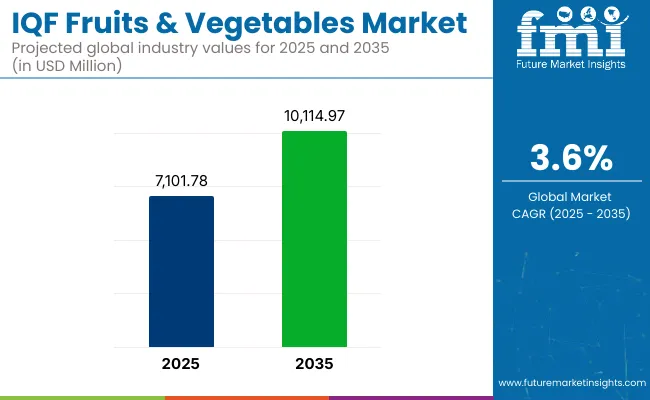

As of 2025, the global IQF fruits and vegetables market is valued at approximately USD 7,101.78 million and is likely to register a CAGR of 3.6% to surpass USD 10,114.97 million by the end of 2035. Demand has been sustained by evolving consumer preferences toward minimally processed, nutrient-retentive foods. IQF technology has gained traction across diverse food categories due to its ability to preserve taste, texture, and nutrition without additives or preservatives.

| Attributes | Description |

|---|---|

| Estimated Global Industry Size (2025 E) | USD 7,101.78 Million |

| Projected Global Industry Value (2035 F) | USD 10,114.97 Million |

| Value-based CAGR (2025 to 2035) | 3.6% |

The market is being driven by multiple converging trends. A shift toward clean-label and additive-free products has elevated demand for IQF formats that enable rapid freezing without chemical preservatives. Manufacturers are increasingly relying on IQF fruits and vegetables to ensure year-round ingredient availability for packaged foods, especially in bakery, dairy, and ready-to-eat meals.

However, capital-intensive freezing infrastructure and cold chain limitations in developing regions have been constraining broader adoption. Furthermore, volatility in raw material supply and seasonal dependencies continue to impact procurement costs.

Despite this, innovation in IQF process technologies and improved logistics are supporting the scalability of operations. Private-label brands and institutional buyers are expanding their IQF product portfolios as part of cost-optimization strategies, intensifying competition across regional markets.

By 2035, the market is expected to see a rise in strategic collaborations between growers, processors, and retailers to build vertically integrated supply chains. IQF fruits are anticipated to retain a majority share, especially in Western markets where bakery, dessert, and smoothie consumption remains high.

Vegetables will gain renewed momentum in Asia-Pacific and Latin America as demand surges in convenience foods. With rising emphasis on food safety, sustainability, and waste reduction, IQF formats are positioned to serve future-ready food systems. Regulatory acceptance and technological sophistication will further unlock growth avenues in institutional food services and export-focused businesses.

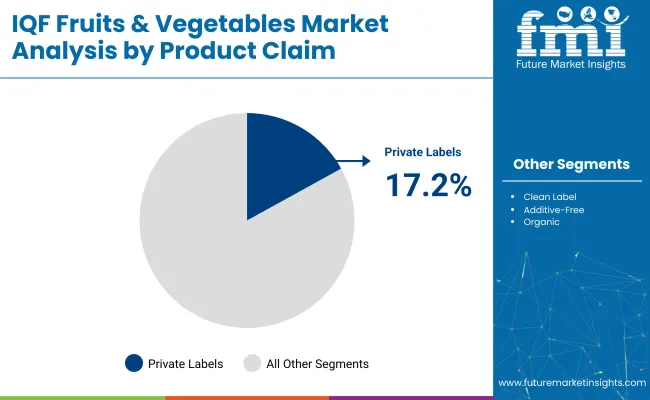

Retail private labels are estimated to capture approximately 17.2% market share within the IQF fruits and vegetables segment in 2025. This share is expected to grow steadily as retailers across North America and Western Europe broaden their clean-label frozen food offerings under store brands.

Strategic investments in private label SKUs have been prioritized by retailers such as Lidl, ALDI, and Tesco to counter inflationary pressures while capitalizing on rising consumer demand for transparency and affordability. The IQF format aligns with private label imperatives: it enables year-round availability, mitigates spoilage losses, and simplifies ingredient traceability.

Moreover, as regulatory scrutiny intensifies around shelf-life enhancers and synthetic additives, retailers increasingly favor IQF ingredients that naturally meet clean-label standards. For instance, Tesco’s “Grower’s Harvest” and ALDI’s “Simply Nature” ranges have expanded IQF vegetable SKUs across European markets.

Private labels are also forming backward linkages with processors to secure dedicated IQF production lines and reduce sourcing volatility. With major supermarket chains investing in value-added frozen assortments, the segment is expected to evolve from bulk-pack offerings to differentiated IQF blends tailored for ethnic cuisines, smoothies, and meal kits. This trajectory reflects a maturing demand for affordable, high-quality, ready-to-use frozen produce across mainstream retail.

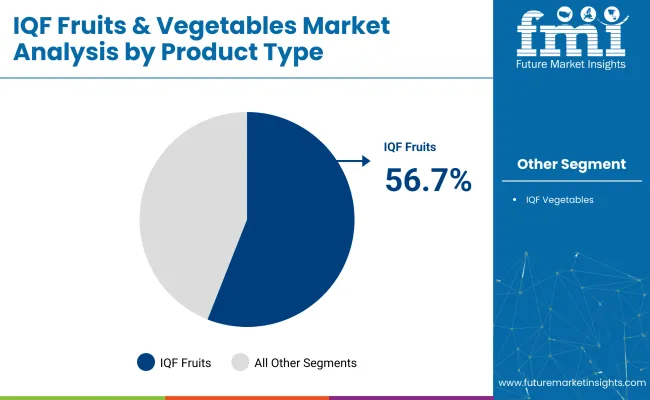

Functional IQF fruit and vegetable blends are projected to account for around 56.7% of the global IQF segment by 2025, with rapid traction among sports nutrition, elderly care, and wellness-centric product lines. Blends featuring blueberries, spinach, beetroot, and kale are increasingly being integrated into clinical nutrition and personalized diet products due to their antioxidant density and microbiome-supportive fiber content.

IQF’s ability to preserve phytonutrients and bioactives without compromising on quality gives it an edge over conventionally frozen or heat-treated formats. In Western Europe, manufacturers such as Ardo and Crop’s NV have introduced IQF superfood mixes tailored for functional smoothies and plant-forward meals, aligned with dietary guidelines on healthy aging. Meanwhile, USA operators like Wawona Frozen Foods are supplying targeted IQF blends to the nutraceutical and frozen meal prep sectors.

This growth is also supported by cross-sector partnerships between food scientists and dietitians to design IQF matrices that enhance absorption and palatability in specialized medical or geriatric diets. According to EFSA, the stability of bioactives during freezing is a key determinant for functional labeling claims, positioning IQF as a preferred processing method. As functional nutrition continues to blur the lines between food and medicine, IQF formats are expected to secure long-term relevance in wellness-focused innovation pipelines.

Increased use of IQF products in restaurants and cafes.

Thanking the rise of IQF (Individually Quick Frozen) products within the restaurant and cafe sector the foodservice industry undergoes revolutionary changes through its consistent supply of dependable high-quality food ingredients year-round.

IQF technology represents a freezing approach that freezes individual fruit and vegetable items while maintaining their original texture alongside flavor elements and nutritional composition. This is ensured by keeping each piece separate while being portioned by the chefs so they use only what is needed and in turn combat food waste.

The main benefits of IQF products are consistency and convenience. Restaurants and cafes can keep menu items consistent regardless of time seasons, thereby safeguarding that the same quality ingredients are used for their dishes throughout the year. This especially helps restaurants that have signature dishes relying on the availability of a specific fruit or a vegetable. In addition, IQF products mean less prep work and time saving, an important factor in the fast-paced kitchens.

Integration of IQF fruits and vegetables in convenient meal solutions.

Capable consumers seek efficient nutritious and easy-to-make meal solutions with IQF (Individually Quick Frozen) fruits and vegetables integrated for popular use. The IQF technique lets producers freeze individual pieces of produce while preserving their sensory qualities and nutritional values thus enabling easy portion management and product use. These time-preserved foods exist in excellent condition so manufacturers select them for making ready-to-eat meals and meal kits.

The use of IQF fruits and vegetables for convenient meal solutions provides stability and practicality in working with them. They can simply open a bag of prepared fruits and vegetables, toss them into a pan, and stir-fry or just add water, heat, and eat during busy times without any respect to the retort or shelf life of those same foods.

Less time to prepare means that those with heavy work schedules or taxi them to extracurricular activities can provide nutritious meals without long prep times. By having IQF products in preportioned amounts, food waste is greatly reduced as customers can take what they need and stow the rest for later.

The IQF fruit-and-vegetable revolution is going further and further into many meal solutions, including frozen meals, smoothies, and meal kits. The products align with various dietary requirements because they meet the needs of people who want healthy choices and vegetarians alongside individuals following plant-based diets. The inclusion of frozen fruits and vegetables in these meals increases their nutritional quality because they contain essential vitamins and minerals as well as antioxidant compounds.

Incorporation of unique items like dragon fruit and jackfruit.

TheIQF Fruits and Vegetables Marketis on a very steady growth path due to convenience foods and ready-to-eat foods. Modern life patterns put extra needs on time availability, and tight schedules among present-day consumers are driving this transformation. Ready-to-eat foods appeal to people and families because these pre-packaged meals, along with snacks and beverages, do not require much time for the preparation and provide easy convenience.

The innovation in food additives results from the ever-increasing demand for convenience foods to better their quality, taste, and shelf stability. Food preservatives further enhance the period during which foods made earlier and now are waiting to be eaten will remain safe.

Emulsifiers and stabilizers prove to extend good quality texture, so that the products look good even after extended storage. The manufacturer enhances their flavor, along with natural ingredients to promote taste and nutritional value.

This upsurge in consumer awareness for healthier products has prompted the manufacturers to provide contamination-free versions of convenient food. Capacities of health functions with vitamins and minerals along with probiotics are incorporated by the manufacturers in the ready-to-eat food production. Transparent and eat-healthy are the two consumer demands, hence the use of accepted natural additives will witness an increase.

Growing urban populations driving demand for quick and easy meal options.

The urbanization phenomenon has accelerated the demand for rapid meal solutions ranging from one-stop shopping for IQF (Individually Quick Frozen) fruits and vegetables. Fast-paced urban lifestyle-less time, chance-based convenience becomes the first choice for most of the people and families. Thus, a rise in preference for food articles that require little preparation and can be used in a daily meal with minimal fuss is being observed.

This can be satisfied by IQF fruits and vegetables, which the consumer simply needs to wash, cut, and ready to use while retaining their nutrients and flavor until consumption. IQF refers to the method of freezing such food by holding it under very low temperatures, so each fruit or vegetable is frozen separately, not allowing for any clumping together, therefore making it very easy to cater for a needed amount at that time. In the case of urban ideas, this would go step forward in providing easy access to varieties of fruits and vegetables without lengthy preparation.

Tier1:The leading companies operating in IQF (Individually Quick Frozen) fruits and vegetables market are Novozymes A/S, BASF SE, Royal DSM N.V. and E.l. Du Pont de-Nemours& Company. The giants dominate the market by virtue of their stronghold due to vast product portfolios, cutting-edge technologies, and strong global presence. Strong R&D investments and innovation set the benchmark for the rest of the industry and ensure constant growth and expansion.

Tier 2:These companies, Rossari Biotech Limited, AB Enzymes GmbH, Lallemand Inc., and Amano Enzymes Inc., are rapidly growing and gaining market share and have a vast product range and a focus on expanding their market presence.

They invest in innovation, becoming strong competitors against Tier 1 companies. These companies usually target either emerging markets or niche segments, which they see as opportunities to fill the gap between Tier-1 and Tier-3 companies.

Tier 3:Tier-3 companies comprise Biocatalysts Limited, Creative Enzymes, Nagase & Company, Chr Hansen Holding A/S, Jiangsu Boli Bioproducts Co. Limited, and Kemin Industries, Inc. These firms offer products and technical capabilities custom-made for specific market needs and regional influence.

Therefore, Tier-3 companies usually have small shares in the market, yet they are very important in addressing unique customer needs. Because of their focus on specialized solutions, Tier-3 companies can create unique market positions even though they do not operate at the size of Tier 1 or 2 companies.

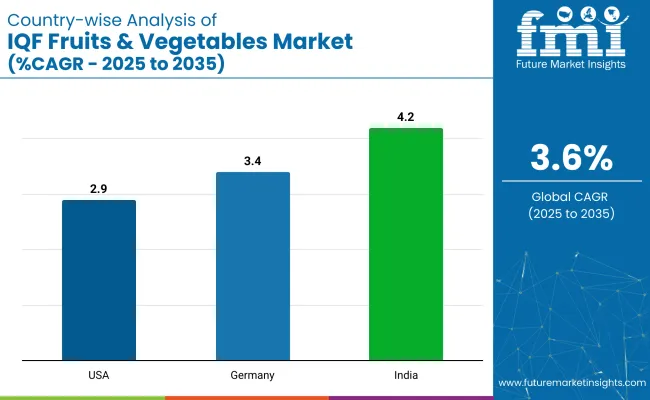

The following table shows the estimated growth rates of the significant three geographies sales. USA and Germany are set to exhibit high consumption, recording CAGRs of 2.9%,3.4% and 4.2% respectively, through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| USA | 2.9% |

| Germany | 3.4% |

| India | 4.2% |

Another great aspect of this expansion of online grocery platforms in the USA is an improved accessibility of the individual quick-frozen (IQF) range. With e-commerce and digital shopping tremendously gaining momentum, consumers can leisurely browse and purchase an extensive lineup of IQF fruits and vegetables from the comforts of their homes.

These platforms are user-friendly, with adequate product descriptions and customer reviews to help the consumer during informed decision-making. Besides, online grocery shopping usually includes home delivery or click-and-collect options, which guarantee that the IQF products are delivered on time by quick and efficient means to ensure quality. Such easy accessibility therefore meets the raising demand for convenient and healthy food option while also favoring the market growth of IQF products in the USA.

The demand for frozen fruits and vegetables that freeze individually rises sharply when German citizens develop increased health consciousness. The consumer focus on healthy eating and nutritious diets has led them to seek food products which maintain their vitamins and minerals and freshness content.

The freezing process performed by IQF technology protects nutritional value by freezing fruits and vegetables exactly at their prime ripeness thus keeping the products nutritious after freezing. Also, IQF products are designed with convenience in mind in terms of portion control and low incidence of wastage, thus attracting interest among individual health seekers.

This increasing trend toward healthier lifestyles is what drives the market for IQF fruits and vegetables within Germany, as consumers acknowledge and appreciate the health benefits these products bestow.

The swift pace of Indian urban growth along with changing food patterns has upped the consumption of frost-dried food products. The urban populace demonstrates increasing interest in food items that are ready-to-eat while being convenient and nutritious solutions. IQF technology, which serves well to retain the inherent flavor, texture, and nutrition of fruits and vegetables, is highly being supported by the need.

The suspicion about healthiness and preference for products that promise near-fresh quality in frozen goods have also increased. With a large and growing middle class with disposable income, there is an ever-greater demand for premium health food. The rising number of modern retail outlets and supermarkets, alongside online platforms, is fuelling the accessibility and availability of IQF fruits and vegetables, making them a vital part of urban diets in India.

Within the coming years, the IQF (Individually Quick Frozen) market for fruits and vegetables is set for significant growth owing to rising consumer demand for convenience and nutrition in food. Novozymes A/S, an enzyme technology specialist, is an important participant with its solutions that enhance the effectiveness and quality of IQF processes.

Advanced Enzymes Technologies Ltd, having a wide range of enzyme products, contributes to enhancing the texture parameter, flavor, and nutritional content of frozen fruits and vegetables. BASF SE, with its stronghold in the chemical industry, uses its considerable R&D capabilities and infrastructure to provide innovative solutions with regard to the IQF market.

Royal DSM N.V. offers solutions in sustainable development and innovative food ingredients in response to the increasing demand for healthy and convenient food options. Competitive IQF market players are, therefore, well positioned to exploit the growing IQF market, with every one of the companies contributing uniquely toward meeting the market shifts resulting from changing consumer preferences.

The industry is projected to grow at a CAGR of 3.6% during the forecast period.

By 2035, the market is estimated to reach USD 10,114.97 million in sales value.

North America is expected to dominate global consumption.

Leading manufacturers include DuPont, Archer Daniels Midland, Cargill Incorporated, and CHR.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

IQF Vegetables Market Size and Share Forecast Outlook 2025 to 2035

Global Fruits and Vegetable Bag Market Growth – Trends & Forecast 2024-2034

Fresh Fruits & Vegetables Market Size and Share Forecast Outlook 2025 to 2035

Canned Fruits Market Size and Share Forecast Outlook 2025 to 2035

Frozen Fruits and Vegetables Market Size and Share Forecast Outlook 2025 to 2035

Freeze Dried Fruits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Competitive Overview of Freeze Dried Fruits Market Share

Freeze Dried Fruits And Vegetables Market Size and Share Forecast Outlook 2025 to 2035

Packaged Fresh Fruits Market Analysis by Berries, Citrus, Tropical Fruits, Stone Fruits, and Others Through 2035

UK Freeze Dried Fruits Market Insights – Size, Demand & Industry Growth 2025–2035

USA Freeze Dried Fruits Market Growth – Innovations, Trends & Forecast 2025–2035

ASEAN Freeze Dried Fruits Market Growth – Trends, Demand & Innovations 2025–2035

Europe Freeze Dried Fruits Market Growth – Demand, Innovations & Forecast 2025–2035

Australia Freeze Dried Fruits Market Report – Growth, Demand & Forecast 2025–2035

Latin America Freeze Dried Fruits Market Report – Demand, Growth & Industry Forecast 2025–2035

CNC Slitting Lathes Market Size and Share Forecast Outlook 2025 to 2035

Swine Disease Diagnostic Kit Market Size and Share Forecast Outlook 2025 to 2035

Clad Wood Awning Window Market Size and Share Forecast Outlook 2025 to 2035

Strain Type Pressure Sensors Market Size and Share Forecast Outlook 2025 to 2035

Stud Type Track Roller Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA