The Australian Non-Alcoholic Malt Beverages market is estimated to be worth USD 88.7 million by 2025 and is projected to reach a value of USD 308.4 million by 2035, growing at a CAGR of 13.3% over the assessment period 2025 to 2035.

| Metrics | Values |

|---|---|

| Industry Size in 2025 | USD 88.7 million |

| Value in 2035 | USD 308.4 million |

| Value-based CAGR from 2025 to 2035 | 13.3% |

Australia refers to the share of malt-based drinks, also known as a malted drink that consists of beverages that are brewed as beer but the process of extracting or removing its alcohol content takes place. Being carbonated beverages, they often resemble beer drinking without the resultant intoxication that usually accompanies a beer drinker.

This, therefore, goes with the change in lifestyle preference among consumers hence, healthy consciousness and concern for low calorie, alcohol-free beverages have triggered this demand in the market.

The significance of this market is in the ability to satisfy a varied consumer base from people avoiding alcohol due to health or religious grounds up to the level of simple desires to enjoy refreshing drinks minus the adverse impacts associated with alcohol consumption. Increasing demand calls for even more innovation on the side of companies launching products that fulfill these emerging needs of consumers.

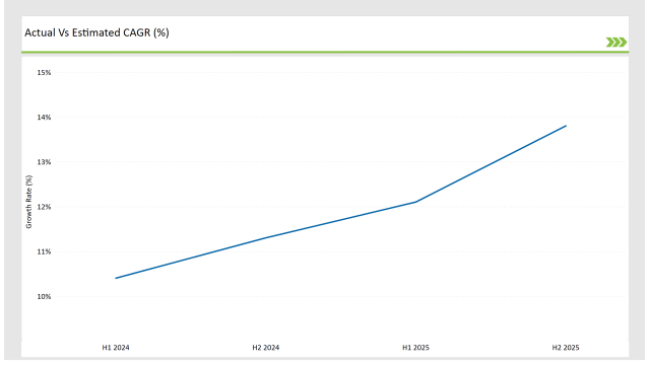

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Australian Non-Alcoholic Malt Beverages market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Non-Alcoholic Malt Beverages sector is predicted to grow at a CAGR of 12.8% during the first half of 2025, increasing to 13.8% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 10.4% in H1 but is expected to rise to 11.3% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

These numbers reflect the constantly changing nature of the Australian marketplace for non-alcoholic malt drinks, affected by dynamic shifts in consumer preference, new directions in regulatory regimes, and significant advances in the natural flavorings space.

This bi-annual report offers inputs valuable to organizations looking to transform their business models, fully realize prospective market growth, and fully understand the challenges and opportunities within this market. Understanding these trends will be very important for any company to remain competitive in this rapidly expanding market and reacting towards the changes in demand from an ever-growing consumer market.

| Date | Development/M&A Activity & Details |

|---|---|

| 2023 | Carlton & United Breweries (CUB) launched Asahi Super Dry 0.0%, Japan's number one beer, but this time as a non-alcoholic variant. This variant is brewed, just like the Japanese original way of brewing combined with excellent ingredients, and this excellent quality was also rewarded at the London World Alcohol-Free Awards 2023. |

| 2023 | Little Creatures launched its novel product i.e., non-alcoholic malt beer called Flying Low Ale, which is highly hoppy and fruity. Such a product gives an excellent flavor solution to the increased demand for no-alcohol versions. This is one of his strategic moves toward consolidating his brand's position and streamlining operations across Australia and New Zealand. |

Rise of Non-Alcoholic Malt Beverages in the Hospitality Industry

Non-alcoholic malt beverages are now appearing alongside traditional alcoholic options on menus, and most venues now offer them as alternatives for drivers, women in the final stages of pregnancy, or for just anyone that wants to have a refreshing drink without the after-effects of alcohol. This trend has a deep impact on the market because it creates a different channel for growth other than retail.

As consumers become more aware of the availability of the beverage through greater visibility and accessibility in public spaces, demand will increase sales volume. Moreover, the popularity of non-alcoholic malt beverages in bars and restaurants might act as a catalyst for further innovation as places of entertainment look at offering more diverse and premium options to keep pace with changing customer tastes.

The introduction of these drinks into social environments will minimize the stigma associated with non-alcoholic beverages over time, thereby making their consumption more mainstream and firmly establishing their position in the larger Australian beverage market.

Consumers Aware of Health Put an Emphasis on Useful Ingredients

An increasing proportion of Australian consumers view functional benefits within their beverages-which the scope of nonalcoholic malted beverages- to be highly beneficial. In keeping with health-gain perspectives of health-conscious Australian consumers, increasing proportions of those beverages are created with the incorporated added health attributes of vitamins and minerals, and more recently of probiotics as well as electrolytes.

This trend will positively impact the market by bringing in a more diverse range of consumers, who may not have considered non-alcoholic malt beverages before. Functional benefits are also going to drive product development because manufacturers are just beginning to experiment with including ingredients such as adaptogens, antioxidants, and low sugar alternatives.

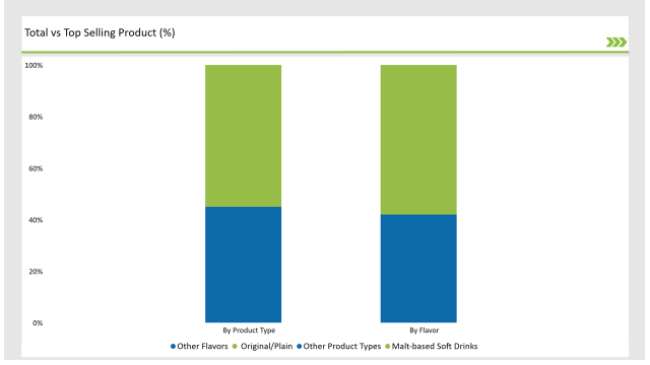

% share of Individual categories by Product Type and Flavor in 2025

Malt-based soft drinks have witnessed an impressive growth curve in Australia as the evolving needs of the consumer increase their demands for greater beverage variety. Not similar to any traditional soft drinks or alcohol beverages, malt-based drinks present a different flavor: maltiness in barley mixed with a refreshing taste that is typically light and almost bubbly. Such flavors find great acceptance with many consumers seeking a deviation from the ordinary sweetened soda drinks or alcohol drinks.

These are usually because of increasing interests of most of the individuals around the globe that tend to drink less or stay away from it altogether, with malt-based soft drinks emerging to be perfect beverages, with good satisfaction yet having no alcohol-inducing impact. This has therefore created a high demand, especially for those people who love the taste of beer but do not want to take it because it contains alcohol while health-conscious consumers need a refreshing beverage low on calories.

The original/plain segment of the non-alcoholic beverage market remains strong in Australia as consumers increasingly seek authenticity, simplicity, and familiar flavors in a changing world. Consumers are getting increasingly conscious of what they put into their drinks. Such products are easy to enjoy in any type of setting as they do not require specific settings or expectations as flavored drinks may demand.

The core need for this is reliability, consistency of taste, and offering Australians a comfortable beverage that tastes refreshing and familiar. Refining these products, improving their taste profiles, and making even the simplest offers meet the quality standards will remain a priority.

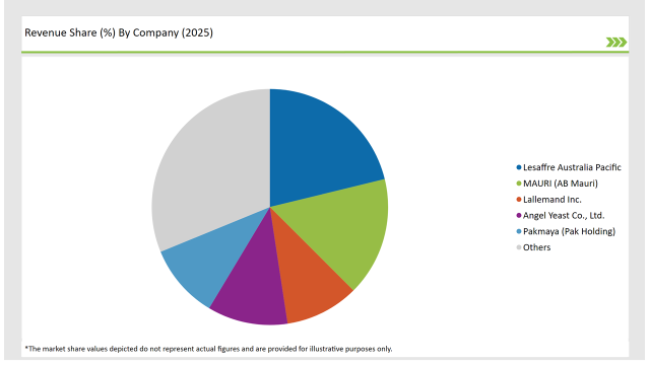

Tier 1 participants in the Australian non-alcoholic malt beverages market are the market leader companies that dominate a larger share of the market and drive trends primarily due to their well-established brand presence, widespread distribution networks, and innovation. Often, these are global or national beverage sector leaders, which have heavily invested in their non-alcoholic offerings.

Tier 2 players in the Australian non-alcoholic malt beverages market have a strong presence but not yet on the same scale and reach as Tier 1 players. Companies usually focus on high-quality, distinctive products to serve the growing demand for craft-style and innovative non-alcoholic drinks. This is where their niche, premium offers with unique flavors will position them as the sought-after choice of the health-conscious and flavor-conscious consumer.

Tier 3 players represent the smaller, emerging brands in the Australian non-alcoholic malt beverages market. These companies focus on a particular consumer segment or product innovation and often operate regionally or within specific niche categories. Smaller brands are agile and respond fast to market changes, hence acting as innovative disruptors within the market.

2025 Market share of Australia Non-Alcoholic Malt Beverages manufacturers

As per the product type segment, the market is segregated into malt beers, malt-based soft drinks, malt extracts, and others.

As per the flavor segment, the market is segregated into original/plain, flavored, and herbal.

As per the packaging type segment, the market is segregated into cans, bottles, pouches, and others.

As per the distribution channel segment, the market is segregated into B2B/HoReCa, and B2C (hypermarkets/supermarkets, convenience stores, online retail, and others).

By 2025, the Australian Non-Alcoholic Malt Beverages market is expected to grow at a CAGR of 13.3%.

By 2035, the sales value of the Australian Non-Alcoholic Malt Beverages industry is expected to reach USD 308.4 million.

Key factors propelling the Australian Non-Alcoholic Malt Beverages market include growing popularity of social drinking without the intoxication, changing consumer perception of alcohol-free beverages as trendy, integration of functional ingredients for health-focused offerings, and emergence of alternative malt-based beverages with unique ingredients.

Prominent players in Australia Non-Alcoholic Malt Beverages manufacturing include Carlton & United Breweries, Asahi Beverages Australia, Coca-Cola Amatil, PepsiCo, Inc., Coopers Brewery, Little Creatures Brewing, Stone & Wood Brewing, Mountain Goat Beer, 4 Pines Brewing Company, and Young & Jackson, among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Australia Pallet Wraps Market Size and Share Forecast Outlook 2025 to 2035

Australia and South Pacific islands Tourism Market Size and Share Forecast Outlook 2025 to 2035

Australia Legal Cannabis Market - Size, Share, and Forecast 2025 to 2035

Australia Probiotic Supplements Market Trends – Growth, Demand & Forecast 2025–2035

Australia Chickpea Protein Market Outlook – Demand, Trends & Forecast 2025–2035

Australia Non-Dairy Creamer Market Outlook – Size, Demand & Forecast 2025–2035

Australia Chitin Market Analysis – Growth, Size & Forecast 2025–2035

Australia Bubble Tea Market Trends – Size, Share & Forecast 2025–2035

Australia Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

Australia Food Testing Services Market Growth – Trends, Demand & Innovations 2025–2035

Australia Food Emulsifier Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Pulses Market Report – Trends, Demand & Industry Forecast 2025–2035

Australia Probiotic Strains Market Growth – Trends, Demand & Innovations 2025–2035

Australia Frozen Ready Meals Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Yerba Mate Market Growth – Trends, Demand & Innovations 2025–2035

Australia Sweetener Market Analysis – Size, Share & Forecast 2025–2035

Australia Food Service Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Yeast Extract Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Canned Tuna Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Calf Milk Replacer Market Outlook – Share, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA