The Australian Frozen Ready Meals market is estimated to be worth USD 126.5 million by 2025 and is projected to reach a value of USD 336.9 million by 2035, growing at a CAGR of 10.2% over the assessment period 2025 to 2035

| Attributes | Values |

|---|---|

| Estimated Australia Industry Size in 2025 | USD 126.5 million |

| Projected Australia Value in 2035 | USD 336.9 million |

| Value-based CAGR from 2025 to 2035 | 10.2% |

Frozen Ready Meals in Australia are pre-cooked, frozen food products requiring minimum preparation before being consumed. The convenience and longer shelf lives make them very useful. Commonly available single-serve dishes, family meals, and even healthier options, including gluten-free, low-calorie, or plant-based varieties, are readily found in the supermarket private labels of retail stores and cater to the busy professional to the family needing a fast meal solution.

With a rise in urbanization, two-income households, and preference towards saving time while consuming food items, this product has generated an increased demand. The frozen format also maintains the nutritional level that attracts the health-conscious buyers. Moreover, developments in packaging and flavor profiles have enhanced the perceived value of frozen meals by removing the stigma around convenience versus quality.

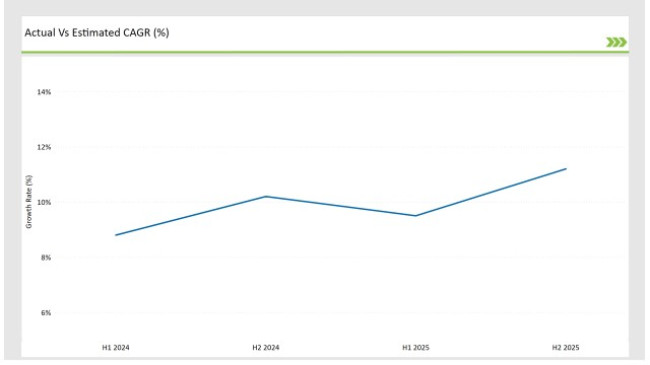

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Australian Frozen Ready Meals market. This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Frozen Ready Meals sector is predicted to grow at a CAGR of 8.8% during the first half of 2025, increasing to 10.2% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 9.5% in H1 but is expected to rise to 11.2% in H2. This pattern reveals a decrease of 15 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 25 basis points in the second half of 2025 compared to the second half of 2024.

These numbers reflect the shifting landscape of the Australian Frozen Ready Meals market through changing consumer needs, new legislations, and food innovation including natural coloring substitutes.

This report is a bi-annual one that provides critical information to organizations to strategize and plan with the growth prospect of the market while also mitigating the obstacles and opportunities which arise. Understanding these dynamics will help companies position themselves in the best possible way to meet consumer expectations and capitalize on emerging trends in the frozen meals sector.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | The plant-based food company v2food acquired the ready meals brand Soulara in early 2024. This acquisition focused on expanding the v2food portfolio by infusing plant-based meat products into Soulara vegetable-centric ready-to-cook, while satisfying growing consumer demand for convenient, healthy, and plant-based meal options |

| 2024 | The acquisition involved an alliance by the Australian canned food company SPC with The Original Juice Co and Singaporean-registered powdered milk business, Nature One. After merging, this entity achieved annual sales more than USD 400 million and hoped to gain greater bargaining power with major retailers, including Woolworths and Coles. |

Gourmet at Home: Premiumization of Frozen Ready Meals

The Australian Frozen Ready Meals market is experiencing increased demand for premium and gourmet offerings. Consumers want to have restaurant-quality meals in their homes, hence the surge. This perception change reflects how frozen meals are no longer a cheap but rather basic option but, instead, as indulgent high-quality dining out alternatives.

Premium offerings include meals with exotic flavors, artisan recipes, and ingredients sourced from regional producers, including Tasmanian salmon or Wagyu beef or native bush spices. This trend is changing the competitive landscape as companies innovate to present high-end frozen meal lines. Companies that will be able to market these meals as high-quality, authentic, and crafted by chefs will likely attract discerning consumers. Premiumization also raises the average price point, which improves profitability for manufacturers and retailers.

Indigenous Ingredients: A Taste of Australian Heritage

An emerging trend to be embraced and appreciated in this country is frozen ready meals containing native Australian ingredients. Some of these flavors offer an opportunity to create distinct dishes that might otherwise have no other significance beyond being new tastes, while some also resonate as cultural pride and local identity.

This trend impacts the marketplace by opening the door to allow manufacturers to differentiate their products in such a crowded space. At the same time, it appeals to consumers interested in exploring Australian indigenous culture through food. Sourcing and recipe development with Indigenous communities add authenticity and help create shared economic opportunities.

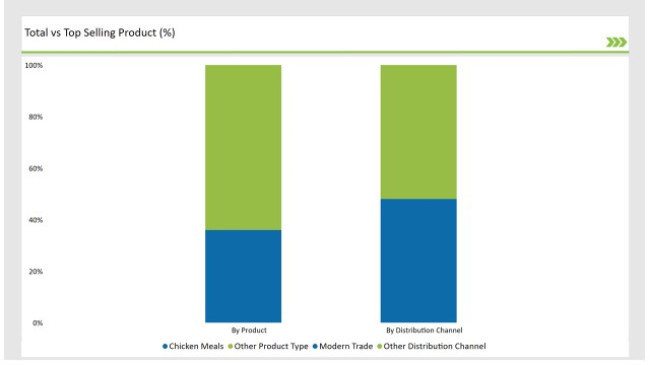

% share of Individual categories by Product Type and Distribution Channel in 2025

Chicken meals dominate the Australian Frozen Ready Meals market because of their versatility, affordability, and cultural resonance. In fact, it is one of the most frequently consumed proteins in the country: chicken was widely embraced, both in quantity and quality, across different demographics, making it a natural fit for ready meals. Convenience emerges as a major factor in this segment's success.

Easy-to-prepare, frozen chicken meals including schnitzel, nuggets, and pre-marinated cuts appeal for a rapid source of protein to a busy Australian. Chicken also offers a flavor devoid of pungency that families love, children approve of, and everyone likes to consume. In terms of health motivation, lean protein is offered for those health conscious consumers seeking low-fat, higher protein meals.

The modern trade channel, supermarket, hypermarket, and large-format stores, is dominating the Australian Frozen Ready Meals market due to their wide reach, affordability, and meeting the diverse needs of one profile under the same roof. Woolworths and Coles continue to be the dominant supermarket chain offering a number of frozen meal products including budget private labels, to premium and healthy brands.

The scale is used by modern trade retailers to avail competitive price opportunities and an exclusive set of product lines, such as private-label frozen meals. Private labels would turn out to be outperformers for smaller players to meet affordable, high-quality offerings fitted to local tastes..

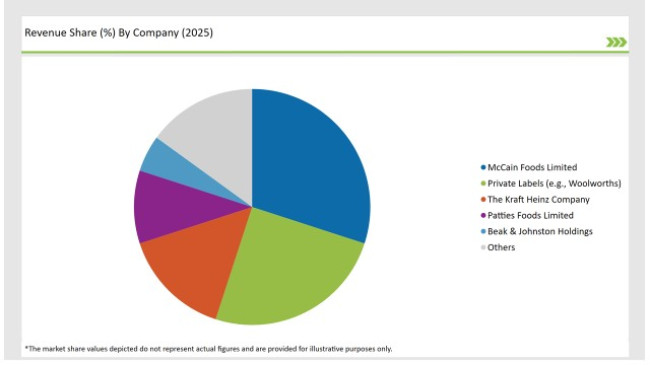

2025 Market share of Australia Frozen Ready Meals manufacturers

Note: The above chart is indicative in nature

Tier 1 players in the Australian Frozen Ready Meals market have huge market shares and a diversified product portfolio by large multinational and local players. Such players can innovate continuously to provide both premium quality frozen meals and a sound distribution network in supermarkets, hypermarkets, and online platforms.

Tier 2 players in the Australian Frozen Ready Meals market comprise major regional brands and local food manufacturers. Companies in this category have strong presence in the market and good brand recognition. Often, these firms focus on the regional tastes as they can produce familiar, homely food to which locals respond well.

Tier 3 in the Australian Frozen Ready Meals market consists of smaller, niche players and emerging brands, local food startups, boutique meal companies, and ethnic-focused brands. These businesses mainly target specific market segments with new offerings, like organic, vegan, or allergen-free frozen meals.

The industry includes various product type of Frozen Ready Meals such as vegetarian meals, chicken meals, beef meals, and others.

The industry includes various packaging type of such as plastics, aluminum cans, and glass.

The industry includes numerous distribution channel such as food chain services, modern trade, departmental stores, online stores, and other distribution channel.

By 2025, the Australian Frozen Ready Meals market is expected to grow at a CAGR of 10.2%.

By 2035, the sales value of the Australian Frozen Ready Meals industry is expected to reach USD 336.9 million.

Key factors propelling the Australian frozen ready meals market include increased popularity of premium and gourmet meal options, consumer demand for convenience and time-saving solutions, and strong influence of Australian supermarkets and private labels.

Prominent players in Australia Frozen Ready Meals manufacturing include PFD Food Services, Blue Seas Food Services, PMFresh, ChillFreeze Logistics & Storage, St George Smallgoods Pty Ltd., Nestlé S.A., Unilever PLC, General Mills Inc., McCain Foods Limited, and Conagra Brands Inc. among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Australia Pallet Wraps Market Size and Share Forecast Outlook 2025 to 2035

Australia and South Pacific islands Tourism Market Size and Share Forecast Outlook 2025 to 2035

Australia Legal Cannabis Market - Size, Share, and Forecast 2025 to 2035

Australia Probiotic Supplements Market Trends – Growth, Demand & Forecast 2025–2035

Australia Chickpea Protein Market Outlook – Demand, Trends & Forecast 2025–2035

Australia Non-Dairy Creamer Market Outlook – Size, Demand & Forecast 2025–2035

Australia Chitin Market Analysis – Growth, Size & Forecast 2025–2035

Australia Bubble Tea Market Trends – Size, Share & Forecast 2025–2035

Australia Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

Australia Non-Alcoholic Malt Beverages Market Insights - Trends & Forecast 2025 to 2035

Australia Food Testing Services Market Growth – Trends, Demand & Innovations 2025–2035

Australia Food Emulsifier Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Pulses Market Report – Trends, Demand & Industry Forecast 2025–2035

Australia Probiotic Strains Market Growth – Trends, Demand & Innovations 2025–2035

Australia Yerba Mate Market Growth – Trends, Demand & Innovations 2025–2035

Australia Sweetener Market Analysis – Size, Share & Forecast 2025–2035

Australia Food Service Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Yeast Extract Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Canned Tuna Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Calf Milk Replacer Market Outlook – Share, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA