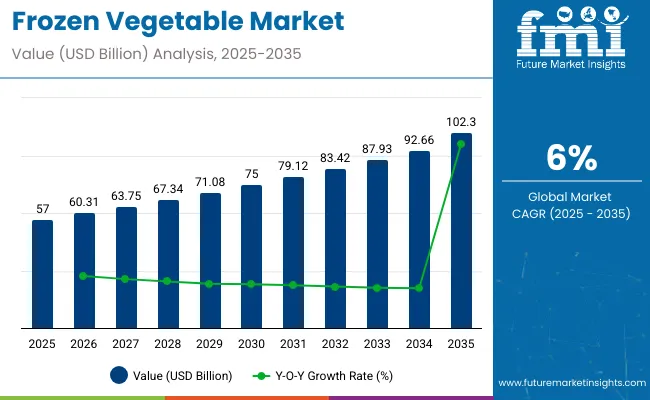

The global frozen vegetable market is projected to grow from USD 57 billion in 2025 to USD 102.3 billion by 2035, registering a CAGR of 6%. The market expansion is being driven by rising urbanization, busy lifestyles, and the growing demand for convenient, ready-to-cook food options.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 57 billion |

| Industry Value (2035F) | USD 102.3 billion |

| CAGR (2025 to 2035) | 6% |

Health-conscious consumer trends and the emphasis on nutrition retention are encouraging the adoption of frozen vegetables as viable alternatives to fresh produce. Technological advancements in freezing techniques, attractive packaging innovations, and improved cold chain logistics are enhancing product quality and shelf life, fostering broader market adoption across retail and food service sectors.

The market holds a significant share within its parent markets. It accounts for 25% of the global frozen food market, reflecting its staple status. Within the processed food market, it contributes nearly 5%, while in the broader packaged food market, its share is around 4% due to high retail penetration.

In the food and beverage market, frozen vegetables comprise roughly 1%, indicating niche yet steady growth. It holds a strong share in the frozen food segment (25%) and notable positions in processed and packaged food markets, though its footprint in the broader consumer products sector remains limited at under 0.1%.

Government regulations impacting the market focus on food safety standards, cold chain management, and nutrition labelling. The Food Safety and Standards (Food Products Standards and Food Additives) Regulations, 2011, and the Food Safety and Standards (Packaging and Labelling) Regulations, 2011 in India set strict norms for processing, packaging, and temperature control to ensure product quality and consumer safety.

Additionally, guidelines under the FSSAI mandate clear labelling of nutritional content and storage instructions for frozen vegetables, driving manufacturers to maintain compliance, improve operational practices, and ensure safer and healthier food choices for consumers.

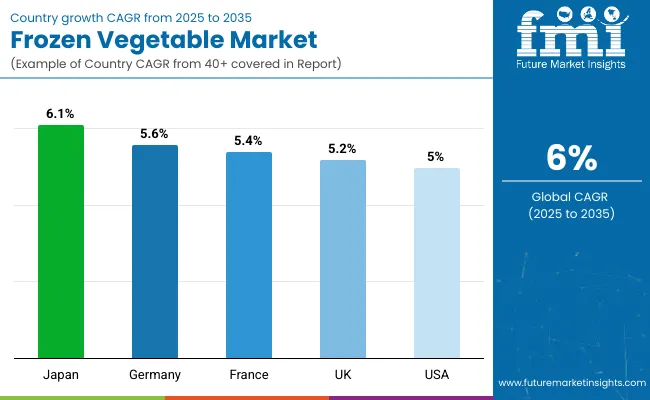

Japan is projected to be the fastest-growing market, expected to expand at a CAGR of 6.1% from 2025 to 2035. Retail customers will lead the end user segment with a 65% share, while indirectchannel will dominate the distribution channel segment with a 60% share. The UK and USA markets are also expected to grow steadily at CAGRs of 5.2% and 5%, respectively, while Germany and France will record CAGRs of 5.6% and 5.4%, respectively.

Per capita consumption of frozen vegetables varies across regions, influenced by consumer lifestyles, cold chain infrastructure, and dietary patterns. Frozen vegetables are valued for their convenience, extended shelf life, and nutritional retention, making them a popular choice in both household and commercial food preparation. With the rising demand for ready-to-cook meals and health-conscious eating, global consumption of frozen vegetables is witnessing steady growth.

The global trade of frozen vegetables is expanding due to growing demand for convenient, long-lasting, and nutrient-retaining food products. Trade is driven by seasonal supply gaps, differences in agricultural output, and increasing consumer demand for out-of-season vegetables across regions.

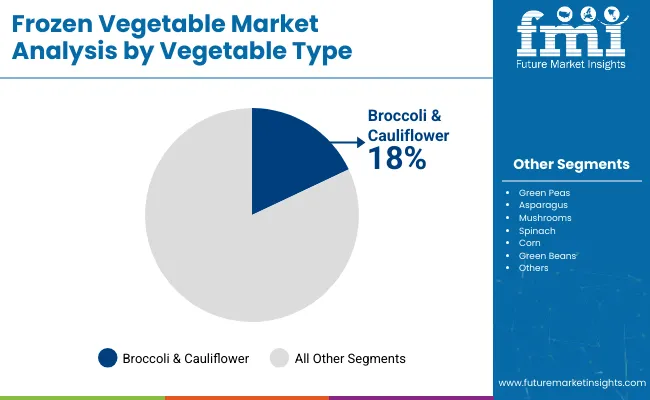

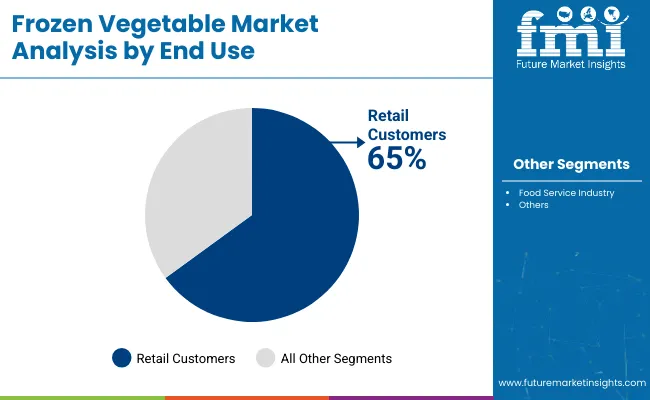

The market is segmented by product type, end user, distribution channel, and region. By product type, the market is divided into broccoli, green peas, asparagus, mushrooms, spinach, corn, green beans, and others (mixed vegetables, carrots, bell peppers, okra). In terms of end user, the market is bifurcated into the food service industry and retail customers.

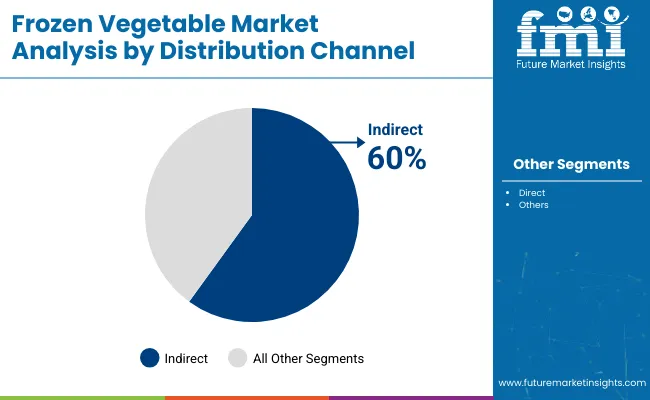

Based on distribution channel, the market is bifurcated into direct and indirect (hypermarkets/supermarkets, convenience stores, grocery stores, online retailers, and other channels). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

Broccoli is projected to lead the product type segment, capturing 18% of the market share by 2025. This vegetable remains a top choice among health-conscious consumers and food service menus.

Retail customers are expected to capture 65% of the market share by 2025, driven by rising urbanization, busy lifestyles, and increasing consumer preference for convenient, nutritious frozen vegetable options for home cooking and daily meals.

Indirect channel is projected to dominate the distribution channel segment with a 60% global market share by 2025, driven by wide product availability, strong retail presence, and consumer trust in quality and variety.

The global frozen vegetable market is experiencing steady growth, driven by increasing urbanization, busy lifestyles, and rising demand for convenient, nutritious food options. Frozen vegetables play a crucial role in ensuring year-round availability of produce with minimal nutrient loss, catering to both retail consumers and the food service industry.

Japan momentum in the frozen vegetable market is driven by its aging population, high demand for convenience foods, and strong retail cold chain infrastructure. Germany and France maintain consistent demand driven by health-conscious consumers and the popularity of plant-based diets. In contrast, developed economies such as the USA (5% CAGR), UK (5.2%), and Japan (6.1%) are expected to expand at a steady 0.83-1.01x of the global growth rate.

Japan leads growth due to strong demand for convenient, premium-quality frozen vegetables catering to aging populations and busy professionals. Germany follows with steady expansion driven by health trends, organic product demand, and stringent EU labelling standards. France maintains similar growth, supported by national nutrition policies and preference for mixed vegetable blends in traditional cuisine.

UK growth is slightly slower, supported by rising veganism and health campaigns, though impacted by post-Brexit pricing adjustments. USA growth remains moderate, driven by health-conscious meal preparation and organic preferences, with strong retail promotions and private label offerings contributing to market value expansion.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The Japan frozen vegetable revenue is growing at a CAGR of 6.1% from 2025 to 2035. Growth is driven by demand for easy-to-prepare vegetables among aging populations and working professionals. As a technology-driven OECD economy, Japan prioritizes high-quality frozen produce with advanced packaging and extended shelf life.

Frozen vegetable sales in Germany are expected to expand at a 5.6% CAGR during the forecast period, slightly below the global average but strongly health-trend led. EU clean label goals, dietary shifts towards vegetarian meals, and sustainability standards are pushing adoption of frozen vegetables.

The French frozen vegetable market is projected to grow at a 5.4% CAGR during the forecast period, mirroring Germany in its health-conscious adoption trajectory. Demand is driven by national nutrition policies, consumer preference for convenience foods, and culinary tradition adaptations.

The USA frozen vegetable market is projected to grow at 5% CAGR from 2025 to 2035, translating to 0.83x the global rate. Unlike emerging markets focused on price-driven consumption, USA demand is heavily tied to health trends, home cooking, and meal preparation practices.

The UK frozen vegetable revenue is projected to grow at a CAGR of 5.2% from 2025 to 2035, representing slower growth among top OECD nations, at 0.87 times the global pace. Growth is supported by health campaigns and rising veganism in retail and food service industries. Post-Brexit import adjustments have slightly affected pricing structures.

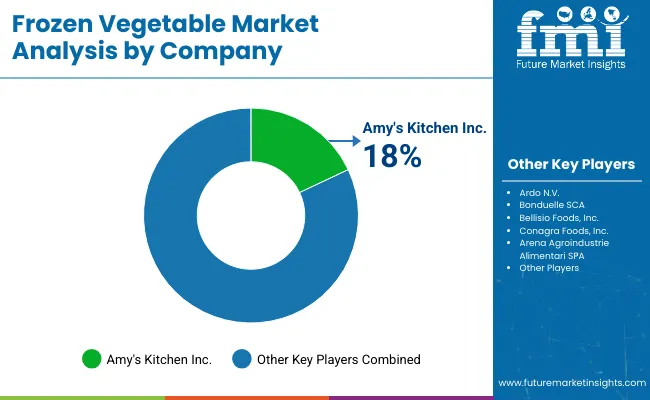

The market is moderately consolidated, with leading players like Nestle, Bonduelle SCA, Conagra Foods, Inc., General Mills Inc., and Ardo N.V. dominating the industry. These companies provide a wide range of high-quality frozen vegetables catering to retail consumers and the food service sector. Nestle focuses on premium frozen vegetable products with innovative packaging solutions, while Bonduelle SCA specializes in diverse frozen vegetable blends and ready-to-cook options.

Conagra Foods, Inc. delivers convenient, nutritious frozen vegetable meals under multiple brands. General Mills Inc. offers versatile frozen vegetable products catering to health-conscious consumers. Ardo N.V. is known for its extensive vegetable portfolio with sustainable sourcing practices.

Other key players like Amy's Kitchen, Inc., Bellisio Foods, Inc., Arena Agroindustrie Alimentari SPA, Findus Group, Goya Foods, Inc., H.J. Heinz Company, Iceland Foods Ltd, Kellogg Co., and B&G Foods, Inc. contribute by providing specialized, high-quality frozen vegetables for varied global culinary applications.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 57 billion |

| Projected Market Size (2035) | USD 102.3 billion |

| CAGR (2025 to 2035) | 6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value/kilotons for volume |

| Product Type Analyzed | Broccoli, Green Peas, Asparagus, Mushrooms, Spinach, Corn, Green Beans, and Others (Mixed Vegetables, Carrots, Bell Peppers, and Okra) |

| End User Analyzed | Food Service Industry, Retail Customers |

| Distribution Channel Analyzed | Direct and Indirect (Hypermarkets/Supermarkets, Convenience Stores, Grocery Stores, Online Retailers, and Other Channels) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East and Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia |

| Key Players Influencing the Market | Amy's Kitchen, Inc., Ardo N.V., Bonduelle SCA, Bellisio Foods, Inc., Conagra Foods, Inc., Arena Agroindustrie Alimentari SPA, Findus Group, Goya Foods, Inc., H.J. Heinz Company, Iceland Foods Ltd, General Mills Inc., Nestle, Kellogg Co., and B&G Foods, Inc. |

| Additional Attributes | Dollar sales by product type, share by distribution channel, regional demand growth, policy influence, convenience trends, competitive benchmarking |

The market is valued at USD 57 billion in 2025.

The market is forecasted to reach USD 102.3 billion by 2035, reflecting a CAGR of 6%.

Retail customers will lead the end user segment, accounting for 65% of the global market share in 2025.

Indirect channel will dominate the distribution channel segment with a 60% share in 2025.

Japan is projected to grow at the fastest rate, with a CAGR of 6.1% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Frozen Fruits and Vegetables Market Size and Share Forecast Outlook 2025 to 2035

Frozen Pet Food Market Size and Share Forecast Outlook 2025 to 2035

Frozen Yogurt Market Size and Share Forecast Outlook 2025 to 2035

Frozen Egg Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Frozen Tissues Samples Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Frozen Pastries Market Size and Share Forecast Outlook 2025 to 2035

Frozen Baked Goods Market Size and Share Forecast Outlook 2025 to 2035

Frozen Potatoes Market Size and Share Forecast Outlook 2025 to 2035

Frozen Beverage Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Frozen Meat Grinder Market Size and Share Forecast Outlook 2025 to 2035

Frozen Cheese Market Size and Share Forecast Outlook 2025 to 2035

Frozen Snacks Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Frozen Fruit Bars Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Frozen Desserts Market Growth Share Trends 2025 to 2035

Frozen Ready Meals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Frozen Tortilla Market Size, Growth, and Forecast for 2025 to 2035

Market Share Insights in the Frozen Food Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA