The Australian Chickpea Protein market is estimated to be worth USD 0.48 million by 2025 and is projected to reach a value of USD 0.92 million by 2035, growing at a CAGR of 6.7% over the assessment period 2025 to 2035

| Attributes | Values |

|---|---|

| Estimated Australia Industry Size in 2025 | USD 0.48 million |

| Projected Australia Value in 2035 | USD 0.92 million |

| Value-based CAGR from 2025 to 2035 | 6.7% |

Chickpea protein market in Australia refers to the production, processing and distribution of protein from chickpeas, utilizing in food and beverages applications, dietary supplements, and animal feed applications. Chickpea protein is a plant protein source rich in essential amino acids, which has received so much attention due to its nutritional value, allergen-free nature, and sustainability. The main form through which it is available is in the form of isolates, concentrates, and flour.

In Australia, the chickpea protein market is meaningful because it matches the growth of consumer demand in plant-based and clean-label food. Growing environmentally responsible concerns alongside increasing consumers' preferences for vegetarian and vegan diets make chickpea protein an environmentally friendly alternative to traditional animal-source proteins. The market gains mileage from the powerful base of chickpea cultivation in the regions of Queensland and New South Wales.

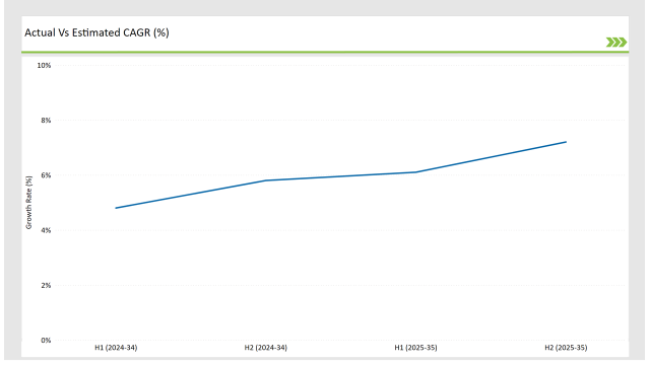

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Australian Chickpea Protein market. This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Chickpea Protein sector is predicted to grow at a CAGR of 6.1% during the first half of 2025, increasing to 7.2% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 4.8% in H1 but is expected to rise to 5.8% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

The Australian Chickpea Protein market landscape is dynamic, in a continuous flux of shifting consumer preferences, innovative developments, and evolving dynamics of the market. Key factors for this market include changes in product formulation, diet-related shifts, and a desire for diverse flavors in creamers, all contributing to this market growth. This periodic analysis is helpful for businesses in sharpening strategies, tapping into emerging opportunities, and identifying challenges to efficiently overcome them and gain a competitive advantage in the marketplace.

| Date | Development/M&A Activity & Details |

|---|---|

| 2023 | Vitasoy expanded its line of plant-based beverages with chickpea protein-based drinks. The drinks were pitched as a dairy alternative, offering protein from chickpeas suitable for vegan and allergen-free diets. It launched toward the rising demand for plant-based proteins in beverages in Australia, for which the company has long seen a growing vegan or flexitarian consumer base take up more plant-based alternatives to traditional dairy drinks. |

| 2023 | The Israeli company ChickP Protein launched its 90% chickpea protein isolate into the Australian market. This highly concentrated isolate will be used in active nutrition products like protein bars, shakes, and functional foods. The product fits the growing need for plant-based alternatives to protein within the Australian market, especially in the fitness- and health-conscious consumer markets. |

Booming Demand for Protein-Enriched Snacks and Beverages

There is an increased market demand for protein-enriched snack and beverage in Australia, triggered by lifestyle changes among consumers and by health and fitness options. With growing Australians adapting to active lifestyle patterns and routine regimes, there has been an increased on-the-go, high-protein-rich snack and beverage demand. Chickpea protein has gained popularity because of its nutritional profile.

This rising demand is going to drive innovation in product formulation and create more lucrative opportunities for local food manufacturers and processors. It will also attract investment in processing technologies that enhance the sensory and functional properties of chickpea protein to be used in broader applications.

Integration into Gluten-Free and Allergen-Free Culinary Staples

The food industry of Australia is developing gluten-free and allergen-free products to meet the dietary requirements of consumers suffering from food sensitivities. Chickpea protein is increasingly being incorporated into bread, pasta, and baked goods, thus providing a nutritious and allergen-friendly alternative to wheat-based products.

As awareness about coeliac disease and gluten intolerance spreads, high-quality alternatives for conventional staples are increasingly in demand in Australia. The increased nutritional profile coupled with suitability in gluten-free products makes chickpea protein an excellent substitute.

In response to the ever-growing but still niche demand in Australia, artisan bakeries, health food brands, and mainstream food producers are starting to use chickpea protein for their respective formulations. This trend is going to greatly expand the usage of chickpea protein in Australian food industries as it will further collaborate local chickpea farmers with processors and food manufacturers in the country.

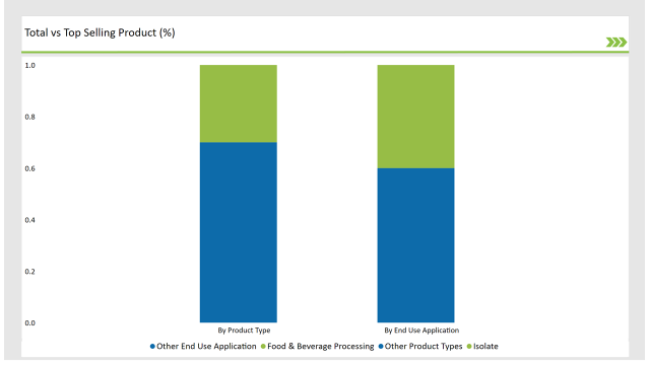

% share of Individual categories by Product Type and End Use Application in 2025

The chickpea protein isolate has been gaining the highest percentage share of the Australian market as it has the highest content of protein, with versatility in its application in food, and more and more consumers are becoming health-conscious. Chickpea protein isolate has a higher content of protein compared to chickpea flour or concentrates.

It is therefore used to create products with 80% to 90% pure protein, and such products are suitable for the high-protein, low-carb, or muscle recovery-conscious consumer. Its applications can be found in protein bars, shakes, and ready-to-eat meals. The increasing market trend for isolates comes from the increased demand for protein products designed to fulfill athletes, fitness, and nutrition-conscious people's special nutritional needs.

Processed food and beverage still dominate chickpea protein demand in the Australian market, because the demand for plant-based food ingredients in items of everyday foods is on an increasing trend there. Chickpea protein is a versatile ingredient that can enhance the nutritional profile of many products, and it is suitable for both vegan and vegetarian diets.

It is therefore a prime ingredient for food and beverage manufacturers. The protein is being incorporated into a wide range of products, including dairy alternatives, plant-based snacks, protein bars, beverages, and ready-to-eat meals. Due to its neutral taste and smooth mouthfeel, this is a versatile substitute for proteins from animals while also being a zero allergy, offering more appeal to sensitive consumers.

Note: The above chart is indicative in nature

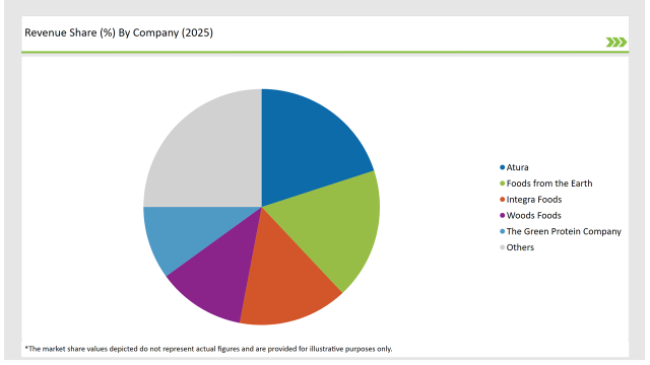

Tier 1 companies are large multinational corporations with an extensive distribution network and considerable R&D capabilities. These companies represent the main players in the market and are well ahead of their competitors in production capacity, technology, and new product development. These players have strong relationships with food and beverage manufacturers, who offer a large variety of chickpea protein products for several end-use applications, including isolates, concentrates, and flours.

Tier 2 companies in the Australian chickpea protein market are mid-sized regional players and specialist manufacturers. Often specializing in specific applications, such as plant-based protein snacks, functional foods, and dairy alternatives, these companies would meet the needs of the smaller, healthier-conscious consumer segments.

Tier 3 players in the Australian chickpea protein market consist of emerging players and local innovators for niche applications, exploring the potential of chickpea protein. Companies within this tier are generally startups or smaller companies that look forward to the creation of new products. Some of these are protein-rich beverages, plant-based meats, or specialty food products.

The industry includes various product typesuch as isolate, concentrate, textured, and hydrolyzed.

The industry includes numerousend-use applications such as Food & Beverage Processing, Sports Nutrition, Infant Nutrition, Pharmaceutical Products, Personal Care Products, and Animal Nutrition.

By 2025, the Australian Chickpea Protein market is expected to grow at a CAGR of 6.7%

By 2035, the sales value of the Australian Chickpea Protein industry is expected to reach USD 0.92 million.

Key factors propelling the Australian Chickpea Protein market include increasing consumer awareness on protein sources, rising popularity of gluten-free products, and support for local agriculture and chickpea cultivation.

Prominent players in Australia Chickpea Protein manufacturing include Atura, ChickP Protein, Tate & Lyle, Roquette, Cargill, The Scoular Company, ADM (Archer Daniels Midland), Vitasoy, The Australian Protein Company, Foods from the Earth, Integra Foods, Woods Foods, and The Green Protein Company among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Australia Pallet Wraps Market Size and Share Forecast Outlook 2025 to 2035

Australia and South Pacific islands Tourism Market Size and Share Forecast Outlook 2025 to 2035

Australia Legal Cannabis Market - Size, Share, and Forecast 2025 to 2035

Australia Probiotic Supplements Market Trends – Growth, Demand & Forecast 2025–2035

Australia Non-Dairy Creamer Market Outlook – Size, Demand & Forecast 2025–2035

Australia Chitin Market Analysis – Growth, Size & Forecast 2025–2035

Australia Bubble Tea Market Trends – Size, Share & Forecast 2025–2035

Australia Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

Australia Non-Alcoholic Malt Beverages Market Insights - Trends & Forecast 2025 to 2035

Australia Food Testing Services Market Growth – Trends, Demand & Innovations 2025–2035

Australia Food Emulsifier Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Pulses Market Report – Trends, Demand & Industry Forecast 2025–2035

Australia Probiotic Strains Market Growth – Trends, Demand & Innovations 2025–2035

Australia Frozen Ready Meals Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Yerba Mate Market Growth – Trends, Demand & Innovations 2025–2035

Australia Sweetener Market Analysis – Size, Share & Forecast 2025–2035

Australia Food Service Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Yeast Extract Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Canned Tuna Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Calf Milk Replacer Market Outlook – Share, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA