strong emphasis on dietary fiber and gel properties. |

| CP Kelco | A worldwide industry leader in pectin and hydrocolloids, with high-performing gelling agents for food, beverage, and pharmaceutical applications. Emphasizes natural and sustainable offerings. |

| Silvateam S.p.A. | Provides natural and sustainable products for the food and beverage industry. Prioritizes organic raw materials and supplying solutions to jam, dairy, and fruit products. |

| Compañía Española de Algas Marinas S.A (CEAMSA) | Offers natural pectin derived from seaweed for food applications, responding to demand for plant-based and sustainable solutions. |

| Cargill Incorporated | Offers pectin ingredients applied in food and beverages with a focus on clean-label, healthier options. Famous for its worldwide distribution network and leadership in plant-based solutions. |

| Ingredion Incorporated | Provides an extensive portfolio of solutions with emphasis on functional applications within food and beverage. Explores expertise in clean-label and natural pectin for food processing. |

| Naturex | Operates a platform of natural ingredients, providing solutions for health and wellness segments with a focus on clean-label and plant-based ingredients. |

| Lucid Colloids Ltd. | Offers quality pectin based on natural origin, addressing requirements of food, beverage, and dietary supplement companies in Western Europe. |

| DowDupont | Provides products utilized for food and pharmaceutical uses. Emphasizes providing innovative, high-quality solutions for diverse consumer requirements. |

The Western European industry is moving towards clean-label and organic categories as consumers prefer more natural and plant-based food ingredients. Established brands such as Tate & Lyle LLC and CP Kelco are riding this trend by delivering high-quality, sustainable products to complement the demand for healthy food options. These industry leaders are stressing on innovation, sustainability, as well as synchronization with consumer affinity towards natural food ingredients.

Smaller companies like Silvateam S.p.A. and Lucid Colloids Ltd. are carving a niche for themselves by targeting niche markets and providing specialty products that focus on natural sourcing, ethical behavior, and sustainability. These companies' products are especially attractive to European consumers seeking environmentally friendly alternatives and superior ingredients.

As the industry continues to develop, large and small players alike are turning their attention to product diversification, technology development, and positioning themselves with sustainability programs. These efforts put them in a good position to gain a greater portion of the market as consumer trends continue to move towards healthier, cleaner, and more sustainable food products.

In terms of product type, the market is bifurcated into high methoxyl and low methoxyl.

With respect to application, the industry is classified into jams & jellies, beverages, bakery fillings & toppings, dairy products & frozen desserts, confectionery, meat & poultry products, dietary supplements, functional food, pharmaceutical, personal care & cosmetics, and others.

By country, the industry is segregated into the UK, Germany, Italy, France, Spain, and the rest of Europe.

The market is expected to reach USD 260.6 million in 2025.

The market is projected to witness USD 401.6 million by 2035.

The market is slated to capture 4.5% CAGR during the study period.

High methoxyl pectin is preferred the most.

Leading companies include Tate & Lyle LLC, Koninklijke DSM N.V., CP Kelco, Silvateam S.p.A., Compañía Española de Algas Marinas S.A (CEAMSA), Cargill Incorporated, Ingredion Incorporated, Naturex, Lucid Colloids Ltd., and DowDupont.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2018 to 2033

Table 2: Industry Analysis and Outlook Volume (MT) Forecast by Country, 2018 to 2033

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Industry Analysis and Outlook Volume (MT) Forecast by Product Type, 2018 to 2033

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Industry Analysis and Outlook Volume (MT) Forecast by Application, 2018 to 2033

Table 7: UK Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 8: UK Industry Analysis and Outlook Volume (MT) Forecast By Region, 2018 to 2033

Table 9: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 10: UK Industry Analysis and Outlook Volume (MT) Forecast by Product Type, 2018 to 2033

Table 11: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: UK Industry Analysis and Outlook Volume (MT) Forecast by Application, 2018 to 2033

Table 13: Germany Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 14: Germany Industry Analysis and Outlook Volume (MT) Forecast By Region, 2018 to 2033

Table 15: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: Germany Industry Analysis and Outlook Volume (MT) Forecast by Product Type, 2018 to 2033

Table 17: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Germany Industry Analysis and Outlook Volume (MT) Forecast by Application, 2018 to 2033

Table 19: Italy Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 20: Italy Industry Analysis and Outlook Volume (MT) Forecast By Region, 2018 to 2033

Table 21: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 22: Italy Industry Analysis and Outlook Volume (MT) Forecast by Product Type, 2018 to 2033

Table 23: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Italy Industry Analysis and Outlook Volume (MT) Forecast by Application, 2018 to 2033

Table 25: Spain Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 26: Spain Industry Analysis and Outlook Volume (MT) Forecast By Region, 2018 to 2033

Table 27: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Spain Industry Analysis and Outlook Volume (MT) Forecast by Product Type, 2018 to 2033

Table 29: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Spain Industry Analysis and Outlook Volume (MT) Forecast by Application, 2018 to 2033

Table 31: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 32: Rest of Industry Analysis and Outlook Volume (MT) Forecast by Product Type, 2018 to 2033

Table 33: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 34: Rest of Industry Analysis and Outlook Volume (MT) Forecast by Application, 2018 to 2033

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 3: Industry Analysis and Outlook Value (US$ Million) by Country, 2023 to 2033

Figure 4: Industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 5: Industry Analysis and Outlook Volume (MT) Analysis by Country, 2018 to 2033

Figure 6: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 7: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 8: Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 9: Industry Analysis and Outlook Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 10: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Industry Analysis and Outlook Volume (MT) Analysis by Application, 2018 to 2033

Figure 14: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 17: Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 18: Industry Analysis and Outlook Attractiveness by Region, 2023 to 2033

Figure 19: UK Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 20: UK Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 21: UK Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 22: UK Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 23: UK Industry Analysis and Outlook Volume (MT) Analysis By Region, 2018 to 2033

Figure 24: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 25: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 26: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 27: UK Industry Analysis and Outlook Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 28: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 29: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 30: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: UK Industry Analysis and Outlook Volume (MT) Analysis by Application, 2018 to 2033

Figure 32: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: UK Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 35: UK Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 36: UK Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 37: Germany Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: Germany Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 39: Germany Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 40: Germany Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 41: Germany Industry Analysis and Outlook Volume (MT) Analysis By Region, 2018 to 2033

Figure 42: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 43: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 44: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: Germany Industry Analysis and Outlook Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 46: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Germany Industry Analysis and Outlook Volume (MT) Analysis by Application, 2018 to 2033

Figure 50: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Germany Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 53: Germany Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 54: Germany Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 55: Italy Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 56: Italy Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 57: Italy Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 58: Italy Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 59: Italy Industry Analysis and Outlook Volume (MT) Analysis By Region, 2018 to 2033

Figure 60: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 61: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 62: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 63: Italy Industry Analysis and Outlook Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 64: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 65: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 66: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Italy Industry Analysis and Outlook Volume (MT) Analysis by Application, 2018 to 2033

Figure 68: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Italy Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 71: Italy Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 72: Italy Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 73: France Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: France Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 75: France Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 76: France Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 77: France Industry Analysis and Outlook Volume (MT) Analysis By Region, 2018 to 2033

Figure 78: France Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 79: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 80: France Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 81: France Industry Analysis and Outlook Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 82: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 83: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 84: France Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: France Industry Analysis and Outlook Volume (MT) Analysis by Application, 2018 to 2033

Figure 86: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: France Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 89: France Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 90: France Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 91: Spain Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Spain Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 93: Spain Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 94: Spain Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 95: Spain Industry Analysis and Outlook Volume (MT) Analysis By Region, 2018 to 2033

Figure 96: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 97: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 98: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 99: Spain Industry Analysis and Outlook Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 100: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 101: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 102: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: Spain Industry Analysis and Outlook Volume (MT) Analysis by Application, 2018 to 2033

Figure 104: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: Spain Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 107: Spain Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 108: Spain Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 109: Rest of Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 110: Rest of Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 111: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 112: Rest of Industry Analysis and Outlook Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 113: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 114: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 115: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 116: Rest of Industry Analysis and Outlook Volume (MT) Analysis by Application, 2018 to 2033

Figure 117: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 118: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 119: Rest of Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 120: Rest of Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Western Europe Automotive Lighting Market Growth – Trends & Forecast 2023-2033

Western Europe Probiotic Supplement Market Analysis in – Growth & Market Trends from 2025 to 2035

Western Europe Automotive Load Floor IndustryAnalysis in Western Europe Forecast & Analysis 2025 to 2035

Western Europe Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Western Europe Automotive Turbocharger Market Growth – Trends & Forecast 2023-2033

Western Europe Building Automation System Market by System, Application and Region - Forecast for 2025 to 2035

Western Europe Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Mezcal Industry Analysis in Western Europe Report – Growth, Demand & Forecast 2025 to 2035

I2C Bus Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Isomalt Industry Analysis in Western Europe – Size, Share & Forecast 2025 to 2035

Taurine Industry in Western Europe - Trends, Market Insights & Applications 2025 to 2035

Western Europe Steel Drum Market Insights – Trends & Forecast 2023-2033

Pallet Wrap Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Resveratrol Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Western Europe Size and Share Forecast Outlook 2025 to 2035

Polydextrose Industry Analysis in Western Europe Growth, Trends and Forecast from 2025 to 2035

Glassine Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Tarpaulin Sheet Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Western Europe Industrial Drum Market Growth – Trends & Forecast 2023-2033

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA