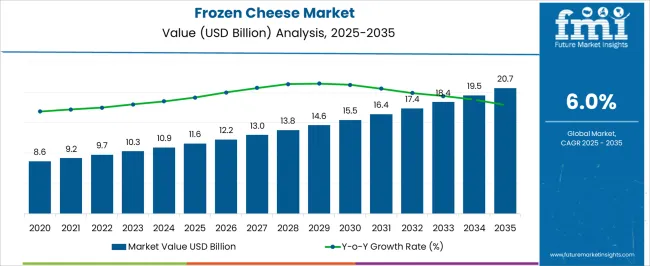

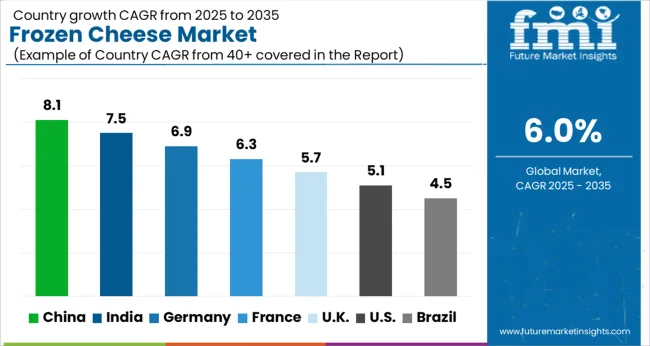

The Frozen Cheese Market is estimated to be valued at USD 11.6 billion in 2025 and is projected to reach USD 20.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

| Metric | Value |

|---|---|

| Frozen Cheese Market Estimated Value in (2025 E) | USD 11.6 billion |

| Frozen Cheese Market Forecast Value in (2035 F) | USD 20.7 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The frozen cheese market is experiencing consistent growth as global demand for ready-to-use dairy products intensifies across foodservice, retail, and institutional sectors. Manufacturers are expanding frozen cheese portfolios to align with evolving culinary trends and cross-border consumption patterns. The growth of organized retail and improvements in temperature-controlled logistics have enhanced the distribution of frozen cheese products, especially in urban and semi-urban markets.

Product innovation in terms of shredded, sliced, and block formats is catering to rising usage in quick service restaurants and packaged meal solutions. Additionally, extended shelf life and minimal preservative use have made frozen cheese appealing to both health-conscious consumers and commercial food operators.

Rising milk production efficiency and growing investments in cold storage infrastructure are also boosting frozen cheese availability and affordability. Future expansion is expected to stem from emerging markets, where changing dietary patterns and the rise of Western cuisine are increasing the frequency of frozen dairy product purchases.

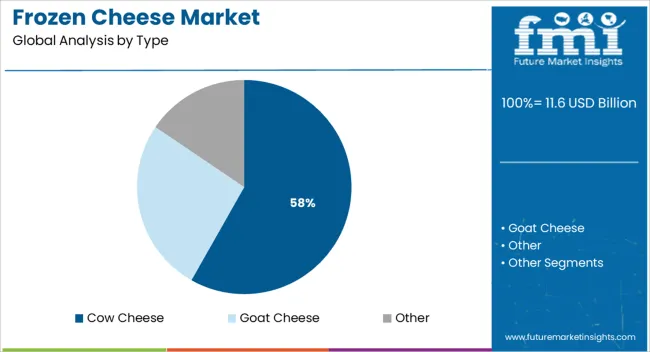

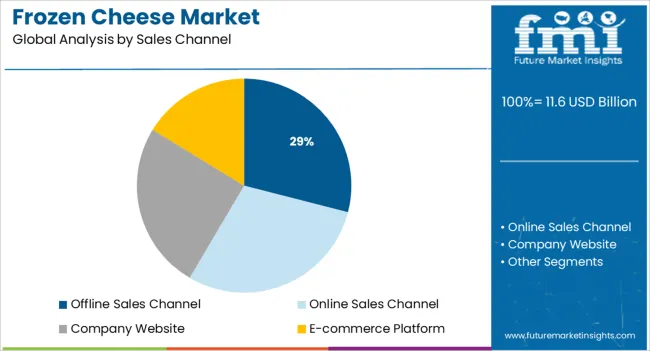

The market is segmented by Type and Sales Channel and region. By Type, the market is divided into Cow Cheese, Goat Cheese, and Other. In terms of Sales Channel, the market is classified into Offline Sales Channel, Online Sales Channel, Company Website, and E-commerce Platform. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Cow cheese is projected to account for 58.2% of the total revenue in the type segment by 2025, positioning it as the dominant variety in the frozen cheese market. This leadership is being supported by high global production volumes of cow milk and the wide consumer acceptance of its flavor, texture, and nutritional profile.

Cow cheese is versatile and widely used across culinary applications ranging from pizzas and pastas to snacks and meal kits, which has expanded its presence in both retail and foodservice channels. The adaptability of cow cheese to various processing formats including grated, cubed, and block forms has increased its commercial viability in frozen storage and transport environments.

Additionally, cow cheese benefits from consistent sourcing, making it cost-effective for manufacturers and reliable in terms of quality standards. As demand for processed and ready-to-eat food continues to grow, cow cheese remains the preferred base product in frozen cheese offerings globally.

Offline sales channels are expected to capture 29% of the frozen cheese market revenue in 2025, reflecting their sustained importance in consumer access. This dominance is attributed to the strong presence of frozen cheese in supermarkets, hypermarkets, and specialty stores that provide dedicated cold storage infrastructure and immediate product availability.

These channels enable consumers to physically inspect packaging quality, expiration dates, and storage conditions, which remains a critical factor for frozen dairy products. Promotional in-store campaigns and bundling with complementary goods such as frozen meals or bakery products have further encouraged walk-in purchases.

In many regions, particularly where internet penetration is moderate or inconsistent, offline channels continue to account for the majority of frozen food sales. The availability of varied product assortments and consistent restocking have positioned offline retail as a reliable and preferred sales route, especially for households and foodservice operators relying on last-minute replenishment.

Global demand for frozen Cheese grew at 5.5% CAGR during the historical period of 2020 and 2024. However, with the growing usage of frozen cheese over fresh one for making varieties of dishes within the food industry, the overall demand for frozen cheese is set to grow at a CAGR of 6% between 2025 and 2035.

Since cheese and several other food products cannot last for too long, manufacturers are employing techniques like freezing to preserve them. Cheese is generally frozen within 72 hours of manufacture by using technologies like IQF to arrest protein breakdown and flavor development.

Adoption of these freezing techniques preserves the cheese quality and makes it easy to store and use for an extended period of time.

Frozen cheese has a similar taste to fresh cheese since freezing doesn’t impact the taste and texture. As a result, it has become an ideal alternative to fresh cheese and is being increasingly used in everyday meals, snacks, and desserts.

Along with frozen vegetables, frozen fruits, and frozen meats, the trend for frozen cheese is expected to surge in near future. Frozen cheese is being increasingly used in salads, pasta, soups, and several other applications. This widespread application in the food and beverage industry is expected to propel the demand for frozen cheese in the near future.

Similarly, manufacturers are investing in developing technology to freeze different types of cheese to prolong their shelf life without altering their taste and texture. This will further accelerate the growth of the frozen cheese market during the assessment period.

Rising Usage in Cooked Food Fostering Frozen Cheese Sales in the Global Market

Most of the frozen cheese is being used for cooking dishes in which changes to texture are less noticeable, such as in sauces or on pizza and grilled cheese sandwiches.

Rising production and consumption of these food products as a result of a rapidly growing population, changing lifestyles, and increasing disposable income will therefore continue to push the demand for frozen cheese during the forecast period.

It is better to freeze cheese that is designed to be used in cooking food. However, some forms of cheese should be frozen and others should be refrigerated for optimum taste and flavor. Mozzarella and pizza cheese in addition to soft goat cheese are suitable for freezing. Handmade cheese on the other hand should be consumed fresh to maintain its natural aroma.

Easy Availability of Multiple Brands Propelling Growth in the USA Frozen Cheese Market

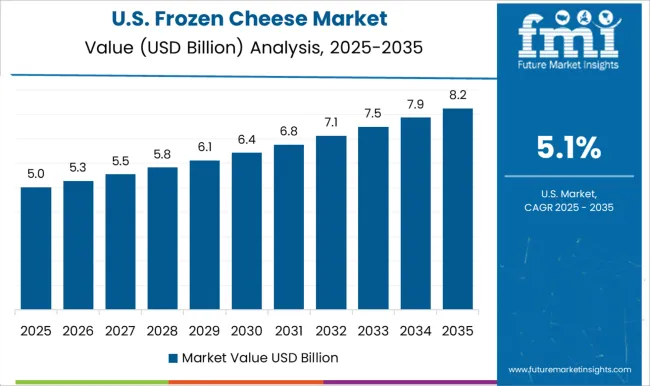

As per FMI, the USA frozen cheese is expected to reach a value of about USD 11.6 Billion in 2025 which is approximately 23% of the global frozen cheese market. Demand for cheese is high in North American nations like the USA due to the easy availability of different brands that offer vegan and plant-based variants.

Cheese is consumed through different food products and is included in everyday snacks and meals. Families generally buy cheese in bulk in order to avail of different offers at supermarkets. Hence freezing cheese is a common practice across the USA

Many players are also offering frozen cheese in different varieties and flavors which is expected to raise the demand for frozen cheese in the market during the forecast period. Besides this, rising consumers' shift towards cheese that has a longer shelf life and is highly portable with a similar nutritional profile as conventional cheese will bode well for the USA frozen cheese market.

In addition to this, increasing consumer spending on fast foods like pizza and hamburgers is likely to act as a catalyst for accelerating growth in the USA frozen cheese market during the forecast period.

Rise in Number of Frozen Cheese Startups Driving Market Growth in India

According to Future Market Insights, the Indian frozen cheese market is expected to reach a valuation of USD 0.9 Billion in 2025 which is approximately 18% of the global frozen cheese market.

This can be attributed to the rising production and consumption of fast foods, exploding population, rising disposable income, and surge in the number of startups offering frozen cheese.

Over the years, the surge in the number of women joining the workforce has increased the demand for ready-to-eat food in the market. Consumers prefer to buy eatables that are easy to cook and have a longer shelf life.

Due to the willingness of consumers to try different international cuisines whose critical ingredient is cheese, sales of frozen cheese are slated to grow at a healthy pace across India.

Similarly, the easy availability of a few foreign brands offering different variants of frozen cheese is expected to further push the revenue generation of the frozen cheese market in the country.

Demand to Remain High for Cow Cheese in The Market

As per FMI, demand for frozen cow cheese will continue to outpace other types during the forecast period, owing to the easy availability of cow’s milk in large quantities and growing consumer preference for cheese derived from cow’s milk because of its peculiar taste and texture.

Cow cheese is available in different forms and flavors and pack sizes for consumers to choose from. Consumers are purchasing food that is easy to make but maintains an essential nutritional profile. These factors are expected to propel the demand for frozen cows’ cheese in the future.

Frozen Cheese Sales to Grow at Highest Pace Through Online Sales Channel

As per FMI, the online channel is predicted to grow at a 6.7% annual rate between 2025 and 2035, accounting for 50% of all sales. In order to increase product awareness brands are collaborating with online marketplaces like Amazon and Walmart.

They are using machine learning and artificial intelligence to improve the consumer experience and make it easier for consumers to navigate the website.

Similarly, to increase consumer awareness, new products are displayed on a variety of internet portals and company websites. Consumers can now select from a variety of frozen cheeses from a variety of brands and price points. In the coming years, this is projected to have a favorable impact on the demand for frozen cheese.

Manufacturers of frozen cheese are experimenting with new methods to meet increased consumer demand for healthful foods. New cheese kinds are being developed by major manufacturers that are healthy to eat.

Similarly, startups like GOOD PLANeT Foods (founded in 2020) and Daiya (2008)are entering the frozen cheese space by launching various frozen cheese varieties including plant-based ones.

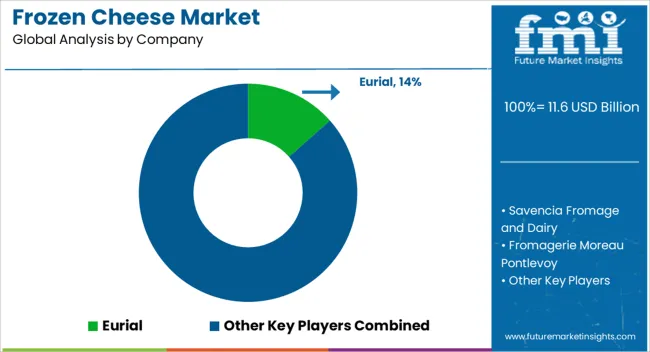

Eurial is one of the prominent players in the frozen cheese space. The company pioneered IQF for cheese through its frozen SOIGNON goat’s cheese slices. Eurial also has a strong presence in the mozzarella cheese category.

The company has over 16 production sites across the globe. It has more than 5,000 producers and 2,500 farms where products are made for specific purposes such as frozen cheese, butter, and cream.

The company has a strong presence in Europe, however, it is also focusing on increasing its revenues from other countries. At present, Eurial’s international activity represents over 35% of its turnover. The company is also focusing on accelerating its international presence through Fromager d’ Affinois & Grand Fermage brands.

Abergavenny Fine Food Co. is another leading player in the frozen cheese space. It has a robust presence in this space through Abergavenny Creamery. The company has a strong focus on sourcing ingredients locally. It also has an excellent supply relationship with farmers who provide the company with fresh milk on a daily basis.

The company has a strong presence in Europe and is well-known for its products. For instance, in 2024, the company was named one of the top 50 fastest-growing independents in the United Kingdom Abergavenny Fine Food Co. is also focusing on partnering with other organizations to consolidate its position. For instance, in 2024, it partnered up with Somerdale International for expanding its blended cheese business.

Delamere Dairy is a United Kingdom-based company with a significant presence in Italy, Hong Kong, Singapore, and the Middle East. The company works with goat farmers across the world as goat milk is one of its primary products.

The company is also focused on sustainable packaging as a preference for environmental conservation is growing. The company further launched new packaging in July 2025 which is made from 75% paperboard renewable raw materials.

Further, it is focusing on boosting its export capabilities internationally. For instance, in July 2025, the company announced that it will be exporting its products to Vietnam.

| Attributes | Details |

|---|---|

| Estimated Market Size (2025) | USD 11.6 billion |

| Projected Market Size (2035) | USD 20.7 billion |

| Anticipated Growth Rate (2025 to 2035) | 6% CAGR |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Million for Value and Million. Sq. M. for Volume |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; and the Middle East & Africa |

| Key Countries Covered | USA, Brazil, Mexico, Germany, United Kingdom, China, India, Japan, Australia, and GCC Countries |

| Key Segments Covered | Form, Type, Source, End-Use Application, Sales Channel, and Region |

| Key Companies Profiled | Eurial; Savencia Fromage and Dairy; Fromagerie Moreau Pontlevoy; Abergavenny Fine Foods; Ile de France; Henri Willig; LACTEOS SEGARRA; President; Le Larry; Delamere Dairy |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global frozen cheese market is estimated to be valued at USD 11.6 billion in 2025.

The market size for the frozen cheese market is projected to reach USD 20.7 billion by 2035.

The frozen cheese market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in frozen cheese market are cow cheese, goat cheese and other.

In terms of sales channel, offline sales channel segment to command 0.0% share in the frozen cheese market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Frozen Pet Food Market Size and Share Forecast Outlook 2025 to 2035

Frozen Yogurt Market Size and Share Forecast Outlook 2025 to 2035

Frozen Egg Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Frozen Tissues Samples Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Frozen Pastries Market Size and Share Forecast Outlook 2025 to 2035

Frozen Baked Goods Market Size and Share Forecast Outlook 2025 to 2035

Frozen Potatoes Market Size and Share Forecast Outlook 2025 to 2035

Frozen Beverage Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Frozen Meat Grinder Market Size and Share Forecast Outlook 2025 to 2035

Frozen Fruits and Vegetables Market Size and Share Forecast Outlook 2025 to 2035

Frozen Vegetable Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Frozen Snacks Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Frozen Fruit Bars Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Frozen Desserts Market Growth Share Trends 2025 to 2035

Frozen Ready Meals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Frozen Tortilla Market Size, Growth, and Forecast for 2025 to 2035

Market Share Insights in the Frozen Food Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA