The Australian Sweetener market is estimated to be worth USD 891.0 million by 2025 and is projected to reach a value of USD 2,524.1 million by 2035, growing at a CAGR of 4.9% over the assessment period 2025 to 2035.

| Attributes | Values |

|---|---|

| Estimated Australia Industry Size in 2025 | USD 891.0 million |

| Projected Australia Value in 2035 | USD 2,524.1 million |

| Value-based CAGR from 2025 to 2035 | 4.9% |

The Australian market for sweeteners has been changing with increased demand from consumers for natural, as well as artificial, sweeteners due to changes in consumer preferences and health consciousness. In addition, as more Australians become aware of the health dangers associated with high sugar consumption-registered conditions of obesity and diabetes-the trend set toward low calorie, sugar-free, and natural alternatives.

It ranges from a list of products such as stevia, sucralose, aspartame, and monk fruit extract, serving various needs across food and beverage sectors like soft drinks, baked goods, dairy, and confectionery.

The Australian sweetener market has been a prime focus for the sector, as it can address both health-related concerns and demand from consumers regarding dieting preferences. With an increasing population of Australians choosing healthy lifestyles, there is a rising demand for low-glycemic, plant-based, and natural sweeteners.

This is an emerging trend in the world where people are more conscious of healthy food choices, and Australians can be considered as one of the prime market fields for this particular food and beverage category.

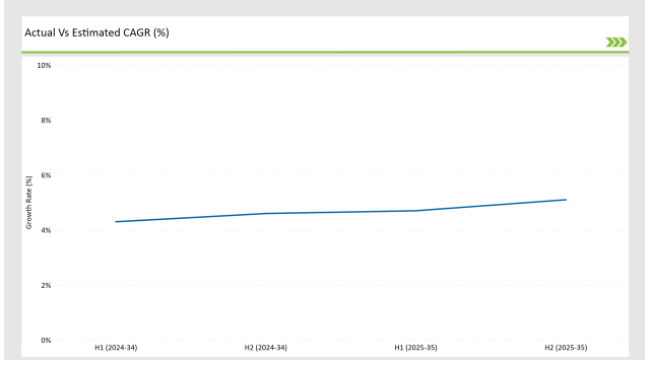

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Australian Sweetener market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Sweetener sector is predicted to grow at a CAGR of 4.7% during the first half of 2025, increasing to 5.1% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 4.3% in H1 but is expected to rise to 4.6% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

These insights shine a light on the rapidly changing landscape of the Australian sweetener market, influenced by a number of factors such as changes in regulatory frameworks, evolving consumer preferences, and continuous innovation in natural sweetening solutions. This bi-annual overview is essential for companies seeking to develop strategies that leverage the expected market growth and effectively address the challenges and opportunities that arise in this competitive sector.

| Date | Development/M&A Activity & Details |

|---|---|

| November 2024 | Samyang Corporation is the world's first allulose manufacturer to venture into the Australian and New Zealand markets has received Novel Food approval from Food Standards Australia New Zealand (FSANZ) to sell its allulose in these markets. The company is recognized as an official low-calorie sweetener for use in sugar-reduced and sugar-free products. |

| 2023 | Lakanto expanded its product line with the introduction of Brown Lakanto , a 1:1 brown sugar substitute. The product is available in different sizes and is now stocked in major Australian retailers, including Coles and Woolworths. |

Rising Popularity of Natural and Plant-Based Sweeteners

There is a seen rise in natural and plant-based sweeteners in Australia, as health-conscious and sugar and artificial sweetener alternatives are in greater demand. Stevia, and monk fruit continue to lead the market because of their low GI, zero-calorie, and natural origin.

One such factor that influences this shift is the concern surrounding increased sugar consumption and the risks of Australia facing higher cases of obesity, diabetes, and many other chronic diseases. As consumers increasingly gravitate toward alternatives to refined sugar, food and beverage manufacturers can only respond through product innovation-included natural sweetener content -and replacing existing content with refined sugar or artificial sweetener.

Sugar Reduction in Beverages: A Paradigm Shift

The Australian beverage market is indeed at a stage where it undergoes a change to reduce sugars and sweeteners will be part of this. Australian government introduced taxes on sugar while the population gained awareness that sugary items caused harm; so, these pressures are motivating producers to adjust the formulation of drinks.

Most categories, including soft drinks, juices, and energy drinks, undergo reformulation from high sugars to artificial or natural sweetener forms.As the consumers are getting health-conscious, low-calorie and sugar-free beverage demand is on a high surge and is likely to continue so. Brands therefore increasingly opt for sugar substitutes such as stevia, erythritol, and sucralose, so they can retain the taste profile while reducing calorie content.

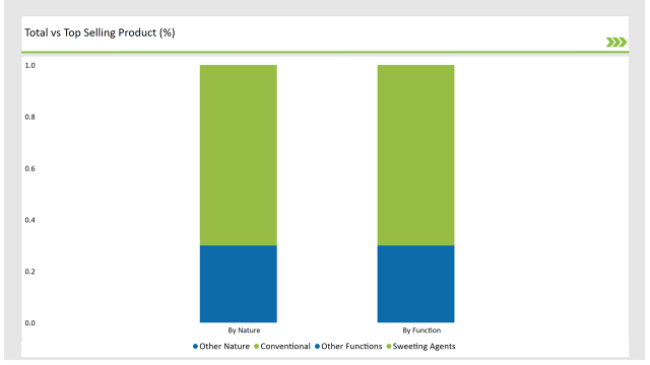

% share of Individual categories by Nature and Function in 2025

The sweetening agents sector dominates the Australian market as customer tastes change towards healthier and more functional ingredients. This movement is being driven by a growing awareness of the harmful health consequences of excessive sugar intake, including obesity, diabetes, and cardiovascular disease.

Since Australians seek alternatives to their traditional sugar intake, demand has increased for sweeteners that contain low-calorie, low-glycemic, and natural options. It is changing the marketplace as demand for functional sweeteners increases. They are no longer demanding sweetness but a health benefit too, such as digestive support or weight management property.

The conventional sweetener segment continues dominating the Australian market because of strong consumer habits in using traditional food and beverage preparation ingredients. Alternatives notwithstanding, conventional sweeteners such as sucrose, glucose, high-fructose corn syrup, and dextrose, among others continue to play fundamental roles in numerous product formulations involving soft drinks, confectioneries, and a wide range of processed foods.

For this reason, these sweeteners are so deeply integrated into manufacturing processes, offering cost-effectiveness and taste consistency in mass-market production. The food industry, especially in the packaged snack sector, cereals, and ready-to-eat meals, continues to use conventional sweeteners based on long history experience and reliability in maintaining taste profiles, texture, and shelf life.

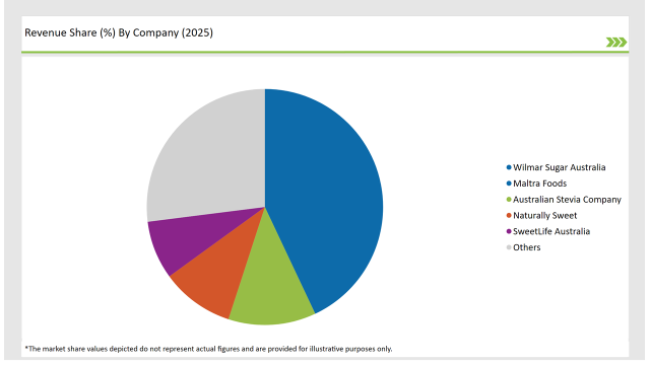

2025 Market share of Australia Sweetener manufacturers

Tier 1 players in the sweetener market in Australia were large multinational companies with resources, distribution networks, and market presence. These dominated the market through offering the whole range of sweeteners from artificial to natural.

Tier 2 players are regional companies and emerging brands that have a significant presence in the Australian sweetener market but are not as dominant as Tier 1 giants. Such companies usually target specific niche markets by offering perhaps unique or even specialized sweeteners for a specific assortment of consumer preferences such as organic, plant-based, etc.

Tier 3 players comprise smaller local companies or startups serving the Australian market. These companies are often focused on niche-specific, high-quality sweeteners or niche-specific consumers such as gluten-free, vegan, or ketogenic-friendly products.

The industry includes various forms/type of Sweetener such as Standard Flakes, Mashed Potato Pellets, Powder/Granules, and Specialty Flakes.

The industry includes various end-use application Snack Foods, Ready Meals, Food Service, Bakery, Soups & Sauces, Others.

By 2025, the Australian Sweetener market is expected to grow at a CAGR of 4.9%

By 2035, the sales value of the Australian Sweetener industry is expected to reach USD 2,524.1 million.

Key factors propelling the Australian Sweetener market include increasing demand for sugar reduction, technological advancements in sweetener production, consumer preference for natural ingredients, and increase in functional and fortified products.

Prominent players in Australia Sweetener manufacturing include Wilmar International, Australian Stevia, Stevia Domain, Maltra Foods, Naturally Sweet, SweetLife Australia, Samyang Corporation, Cargill, Inc., Ingredion, and Tate & Lyle Plc, among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Australia Pallet Wraps Market Size and Share Forecast Outlook 2025 to 2035

Australia and South Pacific islands Tourism Market Size and Share Forecast Outlook 2025 to 2035

Australia Legal Cannabis Market - Size, Share, and Forecast 2025 to 2035

Australia Probiotic Supplements Market Trends – Growth, Demand & Forecast 2025–2035

Australia Chickpea Protein Market Outlook – Demand, Trends & Forecast 2025–2035

Australia Non-Dairy Creamer Market Outlook – Size, Demand & Forecast 2025–2035

Australia Chitin Market Analysis – Growth, Size & Forecast 2025–2035

Australia Bubble Tea Market Trends – Size, Share & Forecast 2025–2035

Australia Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

Australia Non-Alcoholic Malt Beverages Market Insights - Trends & Forecast 2025 to 2035

Australia Food Testing Services Market Growth – Trends, Demand & Innovations 2025–2035

Australia Food Emulsifier Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Pulses Market Report – Trends, Demand & Industry Forecast 2025–2035

Australia Probiotic Strains Market Growth – Trends, Demand & Innovations 2025–2035

Australia Frozen Ready Meals Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Yerba Mate Market Growth – Trends, Demand & Innovations 2025–2035

Australia Food Service Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Yeast Extract Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Canned Tuna Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Calf Milk Replacer Market Outlook – Share, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA