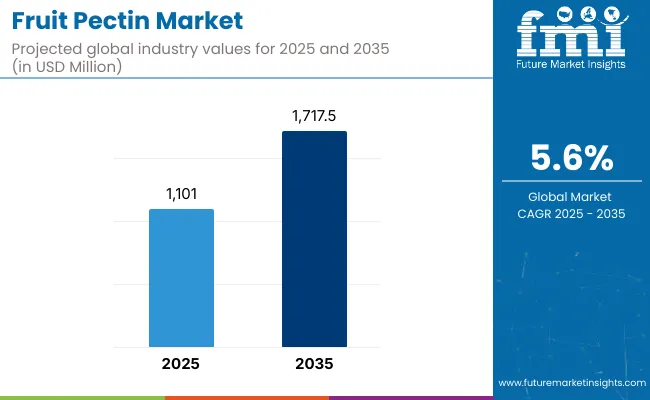

The global Fruit Pectin market is poised to reach a value of USD 1,101.0 Million by 2025 and is projected to reach a value of USD 1,717.5 Million by 2035, reflecting a compound annual growth rate of 5.6% over the assessment period 2025 2035.

| Attributes | Description |

|---|---|

| Estimated Global Industry Size (2025E) | USD 1,101.0 million |

| Projected Global Industry Value (2035F) | USD 1,717.5 million |

| Value-based CAGR (2025 to 2035) | 5.6% |

Fruit pectin market is steadily growing across global front because of its application in food and beverages. Pectin an edible natural polysaccharide extracted from the cell walls of fruits is used as gelling and thickening agent. Food grade Benzyl benzoate finds numerous uses in the preparation of jams, jellies, fruit preserve, and other confectionery products.

Fruit pectin is becoming progressively popular in the market in recent time due to its natural and healthy characteristic as ingredient in foods. Futhermore, increased sensitisation on the health benefits associated with the consumption of pectin including its role on the digestive health has done much to fuel the demand.

Consumer preferences are another factor that are contributing to the growth of the industry. It consumes far less water and produces much less CO2 than other crops used in plant based milks, which would be good news for those interested in the environmental impact of their food.

Given the increase in the consumption of green products in the market, manufacturers place Fruit Pectin under sustainable food products to suit consumers’ moral compass while enjoying its positive impacts on human health. In general, it could be stated that these valuable properties, the opportunities provided by increasing of the production capacities, and the tendencies towards growing of people’s plant-based diets are the main factors which today stimulate the growth of the industry.

Increased use of pectin in plant-based and vegan products

For pectin, this is the perfect niche for it, as there is a trend toward healthy and sustainable living and pectin is a flexible functional ingredient. Also called DR-pectin, a natural polysaccharide, sourced from the cell walls of fruits such as apples and citrus, pectin is an appropriate substitute for gelatin which is an animal by-product.

It is ideal for vegan and vegetarian products which are considered within the framework of the clean label, when consumers are concerned about the number of ingredients and the availability of their products.

Also, pectin is more sustainable and less expensive to manufacture in large quantities than the other emulsifiers. Most often, it is produced from fruit processing by-products including peels and cores effectively utilizing waste materials. This has the added effect of reducing expensive production costs further and at the same time aligns itself well with today’s environmentalism among consumers.

Rising demand for natural and clean-label ingredients in food products

Fruit Pectin is There are several forces behind the increasing concern with natural and clean-label ingredients that is charting globally food business shifting more to the lines of transparency, health and sustainability.

Firstly, today’s consumers are more knowledgeable and conscious about their health as compared to those consumers of the last few decades. As they are being provided with a lot of information, the people are beginning to pay much interest on what is included in foods they take. ‘’Natural and clean label ingredients unpack a health halo, which means that the consumers feel they are healthier, safer, free from synthetic additives, artificial preservatives, and GMOs.

This change is driven by consumers’ increasing awareness of dangers arising from the utilization of artificial components and therefore shoppers are fond of products made from natural ingredients as they understand the composition of the product.

Expansion of pectin applications in pharmaceuticals and cosmetics

Pectin is widely used in pharmaceuticals because it is natural, biocompatible and non- toxic in nature. Due to its properties to from gels and hydrogels this polymer is ideal for use in controlled drug delivery systems. These hydrogels are capable of protecting APIs, and also provide the ability to regulate the delivery of these ingredients in the body.

This indicates that in a medication it is possible to incorporate a time-specific release of its active components which enhances therapeutic efficacy and patient concordance. The former can be attributed to the fact that pectin can be easily modified chemically and physically in order to fit different pharmaceutica applications such as tissue or organ specificity.

In the cosmetics industry, pectin has the advantages of being friendly to skin and has multiple uses. It is used as an emulsifier and a stabilizer to give products such as lotions, creams and gels, a creamy feel without the need for other chemicals.

Pectin has excellent film forming quality and according to its moisturizing effect, it can be used in formulations for care of the skin to prevent dryness. Moreover, pectin based products depict their natural origin which is accolades the recent trend of preferring organic and natural products in beauty products. Antioxidant related properties also work for it; shields skin from environmental challenges hence playing an added role in anti aging product.

Development of low-sugar and sugar-free pectin products

There is emerging market demand for low sugar or no sugar pectin products due to increased focus on low calorie food stuffs. With great concern for health, individuals are turning their attention to avoidant effects brought by excessive consumption of sugar in the diet such as obesity, diabetes & other metabolic diseases. This has created a transition to products with little or no sugar content at all in the market and consumer homes.

A carbohydrate located in the cell wall frugal, mainly in apples and citrus fruits, pectin is considered the main binder for low-sugar and sugar-free products. Before the discovery of adding pectin with sugar, the so-called gelling or thickening effect of the fruit preparations such as jams, jellies and other fruit preserves was attained.

And while the low sugar pectin gels proved to be challenging to produce, current improvements in food technology have made it possible to make gelled pectin products that can be made without the inclusion of much sugar.

This development has been mainly boosted by the presence of high-methoxyl (HM) and low-methoxyl (LM) pectins. HM pectins are active in gel formation in the presence of sugar and acids, they are suitable for traditional high sugar products. In particular, LM pectins can gel in the presence of calcium ions and can be used in low sugar or sugar free products.

This flexibility allows food manufacturers to begin presenting far healthier options that possess the same texturing and stabilising properties as traditional pectin.

During the period 2020 to 2025, the sales grew at a CAGR of 4.8%, and it is predicted to continue to grow at a CAGR of 5.6% during the forecast period of 2025-34.

In the last decade, utilization of fruit pectin experienced significant development attributed to the growing population’s preference for natural and healthy products. In the past, pectin has widely been used in the food industry especially in the production of jams, jellies and other fruiting preparations.

Such uses include its role in the production of materials which have gelling and thickening characteristics in drug and cosmetic industries. There has been progress in the extraction and processing of pectin in the market, leading to higher quality and better production of the product. The markets in the regions like North America and Europe have notably prevailed due to the high consumption rates of products with clean label.

For the projected previews, the fruit pectin market is also likely to grow, These are driven by the increasing customer awareness of purchasing convenience, clean label, all-natural and quality natural products. Additional initiatives, including a worldwide shift to lower sugar consumption and the progress of low- and no-sugar and sugar-alternative pectin products, will both contribute to the market growth.

Similarly, the pharmaceuticals and cosmetics industries may take advantage of pectin because they prefer natural, biocompatible and functional polymers. Novelty in pectin uses and technological advancement in the procurement will also help to boost the market in the coming years.

Tier 1 : CP Kelco, Cargill Inc., Nestlé S.A., Danone S.A., Unilever These companies have massive market influence and reach, adequate funding, and robust Research and Development department. In its natural, sustainable ingredients, the company, CP Kelco, which is based in the United States, and the second largest agriculture and food production company, Cargill Inc.

The food and beverage industries are dominated by Nestlé S.A., Danone S.A., and Unilever; extending their brand image and distribution channels to sustain market control

Tier 2 : it is composed of midsize companies, which have significant market shares, but less power compared to first-tier manufacturers such as Kellogg NA Co. and Yantai Andre Pectin Co. Ltd. Kellogg NA Co. is well reputed for manufacturing breakfast cereals and convenience. the company that is specialized in manufacturing pectin is Yantai Andre Pectin Co. Ltd which has a large market in the industry.

These firms do not compete on the basis of price, but strategic positioning, thereby occupying well-defined market niches or targeting given regions. The concentration ratio here is lower than the one in Tier 1, and this presumably results from presence of several players who seeks to gain a fair share of the market.

Tier 3 : The strategic implications of the Distribution Strategies of Tablet PCs can be summed up in the Tier 3 of the Industry: New players and small industries having negligible market share: The same can be said of Devson Impex Pvt. Ltd. who specialises in the importation and distribution of food and pharmaceutical ingredients.

These are basically small companies that mainly offer specific products or services to the market targeting the various opportunities that are present in the marketplace and that they mainly compete based on price, quality and novelty.

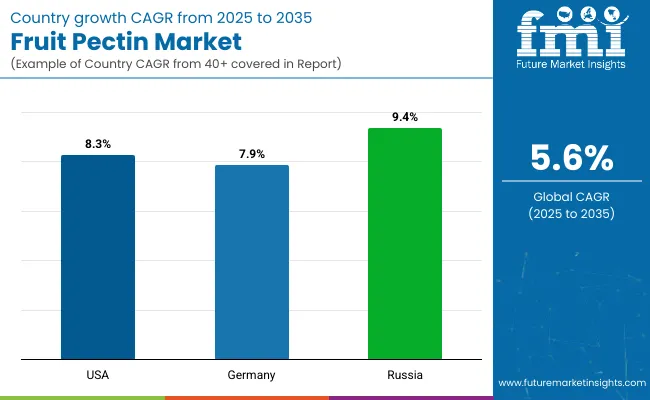

The following table shows the estimated growth rates of the significant three geographies sales. USA and Germany are set to exhibit high consumption, recording CAGRs of 8.3% and 7.9%, respectively, through 2035.

| Country | CAGR, 2025 to 2035 |

|---|---|

| United States | 8.3% |

| Germany | 7.9% |

| Russia | 9.4% |

In the country, The high degree of natural and clean-label food ingredients is due to consumers’ increased concern about the quality of foods they are consuming. The following consumers prefer foods with the freshest and most transparent ingredient list as opposed to foods with what seem more like a science project. In USA They are consciously avoiding synthetic preservatives, artificial colour, and flavour because most of them are believed to cause health problems.

It is also helped by growing concern with nutritional connections as many people seek to obtain more and more information about healthy eating. Thanks to increased awareness about the possible side effects of different types of processed foods consumers are now ready to consider natural products as the healthier and safer ones.

Consumers are more inclined to believe brands that are open about where they source their ingredients and how they are produced, causing an increase in items branded as organic GMO-free, and without the top eight food allergens.

The high degree of natural and clean-label food ingredients is due to consumers’ increased concern about the quality of foods they are consuming. The following consumers prefer foods with the freshest and most transparent ingredient list as opposed to foods with what seem more like a science project. They are consciously avoiding synthetic preservatives, artificial colour, and flavour because most of them are believed to cause health problems.

In addition, clean-label concept corresponds to global trends such as environmental protection and responsibility of consumers. The public is no longer focused on what is being consumed, but how that food was procured as well. Of course, the Millennials care about the environment, animals, and people who work in the companies. This has resulted to establishment of various food products that are obtained through ethical ways and produced through natural methods.

Jams, jellies, and fruit spreads are on the rise, mainly due to factors that mirror the change in consumer preferences and the trends in the market.

To scratch the surface: the health trend prompts consumers to search for products made with natural ingredients generally accepted as pure nourishing healthy foods. Fresh fruit jams, jellies, and some fruit spreads which have limited other additives lend credence to this.

This wholesome treat contributes fresh fruit to one's diet while satisfying the need for sweetness and taste. Some producers are cooperating with physicians and patient associations to formulate spreads with a lower sugar content, using no artificial preservatives, adding health benefits such as fiber and additional vitamins; they are targeting health-savvy individuals.

There is also sentimental attachment to the product and traditional cultural identities associated with them. For many, jams and jellies invoke sweet memories of childhood and traditional recipes, creating familiarity and assurance. This emotional connection promotes continuous consumption or loyalty of consumers for a specific brand or homemade brands.

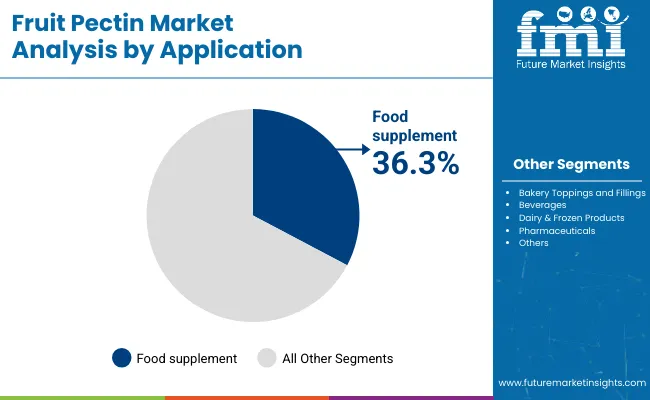

| Segment | Value Share (2025) |

|---|---|

| Food supplement (Function) | 36.3% |

Food supplements are emerging to the fore globally within the fruit pectin market due to the confluence of factors, reflecting the evolving priorities of today's health-conscious consumers.

First, major attraction is attributed to the health benefits of pectin. As a natural dietary fiber, pectin is acknowledged for its role in aiding digestion and promoting gut health, thus contributing to general wellness. From functional food manufacturers to health supplement producers, now, this pull of pectin has extended as its use and demand have grown for its ability to lower cholesterol and assist in weight management.

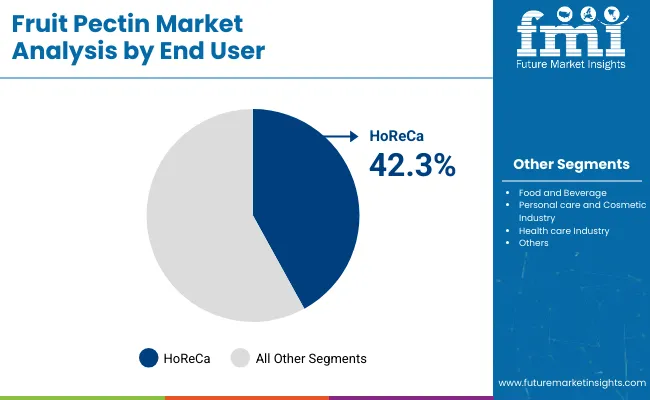

| Segment | Value Share (2025) |

|---|---|

| HoReCa (End-User) | 42.3% |

The growing network of cafés globally is greatly increasing the demand for pea-based milk in the market. More consumers are using plant-based milk in their coffee and tea products, thus cafes are introducing Fruit Pectin as an option to dairy. The milk derived from peas that boasts of a rich texture and has high protein content is slowly taking space on lattes, cappuccino, and smoothens.

That it can foam well, just like dairy milk, makes it a favourite for baristas and consumers in equal measure. This of course is not just helping to increase awareness of pea based milk but is also helping to grow market for the product by presenting it to a new audience. The increasing trend of cafés along with the rising interest in vegan and plant-based products is helping pepper milk to become standard with coffee shops and enhancing its acceptance all over the world.

Competitive landscape in fruit pectin market is dynamic with players like CP Kelco, Cargill Inc., Nestlé S.A., and Danone S.A. leading from the front. These companies utilize their sizeable resources, wide distribution networks and innovative capabilities to remain relevant in the market. CP Kelco is sustainable and is recognized for its natural ingredient solutions.

Cargill, Inc. excels in agriculture and food production. Nestlé S.A. and Danone S.A. retain the top slot in the foods and beverage market, with their wide product portfolios building strong consumer trust.

Mid-sized competitors such as Kellogg NA Co. and Yantai Andre Pectin Co. Ltd. form an important part of the competition, aiming at niche markets and regional domination. While Kellogg NA Co. brings to mind breakfast cereals and convenient foods, Yantai Andre Pectin Co. Ltd. is the global leader in the pectin industry with its niche production.

Lesser companies and new entrants like Devson Impex Pvt. Ltd. play a big part in the stiff competition for the space, wherein professional specializations create more competition, catering to just the very unique consumer needs. And those markets are already developed around innovations, quality, and sustainability as a means with which the small firms intend to gain a foothold.

The market is expected to grow at a CAGR of 5.6% throughout the forecast period.

By 2035, the sales value is expected to be worth USD 1,717.5 million.

USA is expected to dominate the global consumption

Some of the key players in manufacturing include. CP Kelco, Cargill Inc., Devson Impex Pvt. Ltd., Nestlé S.A., Danone S.A., Unilever, Kellogg NA Co., Yantai Andre Pectin Co. Ltd. Danisco A/S, B&V srl.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fruit Punnet Market Forecast and Outlook 2025 to 2035

Fruit And Vegetable Juice Market Size and Share Forecast Outlook 2025 to 2035

Fruit and Vegetable Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Fruit Pomace Market Size and Share Forecast Outlook 2025 to 2035

Fruit Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fruit Tea Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fruit Beverages Market Size, Share, and Forecast 2025 to 2035

Fruit Powders Market Trends - Growth, Demand & Forecast 2025 to 2035

Fruit Jams, Jellies, and Preserves Market Analysis by Type, Distribution Channel, and Region Through 2035

Fruit Wine Market Analysis by Platform, By Application, By Type, and By Region – Forecast from 2025 to 2035

Fruit Beer Market Analysis by Flavor Type, Alcohol Content, Packaging Type, and Sales Channel Through 2035

Competitive Breakdown of Fruit Snacks Suppliers

Fruit Concentrate Puree Market Growth - Trends & Forecast 2025 to 2035

Fruit Snacks Market Analysis by Product Type, Nature, Flavour Type, Distribution Channel Type, and Processing Type Through 2035

Market Share Insights of Fruit Juice Packaging Providers

Fruit Juice Packaging Market Growth – Trends & Forecast through 2035

Global Fruits and Vegetable Bag Market Growth – Trends & Forecast 2024-2034

Fruit Kernel Products Market

Fruit Seed Waste Market

IQF Fruits & Vegetables Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA