The Australia Probiotic Supplements market is estimated to be worth USD 36.2 million by 2025 and is projected to reach a value of USD 209.5 million by 2035, growing at a CAGR of 19.2% over the assessment period 2025 to 2035

| Attributes | Values |

|---|---|

| Estimated Australia Industry Size in 2025 | USD 36.2 million |

| Projected Australia Value in 2035 | USD 209.5 million |

| Value-based CAGR from 2025 to 2035 | 19.2% |

The probiotic supplements market in Australia involves dietary products containing live beneficial microorganisms. These must include bacteria and yeast to ensure that gut health and all-round well-being are enhanced.

These supplements can be marketed in several ways, such as through capsules, powders, and liquids, and are specially made to improve the gut microbiota balance, which is strongly related to immune function, digestion, mental health, and skin health.

The demand of this market lies in catering to a large population, ranging from children to geriatric groups, who need natural and functional solutions for health concerns. A further expansion in market opportunities has been seen in the aging population and the increase in popularity of clean-label, plant-based, and vegan probiotics.

Thus, with better knowledge, sustainable growth in the Australian probiotic supplements market can be expected to take place because of innovation and scientific advancements.It is increasing with preventive care, rising incidents of digestive diseases, and lifestyle disorders such as stress and obesity. Also, due to good regulations in the country, it has ensured the quality of the products, which is giving greater confidence to consumers on probiotics.

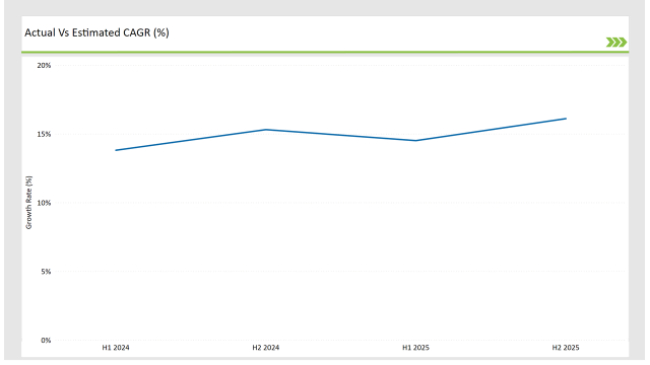

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Australian Probiotic Supplements market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December

For the Australian market, the Probiotic Supplements sector is predicted to grow at a CAGR of 12.4% during the first half of 2025, increasing to 14.3% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 11.3% in H1 but is expected to rise to 13.2% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

The Australian Probiotic Supplements market is dynamic, in constant flux and development; thus, based on changes in customer preferences, updates in the regulations, and development in the formulation technologies. This is of vital importance to the firms trying to match up their strategy to current market trends and capitalize upon the emerging opportunities.

A comprehensive semiannual research into market development directions will be helpful in equipping the enterprises to optimize product offerings and adapt to the shifting requirements of customers. It is a focused strategy that helps organizations capitalize on the expanding market while controlling the challenges presented by a fiercely competitive and rapidly evolving industry.

| Date | Development/M&A Activity & Details |

|---|---|

| June 2024 | ADM's spore-forming probiotic strain, DE111™ (Bacillus subtilis), has been approved by Australia's Therapeutic Goods Administration (TGA). This is the first Bacillus subtilis strain to be approved by the TGA, and it will allow ADM to sell and market DE111™ to Australian consumers. According to Helen Hu, President of Health & Wellness APAC at ADM, this milestone opens up new innovation opportunities for Australian customers, enabling the creation of innovative gut health-supporting products. |

| 2023 | Biome Australia launched three new clinically trialed products in its Activated Probiotics® range: Biome Dental™, Biome Lax™, and Biome Immune™. These launches specifically targeted some of the health concerns, such as oral health, digestive health, and immune support needs among the diversified masses of Australian consumers. |

Probiotic Supplements for Mental Health: The Gut-Brain Connection

The increasing awareness of the gut-brain axis has correspondingly increased demand for probiotic supplements specifically tailored to target mental health in Australia. Probiotics, according to new emerging research, have been shown to impact mood, anxiety, and even cause stress, mediated by associations between gut bacteria and the central nervous system, thus changing the game and portending them as natural remedies for their mental wellbeing.

There are innovating Australian brands developing strains such as Lactobacillus helveticus and Bifidobacteriumlongum that can be related to stress alleviation and performance of brain functions.

Probiotics for Kids: Expanding the Consumer Base

One of the primary growth segments for children's probiotic supplements is in Australia. Parents are getting increasingly aware of how gut health plays a significant role in developing immunity, allergy management, and digestive improvement in children. The demographic is therefore well-served by pediatric probiotics in the form of chewable tablets, gummies, and flavored powders that allow kids to have them easily.

Local brands are innovating with formulations that are specifically designed for children, such as strains like Bifidobacteriuminfantis, which will help the gut flora to be healthy from an early age. These products focus on their safety, efficacy, and pediatrician approval, targeting the cautious yet health-conscious parent in Australia.The same trend influences the market as more customers are likely to be available and there may be opportunities in brand loyalty much earlier in life.

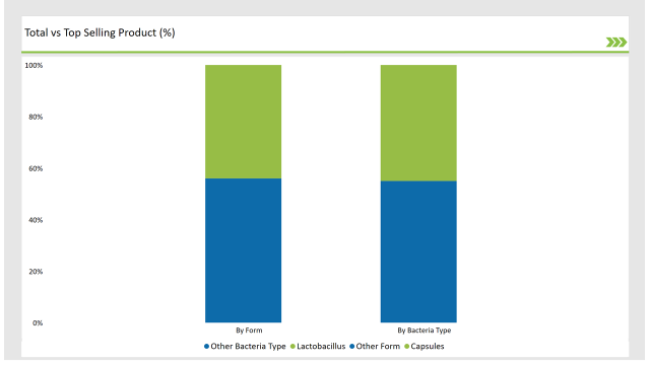

% share of Individual categories by Bacteria Type and Form in 2025

Capsules are the majority share of probiotic supplements sold in Australia since they offer the most precision, stability, and efficacy. Probiotic supplements need to be handled with the utmost care for the live microorganisms to stay viable until it reaches the gut.

Capsules are especially excellent for this as they protect the probiotics from environmental factors like moisture, heat, and acidity in the stomach, and deposit them safely to the intestines where maximum effects can be produced. The Australian market is discerning and wishes for science-backed products.

Capsules offer dosing accuracy, which can be of significant appeal to those who place value on consistency and reliability in their health programs. In addition, since capsules can be designed to have delayed release technologies, including enteric coatings, the probiotics bypass the acidic environment of the stomach, maximizing effectiveness..

Lactobacillus is the top-selling probiotic supplement in Australia, given the scientific validation, wide-ranging health benefits, and proven versatility. This genus of bacteria, Lactobacillus acidophilus, Lactobacillus rhamnosus, and Lactobacillus casei included, is viewed as a gold standard for maintaining gut health since it balances the intestinal flora, enhances digestion, and strengthens the immune system.

Its presence in the market is due in part to how effective Lactobacillus is in terms of dealing with the most commonly experienced health-related issues by this population. Most Australians suffer from lactose intolerance, IBS, and antibiotic-associated diarrhea; Lactobacillus species are known specifically to alleviate all these conditions.

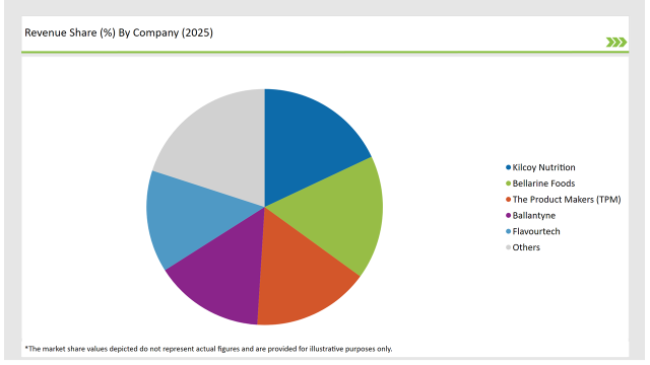

2025 Market share of Australia Probiotic Supplements manufacturers

Tier 1 companies in the Australian probiotic supplements market are Yakult, Danone, and Reckitt Benckiser. These players lead the market because of their financial strength, strong distribution network, and diverse product lines.

They utilize scientific research spanning several decades and leading-edge manufacturing technology to develop top-of-the-range probiotic supplements that appeal both to the end-users in Australia and healthcare practitioners. These companies spend significant amounts on advertisements and consumer awareness, thereby widely spreading their brands.

Tier 2 players are regional companies and emerging market leaders, including Life-Space Probiotics, Biome Australia Limited, and BJP Laboratories. The Tier 2 companies offer localized innovative formulations to meet specific needs of customers. Tier 2 companies are relatively more sensitive to shifts in vegan or allergen-free demand from consumers and mostly operate in fast-growing segments-children or women-specific probiotics.

Tier 3 has smaller niche players, for example, Pro Good, with other start-ups that focus in probiotic innovation. Such companies work on niches: ultra-targeted formulation for particular health conditions or special delivery formats such as chewable probiotics. Being on a shoestring budget, they will have to make direct contact with their customers, work in co-operation with the local health care providers, and exploit niche marketing approaches in order to acquire a market share.

The industry includes various form such as powder, capsules, and tablets.

The industry includes various bacteria type such as glucosamine, probiotics, multivitamins, omega 3 fatty acids, and others.

As per the distribution channelsegment, the market is segregated into retail pharmacies/drug stores, online retail, supermarkets/hypermarkets, and health food stores.

By 2025, the Australian Probiotic Supplements market is expected to grow at a CAGR of 19.2%.

By 2035, the sales value of the Australian Probiotic Supplements industry is expected to reach USD 209.5 million.

Key factors propelling the Australian Probiotic Supplements market include advancements in microbiome research and probiotic innovations, focus on strain-specific benefits and targeted health solutions, and prevalence of digestive and lifestyle-related disorders.

Prominent players in Australia Probiotic Supplements manufacturing include Danone, Yakult Australia DuPont, Reckitt Benckiser, Ecolab, Biome Australia Limited, Life-Space Probiotics, Pro Good, BJP Laboratories, and Cantel Medical among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Australia Pallet Wraps Market Size and Share Forecast Outlook 2025 to 2035

Australia and South Pacific islands Tourism Market Size and Share Forecast Outlook 2025 to 2035

Australia Legal Cannabis Market - Size, Share, and Forecast 2025 to 2035

Australia Chickpea Protein Market Outlook – Demand, Trends & Forecast 2025–2035

Australia Non-Dairy Creamer Market Outlook – Size, Demand & Forecast 2025–2035

Australia Chitin Market Analysis – Growth, Size & Forecast 2025–2035

Australia Bubble Tea Market Trends – Size, Share & Forecast 2025–2035

Australia Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

Australia Non-Alcoholic Malt Beverages Market Insights - Trends & Forecast 2025 to 2035

Australia Food Testing Services Market Growth – Trends, Demand & Innovations 2025–2035

Australia Food Emulsifier Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Pulses Market Report – Trends, Demand & Industry Forecast 2025–2035

Australia Frozen Ready Meals Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Yerba Mate Market Growth – Trends, Demand & Innovations 2025–2035

Australia Sweetener Market Analysis – Size, Share & Forecast 2025–2035

Australia Food Service Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Yeast Extract Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Canned Tuna Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Calf Milk Replacer Market Outlook – Share, Growth & Forecast 2025–2035

Australia Fish Oil Market Growth – Trends, Demand & Innovations 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA