The Australian Food Service Equipment market is estimated to be worth USD 671.9 million by 2025 and is projected to reach a value of USD 1,664.7 million by 2035, growing at a CAGR of 3.4% over the assessment period 2025 to 2035

| Attributes | Values |

|---|---|

| Estimated Australia Industry Size in CY 2025 | USD 671.9 million |

| Projected Australia Value in CY2035 | USD 1,664.7 million |

| Value-based CAGR from CY 2025 to CY 2035 | 3.4% |

The Food service equipment market in Australia covers tools, machines, and devices used for commercial kitchens: cooking equipment, refrigeration units, food processing tools, and storage solutions. In general, the Food service market encompasses restaurants, cafes, catering services, and institutional cafeterias.

With demand for dining experience continually increasing, more sophisticated, efficient, and environmentally friendly equipment must be provided for consumer expectations as well as adherence to regulatory requirements.

This market is important to Australia because it supports the nation's rich hospitality and food sectors, as they are quite potent contributors to the economy. Given such trends as health-conscious eating and sustainability, along with automation, the demand for innovative equipment that helps improve operational efficiencies and reduce energy consumption while enhancing safety will gain importance.

More importantly, this market thrives due to increased focus by the government towards sustainability as individuals embrace energy-saving and eco-friendly products. Overall, Food service equipment has played an integral role in furthering the growth and innovation process in the Australian Food service sector.

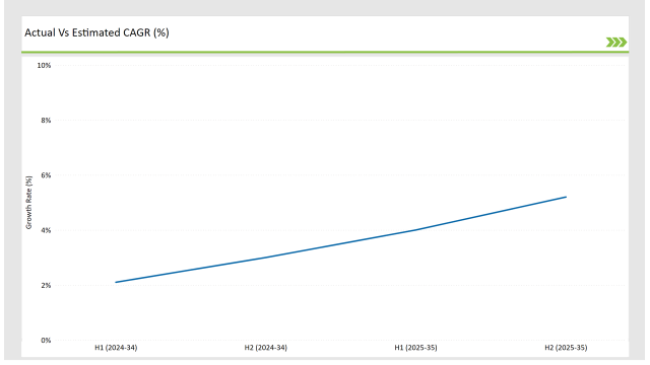

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Australian Food Service Equipment market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Food Service Equipment sector is predicted to grow at a CAGR of 6.6% during the first half of 2025, increasing to 7.0% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 5.9% in H1 but is expected to rise to 6.4% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

These numbers represent the highly dynamic Australian Food Service Equipment landscape that is experiencing change from influence factors such as changing regulations, shifts in consumers' needs, and the evolution of cooking technologies.

It helps organizations stay on track to take up anticipated opportunities and deal with challenges in this evolving market context. Understanding these trends thus enables stakeholders to adapt their strategy effectively, to position themselves for success within a competitive, dynamic industry.

| Date | Development/M&A Activity & Details |

|---|---|

| October 2024 | RATIONAL recently launched a "Test-to-Buy" program for its iVario cooking system. This program lets Food service operators test the equipment before buying it, helping to make more informed decisions and increasing potential penetration rates. |

| October 2024 | The Galaxy Group's Pegasus Ovens appeared on Dave Portnoy's One Bite Pizza Reviews, showing their performance and quality. Such exposure will be beneficial in making the ovens popular among Food service operators seeking reliable cooking solutions. |

Embrace of Smart Kitchen Technology

This market is significant in Australia because it supports the nation's rich hospitality and food sectors, as they are quite potent contributors to the economy. In light of such trends as health-conscious eating and sustainability, coupled with automation, the need for innovative equipment that helps improve operational efficiencies and reduces energy consumption while enhancing safety will grow in importance.

Moreover, increased online food delivery services and fast-casual dining demand more equipment for such business models. The government's focus on sustainability helps the market wherein people move towards energy-efficient, non-polluting products. In summary, Food service equipment is vital to assisting the expansion as well as modernization of the Australian Food service industry.

Growth of Delivery-Optimized Equipment

Food delivery services in Australia have seen the Food service equipment market adapt to the needs of businesses that primarily rely on takeout and delivery. Equipment used to keep food fresh during transportation, including heated delivery bags, temperature-controlled food storage units, and efficient packaging systems, is growing in popularity.

Restaurants and cafes in Australian cities are now making use of the delivery model to cater to a more extensive population. This has created more demand for the equipment that ensures food reaches the customer's doorstep in the best possible condition.

For instance, equipment that will make sure food reaches the customer's doorstep at the right temperature such as heat-retention technology in packaging becomes essential for retaining customer satisfaction. There is also increased use of special food warmers and transport units in kitchens.

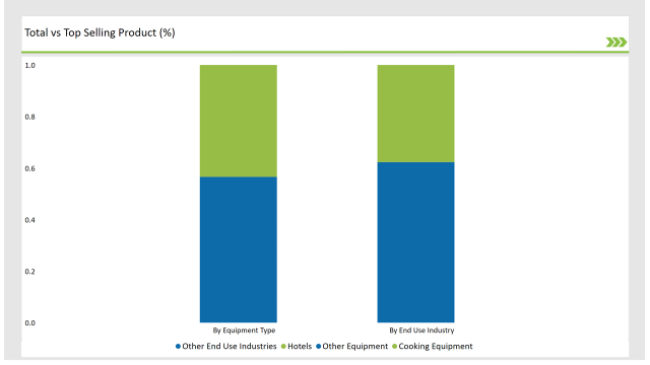

% share of Individual categories by Equipment Type and End Use Industry in 2025

The hospitality industry is the biggest usage segment driving the Food service equipment market in Australia. Due to the existence of numerous high-class hotels, resorts, and boutique accommodations around the country, especially in larger cities such as Sydney, Melbourne, and Brisbane, there is immense demand for state-of-the-art kitchen equipment.

Hotels depend on big, efficient kitchen arrangements that can accommodate a wide range of culinary demands, from room service to event catering, often requiring sophisticated and versatile equipment. Apart from supporting diverse Food service offerings-be it a buffet, fine dining, banquet facilities, or casual eateries within the premises-hotels require equipment that does so.

With steady growth in Australia's tourism industry, especially in regions that attract international and domestic visitors, hotels are rapidly upgrading their kitchens with advanced Food service equipment to meet both culinary excellence and efficient operation.

Cooking equipment is leading in the Australian Food service equipment market as cooking equipment plays an important role in ensuring efficiency and quality of food preparation in almost all Food service operations. In other words, the cooking equipment sector is highly needed in commercial kitchen operations of a hotel or a restaurant, as well as for fast-casual eateries and catering business.

In Australia, the Food service industry is increasing to meet the demand for cooking equipment. It is a booming sector, which goes hand in hand with novel dining concepts and diversified culinary offerings.

Rapidly growing food culture has led chefs and restaurateurs to use more sophisticated cooking equipment in Sydney, Melbourne, and Brisbane to enhance food quality and speed of preparation while ensuring consistency. Combi-ovens, induction cookers, and griddles are equipment necessary for modern kitchens that aim to deliver varied and complex menus with a high standard of service.

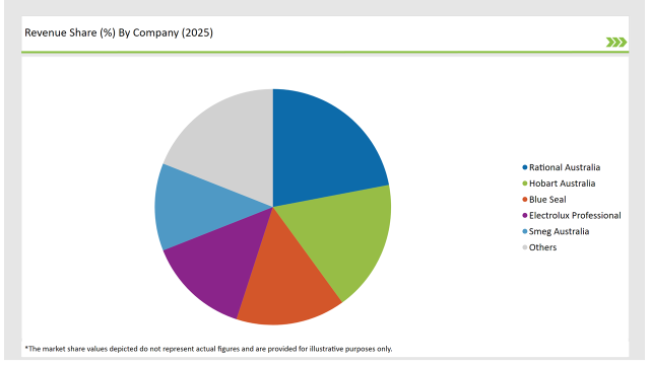

2025 Market share of Australia Food Service Equipment manufacturers

Note: The above chart is indicative in nature

Tier 1 is dominated by the big, well-known players on the domestic front and international manufacturers, who have a very large share of the market through rich product offerings and wide distribution networks. They are well established in Australia and are known for providing high-quality, reliable equipment.

Tier 2 players in the Australian Food service equipment market are mid-tier manufacturers and regional players who play their part in reaching small and medium-sized businesses that have medium levels of operational and budgetary requirements. They typically make products that are either associated with specific types of equipment, such as specialized refrigeration systems, ovens, or fryers, or price points from the high-end offerings.

Tier 3 brands for the Australian Food service equipment market are the small, local players, as well as newer manufacturers. Their product lines typically consist of niche products, like compact appliances, custom kitchen equipment, or new solutions targeting small Food service operators or start-ups.

The industry includes various equipment type of food and drink preparation equipment, cooking equipment, heating and holding equipment, dishwasher and sanitation equipment, refrigerators and chillers, baking equipment, food packaging and wrapping equipment.

The end use industry includes Hotels, fast food restaurants, commercial kitchen, institutional canteens and cafeteria, bakery, travel retail services, and household.

By 2025, the Australian Food Service Equipment market is expected to grow at a CAGR of 3.4%

By 2035, the sales value of the Australian Food Service Equipment industry is expected to reach USD 1,664.7 million.

Key factors propelling the Australian Food Service Equipment market include increasing preference for fast-casual dining, quick-service restaurants (QSRs), and mobile food vendors, technological advancements in cooking equipment, and focusing on operational efficiency and cost management.

Prominent players in Australia Food Service Equipment manufacturing include Rational Australia, Hobart Australia, Blue Seal, Smeg Australia, Electrolux Professional, Moffat, Burton's Food service, The Coffee Emporium, Fisher & Paykel Professional, Rancilio Group Australia, Williams Refrigeration, Hoshizaki Australia, Lainox Australia, Vektor, and Cookon among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Market Share Distribution Among Food Service Equipment Companies

UK Food Service Equipment Market Trends – Growth, Demand & Forecast 2025–2035

USA Food Service Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Food Testing Services Market Growth – Trends, Demand & Innovations 2025–2035

ASEAN Food Service Equipment Market Trends – Growth, Demand & Forecast 2025–2035

Europe Food Service Equipment Market Outlook – Size, Trends & Forecast 2025–2035

Commercial Food Service Equipment Market Growth – Trends & Forecast 2024-2034

Latin America Food Service Equipment Market Trends – Growth, Demand & Forecast 2025–2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Foodservice Paper Bag Companies

Europe Foodservice Disposables Market Insights – Growth & Trends 2024-2034

Foodservice Disposable Market Growth & Trends Forecast 2024-2034

Food Service Industry - Size, Share, and Forecast 2025 to 2035

Food Service Coffee Market Analysis by Type and End User Through 2035

Australia Food Emulsifier Market Insights – Demand, Size & Industry Trends 2025–2035

Food Holding Equipment Market Size and Share Forecast Outlook 2025 to 2035

Food Serving Equipment Market Size and Share Forecast Outlook 2025 to 2035

Food Testing Services Market Size, Growth, and Forecast for 2025–2035

USA Food Service Industry Analysis from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA