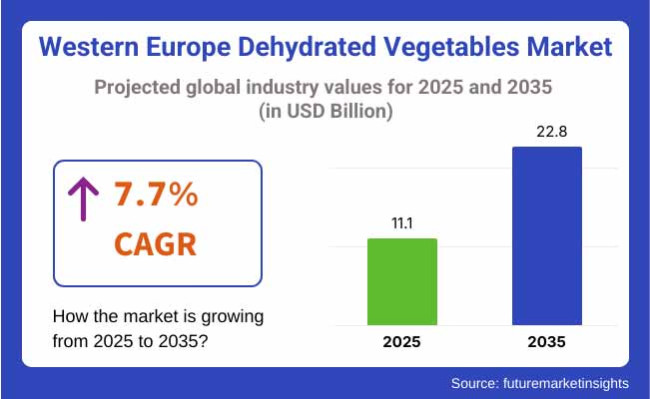

The Western Europe Dehydrated Vegetables Market is poised to exhibit USD 11.1 billion in 2025. The industry is slated to depict 7.7% CAGR from 2025 to 2035, witnessing USD 22.8 billion by 2035. The expansion is driven by lifestyles changes, a raised demand for convenient food, as well as heightening awareness around health and sustainability.

With more people looking to find quick solutions for meals which are healthy, these vegetables have benefited because they carry a long life span, take minimal preparation, and are relatively easy to utilize. This trend meets the fast-paced, contemporary lifestyle of most Western European consumers who look for convenience at the cost of compromising on nutrition.

The other key driver of the market growth is the increased focus on health and wellness. These vegetables preserve most of their nutrients and are hence a preferred choice among health-conscious consumers.

They are rich in vitamins, minerals, and fiber, providing a convenient means to incorporate vegetables into one's diet without requiring regular shopping or concern for spoilage. This complements the increasing demand for plant-based diets and clean eating, which have seen a rise in popularity throughout the region.

Additionally, growing consciousness of food wastage and sustainability has caused most consumers to seek these vegetables. Because dehydration extends the life of vegetables for a longer time, it minimizes food wastage, making it sustainable. This goes in line with the overall trends of sustainability that are driving consumers' buying decisions.

Besides, the COVID-19 pandemic also sped up the transition to home cooking and food buying online, creating a surge in demand for shelf-stable foods such as dehydrated vegetables. The ease of these products, together with their versatility in being applied in a great number of different dishes, ranging from soups to salads, has further accelerated their uptake throughout Western Europe.

The trend study in various end-use applications in the Western European market indicates a rise in emphasis on convenience, health, sustainability, and high quality, with every application having its own unique buying criteria.

At the retail application, consumers are getting more concerned with convenience and health. These products are becoming a convenient option to add vegetables to meals without investing a lot of time in preparation. This increased demand for speedy, healthy foods has resulted in the popularity of dehydrated vegetable mixes, ready-to-consume meals, and soups.

Packaging is also a high priority for consumers, who prefer it to be environmentally friendly, resealable, and easy to store. Additionally, the organic and non-GMO trend has intensified, with increased demand for healthier and environmentally friendly choices.

The foodservice industry, such as restaurants, hotels, and catering, is embracing these products due to their long shelf life, lower waste, and affordability. Fresh produce is costly and perishable, and thus these vegetables offer a good substitute that lowers costs.

The products also respond to the growing demand for plant-based, health-oriented meals, as foodservice operators aim to accommodate the dietary needs of contemporary consumers. These vegetables enable foodservice operators to streamline operations and retain the nutrient content and taste of foods.

In the industrial sector, these products are utilized in a range of products including snacks, processed foods, and ready-to-eat meals. For industrial purchasers, the emphasis is on acquiring high-quality, bulk vegetables that retain their taste and nutritional content even after processing. Clean label trends are also affecting purchasing decisions, with purchasers looking for products that have few additives or preservatives, resulting in a more natural and healthier final product.

Between 2020 and 2024, the Western European market underwent substantial changes largely fueled by changing consumer needs, economic indicators, and technological innovation. Among the major drivers was the rising interest in convenience and ready-to-use foodstuffs that were boosted further by the COVID-19 pandemic, with consumers turning increasingly to home-cooked meals and non-perishable items.

These vegetables became popular due to their long shelf life, low wastage, and convenience in preparation, serving both home consumers and the foodservice market. Further, the increased trend towards healthy eating and growing demand for clean-label and plant-based products contributed to the market's expansion.

Consumers looked for products with less additives and preservatives, hence increasing demand for natural and organic vegetable products. As sustainability grew to become an essential value for most consumers, brands adapted by employing green packaging and touting their green production practices.

From 2025 through 2035, the market is projected to experience further expansion driven by technological advancement and shifting eating habits. The sector will also see innovation in drying technologies enhancing the texture, taste, and nutritional value of dried vegetables to make them even more desirable among consumers.

Increased use of plant-based foods and clean-label foods will remain a major trend, and these vegetables will be a natural, healthy, and versatile ingredient for plant-based dishes. Moreover, as the focus on sustainability grows, consumers and businesses alike will be inclined towards green, sustainable manufacturing processes and packaging options.

Comparative Industry Shift Analysis 2020 to 2024 vs. 2025 to 2035

| Period (2020 to 2024) | Period (2025 to 2035) |

|---|---|

| The pandemic and lifestyle shift in the 2020 to 2024 timeframe triggered a strong surge in demand for convenience foods. Consumers looked for easy and convenient meal solutions, and thus these vegetables gained more popularity in home preparation as well as in the foodservice industry. | Between 2025 to 2035, advances in drying technologies (e.g., freeze-drying, spray drying, and emerging preservation methods) will enhance the texture, taste, and nutritiona l value of products , further increasing their appeal. |

| Since 2020 to 2024 was a time of increased health concerns among consumers, there was also increased demand for clean-label, natural, and organic foods. Dehydrated vegetables fit well into this call because they involved minimal process ing while still offering health benefits. | For the next decade, plant-based diets will not only be increasingly popular but will also have dehydrated vegetables at the core of offering healthful, pla nt-based ingredients. These vegetables will become more common in functional foods and will provide functional benefits such as enhanced digestion and immunity. |

| Sustainability was a big factor from 2020 to 2024. Businesses responded by employing sustainable packaging and emphasizing sustainable production and sourcing practices to fit consumer values. | Between 2025 to 2035, e-commerce growth will propel direct- to-consumer sales of these vegetables. Consumers will be able to find a greater selection of products, and convenience in shopping online, quicker delivery, and more personalized services are likely to be highlighted by brands. |

| To address the increased demand for high-quality products , firms concentrated on supply chain optimization, with enhanced preservation of flavor , color , and nutrients. | Between 2025 to 2035, e-commerce growth will propel direct-to-consumer sales of these products. Consumers will be able to find a greater selection of products, and convenience in shopping online, quicker delivery, and more personalized services are likely to be highlighted by brands. |

Western Europe dehydrated vegetable market, as any business, is not immune to risk factors that will affect its future growth and health. Supply chain disruptions are the most profound risk. In case weather patterns or climate change directly affect crop harvesting, raw vegetable supplies may face shortages, inflate prices, and reduce availability.

Shifting consumer preferences is another significant hazard. While demand for convenient and healthy foods is on the rise, there is also a rising interest in organic and fresh produce. Fresh vegetables are considered more natural and contain more nutrients than dehydrated vegetables.

Moreover, frozen vegetables, which provide convenience as well as retention of nutrients, are proving to be a major threat to these vegetables. If consumer behavior continues to favor fresh or frozen products, the industry could experience shrinking demand, especially if it is not able to keep up with the increasing trend for plant-based, low-sodium, and minimally processed foods.

Regulatory issues are also a problem for the industry. Western Europe has a reputation for having strict food safety and labeling laws. Any modifications to these laws, such as tighter regulations on preservatives, pesticide residues, or packaging, may increase operational expenses. Moreover, any food safety issues, including contamination or labeling mistakes, may result in product recalls that hamper a brand's reputation, causing loss of consumer confidence and market share.

In Western Europe, the granules and powder version of products are one of the most heavily consumed and available ones. It is because of their convenience, ready use, and versatility both for domestic as well as industrial usage.

Powdered and granular forms find general application in soups, sauces, readymade foods, and flavor enhancers and find great demand both in foodservices and in the retail area. The smooth texture of powders makes them simple to add to recipes, providing them with a definite advantage in the busy, convenience-oriented European marketplace. The fact that powdered versions have a longer shelf life further adds to their popularity, making them the first choice of both consumers and food manufacturers looking to minimize food wastage.

Dehydrated vegetables in the form of minced and chopped are also widely used in the Western European market, especially in the foodservice and catering sectors. They are used extensively in prepared meals, snack foods, and as ingredients in other packaged foods.

They are convenient, as they need little preparation and maintain a fair amount of texture when rehydrated, and both professional cooks and home cooks find them appealing. They are not, however, as versatile as powdered forms, which restricts their broad acceptability.

Organic vegetables are being widely marketed in Western Europe because of the increased demand for healthier, more sustainable foodstuffs. As the health-conscious population in the region, consumers increasingly search for products that are pesticide-free, free from synthetic fertilizers, and genetically modified organisms (GMOs).

Organic vegetables fulfill this requirement as they present a clean, wholesome alternative that responds to the tastes of consumers. The public's perception that organic products are healthier and more nutritious compared to their conventionally grown counterparts is a major factor pushing their popularity.

Aside from their healthfulness, sustainability is the major factor contributing to the increasing sales of organic vegetables. Western European consumers are very sensitive to the environmental aspects of their foods, and organic farming methods are perceived as sustainable because they have a focus on biodiversity, healthy soil, and lower chemical applications. Organic dried vegetables, being made with minimum environmental footprint, are attractive to consumers who take eco-friendly and ethical sourcing as a priority.

The Western European market is dominated by large multinational entities as well as specialist smaller companies vying for industry share. Emma Basic, Clearspring, and Speedrange Ltd., for example, have become prominent players by providing high-quality products that match the rising demand for convenient, shelf-stable, and healthy foods.

These businesses are spearheading innovation in product formulation with a view to providing dehydrated vegetables not just rich in nutrition but also aligning with changing consumer attitudes toward organic, non-GMO, and sustainable sourcing.

However, other players like Glorious Commerce Group Co., Ltd, Seawind Foods, and EG Organic Herbs are increasing market presence with the promotion of premium organic vegetables. They target production based on environment-friendly procedures as well as application of organic agriculture farming. Organic product production has been sought increasingly in Western Europe with heightened demand for more health-oriented as well as more environmentally friendly foods among consumers.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| Emma Basic | 5-8% |

| Clearspring | 6-9% |

| Speedrange Ltd. | 4-6% |

| Glorious Commerce Group Co., Ltd | 7-10% |

| Seawind Foods | 5-7% |

| EG Organic Herbs | 6-8% |

| Traina Dried Vegetable Inc. | 4-6% |

| Zuvii | 3-5% |

| NuNatural Inc. | 5-7% |

| Saipro Biotech Pvt. Ltd. | 3-5% |

| Woodland Foods | 5-7% |

| Z Natural Foods | 4-6% |

| Synergy Food Industries | 6-9% |

| Company Name | Key Offerings/Activities |

|---|---|

| Emma Basic | Provides an assortment of dried vegetables that include organic products focusing on quality, health value, and flavor. |

| Clearspring | Renowned for excellent organic products and other natural foods targeting environmentally conscious consumers. |

| Speedrange Ltd. | Dedicated to supplying innovative products to retail and foodservice markets. |

| Glorious Commerce Group Co., Ltd | Specializes in organic vegetables and supply chain solutions with a focus on sustainability and traceability. |

| Seawind Foods | Provides an assortment of vegetable varieties, such as ethnic vegetables, to cater to consumer demand for variety. |

| EG Organic Herbs | Provides organic vegetables and herbs for health-conscious consumers and food companies. |

| Traina Dried Vegetable Inc. | Deals in high-quality vegetables, specializing in the high-end segment of the market. |

| Zuvii | Targets delivering plant-based vegetable products to health-conscious consumers. |

| NuNatural Inc. | Offers a range of vegetable powder and granules with emphasis on natural ingredients. |

| Saipro Biotech Pvt. Ltd. | Supplies both standard and organic vegetables, with a focus on quality and long shelf life. |

| Woodland Foods | Supplies a broad range of vegetables, with a special focus on flavor retention and nutrient preservation. |

| Z Natural Foods | Recognized for supplying vegetables, fruits, and plant-based ingredients for health and wellness uses. |

| Synergy Food Industries | Supplies high-quality dehydrated vegetables, serving the requirements of food producers and direct consumers. |

Emma Basic specializes in delivering high-quality dehydrated vegetables, with a strong emphasis on organic produce to address the increasing demand for healthy, plant-based food in Western Europe. The organization lays significant importance on sustainability, and its products are made with environmentally conscious practices.

Emma Basic strives to innovate on a constant basis to keep pace with changing consumer dietary trends, delivering an extensive range of dehydrated vegetable products that retain their flavor and nutritional content through precise processing methods.

Clearspring is a reputable brand in the Western European industry for dehydrated vegetables, specializing in providing high-quality organic and sustainably produced vegetable products. Clean, natural ingredients are the hallmark of Clearspring, making it a favorite among consumers who focus on leading healthy lives.

The company's focus on quality and the encouragement of environmentally friendly production methods has cemented its position in the industry, especially among health-conscious consumers who appreciate transparency and sustainability in food.

Speedrange Ltd. is a leading dehydrated vegetable supplier in Western Europe, providing a wide variety of high-quality products for retail and industrial use. The company stands out for its emphasis on product innovation and reliability, offering dehydrated vegetable products that suit the requirements of food processing industry manufacturers. The products of the company are favored because they retain the nutrients and flavors of vegetables while providing long shelf life and convenience in a wide range of culinary uses.

Glorious Commerce Group Co., Ltd has widened its coverage in the Western European industry through the supply of high-quality dehydrated vegetables that meet the growing demand for health-oriented ingredients. Both traditional and organic varieties are specialized in by Glorious Commerce, which aims to provide products of high quality that preserve the nutritional value of vegetables.

The company concentrates on making sure that sustainability runs through its supply chain, ensuring that it reduces its environmental footprint while satisfying the increasing demand for dehydrated vegetable products.

Seawind Foods provides a broad range of dehydrated vegetables that are formulated to cater to the increasing demand for clean, healthy, and convenient food in Western Europe. With its reputation for using high-quality ingredients, Seawind Foods is expert in sourcing vegetables from reputable farms and ensuring that its products have maximum nutritional value. The business has built a reputation for its commitment to quality and consistent supply, and is a popular and sought-after choice among manufacturers and consumers.

EG Organic Herbs has become a major player in providing organic dehydrated vegetables and prides itself on having products that cater to the increasing trend of plant-based, sustainable living. The firm's product offerings consist of a range of organic vegetable varieties, all of which are made with a focus on sustainability and quality.

EG Organic Herbs has attracted a loyal customer base within Western Europe because of its dedication to environmentally friendly measures and offering clean, healthy ingredients that appeal to the growing consumer demand for organics.

Traina Dried Vegetable Inc. specializes in high-quality dehydrated vegetables, providing various products that cater to the changing demands of the Western European industry. Traina Dried Vegetable Inc. focuses on delicately dried vegetables that retain their taste and nutritional values.

It is particularly keen on sustainability and makes sure that its production processes are in line with the increasing consumer interest in sustainable food production. With a reputation for reliability and consistency, the company remains a trusted supplier in the industry.

In terms of product type, the industry is classified into carrot, onion, potatoes, broccoli, beans, peas, cabbage, mushrooms, and tomatoes.

With respect to form, the industry is divided into minced & chopped, powder & granules, flakes, slice & cubes, and others.

By nature, the industry is classified into organic and conventional.

In terms of end use, the industry is divided into food manufacturers, food service, and retail.

By technology, the industry is divided into air drying, spray drying, freeze drying, drum drying, vacuum drying, and others.

In terms of distribution channel, the industry is classified into direct and indirect.

By country, the market is segregated into the UK, Germany, Italy, France, and Spain.

The industry is expected to reach USD 11.1 billion in 2025.

The market is projected to witness USD 22.8 billion by 2035.

Organic products are widely consumed.

Leading companies include Emma Basic, Clearspring, Speedrange Ltd., Glorious Commerce Group Co., Ltd, Seawind Foods, EG Organic Herbs, and Traina Dried Vegetable Inc.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2018 to 2033

Table 2: Industry Analysis and Outlook Volume (Tons) Forecast by Country, 2018 to 2033

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Industry Analysis and Outlook Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 6: Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 8: Industry Analysis and Outlook Volume (Tons) Forecast by Nature, 2018 to 2033

Table 9: Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 10: Industry Analysis and Outlook Volume (Tons) Forecast by End Use, 2018 to 2033

Table 11: Industry Analysis and Outlook Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 12: Industry Analysis and Outlook Volume (Tons) Forecast by Technology, 2018 to 2033

Table 13: Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 14: Industry Analysis and Outlook Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 15: UK Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 16: UK Industry Analysis and Outlook Volume (Tons) Forecast By Region, 2018 to 2033

Table 17: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 18: UK Industry Analysis and Outlook Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 19: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 20: UK Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 21: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 22: UK Industry Analysis and Outlook Volume (Tons) Forecast by Nature, 2018 to 2033

Table 23: UK Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 24: UK Industry Analysis and Outlook Volume (Tons) Forecast by End Use, 2018 to 2033

Table 25: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 26: UK Industry Analysis and Outlook Volume (Tons) Forecast by Technology, 2018 to 2033

Table 27: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 28: UK Industry Analysis and Outlook Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 29: Germany Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 30: Germany Industry Analysis and Outlook Volume (Tons) Forecast By Region, 2018 to 2033

Table 31: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 32: Germany Industry Analysis and Outlook Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 33: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 34: Germany Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 35: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 36: Germany Industry Analysis and Outlook Volume (Tons) Forecast by Nature, 2018 to 2033

Table 37: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 38: Germany Industry Analysis and Outlook Volume (Tons) Forecast by End Use, 2018 to 2033

Table 39: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 40: Germany Industry Analysis and Outlook Volume (Tons) Forecast by Technology, 2018 to 2033

Table 41: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 42: Germany Industry Analysis and Outlook Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 43: Italy Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 44: Italy Industry Analysis and Outlook Volume (Tons) Forecast By Region, 2018 to 2033

Table 45: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Italy Industry Analysis and Outlook Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 47: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 48: Italy Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 49: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 50: Italy Industry Analysis and Outlook Volume (Tons) Forecast by Nature, 2018 to 2033

Table 51: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 52: Italy Industry Analysis and Outlook Volume (Tons) Forecast by End Use, 2018 to 2033

Table 53: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 54: Italy Industry Analysis and Outlook Volume (Tons) Forecast by Technology, 2018 to 2033

Table 55: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 56: Italy Industry Analysis and Outlook Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 57: France Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 58: France Industry Analysis and Outlook Volume (Tons) Forecast By Region, 2018 to 2033

Table 59: France Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 60: France Industry Analysis and Outlook Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 61: France Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 62: France Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 63: France Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 64: France Industry Analysis and Outlook Volume (Tons) Forecast by Nature, 2018 to 2033

Table 65: France Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 66: France Industry Analysis and Outlook Volume (Tons) Forecast by End Use, 2018 to 2033

Table 67: France Industry Analysis and Outlook Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 68: France Industry Analysis and Outlook Volume (Tons) Forecast by Technology, 2018 to 2033

Table 69: France Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 70: France Industry Analysis and Outlook Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 71: Spain Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 72: Spain Industry Analysis and Outlook Volume (Tons) Forecast By Region, 2018 to 2033

Table 73: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 74: Spain Industry Analysis and Outlook Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 75: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 76: Spain Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 77: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 78: Spain Industry Analysis and Outlook Volume (Tons) Forecast by Nature, 2018 to 2033

Table 79: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 80: Spain Industry Analysis and Outlook Volume (Tons) Forecast by End Use, 2018 to 2033

Table 81: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 82: Spain Industry Analysis and Outlook Volume (Tons) Forecast by Technology, 2018 to 2033

Table 83: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 84: Spain Industry Analysis and Outlook Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 85: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 86: Rest of Industry Analysis and Outlook Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 87: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 88: Rest of Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 89: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 90: Rest of Industry Analysis and Outlook Volume (Tons) Forecast by Nature, 2018 to 2033

Table 91: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 92: Rest of Industry Analysis and Outlook Volume (Tons) Forecast by End Use, 2018 to 2033

Table 93: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 94: Rest of Industry Analysis and Outlook Volume (Tons) Forecast by Technology, 2018 to 2033

Table 95: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 96: Rest of Industry Analysis and Outlook Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 3: Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 4: Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 5: Industry Analysis and Outlook Value (US$ Million) by Technology, 2023 to 2033

Figure 6: Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 7: Industry Analysis and Outlook Value (US$ Million) by Country, 2023 to 2033

Figure 8: Industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 9: Industry Analysis and Outlook Volume (Tons) Analysis by Country, 2018 to 2033

Figure 10: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 11: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 12: Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 13: Industry Analysis and Outlook Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 14: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 15: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 16: Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 17: Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 18: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 19: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 20: Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 21: Industry Analysis and Outlook Volume (Tons) Analysis by Nature, 2018 to 2033

Figure 22: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 23: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 24: Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 25: Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 26: Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 27: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 28: Industry Analysis and Outlook Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 29: Industry Analysis and Outlook Volume (Tons) Analysis by Technology, 2018 to 2033

Figure 30: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 31: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 32: Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 33: Industry Analysis and Outlook Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 34: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 35: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 36: Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 37: Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 38: Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 39: Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 40: Industry Analysis and Outlook Attractiveness by Technology, 2023 to 2033

Figure 41: Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 42: Industry Analysis and Outlook Attractiveness by Region, 2023 to 2033

Figure 43: UK Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 44: UK Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 45: UK Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 46: UK Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 47: UK Industry Analysis and Outlook Value (US$ Million) by Technology, 2023 to 2033

Figure 48: UK Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 49: UK Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 50: UK Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 51: UK Industry Analysis and Outlook Volume (Tons) Analysis By Region, 2018 to 2033

Figure 52: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 53: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 54: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 55: UK Industry Analysis and Outlook Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 56: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 57: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 58: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 59: UK Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 60: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 61: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 62: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 63: UK Industry Analysis and Outlook Volume (Tons) Analysis by Nature, 2018 to 2033

Figure 64: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 65: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 66: UK Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 67: UK Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 68: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 69: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 70: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 71: UK Industry Analysis and Outlook Volume (Tons) Analysis by Technology, 2018 to 2033

Figure 72: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 73: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 74: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 75: UK Industry Analysis and Outlook Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 76: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 77: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 78: UK Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 79: UK Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 80: UK Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 81: UK Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 82: UK Industry Analysis and Outlook Attractiveness by Technology, 2023 to 2033

Figure 83: UK Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 84: UK Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 85: Germany Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 86: Germany Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 87: Germany Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 88: Germany Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 89: Germany Industry Analysis and Outlook Value (US$ Million) by Technology, 2023 to 2033

Figure 90: Germany Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 91: Germany Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 92: Germany Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 93: Germany Industry Analysis and Outlook Volume (Tons) Analysis By Region, 2018 to 2033

Figure 94: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 95: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 96: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 97: Germany Industry Analysis and Outlook Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 98: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 99: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 100: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 101: Germany Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 102: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 103: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 104: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 105: Germany Industry Analysis and Outlook Volume (Tons) Analysis by Nature, 2018 to 2033

Figure 106: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 107: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 108: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 109: Germany Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 110: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 111: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 112: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 113: Germany Industry Analysis and Outlook Volume (Tons) Analysis by Technology, 2018 to 2033

Figure 114: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 115: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 116: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 117: Germany Industry Analysis and Outlook Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 118: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 119: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 120: Germany Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 121: Germany Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 122: Germany Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 123: Germany Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 124: Germany Industry Analysis and Outlook Attractiveness by Technology, 2023 to 2033

Figure 125: Germany Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 126: Germany Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 127: Italy Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 128: Italy Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 129: Italy Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 130: Italy Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 131: Italy Industry Analysis and Outlook Value (US$ Million) by Technology, 2023 to 2033

Figure 132: Italy Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 133: Italy Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 134: Italy Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 135: Italy Industry Analysis and Outlook Volume (Tons) Analysis By Region, 2018 to 2033

Figure 136: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 137: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 138: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 139: Italy Industry Analysis and Outlook Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 140: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 141: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 142: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 143: Italy Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 144: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 145: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 146: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 147: Italy Industry Analysis and Outlook Volume (Tons) Analysis by Nature, 2018 to 2033

Figure 148: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 149: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 150: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 151: Italy Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 152: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 153: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 154: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 155: Italy Industry Analysis and Outlook Volume (Tons) Analysis by Technology, 2018 to 2033

Figure 156: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 157: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 158: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 159: Italy Industry Analysis and Outlook Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 160: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 161: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 162: Italy Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 163: Italy Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 164: Italy Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 165: Italy Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 166: Italy Industry Analysis and Outlook Attractiveness by Technology, 2023 to 2033

Figure 167: Italy Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 168: Italy Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 169: France Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 170: France Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 171: France Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 172: France Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 173: France Industry Analysis and Outlook Value (US$ Million) by Technology, 2023 to 2033

Figure 174: France Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 175: France Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 176: France Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 177: France Industry Analysis and Outlook Volume (Tons) Analysis By Region, 2018 to 2033

Figure 178: France Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 179: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 180: France Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 181: France Industry Analysis and Outlook Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 182: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 183: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 184: France Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 185: France Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 186: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 187: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 188: France Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 189: France Industry Analysis and Outlook Volume (Tons) Analysis by Nature, 2018 to 2033

Figure 190: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 191: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 192: France Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 193: France Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 194: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 195: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 196: France Industry Analysis and Outlook Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 197: France Industry Analysis and Outlook Volume (Tons) Analysis by Technology, 2018 to 2033

Figure 198: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 199: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 200: France Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 201: France Industry Analysis and Outlook Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 202: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 203: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 204: France Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 205: France Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 206: France Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 207: France Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 208: France Industry Analysis and Outlook Attractiveness by Technology, 2023 to 2033

Figure 209: France Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 210: France Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 211: Spain Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 212: Spain Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 213: Spain Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 214: Spain Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 215: Spain Industry Analysis and Outlook Value (US$ Million) by Technology, 2023 to 2033

Figure 216: Spain Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 217: Spain Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 218: Spain Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 219: Spain Industry Analysis and Outlook Volume (Tons) Analysis By Region, 2018 to 2033

Figure 220: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 221: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 222: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 223: Spain Industry Analysis and Outlook Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 224: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 225: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 226: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 227: Spain Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 228: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 229: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 230: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 231: Spain Industry Analysis and Outlook Volume (Tons) Analysis by Nature, 2018 to 2033

Figure 232: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 233: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 234: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 235: Spain Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 236: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 237: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 238: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 239: Spain Industry Analysis and Outlook Volume (Tons) Analysis by Technology, 2018 to 2033

Figure 240: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 241: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 242: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 243: Spain Industry Analysis and Outlook Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 244: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 245: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 246: Spain Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 247: Spain Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 248: Spain Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 249: Spain Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 250: Spain Industry Analysis and Outlook Attractiveness by Technology, 2023 to 2033

Figure 251: Spain Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 252: Spain Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 253: Rest of Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 254: Rest of Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 255: Rest of Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 256: Rest of Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 257: Rest of Industry Analysis and Outlook Value (US$ Million) by Technology, 2023 to 2033

Figure 258: Rest of Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 259: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 260: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 261: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 262: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 263: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 264: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 265: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 266: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 267: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 268: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by Nature, 2018 to 2033

Figure 269: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 270: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 271: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 272: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 273: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 274: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 275: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 276: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by Technology, 2018 to 2033

Figure 277: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 278: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 279: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 280: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 281: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 282: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 283: Rest of Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 284: Rest of Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 285: Rest of Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 286: Rest of Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 287: Rest of Industry Analysis and Outlook Attractiveness by Technology, 2023 to 2033

Figure 288: Rest of Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Western Blotting Processors Market Trends and Forecast 2025 to 2035

Western Blotting Market is segmented by product, application and end user from 2025 to 2035

Western Europe Automotive Performance Tuning & Engine Remapping Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Western Europe Bicycle Component Aftermarket Analysis Size and Share Forecast Outlook 2025 to 2035

Western Europe Automotive Load Floor IndustryAnalysis in Western Europe Forecast & Analysis 2025 to 2035

Western Europe Probiotic Supplement Market Analysis in – Growth & Market Trends from 2025 to 2035

Western Europe Women’s Intimate Care Market Analysis – Size, Share & Trends 2025 to 2035

Western Europe Non-Dairy Creamer Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Western Europe Last-mile Delivery Software Market – Growth & Outlook through 2035

Western Europe Inkjet Printer Market – Growth & Forecast 2025 to 2035

Western Europe HVDC Transmission System Market – Growth & Forecast 2025 to 2035

Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Western Europe Intelligent Enterprise Data Capture Software Market - Growth & Forecast 2025-2035

Communications Platform as a Service (CPaaS) Market Growth - Trends & Forecast 2025 to 2035

Visitor Management System Industry Analysis in Western Europe - Market Outlook 2025 to 2035

Western Europe Base Station Antenna Market - Growth & Demand 2025 to 2035

Western Europe Banking-as-a-Service (BaaS) Platform Market - Growth & Demand 2025 to 2035

Western Europe Event Management Software Market Trends – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA