The global frozen food market has a moderately concentrated structure with the participation of the big multinationals, though regional players and contemporary brands have played the largest share. Among the top multinational companies, the total market accounted for 55% share with Nestlé, Conagra Brands, General Mills, Unilever, and Tyson Foods.

With a highly widespread presence and diversified portfolios across several supply chains, they have been able to stay on top. Regional Players represent 25%. These include players like McCain Foods (Canada), Nomad Foods (UK), Frosta AG (Germany), and Greenyard (Belgium), that rely on the local consumer preferences and robust regional distribution networks.

Startups & Niche Brands account for 12%, brands such as Amy's Kitchen (USA), Strong Roots (Ireland), and Dr. Praeger's (USA) catering to the categories of plant-based, organic, and gluten-free frozen food. Private Labels 8% led by Tesco (UK), Walmart (USA), and Aldi (Germany), with private label frozen food from store-brand.

Global Market Share by Key Players

| Global Market Share 2025 | Industry Share (%) |

|---|---|

| Top Multinationals (Nestlé, Conagra Brands, General Mills, Unilever, Tyson Foods) | 55% |

| Regional Leaders (McCain Foods, Nomad Foods, Frosta AG, Greenyard, Ajinomoto) | 25% |

| Startups & Niche Brands (Amy’s Kitchen, Strong Roots, Dr. Praeger’s) | 12% |

| Private Labels (Tesco, Walmart, Aldi, Carrefour, Lidl) | 8% |

The market is moderately consolidated at the top, and global giants dominate while regional brands and niche players thrive in specialty and emerging segments.

Frozen Ready Meals dominates the market for frozen food. In 35% of the market, this segment encompasses a wide range of pre-cooked and convenience-oriented meals which emerge popular among consumers seeking a convenient meal option that may be prepared rapidly. The Frozen Seafood & Meat Products segment holds the second highest share at 30% of the market.

These customer groups demand the best in quality protein sources. The Frozen Seafood & Meat Products category is 20% higher in volume, which basically tends towards indulgent and on-the-go snacking. Frozen Fruits & Vegetables constitute 10% of the market, as consumers are increasingly looking for healthier and more convenient ways to add these products to their diets. The remaining 5% of the market falls under the "Others" category, which could include specialized or niche frozen food products.

Supermarkets/Hypermarkets lead the frozen food market, accounting for 45% of sales. They cater for very many options frozen foods offer as well as remain a great point of purchase-one-stop shopping-convenience store as well as the independent retailer is at 22% to support faster and closer supply of frozen food. Internet sales remain 18% and here it means because people turn into ordering more frequently since the rise of COVID-19.

The Food Service/HoReCa (Hotel, Restaurant, and Catering) segment makes up 12% of sales, representing demand in the hospitality and food service sectors for frozen food products. "Others" makes up the final 3% of sales, which might represent specialized or niche distribution channels.

Major players began to push for eco-friendly packaging solutions, expanding their plant-based and high-protein product lines. E-commerce increased very quickly as consumers embraced online shopping for frozen foods, while innovative startups carved out niches in gluten-free and organic segments. Mergers and acquisitions among regional and multinational firms reshaped the competitive landscape, driving higher market concentration in key regions. This year was marked by a stronger focus on regional flavor profiles and premium quality products as producers shifted their product line portfolios to serve the healthy, yet indulgent, consumer needs.

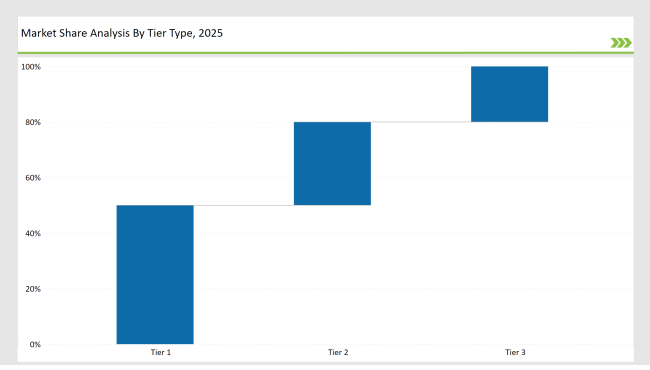

| By Tier Type | Tier 1 |

|---|---|

| Market Share (%) | 50% |

| Example of Key Players | Nestlé, Conagra, Unilever, Tyson Foods, General Mills |

| By Tier Type | Tier 2 |

|---|---|

| Market Share (%) | 30% |

| Example of Key Players | McCain Foods, Nomad Foods, Frosta AG, Greenyard, Ajinomoto |

| By Tier Type | Tier 3 |

|---|---|

| Market Share (%) | 20% |

| Example of Key Players | Amy’s Kitchen, Strong Roots, private label brands, smaller regional players |

| Brand | Key Focus |

|---|---|

| Nestlé | Accelerated plant-based frozen food launches under Sweet Earth and expanded distribution in Asia . |

| Conagra Brands | Enhanced Healthy Choice line with new protein bowls and launched family-sized meal options. |

| McCain Foods | Rolled out fully renewable energy initiatives across North American facilities by end-2024. |

| Tyson Foods | Introduced new plant-based frozen nuggets and expanded distribution into Europe . |

| Unilever | Partnered with local farmers in Latin America to produce sustainable frozen vegetables . |

| Nomad Foods | Introduced premium frozen pasta dishes , targeting the high-end European market. |

| Amy’s Kitchen | Launched organic frozen breakfast burritos to meet growing morning meal demand. |

| Greenyard | Increased organic produce capacity by investing in advanced IQF (Individually Quick Frozen) technology . |

| Frosta AG | Released plastic-free packaging across their frozen fish range in Germany. |

| Strong Roots | Expanded into South America with a focus on plant-based frozen sides and snacks . |

With more health-conscious consumers demanding high-protein and functional frozen meals, developing product lines to suit specific dietary needs would benefit the brand. Examples may include keto-friendly frozen meals, protein-enriched frozen snacks, or any other frozen food product formulated to meet the nutritional requirements of the health-conscious consumer.

Rising consumer demand for more authentic ethnic, frozen meal products, such as Indian curries, Asian dumplings, or Mediterranean flatbreads, for example, also will fuel that market. Any manufacturer that works to develop new and expand those offerings in their regional cuisine may capitalize on emerging consumer interest for global flavors as well as upgraded culinary experiences. This growth of online grocery shopping and subscription-based meal delivery services opens great opportunities for frozen food brands. With the creation of robust direct-to-consumer platforms, brands can avoid traditional retail channels, acquire precious consumer insights, and thereby potentially improve profitability.

Manufacturers will then be able to offer better frozen food products because of advanced freezing technologies, for example, Individual Quick Freezing and other innovative methods of freezing, with improved quality in texture and taste. Technologies such as the ones mentioned earlier can be differentiated by brands competing in the freezers' markets because consumers could have frozen goods that are relatively closer to what they get with fresh, unfrozen foods.

The top five companies-Nestlé, Conagra Brands, General Mills, Unilever, and Tyson Food-collectively hold around 50% of the global frozen food market.

North America and Europe lead the market, accounting for more than 60% of global frozen food consumption. Emerging markets like Asia-Pacific and Latin America are rapidly growing, fueled by urbanization and changing dietary patterns.

Private label brands hold about 8% of the market, with retailers like Tesco, Walmart, and Aldi offering affordable alternatives to branded frozen products.

Plant-based frozen foods have seen significant growth, contributing to the 12% share held by startups and niche brands that focus on vegan and vegetarian options.

Manufacturers face challenges such as rising raw material costs, maintaining consistent product quality, and meeting sustainability requirements for packaging and production processes.

Technological advancements like IQF and improved cold chain logistics are enhancing product quality, extending shelf life, and reducing food waste.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Breakdown of Frozen Food Packaging Manufacturers

Frozen Yogurt Market Size and Share Forecast Outlook 2025 to 2035

Frozen Egg Market Size and Share Forecast Outlook 2025 to 2035

Frozen Tissues Samples Market Size and Share Forecast Outlook 2025 to 2035

Frozen Pastries Market Size and Share Forecast Outlook 2025 to 2035

Frozen Baked Goods Market Size and Share Forecast Outlook 2025 to 2035

Frozen Potatoes Market Size and Share Forecast Outlook 2025 to 2035

Frozen Beverage Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Frozen Meat Grinder Market Size and Share Forecast Outlook 2025 to 2035

Frozen Fruits and Vegetables Market Size and Share Forecast Outlook 2025 to 2035

Frozen Vegetable Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Frozen Cheese Market Size and Share Forecast Outlook 2025 to 2035

Frozen Snacks Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Frozen Fruit Bars Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Frozen Desserts Market Growth Share Trends 2025 to 2035

Frozen Ready Meals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Frozen Tortilla Market Size, Growth, and Forecast for 2025 to 2035

Frozen Dough Market Analysis by type, distribution channel and region through 2035

Frozen Sardine Market Analysis Freezing Process, Form, Packaging Type and Distribution channel Through 2035

Frozen Pizza Market Growth - Consumer Preferences & Industry Expansion 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA