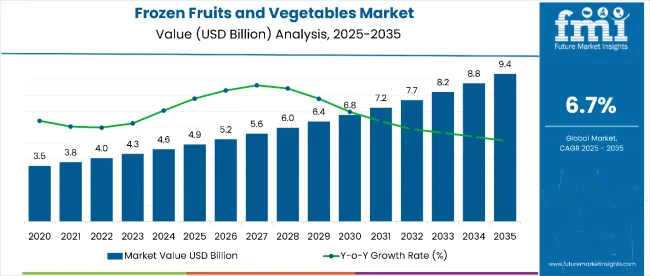

The frozen fruits and vegetables market is estimated to be valued at USD 4.9 billion in 2025 and is projected to reach USD 9.4 billion by 2035, registering a CAGR of 6.7% over the forecast period. The frozen fruits and vegetables market is projected to add an absolute dollar opportunity of USD 20.4 billion over the forecast period.

| Metric | Value |

|---|---|

| Frozen Fruits and Vegetables Market Estimated Value in (2025E) | USD 4.9 billion |

| Frozen Fruits and Vegetables Market Forecast Value in (2035F) | USD 9.4 billion |

| Forecast CAGR (2025 to 2035) | 6.7% |

This reflects a 1.92 times growth at a compound annual growth rate of 6.7%. The market's evolution is expected to be shaped by rising demand for convenience foods, expanding cold chain infrastructure, and growing health consciousness among consumers seeking nutritious, shelf-stable alternatives to fresh produce.

By 2030, the market is likely to reach approximately USD 37.8 billion, accounting for USD 9.0 billion in incremental value over the first half of the decade. The remaining USD 11.4 billion is expected during the second half, suggesting a moderately back-loaded growth pattern. Product diversification across frozen berries, tropical fruits, and mixed vegetables is gaining traction due to expanding applications in food service, retail, and direct-to-consumer channels.

Companies such as Dole Packaged Foods and General Mills are advancing their competitive positions through investment in Individual Quick Freezing (IQF) technologies and sustainable packaging solutions. E-commerce and digital-first procurement models are supporting expansion into urban markets, ready-to-eat meal solutions, and premium organic segments. Market performance will remain anchored in cold chain efficiency, product quality standards, and nutritional value retention benchmarks.

The market holds approximately 45% of the convenience foods market, driven by busy lifestyles, extended shelf life, and year-round product availability. It accounts for around 38% of the processed foods market, supported by growing demand from food service industries and retail consumers seeking quick meal solutions.

The market contributes nearly 32% to the health foods market, particularly for products retaining nutritional value while offering convenience. It holds close to 28% of the cold chain foods market, where advanced freezing technologies maintain product quality and safety. The share in the sustainable food packaging market reaches about 25%, reflecting the industry's focus on eco-friendly packaging solutions and reduced food waste.

The market is undergoing structural change driven by rising demand for healthy convenience foods and technological advances in freezing and packaging. Advanced processing methods using Individual Quick Freezing (IQF) and flash-freezing technologies have enhanced product quality, nutritional retention, and texture preservation, making frozen alternatives increasingly comparable to fresh produce.

Manufacturers are introducing organic options, exotic fruit varieties, and ready-to-cook vegetable medleys tailored for diverse consumer preferences and dietary requirements.

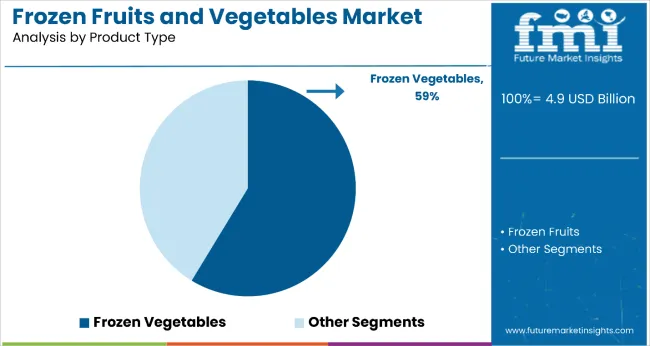

The market is segmented by product type, category, distribution channel, and region. By product type, the market is bifurcated into frozen fruits (melons, citrus fruits, berries, mango, kiwi, and others [mixed fruits, tropical fruits]) and frozen vegetables (peas, mushrooms, carrots, beans, and others [corn, spinach, broccoli, mixed vegetables]).

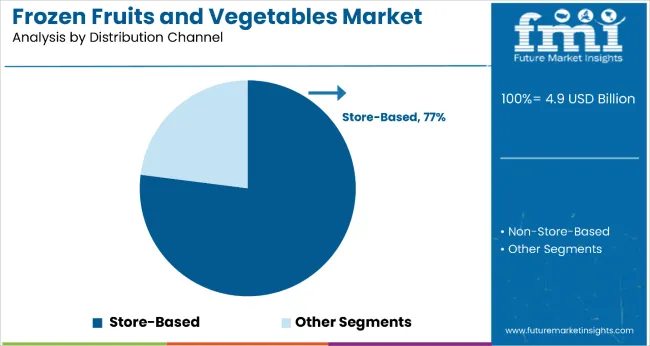

Based on category, the market is divided into organic and conventional. In terms of distribution channel, the market is classified into store-based (supermarkets & hypermarkets, convenience stores, and online retailers) and non-store-based. Regionally, the market is characterized into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

The frozen vegetables segment holds a dominant position with 59% of the market share in the product type category, driven by its broad application across food service, retail, and home cooking. Frozen vegetables are favored for their convenience, uniform quality, and extended shelf life compared to fresh produce, making them a reliable choice year-round.

The segment benefits from strong demand in restaurants, hotels, and institutional catering, where consistent availability and cost-efficiency are essential. Popular offerings include peas, corn, carrots, beans, broccoli, and mixed vegetable blends suited for diverse culinary needs.

Manufacturers are expanding their organic frozen vegetable lines and launching innovative packaging such as steam-in-bag and microwave-ready formats targeting time-pressed consumers. With plant-based eating and meal kit services on the rise, frozen vegetables are becoming essential in both retail and commercial food preparation, sustaining steady segment growth.

The store-based distribution segment leads with 77.0% of the market share, reflecting enduring consumer trust in traditional retail formats. This segment includes supermarkets, hypermarkets, and convenience stores, which offer product variety, competitive pricing, and promotional incentives such as loyalty rewards and combo deals.

Physical stores remain popular for their product visibility, instant availability, and assurance in purchasing frozen goods. Innovations like improved cold chain systems, better freezer layouts, and an increasing number of private label offerings enhance the shopper experience.

The rise of click-and-collect services further bridges online convenience with in-store reliability. While non-store-based channels are expanding, they face logistical hurdles in handling frozen inventory. Consequently, store-based retail remains the most profitable and stable channel for frozen food sales.

The market growth is driven by increasing consumer demand for convenient, nutritious food options that fit busy modern lifestyles. Advanced freezing technologies have debunked myths about nutritional inferiority, with frozen products often retaining more vitamins and minerals than fresh produce that travels long distances.

Growing awareness of food waste reduction and year-round availability of seasonal produce are driving adoption among environmentally conscious consumers. Government initiatives promoting fruit and vegetable consumption, along with expanding cold chain infrastructure in developing economies, are enhancing market accessibility.

As urbanization accelerates globally and dual-income households increase, the demand for time-saving meal solutions continues to rise. With food service industries recovering post-pandemic and e-commerce platforms expanding frozen food delivery capabilities, the market outlook remains favorable. The growing popularity of plant-based diets, smoothie consumption, and healthy snacking trends position frozen fruits and vegetables as essential ingredients for modern food preparation and consumption patterns.

From 2025 to 2035, the market adopted advanced Individual Quick Freezing (IQF) technologies and sustainable packaging solutions to improve product quality and environmental compliance. Applications include convenient meal preparation, food service ingredient supplies, and year-round availability of seasonal produce.

Manufacturers are introducing organic variants and exotic fruit options that deliver superior nutrition retention and expanded flavor profiles. E-commerce-ready packaging formats now support direct-to-consumer delivery requirements. OEMs increasingly supply co-packed private label products with customized blends and portion-controlled formats to reduce inventory complexity for retailers.

Health Consciousness and Convenience Drive Market Adoption

Growing consumer awareness of nutrition and convenience has been identified as the primary catalyst driving growth in the frozen fruits and vegetables market. In 2024, health-focused dietary trends prompted widespread adoption of frozen alternatives that retain essential vitamins and minerals while offering extended shelf life. By 2025, busy urban consumers were incorporating frozen fruits and vegetables to meet daily nutrition requirements without frequent grocery shopping.

E-commerce Integration Creates Distribution Opportunities

In 2024, online grocery platforms integrated advanced cold chain logistics to enable reliable frozen food delivery, expanding market access beyond traditional retail channels. By 2025, direct-to-consumer subscription models were providing customized frozen fruit and vegetable selections based on dietary preferences and seasonal availability. These developments demonstrate that digital commerce capabilities can significantly expand market reach and customer engagement.

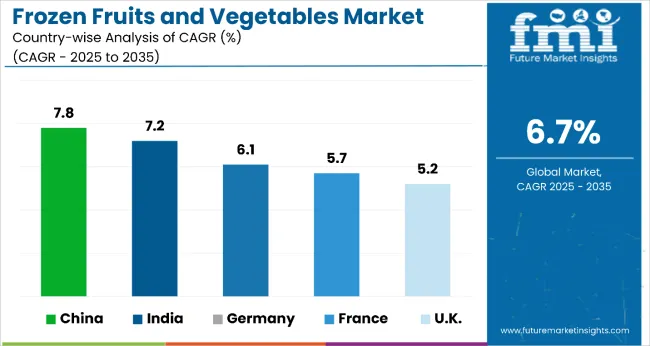

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.2% |

| Germany | 6.1% |

| France | 5.7% |

| UK | 5.2% |

China is projected to lead the market with the highest CAGR of 7.8% from 2025 to 2035, driven by large-scale industrial investments, advanced IQF technology, and strong government backing. India follows closely with a 7.2% CAGR, propelled by rising urban demand, growing cold chain infrastructure, and export-focused production, outperforming the global average by 1.7%.

Germany is set to grow at 6.1% CAGR, led by premium organic offerings and EU-compliant imports. France is forecast to grow at 5.7% CAGR, fueled by artisanal product demand and localized sourcing, slightly above the global average. The UK trails with a 5.2% CAGR, marginally below the global benchmark, influenced by post-Brexit supply chain adjustments and sustainability priorities.

The report covers an in-depth analysis of 40+ countries; five top performing OECD countries are highlighted below.

Frozen fruits and vegetables market in China is projected to grow at a CAGR of 7.8% from 2025 to 2035, driven by rapid urbanization and expanding middle-class population seeking convenient food options. Domestic manufacturers are establishing large-scale processing facilities with advanced IQF technology to serve both domestic and export markets. Government support for agricultural modernization and cold chain development has accelerated investment in freezing capacity and quality certification systems.

Frozen fruits and vegetables revenue in India is forecast to grow at a CAGR of 7.2% from 2025 to 2035, ahead of the global average by 1.7%. Rising disposable income and growing working population are driving demand for convenient meal solutions. Government initiatives promoting food processing industry development and cold chain infrastructure are supporting market growth. Export-oriented production is increasing to serve international markets for tropical frozen fruits and specialty vegetables.

Germany frozen fruits and vegetables demand is expected to grow at a CAGR of 6.1% from 2025 to 2035, exceeding the global rate by 0.6%. Growth is centered on premium organic and sustainably sourced products meeting strict EU quality standards. Demand for exotic frozen fruits and specialty vegetable blends is increasing among health-conscious consumers. Advanced processing technologies and efficient cold chain logistics support high-quality product distribution across European markets.

Sales of frozen fruits and vegetables in France are forecast to grow at a CAGR of 5.7% from 2025 to 2035, marginally ahead of the global average. Growth is concentrated in artisanal and premium frozen products, particularly in Paris and Lyon metropolitan areas. French regulations favoring locally sourced and traceable ingredients are supporting market expansion. Domestic suppliers are developing specialized formulations for high-end culinary applications while maintaining traditional quality standards.

The UK frozen fruits and vegetables revenue is expected to grow at a CAGR of 5.2% from 2025 to 2035, underperforming the global average by 0.3%. Demand is driven by established convenience food culture and growing interest in plant-based eating. London-based food service sector leads in premium frozen produce adoption. Brexit-related supply chain adjustments and sustainability focus are reshaping sourcing patterns, although market fundamentals remain strong for health-oriented frozen options.

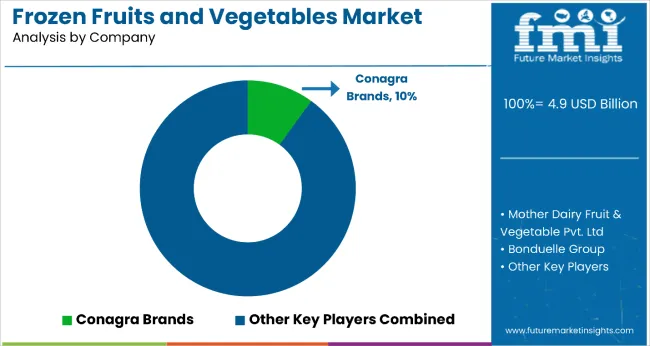

The market is moderately fragmented, led by Dole Packaged Foods LLC with a 12.8% market share. The company holds a leading position through its comprehensive global supply chain, advanced processing capabilities, and strong brand recognition across both retail and food service channels.

Dominant player status is held exclusively by Dole Packaged Foods LLC. Key players include General Mills Inc., Conagra Brands Inc., Bonduelle Group, Ardo N.V., Birds Eye Foods Inc., McCain Foods Limited, Simplot Australia PTY Ltd., Pinnacle Foods Corp., SunOpta Inc., H.J. Heinz Company, Findus Sverige AB, Capricorn Food Products India Ltd., Nature's Touch Frozen Foods Inc., and Welch Foods Inc., each providing specialized frozen fruit and vegetable products for retail, food service, and industrial applications across diverse geographic markets.

Emerging players face barriers due to cold chain infrastructure requirements and established supplier relationships with major retailers. Market demand is driven by convenience trends, health consciousness, and expanding applications in food service and ready-to-eat meal segments requiring consistent quality and year-round availability.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.9 billion |

| Product Type | Frozen Fruits (melons, citrus fruits, berries, mango, kiwi, and others such as tropical and seasonal fruits) and Frozen Vegetables (peas, mushrooms, carrots, beans, and others such as corn, spinach, and mixed vegetables). |

| Category | Organic and Conventional |

| Distribution Channel | Store-Based (Supermarkets & Hypermarkets, Convenience Stores, and Online Retailers) and Non-Store-Based |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa, Australia, and 40+ countries |

| Key Companies Profiled | HJ Heinz, Findus Sverige AB, Simplot Australia PTY Ltd., Pinnacle Foods Corp., Bonduelle Group, SunOpta Inc., Fruktana Ltd., Breukers Schamp Foods, Ardo N.V., Dole, Capricorn Food Products India Ltd., Alasko Foods Inc. |

| Additional Attributes | Dollar sales by product type and distribution channel, growing usage in convenience foods and health-conscious applications, stable demand in food service and retail segments, innovations in IQF technology and sustainable packaging improve product quality, nutritional retention, and environmental compliance |

The global frozen fruits and vegetables market is estimated to be valued at USD 4.9 billion in 2025.

The market size for the frozen fruits and vegetables market is projected to reach USD 9.4 billion by 2035.

The frozen fruits and vegetables market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in frozen fruits and vegetables market are frozen fruits, _melons, _citrus fruits, _berries, _mango, _kiwi, _berries, _others (pineapple, grapes, pomegranate, apple slices), frozen vegetables, _peas, _mushrooms, _carrots, _beans and _others (corn, spinach, broccoli, cauliflower).

In terms of category, organic segment to command 39.7% share in the frozen fruits and vegetables market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Frozen Pet Food Market Size and Share Forecast Outlook 2025 to 2035

Frozen Yogurt Market Size and Share Forecast Outlook 2025 to 2035

Frozen Egg Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Frozen Tissues Samples Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Frozen Pastries Market Size and Share Forecast Outlook 2025 to 2035

Frozen Baked Goods Market Size and Share Forecast Outlook 2025 to 2035

Frozen Potatoes Market Size and Share Forecast Outlook 2025 to 2035

Frozen Beverage Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Frozen Meat Grinder Market Size and Share Forecast Outlook 2025 to 2035

Frozen Vegetable Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Frozen Cheese Market Size and Share Forecast Outlook 2025 to 2035

Frozen Snacks Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Frozen Fruit Bars Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Frozen Desserts Market Growth Share Trends 2025 to 2035

Frozen Ready Meals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Frozen Tortilla Market Size, Growth, and Forecast for 2025 to 2035

Market Share Insights in the Frozen Food Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA