The Australia Probiotic Strains market is estimated to be worth USD 180.8 million by 2025 and is projected to reach a value of USD 297.3 million by 2035, growing at a CAGR of 5.1% over the assessment period 2025 to 2035

| Metrics | Values |

|---|---|

| Industry Size (2025) | USD 180.8 million |

| Industry Value (2035) | USD 297.3 million |

| Value-based CAGR (2025 to 2035) | 5.1% |

The probiotic strains market in Australia is focused upon the production and distribution of live microorganisms-probiotic-containing products that promote digestive and immunological health within individuals when these are consumed appropriately. These often include bacteria in the form of Lactobacillus or Bifidobacterium, which find application in nutritional supplements, functional foods, or beverages.

It has been known to balance the gut microbiota, support digestion, and improve immune function, making probiotics so popular. Probiotics are used in Australian dietary supplements, yogurts, and drinks, and the demand for keeping a healthy life and improving mental and physical well-being is on the rise.

Probiotics are also being marketed for benefits beyond digestion, such as enhancing skin health and mental clarity, with the rise in wellness trends, which further drives market growth.

The importance of the Probiotic Strains market in Australia lies in the growing preference for preventative healthcare, natural remedies, and personalized nutrition, all of which have contributed to the robust demand for probiotic products. The market is also supported by the ongoing research on the health benefits of specific probiotic strains, which serves as a good foundation for future innovation.

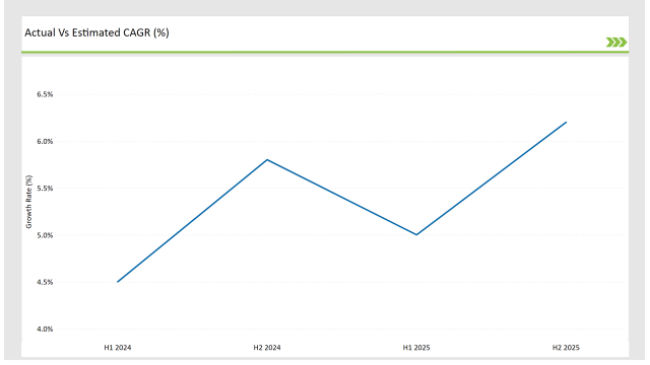

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Australian Probiotic Strains market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Probiotic Strains sector is predicted to grow at a CAGR of 5.0% during the first half of 2025, increasing to 6.2% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 4.5% in H1 but is expected to rise to 5.8% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

These figures reflect an Australian Probiotic Strains market that continues to be both dynamic and subject to rapid transformations, driven factors such as altered consumer preferences and changing regulatory patterns, as well as continuous novelties through probiotic formulas.

This kind of semiannual analysis is what businesses need so they can advance their strategies toward the growth envisioned in the projected market and succeed in the changing challenges and prospects in the given sector. These are the trends one needs to be aware of to stay ahead and respond to the changing market demand.

| Date | Development/M&A Activity & Details |

|---|---|

| December 2023 | Biome Australia Ltd has announced a new probiotic strain, Lactobacillus plantarum BMB18, to be identified and validated. This advancement is expected to enhance the company's product offerings and strengthen its position in the market. |

| December 2023 | Blis Technologies signed a license agreement with skincare brand Emma Lewisham that will use Blis' Q24 probiotic strain in some of its cosmetics. The use of this superior probiotic technology will boost the effectiveness of its skincare range for Emma Lewisham. |

Increased Focus on Gut-Brain Axis and Mental Health Benefits

The connection with the gut is bringing about a new dimension to the Australian probiotic strains market. It has been well established that the gut microbiome plays a crucial role in the functioning of the brain, mood, and mental health.

This has raised much interest in research related to probiotics as a potential therapeutic approach for stress management, anxiety, and even depression. As such, probiotic products available in the Australian market are being prepared not only to help the body in digestive wellness but also mental well-being.

With this current trend, producers will come out with targeted strains that have an effect on the mind. This trend will probably drive innovation in both the supplements and functional food sectors, encouraging companies to focus on probiotics that cater to a holistic view of health.

For instance, Lactobacillus rhamnosus and Bifidobacterium longum are some of the strains that are increasingly being used because they can affect the gut-brain axis.

Personalized Nutrition and Probiotic Strain Customization

Customized probiotic strains for individual health needs will increase with the growth in the adoption of personalized nutrition in Australia. Personalized health solutions are in high demand among consumers who look for products in sync with their specific genetic makeup, lifestyle, and health conditions.

This trend is increasingly popular in the probiotic strains market, with consumers now demanding probiotics targeted to their gut microbiome, digestive health, immune system, or even skin conditions.

Advances in microbiome analysis technologies as well as genetic testing allow consumers to have access to recommendations for probiotic strains tailored to each of their individual microbiome profiles. Probiotic companies are beginning to explore this notion, for instance, offering products specially formulated after microbiome analysis or through collaboration with health professionals.

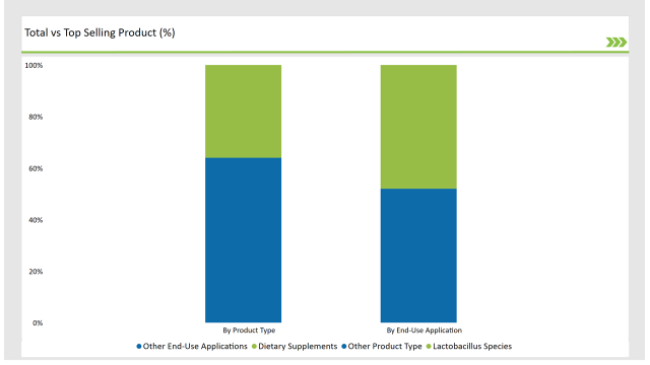

% share of Individual categories by Product Type and End-Use Application in 2025

Lactobacillus species have recently become the leading probiotic strain group in the Australian market due to well-established health benefits and versatility in promoting digestive health. This is because Lactobacillus strains are valued in both supplement and functional food sectors because they survive stomach acidity and reach the intestines.

Some of the well-established probiotics for gut health support are Lactobacillus rhamnosus, Lactobacillus acidophilus, and Lactobacillus plantarum. These have shown efficacy in improving gut health, inhibiting pathogens, and boosting digestion. Growing consumer knowledge regarding gut health, its connection with the microbiome, and a holistic well-being drives the increasing demand for lactobacillus dominance.

Probiotics have been most in demand owing to their ability to increase demand for preventative health solutions, hence, with more awareness about gut health. This segment is therefore the largest in the dietary supplement category for probiotics.

Consumers can conveniently introduce beneficial microorganisms into their lifestyles through the supplementation of probiotics in capsules, tablets, powders, or gummies. This convenience, coupled with the growing recognition of the role probiotics play in supporting digestive health, immunity, and overall wellness, makes dietary supplements the most preferred format for probiotic consumption.

Probiotics, therefore, in supplemental form, has now become not only a popular non-invasive approach to boost gut health but also enhance digestive power and a balancing act between the microbiome. Being controlled on dosage by targeting specific concern, supplements would become extremely alluring to consumers seeking a personalized approach to their well-being.

Note: The above chart is indicative in nature

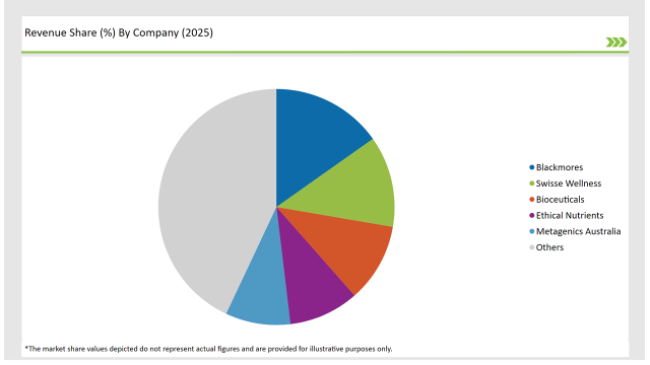

The Tier 1 segment of the Australia Probiotic Strains market is primarily dominated by large, well-known companies that hold a significant share of the market and brands. They have good research and development capabilities and an enormous range of products along with their ability to ensure consistent quality in probiotic products.

Tier 2 firms are mid-size players and niche players; each is specific to some probiotic strains or product lines. Players here usually differ by specialized formulations or targeted health benefits or by satisfying the needs of specific demographics like people with certain dietary restrictions or those who seek a more personalized nutritional approach.

These tier companies specialize on providing more specific and niche probiotics, where solution is centered around addressing consumer-specific needs that concern digestive health, immunity, or mental well-being.

Tier 3 includes emerging small-size companies entering or with early experience in a low number of different products within this market space; these may engage in development in innovative new product lines and perhaps niche positioning opportunities, including probiotics within organic or plant-based products.

As per the product type segment, the market is segregated into lactobacillus species, bifidobacterium species, bacullis species, and others.

As per the processing technology segment, the market is segregated into air drying, freeze drying, microwave drying, others

As per the end use segment, the market is segregated into B2B (Direct), food service, and retail (B2C).

As per the end-use application segment, the market is segregated into food & beverage processing, dietary supplements, personal care & cosmetics, others.

By 2025, the Australia Probiotic Strains market is expected to grow at a CAGR of 5.1%.

By 2035, the sales value of the Australia Probiotic Strains industry is expected to reach USD 297.3 million.

Key factors propelling the Australia Probiotic Strains market include rising adoption of probiotics in sports and fitness communities, advancements in probiotic strain research and innovation, increased demand for natural and preventative health solutions, and growing consumer awareness of gut health and wellness.

Prominent players in Australia Probiotic Strains manufacturing include Biotics Research Australia, Blackmores, Metagenics Australia, Bioceuticals, Integria Healthcare, Designs for Health Australia, Ethical Nutrients, Swisse Wellness, Solgar Australia, and Biome Therapeutics among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Australia Pallet Wraps Market Size and Share Forecast Outlook 2025 to 2035

Australia and South Pacific islands Tourism Market Size and Share Forecast Outlook 2025 to 2035

Australia Legal Cannabis Market - Size, Share, and Forecast 2025 to 2035

Australia Chickpea Protein Market Outlook – Demand, Trends & Forecast 2025–2035

Australia Non-Dairy Creamer Market Outlook – Size, Demand & Forecast 2025–2035

Australia Chitin Market Analysis – Growth, Size & Forecast 2025–2035

Australia Bubble Tea Market Trends – Size, Share & Forecast 2025–2035

Australia Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

Australia Non-Alcoholic Malt Beverages Market Insights - Trends & Forecast 2025 to 2035

Australia Food Testing Services Market Growth – Trends, Demand & Innovations 2025–2035

Australia Food Emulsifier Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Pulses Market Report – Trends, Demand & Industry Forecast 2025–2035

Australia Frozen Ready Meals Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Yerba Mate Market Growth – Trends, Demand & Innovations 2025–2035

Australia Sweetener Market Analysis – Size, Share & Forecast 2025–2035

Australia Food Service Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Yeast Extract Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Canned Tuna Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Calf Milk Replacer Market Outlook – Share, Growth & Forecast 2025–2035

Australia Fish Oil Market Growth – Trends, Demand & Innovations 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA