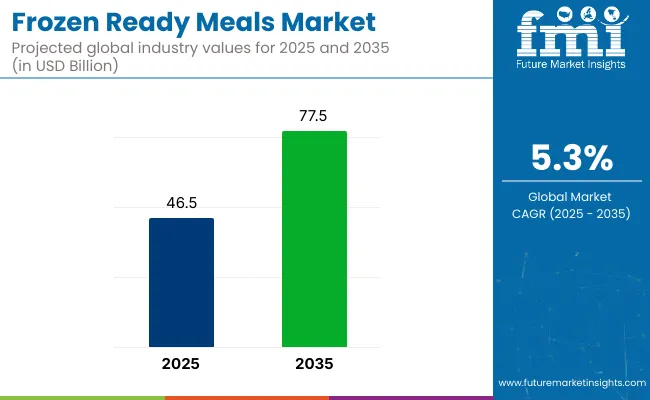

The global frozen ready meals market is projected to grow from USD 46.5 billion in 2025 to USD 77.5 billion by 2035, registering a CAGR of 5.3%. Market growth is driven by rising urbanization, increasing demand for convenience foods, and evolving consumer lifestyles seeking quick meal solutions.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 46.5 billion |

| Industry Value (2035F) | USD 77.5 billion |

| CAGR (2025 to 2035) | 5.3% |

The trend of single-serve, microwave-ready, allergen-free, and plant-based meal options continues to expand, supported by innovative packaging, digital retail penetration, and clean-label product introductions by leading brands across regions.

The market holds an estimated 100% share within the frozen ready meals category itself, as it defines this segment. It contributes approximately 32% to the broader frozen food market, reflecting its strong role among frozen categories.

Within the convenience food market, its share is around 9%, highlighting its position as a popular quick meal solution. In the processed food market, its share remains near 3%, while in the vast food and beverage market, frozen ready meals account for less than 1% given the category’s narrower niche relative to total food spending.

Government regulations impacting the market focus on food safety standards, packaging norms, and cold chain compliance. Agencies such as the FDA in the USA, FSSAI in India, and EFSA in Europe mandate strict hygiene, labelling transparency, and temperature-controlled storage for frozen meals.

Additionally, certifications such as HACCP and ISO 22000 guide manufacturers in ensuring food safety, allergen management, and consumer protection. These regulations drive continuous product innovation and packaging advancements, enhancing market trust and adoption globally.

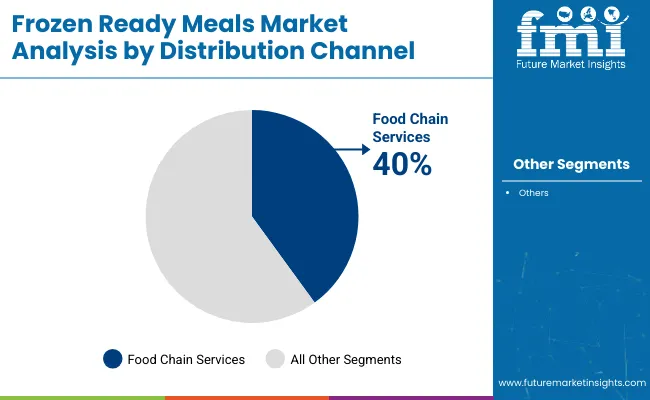

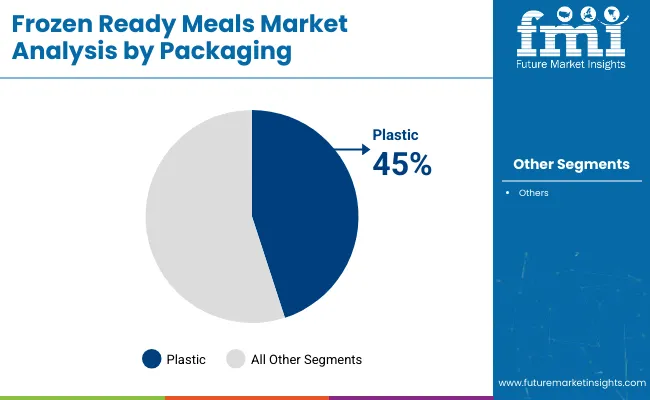

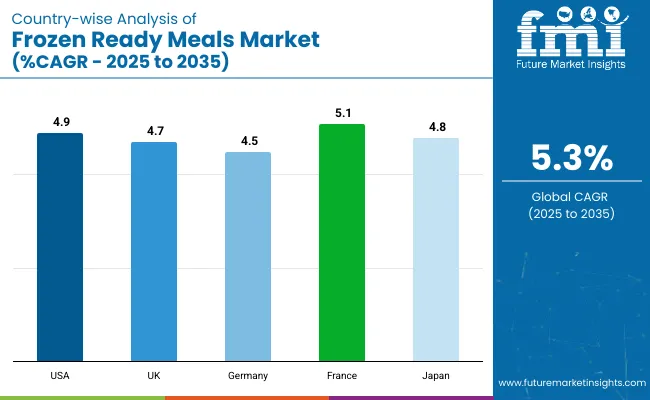

France is projected to be the fastest-growing market among major OECD countries, expanding at a CAGR of 5.1% from 2025 to 2035. Plastic packaging will lead the packaging type segment with a 45% share, while food chain services will dominate the distribution channel segment with a 40% share.

The USA and Germany markets are also expected to grow steadily, with CAGRs of 4.9% and 4.5% respectively, driven by rising demand for convenient, health-conscious frozen meals across these regions.

The frozen ready meals market is segmented by product type, distribution channel, packaging type, and region. Product types include vegetarian meals, chicken meals, beef meals, and other meals (seafood meals, lamb meals, vegan alternatives, and mixed combo meals).

Distribution channels comprise food chain services, modern trade, departmental stores, online stores, and other distribution channels (convenience stores, specialty food retailers, vending machines, and direct-to-consumer). Packaging types considered are aluminium can, plastic, and glass.

Regional analysis includes North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia and Pacific, and the Middle East and Africa.

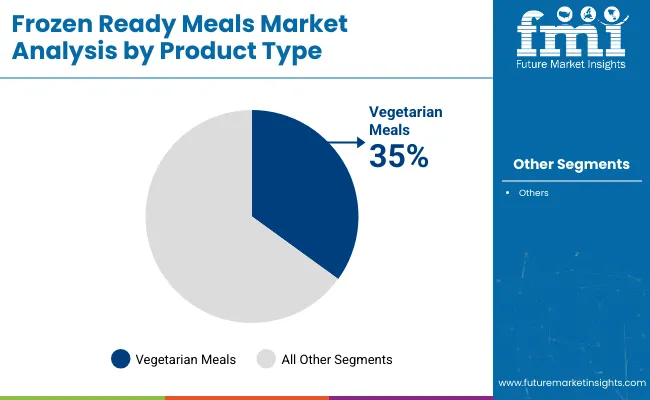

Vegetarian meals are anticipated to dominate the product type segment, holding 35% of the market share by 2025. This growth is driven by rising plant-based dietary preferences and health-conscious consumer behavior.

Food chain services are expected to lead the distribution channel segment with a 40% market share in 2025. Their growth is attributed to quick service models and increasing consumer reliance on food chains.

Plastic packaging is projected to dominate the segment with 45% of the total market share by 2025. Its cost-effectiveness, versatility, and suitability for ready-to-heat formats contribute to its continued dominance.

The global frozen ready meals market is experiencing steady growth, driven by the rising demand for convenient meal solutions and the evolving lifestyles of urban consumers. Frozen ready meals play a crucial role in providing quick, nutritious options for busy individuals and families, while also supporting food service chains with consistent quality and operational efficiency.

Recent Trends in the Frozen Ready Meals Market

Challenges in the Frozen Ready Meals Market

France leads with a CAGR of 5.1%, driven by health-conscious and urban consumers. Japan follows at 4.8%, fueled by premium single-serve demand. The USA grows at 4.9%, focusing on health-oriented and allergen-free meals.

Germany’s CAGR is 4.5%, supported by sustainability and plant-based trends, while the UK shows the slowest growth at 4.7%, driven by vegetarian and eco-friendly options. Overall, France and the USA outperform the global market average, whereas Germany and the UK lag slightly, with Japan closely matching global premiumization and convenience trends.

The report covers in-depth analysis of 40+ countries, five top-performing OECD countries are highlighted below.

The Japan frozen ready meals revenue is poised to grow at a CAGR of 4.8% from 2025 to 2035. Growth is driven by high demand for quick, premium meal options suited to small households and busy professionals.

The sales of frozen ready meals in Germany are slated to expand at 4.5% CAGR during the forecast period, below the global average but strongly regulation led. EU food safety regulations, sustainability goals, and demand for plant-based diets are driving market growth.

The French frozen ready meals market is projected to grow at a 5.1% CAGR during the forecast period, mirroring Germany in its policy-backed adoption trajectory. Demand is driven by health-conscious consumers, clean-label trends, and convenience-focused urban lifestyles.

The USA frozen ready meals market is projected to grow at 4.9% CAGR from 2025 to 2035, translating to 0.56x the global rate. Unlike emerging markets focused on value packs, USA demand is driven by health-focused frozen meals, protein-rich options, and allergen-free product lines.

The UK frozen ready meals revenue is projected to grow at a CAGR of 4.7% from 2025 to 2035, representing the slowest growth among the top OECD nations, at 0.33 times the global pace.

The market is moderately consolidated, with leading players like Nestle S.A., Conagra Brands, Inc., McCain Foods Ltd., General Mills, and Dr. Oetker GmbH dominating the industry. These companies provide diverse, innovative frozen meal solutions catering to consumers across retail and food service channels.

Nestle S.A. focuses on brands like Lean Cuisine and Stouffer’s, offering balanced and premium meal options, while Conagra Brands, Inc. specializes in convenient and health-focused meals under brands such as Healthy Choice and Marie Callender’s.

McCain Foods Ltd. delivers frozen potato products and ready meals with global distribution, and General Mills offers popular frozen brands catering to health-conscious segments. Dr. Oetker GmbH is known for its premium frozen pizzas and European ready meals. Other key players like Daiya Foods Inc., California Pizza Kitchen, Atkins Nutritionals, Inc., H.J. Heinz, and FRoSTA AG contribute by providing specialized, high-quality frozen products for various consumer preferences and regional tastes.

Recent Frozen Ready Meals Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 46.5 billion |

| Projected Market Size (2035) | USD 77.5 billion |

| CAGR (2025 to 2035) | 5.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value/million units for volume |

| Product Types Analyzed | Vegetarian Meals, Chicken Meals, Beef Meals, Others (seafood meals, lamb meals, vegan alternatives, and mixed combo meals) |

| Distribution Channels Analyzed | Food Chain Services, Modern Trade, Departmental Stores, Online Stores, Other Distribution Channel (convenience stores, specialty food retailers, vending machines, and direct-to-consumer) |

| Packaging Types Analyzed | Aluminium Can, Plastic, Glass |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia |

| Key Players Influencing the Market | General Mills, Nestle S.A., McCain Foods Ltd., Dr. Oetker GmbH, Daiya Foods Inc., Connies Pizza, Conagra Brands, Inc., Atkins Nutritionals, Inc., California Pizza Kitchen, H.J. Heinz, FRoSTA AG, Forstar Frozen Foods Private Limited, Kohinoor Foods Limited, Petonia Foods Private Limited, Amul, Ovobel Foods, ITC Limited, Godrej Tyson Foods Limited |

| Additional Attributes | Dollar sales by product category (vegetarian, chicken, beef), dollar sales by packaging type (plastic, aluminium, glass), frozen meal penetration in retail vs food service, regional shifts in meal preferences, clean-label and health-conscious frozen options, trends in single-serve packaging and direct-to-consumer delivery |

As per product type, the industry has been categorized into Vegetarian Meals, Chicken Meals, Beef Meals, and Other Meals.

As per distribution channel, the industry has been categorized into Food Chain Services, Modern Trade, Departmental Stores, Online Stores, and Other Distribution Channel.

This segment is further categorized into Aluminium Can, Plastic, and Glass.

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The market is valued at USD 46.5 billion in 2025.

The market is forecasted to reach USD 77.5 billion by 2035, reflecting a CAGR of 5.3%.

Vegetarian meals will lead the product type segment, accounting for 35% of the global market share in 2025.

Plastic packaging will dominate the packaging type segment with a 45% share in 2025.

France is projected to grow at the fastest rate among major OECD countries, with a CAGR of 5.1% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Frozen Cooked Ready Meals Market Report – Demand, Trends & Industry Forecast 2025-2035

United Kingdom Frozen Ready Meals Market Analysis – Growth, Trends & Forecast 2025–2035

USA Frozen Ready Meals Market Analysis – Growth, Applications & Outlook 2025-2035

Australia Frozen Ready Meals Market Insights – Demand, Size & Industry Trends 2025–2035

Latin America Frozen Ready Meals Market Insights – Demand & Forecast 2025–2035

Frozen Egg Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Frozen Tissues Samples Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Frozen Pastries Market Size and Share Forecast Outlook 2025 to 2035

Frozen Baked Goods Market Size and Share Forecast Outlook 2025 to 2035

Frozen Potatoes Market Size and Share Forecast Outlook 2025 to 2035

Frozen Beverage Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Frozen Meat Grinder Market Size and Share Forecast Outlook 2025 to 2035

Frozen Fruits and Vegetables Market Size and Share Forecast Outlook 2025 to 2035

Frozen Vegetable Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Frozen Cheese Market Size and Share Forecast Outlook 2025 to 2035

Frozen Snacks Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Frozen Fruit Bars Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA