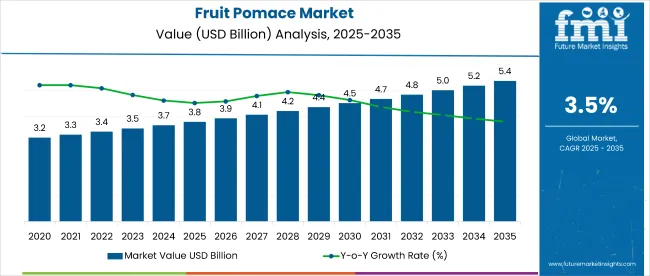

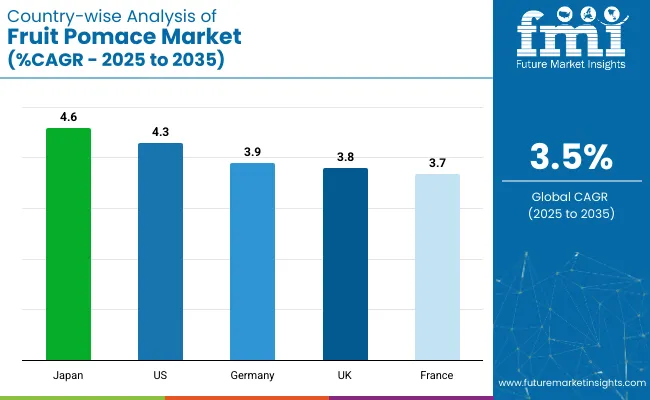

The global fruit pomace market is projected to grow from USD 3.8 billion in 2025 to USD 5.4 billion by 2035, registering a CAGR of 3.5%.

The market expansion is driven by increasing demand for natural and organic ingredients in food & beverage products, as well as rising consumer preference for plant-based and nutritionally enriched diets. Fruit pomace is gaining popularity as a sustainable resource for producing animal feed, beverages, snacks, and nutraceuticals.

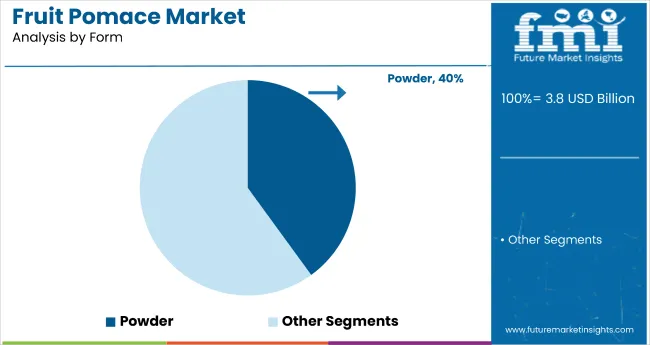

The use of fruit pomace as a dietary supplement is also on the rise, driven by its high antioxidant content, fibre, and pectin nutrients, which contribute to better health and wellness. Manufacturers are developing a variety of fruit pomace products, such as liquid, powder, and paste forms, to cater to the growing consumer demand for healthy, eco-friendly options.

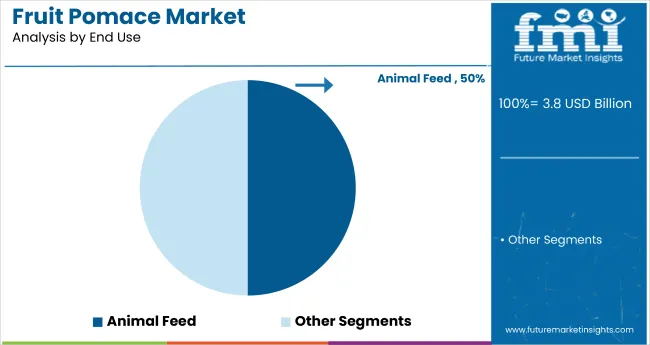

The market holds a notable share across its parent markets. In the animal feed market, it accounts for 50%, owing to its high demand as a cost-effective and nutritious feed ingredient. Within the food & beverage ingredients market, the global market captures around 15%, driven by its inclusion in beverages, snacks, and functional foods.

The market’s contribution to the health supplements market is about 5%, as consumers turn to fruit pomace for its antioxidants and fiber. It represents around 2% of the nutraceuticals market and less than 0.5% in the organic food market, though its presence is growing steadily in these sectors due to increasing sustainability trends.

Government regulations impacting the market focus on sustainability, waste reduction, and the promotion of healthy food options. The Food Safety and Standards Authority of India (FSSAI) and similar agencies globally encourage the use of fruit-based by-products like pomace in food and animal feed. Regulations on organic food production also foster the growth of fruit pomace use in vegan, gluten-free, and health-conscious diets. These regulations support the adoption of fruit pomace as a sustainable and nutritious ingredient, driving further market growth.

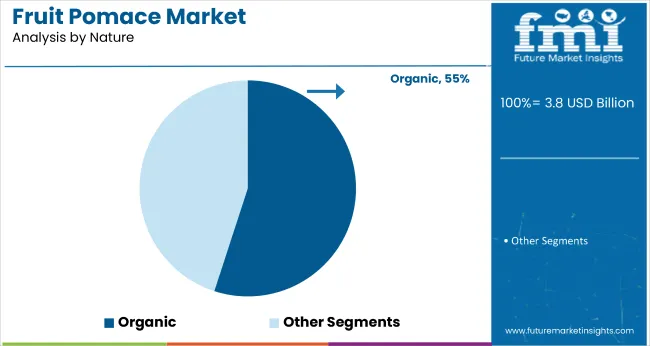

Japan is projected to be the fastest-growing market, expected to expand at a CAGR of 4.6% from 2025 to 2035. Animal feed will lead the end use segment with a 50% share, while organic will dominate the nature segment with a 55% share. The UK and France markets are also expected to grow steadily at CAGRs of 3.8% and 3.7%, respectively. The USA and Germany are projected to grow at a moderate pace, with CAGRs of 4.3% and 3.9%, respectively.

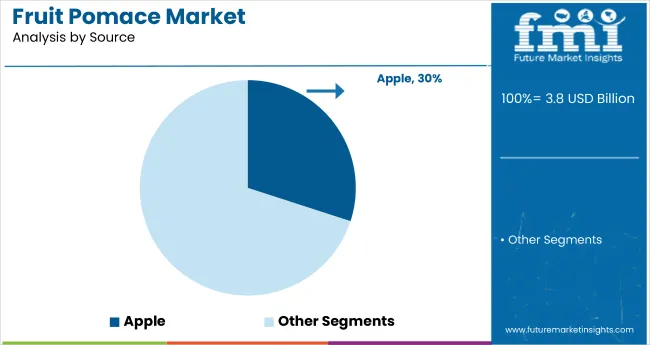

The market is segmented by source, form, nature, end use, and region. By source, the market is divided into apple, banana, berries, citrus, grape, mango, and other sources (pear, peach, pineapple, and pomegranate). In terms of form, the market is classified into liquid/paste, pellets, and powder. Based on nature, the market is bifurcated into conventional and organic.

By end use, the market is divided into animal feed, beverage processing, biofuel production, cosmetics & personal care, dairy products, dietary supplements, edible oils & fats, food processing, pectic production, and other (bio-based packaging, pharmaceuticals, bakery & confectionery, natural food colorants). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Asia Pacific, and the Middle East & Africa.

Apple is expected to dominate the source segment, holding a projected 30% market share by 2025. This dominance is driven by its widespread use in animal feed, beverage processing, pectin production, and its high availability in apple-producing regions.

Powder is anticipated to capture 40% of the market share by 2025, driven by its versatility in dietary supplements, food processing, and animal feed, where ease of incorporation is essential.

Organic is projected to lead the nature segment, capturing 55% of the market share by 2025. This growth is driven by rising consumer demand for natural and sustainable ingredients in food, beverages, and cosmetic products.

Animal feed is projected to dominate the end use segment, holding 50% of the global market share by 2025, driven by the high nutritional value of fruit pomace as a sustainable and cost-effective ingredient in animal diets.

The global fruit pomace market is experiencing steady growth, driven by the increasing demand for sustainable, plant-based ingredients and the rising popularity of healthy, eco-friendly food options. Fruit pomace plays a crucial role in providing cost-effective, nutrient-rich solutions for animal feed, beverage processing, and nutraceuticals.

Recent Trends in the Fruit Pomace Market

Challenges in the Fruit Pomace Market

Japan’s momentum is driven by high demand for organic and sustainable ingredients in its food, beverage, and biofuel industries, with regulatory focus on reducing agricultural waste and promoting circular economies. Germany and France witness consistent growth supported by EU sustainability mandates and funding for green agriculture initiatives. Developed economies like the USA (4.3% CAGR), UK (3.8%), and Japan (4.6%) are expected to expand at a pace of 1.2-1.3x the global growth rate.

Japan leads with a focus on organic, plant-based ingredients and sustainability in food and beverage sectors, setting it apart with its zero-waste manufacturing goals. The USA emphasizes fruit pomace in animal feed, dietary supplements, and food processing, driven by regulatory support for agricultural waste reduction.

Germany benefits from EU sustainability mandates, increasing its use in biofuel production and food processing. France follows suit, with growth fueled by national sustainability targets and eco-friendly agriculture practices, especially in biofuels and dietary supplements. The UK shows steady growth, focusing on food processing and health-focused food applications, with rising investment in sustainable ingredients post-Brexit.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The Japan fruit pomace revenue is growing at a CAGR of 4.6% from 2025 to 2035. Growth is driven by the high demand for organic, plant-based ingredients in food and beverage sectors, as well as the country’s push for zero-waste manufacturing.

The fruit pomace market in Germany is expected to expand at a 3.9% CAGR during the forecast period, slightly above the global average. The demand is driven by EU decarbonization goals, increasing adoption in biofuel production, and the rising use of pomace in animal feed and pectin production.

The French fruit pomace revenue is projected to grow at a 3.7% CAGR, mirroring Germany’s growth trajectory. Demand is driven by France’s national sustainability targets, which emphasize reducing food waste and improving recycling processes.

The USA fruit pomace market is projected to grow at a 4.3% CAGR from 2025 to 2035, translating to 1.2x the global growth rate. Unlike emerging markets, USA demand is heavily focused on incorporating fruit pomace into animal feed, dietary supplements, and food processing.

The fruit pomace revenue in UK is projected to grow at a 3.8% CAGR from 2025 to 2035, slightly below the global growth rate. The market growth is supported by increasing regulations in the food and beverage industry to reduce food waste and enhancing recycling processes.

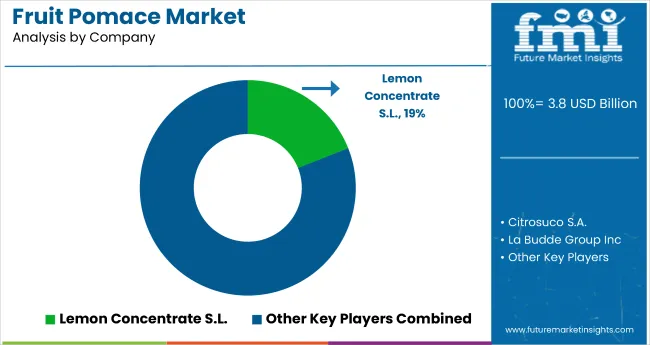

The market is moderately consolidated, with key players like Lemon Concentrate S.L., Citrosuco S.A., La Budde Group Inc., AGRANA Beteiligungs-AG, and Louis Dreyfus Company B.V. leading the industry. These companies provide innovative, high-quality fruit pomace solutions for various applications, including food processing, biofuel production, and animal feed.

Lemon Concentrate S.L. is known for its high-quality fruit concentrate systems, while Citrosuco S.A. offers a wide range of 100% natural juice solutions. La Budde Group Inc. specializes in turning agricultural by-products into value-added products, while AGRANA Beteiligungs-AG provides sustainable pomace products for food processing. Louis Dreyfus Company B.V. is recognized for its extensive supply chain expertise in the fruit pomace sector.

Other notable players like Yantai North Andre Juice Co. Ltd., Sucocitrico Cutrale Ltd., Constellation Brands, Inc., FruitSmart, Inc., GreenField Sp. z o.o. Sp. K., and Appol sp. z o.o. contribute by offering specialized solutions in food processing, nutraceuticals, and biofuel production, further strengthening the market’s diverse supply base.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 3.8 billion |

| Projected Market Size (2035) | USD 5.4 billion |

| CAGR (2025 to 2035) | 3.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value/volume in kilotons |

| Source Analyzed | Apple, Banana, Berries, Citrus, Grape, Mango, and Other Sources (Pear, Peach, Pineapple, and Pomegranate) |

| Form Analyzed | Liquid/Paste, Pellets, and Powder |

| Nature Analyzed | Conventional and Organic |

| End-Use Analyzed | Animal Feed, Beverage Processing, Biofuel Production, Cosmetics & Personal Care, Dairy Products, Dietary Supplements, Edible Oils & Fats, Food Processing, Pectic Production, and Other (Bio-based packaging, Pharmaceuticals, Bakery & Confectionery, Natural Food Colorants). |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Asia Pacific, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia |

| Key Players Influencing the Market | Lemon Concentrate S.L., Citrosuco S.A., La Budde Group Inc., AGRANA Beteiligungs-AG, Louis Dreyfus Company B.V., Yantai North Andre Juice Co. Ltd., Sucocitrico Cutrale Ltd., Constellation Brands, Inc., FruitSmart, Inc., GreenField Sp. z o.o. Sp. K., Appol sp. z o.o. |

| Additional Attributes | Dollar sales by source, share by form, regional demand growth, policy influence, sustainability trends, competitive benchmarking |

The global fruit pomace market is estimated to be valued at USD 3.8 billion in 2025.

The market size for the fruit pomace market is projected to reach USD 5.4 billion by 2035.

The fruit pomace market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in fruit pomace market are apple, citrus, banana, berries, grape, mango and others.

In terms of foam, powder segment to command 57.3% share in the fruit pomace market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fruit And Vegetable Juice Market Size and Share Forecast Outlook 2025 to 2035

Fruit and Vegetable Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Fruit Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fruit Tea Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fruit Beverages Market Size, Share, and Forecast 2025 to 2035

Fruit Powders Market Trends - Growth, Demand & Forecast 2025 to 2035

Fruit Jams, Jellies, and Preserves Market Analysis by Type, Distribution Channel, and Region Through 2035

Fruit Wine Market Analysis by Platform, By Application, By Type, and By Region – Forecast from 2025 to 2035

Fruit Beer Market Analysis by Flavor Type, Alcohol Content, Packaging Type, and Sales Channel Through 2035

Competitive Breakdown of Fruit Snacks Suppliers

Fruit Concentrate Puree Market Growth - Trends & Forecast 2025 to 2035

Fruit Snacks Market Analysis by Product Type, Nature, Flavour Type, Distribution Channel Type, and Processing Type Through 2035

Analysis and Growth Projections for Fruit Pectin Business

Market Share Insights of Fruit Juice Packaging Providers

Fruit Juice Packaging Market Growth – Trends & Forecast through 2035

Fruit Punnet Market Trends – Growth & Forecast 2024-2034

Global Fruits and Vegetable Bag Market Growth – Trends & Forecast 2024-2034

Fruit Seed Waste Market

Fruit Kernel Products Market

IQF Fruits & Vegetables Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA