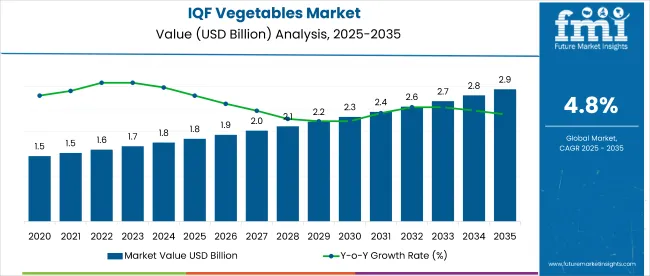

The global IQF vegetables market is valued at USD 1.8 billion in 2025 and is expected to reach USD 2.9 billion by 2035, reflecting a CAGR of 4.8%. Growth expansion is driven by rising demand for convenience foods, increasing awareness of healthy eating, and advancements in IQF (Individually Quick Frozen) freezing technology that preserves nutritional value and enhances shelf life.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 1.8 billion |

| Projected Value (2035F) | USD 2.9 billion |

| CAGR (2025 to 2035) | 4.8% |

The growing preference for ready-to-eat meals and the expansion of food service chains globally are also likely to stimulate demand across both developed and developing markets.

The market holds an estimated 14-16% share of individually quick-frozen (IQF) produce, driven by rising demand for high-quality frozen ingredients with extended shelf life. Within the processed vegetables segment, IQF vegetables represent approximately 28-30%, supported by technological advantages in preservation, texture retention, and nutritional value.

In the convenience food market, IQF vegetables account for nearly 10%, reflecting their widespread use in ready-to-cook and frozen meal solutions. The cold chain logistics sector sees a smaller but critical share of around 6-8%, emphasizing the need for specialized storage and transportation infrastructure. Additionally, IQF vegetables contribute approximately 12% to advancements in food preservation technologies, highlighting their role in enhancing shelf stability and reducing food waste.

Government regulations imapcting the market focus on innovation in processing technologies, diversified product offerings, and sustainable packaging initiatives. Advancements such as nitrogen-based IQF systems and investments in cold chain logistics are enhancing product shelf life and distribution reach, making frozen vegetables more accessible across regions. Regulatory approvals in multiple countries are further opening new avenues for market expansion, particularly in health-conscious and import-reliant economies.

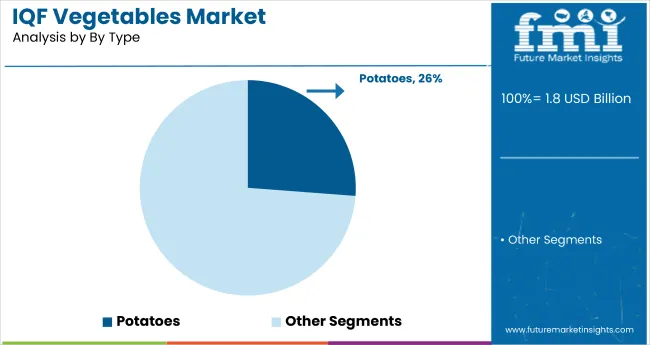

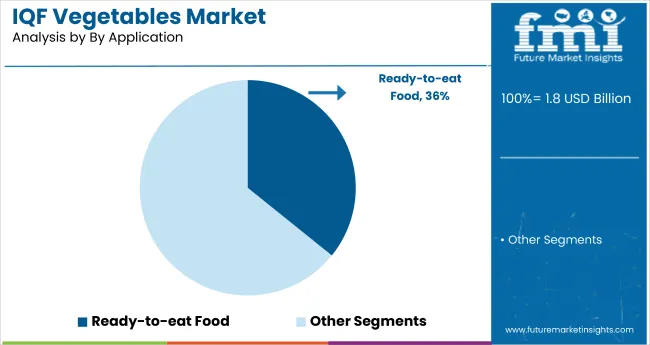

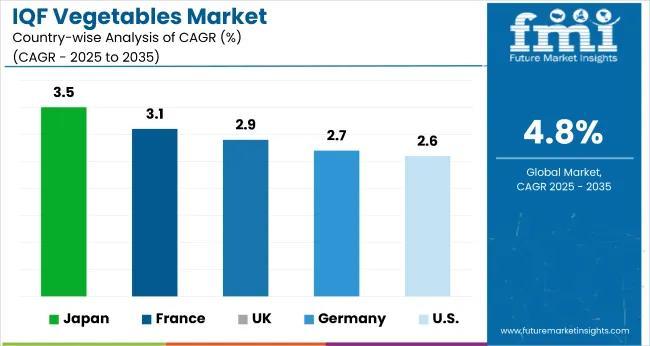

The USA is projected to be a leading market, expanding at a CAGR of 2.6% from 2025 to 2035. Potatoes will lead the type segment with a 26% share, while, ready-to-eat food will dominate the application segment with a 36% market share in 2025.The Germany and Japan markets Other key markets such as Germany and Japan are also expected to grow steadily at CAGRs of 2.7% and 3.5%, respectively.

The IQF vegetables market is segmented into type, application and region. By type, the market includes beans, peas, corn & baby corn, broccoli & cauliflower, potato, onion, tomato and carrot. By application, the market is segmented into food (Bakery, confectionary & snack food, dairy & dessert, cooking food, ready to eat food), and beverage (Juice and other non-alcoholic beverages), and concentrate.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and Middle East & Africa.

Potatoes are projected to lead the type segment,accounting for 26% of the global market share in 2025. The increasing use of IQF potatoes in quick meals, fast food chains, and processed food manufacturing has supported its dominance. This segment benefits from its long shelf life, ease of cooking, and high versatility across cuisines. The rising popularity of Western diets in developing regions has further amplified demand for IQF potato-based products.

Ready-to-eat food is expected to dominate the application segment,accounting for 36% of the market share in 2025. Growing demand for convenience and time-saving meal options has significantly increased the adoption of IQF vegetables in ready-to-eat products. These meals are favored by working professionals and urban households due to minimal preparation requirements and high nutritional retention.

The global IQF fruits and vegetables market has been experiencing steady growth, driven by rising consumer demand for minimally processed, nutrient-rich, and convenient foods. IQF technology preserves taste, texture, and nutritional value without additives, making it popular across sectors like ready-to-eat meals, bakery, and dairy.

Recent Trends in the IQF Vegetables Market

Key Challenges in the IQF Vegetables Market

Japan is projected to lead the IQF vegetables market due to strong consumer preference for convenient, health-oriented frozen foods and widespread adoption in retail and foodservice sectors.

The UK is expected to grow at a CAGR of 2.9%, as increased health awareness and expanded supermarket offerings continue to drive interest in IQF products.While, Germany market is expected to grow at 2.7% and the USA, at a CAGR of 2.6%.

The report covers an in-depth analysis of 40+ countries; with the five top-performing OECD nations highlighted below.

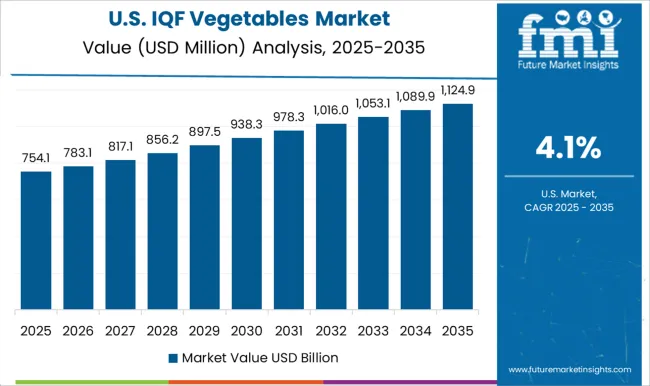

The USA IQF vegetables revenue is growing at a CAGR of 2.6% from 2025 to 2035. Growth is driven by widespread adoption of frozen foods, increased consumer preference for convenience, and robust cold storage infrastructure. Leading brands and private labels are expanding portfolios with healthier, organic, and eco-friendly IQF products to align with consumer trends.

The sales of IQF vegetables in the UK are expanding at a CAGR of 2.9% during the forecast period. Growth is driven by rising adoption of health-conscious and plant-based diets, coupled with an increase in one-person households. The expansion of digital grocery platforms and focus on packaging sustainability are reinforcing the segment’s appeal.

The Germany IQF vegetables market is projected to grow at a CAGR of 2.7% from 2025 to 2035. Growth is driven by increasing number of consumers in Germany drawn to frozen vegetables due to convenience, nutritional preservation, and growing environmental awareness. The rise in smaller households, eco-packaging initiatives, and the rising popularity of frozen organic options further support the demand.

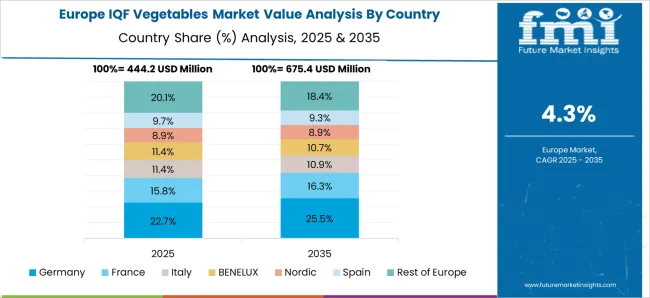

The IQF vegetables revenue in France is expected to grow at a CAGR of 3.1% from 2025 to 2035. France remains a key hub in Europe for IQF vegetable distribution due to its developed cold chain and diverse frozen food offerings. French consumers continue to prioritize food quality and health, driving sales of nutrient-rich and minimally processed frozen vegetables.

The Japan IQF vegetables market is projected to grow at a CAGR of 3.5% from 2025 to 2035. The demand is fueled by aging demographics, busy urban lifestyles, and a preference for hygienically packed, ready-to-use food products. IQF potatoes and corn dominate the Japanese market due to consistent year-round availability and high-quality preservation techniques.

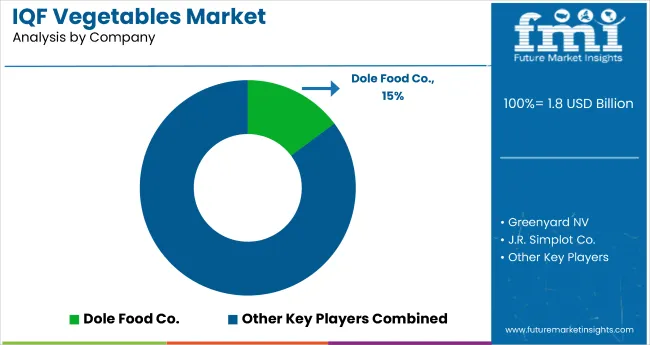

The IQF vegetables market is moderately fragmented, with several regional and global players competing based on product quality, sourcing capabilities, innovation, and retail partnerships. Companies like B&G Foods Holdings Corp., Dole Food Co., ConAgra Foods, and Greenyard NV maintain substantial presence through extensive distribution networks and large-scale production facilities, while newer entrants are gaining traction through niche offerings and sustainable packaging.

Top companies are actively pursuing strategies focused on expanding processing capacity, launching innovative product formats, and establishing regional partnerships to improve supply resilience. Price competitiveness, investment in food safety certifications, and alignment with organic and clean-label trends are central to supplier strategies. In 2025, companies have been observed enhancing automation in IQF lines, strengthening their presence in Asia and North America, and securing long-term contracts with major foodservice providers and supermarkets.

Recent IQF Vegetables Market News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 1.8 billion |

| Projected Market Size (2035) | USD 2.9 billion |

| CAGR (2025 to 2035) | 4.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billion/Volume in Kilotons |

| By Type | Beans, Peas, Corn & Baby Corn, Broccoli & Cauliflower, Potato, Onion, Tomato, and Carrot |

| By Application | Food (Bakery, Confectionery & Snack Food, Dairy & Dessert, Cooking Food, Ready-to-Eat), Beverage (Juice, Other Non-Alcoholic Beverages), and Concentrate |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Players | B&G Foods Holdings Corp., Capricorn Food Products India Ltd, ConAgra Foods, Inc., Dole Food Co., Greenyard NV, J.R. Simplot Co., Kerry Group Plc., Pinnacle Foods, Inc., SunOpta Inc., Uren Food Group Limited |

| Additional Attributes | Dollar sales by product type, share by functionality, regional demand growth, regulatory influence, clean- label trends, competitive benchmarking |

The global IQF vegetables market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the IQF vegetables market is projected to reach USD 2.9 billion by 2035.

The IQF vegetables market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in IQF vegetables market are beans, peas, corn and baby corn, broccoli and cauliflower, potato, onion, tomato and carrot.

In terms of application, food segment to command 38.6% share in the IQF vegetables market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

IQF Fruits & Vegetables Market Size, Growth, and Forecast for 2025 to 2035

Fresh Vegetables Market Size and Share Forecast Outlook 2025 to 2035

Freeze-Dried Vegetables Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fresh Fruits & Vegetables Market Size and Share Forecast Outlook 2025 to 2035

Frozen Fruits and Vegetables Market Size and Share Forecast Outlook 2025 to 2035

Demand for Dehydrated Vegetables in EU Size and Share Forecast Outlook 2025 to 2035

Freeze Dried Fruits And Vegetables Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Dehydrated Vegetables Market Analysis by Product Type, Form, Nature, End Use, Technology, Distribution Channel, and Country Through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA