The Australia concrete pump market covers the demand for mechanical devices used to transfer liquid concrete through pumping, primarily across the construction, infrastructure, mining, and industrial sectors. These pumps are critical for delivering concrete in high-rise buildings, tunnels, bridges, and remote sites, offering speed, precision, and labour efficiency.

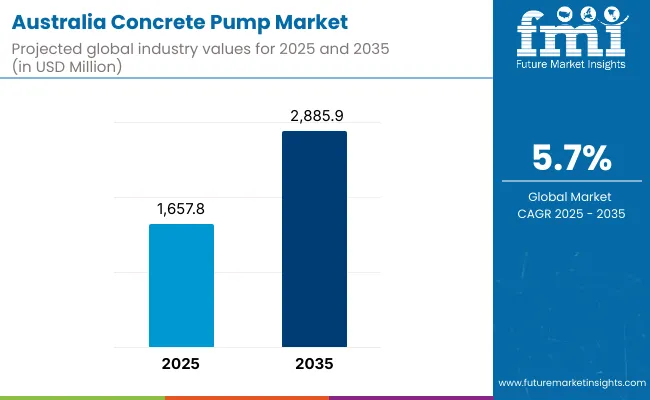

Australia’s concrete pump industry is heavily influenced by infrastructure development, urban expansion, mining investments, and growing interest in automation and operator safety. In 2025, the Australian concrete pump market is projected to reach approximately USD 1,657.8 million, and is expected to grow to around USD 2,885.9 million by 2035, reflecting a Compound Annual Growth Rate (CAGR) of 5.7% during the forecast period.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 1,657.8 Million |

| Projected Market Size in 2035 | USD 2,885.9 Million |

| CAGR (2025 to 2035) | 5.7% |

As per the market insights, in terms of share, concrete pump market in eastern Australia, which includes New South Wales, Victoria and Queensland, captures the substantial pie on account of rapid urbanization, public infrastructure spend and high rise construction in Sydney, Brisbane and Melbourne.

Demand for truck-mounted boom pumps and trailer-mounted pumps are driven by major transport projects such as the Sydney Metro, Cross River Rail and West Gate Tunnel. The area is also home to large concrete pump rental fleets and domestic manufacturing operations.

Demand remains strong in southern Australia, particularly South Australia and Tasmania, with moderate but steady demand driven by roadworks, port infrastructure, renewable energy projects and regional housing. Concrete pumps are widely used in Adelaide for civil tunnelling and public transit extensions, while Tasmania’s hydropower and tourism infrastructure boom favours small and mid-size line pumps. Low-emission pumping systems for eco-sensitive areas are drawing greater interest.

In Northern Territory and the northern half of Queensland, the market is driven by remote construction requirements, mining operations, and cyclone-hardened infrastructure projects. On rugged terrains, contractors usually prefer high-pressure stationary pumps for long-distance delivery. Mining activity close to Darwin and Mount Isa underpins growth, as do traffic-setting federal initiatives on remote housing and defence upgrades, with mobile and skid-mounted pumps driving flexible deployment.

Western Australia is a key market for concrete pumps driven by intensive mining activities, offshore LNG infrastructure, and urbanisation in Perth. High demand for heavy-duty concrete pumps in these regions, which need to handle abrasive material loads and high output required throughout the Pilbara and Goldfields regions. In Perth, development of industrial and commercial mega projects, such as the new health campus, drive the demand for long reach boom pumps and automated control systems.

Extending over the dry interior of Queensland, South Australia, Northern Territory and Western Australia, Central Australia’s market is small but the upgrades to infrastructure, sealing of roads, and government housing programs in Indigenous communities are important.

Due to harsh climate conditions and limited access to ready-mix facilities, mobile and trailer-mounted pumps are preferred that provide off-grid capability. In Alice Springs and regional corridors this usually relies on pump-and-mix solutions with diesel powered, compact units.

Equipment Cost, Labour Shortages, and Emission Regulations

Australia concrete pump market included a mix of growing capex along with the skilled man force-shortage coupled with the pressure of tightening environmental regulations. The rising cost of imported concrete pumping equipment, particularly in Europe and Asia, threatens small construction company’s ability to expand operations.

Furthermore, a lack of qualified pump operators and maintenance technicians is causing delays in delivery timelines for projects, particularly in regional and remote locations. New Stage V engine regulations as well as low-emission mandates arising from government funded infrastructure projects are generating an immediate demand for greener, more fuel-efficient pumping solutions, which may necessitate substantial fleet upgrades.

Infrastructure Pipeline, High-Rise Construction, and Equipment Rental Expansion

Despite these challenges, there is significant opportunity for growth in the wake of Australia’s billion-dollar investment plans into infrastructure for transport corridors, rail projects, and urban redevelopment. Even with tight restrictions on the number of new subdivisions of land in each state, the demand for truck-mounted boom pumps and high-pressure line pumps is also on the rise, thanks to the increasing supply of multi-storey residential and commercial towers in Sydney, Melbourne and Brisbane.

In addition, the booming equipment rental companies are also broadening the availability of concrete pumps to small contractors as well. In urban and remote construction sites, the increasing integration of telematics-enabled fleet management, remote diagnostics, and safety-enhanced pump controls are anticipated to improve operational efficiency and compliance.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Safe Work Australia emphasized concrete pump safety guidelines, including hose whip prevention, pipeline inspections, and operator certifications. States imposed axle weight and height restrictions on pump trucks. |

| Equipment Trends | Boom pumps dominated high-rise developments, while line pumps served housing and remote-area projects. Diesel-powered pumps with Euro V engines were preferred for efficiency and power. |

| Contractor & Builder Preferences | Builders preferred pump types with easy manoeuvrability, quick setup, and minimal maintenance. Rental models surged due to project-based needs and high upfront costs of large pump units. |

| Technology & Manufacturing Innovations | OEMs offered advanced hydraulic systems, digital throttle controls, and high-pressure output features. Telematics were adopted by large contractors for asset tracking. |

| Sustainability & Circular Economy | Steps were taken to reduce emissions via fuel-efficient engines and biodegradable hydraulic oils. Some rental companies introduced maintenance recycling programs for hoses and worn parts. |

| Public Infrastructure Influence | Government fast-tracked bridge, tunnel, and roadworks under the "Infrastructure Investment Program." High-volume concrete pours required reliable pumping for rapid execution and scheduling compliance. |

| Urban & Regional Construction Impact | Demand grew in metro and peri -urban areas as housing demand surged post-lockdown. Rental firms catered to region-specific jobsites in NSW, VIC, and QLD. |

| Market Growth Drivers | Growth driven by housing booms, government stimulus for shovel-ready projects, and preference for efficient concrete delivery in urban centres. Rental flexibility also supported contractor agility. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Green Building Council of Australia (GBCA) and revised NCC codes encourage zero-emission equipment. Emission regulations, noise standards, and workplace automation protocols enforce use of electric pumps and AI-based monitoring for compliance and sustainability reporting. |

| Equipment Trends | Electric and hybrid concrete pumps gain momentum, especially in urban and tunnel applications. Automated, AI-enhanced pumps with real-time diagnostics, autonomous operation, and remote control become essential to large-scale smart construction projects. |

| Contractor & Builder Preferences | Shift toward owning smart, energy-efficient pump fleets supported by digital fleet management. Preference grows for low-noise, low-vibration equipment that meets local council noise restrictions and environmental guidelines for green construction zones. |

| Technology & Manufacturing Innovations | Development of AI-integrated concrete pumps with adaptive pressure systems, wear detection, and performance prediction. Local fabrication with 3D-printed parts and modular pump chassis enhances serviceability and customization for diverse site conditions. |

| Sustainability & Circular Economy | Strong adoption of net-zero and circular economy models with electric pump fleets powered by on-site solar generators. Recyclable components, eco-friendly fluids, and block chain-based asset lifecycle tracking systems redefine equipment sustainability metrics. |

| Public Infrastructure Influence | Concrete pumps play a key role in automated construction of transport corridors, smart logistics hubs, and renewable energy plants. Public procurement prioritizes green-certified equipment, digital twin modelling integration, and autonomous equipment for better project visibility. |

| Urban & Regional Construction Impact | Growth in high-density, vertical housing and modular urban development’s drives adoption of compact and intelligent concrete pump systems with real-time mix quality monitoring. Regional renewable energy and agribusiness projects require mobile, self-powered pumping units. |

| Market Growth Drivers | Expansion driven by automation in construction, ESG compliance pressure, smart city development, and electrification mandates. Increasing use of AI and data analytics in fleet and project planning strengthens demand for intelligent and efficient concrete pumping solutions. |

Demand for mobile pumps in WA is strong, driven by an active mining sector and major resource-world infrastructure and remote construction projects. Concrete pumps are used widely across FIFO camps, mine site facilities, rail and port projects. State also needs heavy-duty line and boom pumps for industrial warehouses, LNG terminal upgrades, and offshore platform support facilities. With WA set for more mining expansions and remote-area housing, demand for durable high-output concrete pumping solutions will continue to increase.

| State | CAGR (2025 to 2035) |

|---|---|

| Western Australia | 5.9% |

Queensland’s concrete pump market continues to grow slowly, driven by urban infrastructure, transport tunnels and coastal real estate developments. This sort of construction is part of the heavy investments being made in the Brisbane metro area and Gold Coast in road upgrades, high-rise condos and waterway restoration, and all of those will require small, nimble systems to pump concrete.

Also, in the state’s north, the demand is growing from renewable energy farms and also from remote airport upgrades, where trailer-mounted pumps are best suited. Beyond Zimbabwe’s borders, population growth and climate-adaptive construction will keep demand robust throughout the region.

| State | CAGR (2025 to 2035) |

|---|---|

| Seoul | 5.8% |

Sydney, as the largest construction market in Australia, is the market driver for high-capacity boom pumps, more precise line pumps and digitally monitored concrete delivery systems across New South Wales. Such large construction projects as Sydney Metro, Parramatta Square, and Western Sydney Airport are generating consistent market demand.

Urban density is driving adoption of telescopic boom pumps for tight-access pouring, particularly for high-rise and podium builds. For next-gen pump tech and operator training programs, NSW continues to be a major draw as the market matures towards productivity and safety.

| State | CAGR (2025 to 2035) |

|---|---|

| New South Wales | 6.0% |

With ambitious transport infrastructure plans along with modular residential construction and high-density urban projects, Victoria drives a robust demand for concrete pumps in the commercial segment. And nowhere is this more evident than in the Melbourne metro region - a major hot spot, with concrete pumping systems at work for rail extensions, metro tunnels and apartment blocks.

Concrete contractors in Victoria are choosing GPS-enabled concrete pumps and fleet-managed dispatch solutions for enhanced jobsite coordination. The state’s drive toward green building codes has additionally increased demand for energy-efficient pumps and carbon tracking capabilities.

| State | CAGR (2025 to 2035) |

|---|---|

| Victoria | 5.7% |

In Australia, mobile concrete pumps are the preferred option throughout construction sites with their ease of transportation, faster set-up time and appropriate for the country’s diverse topography. These truck-mounted units are widely known in high density urban tight locations and in regional job sites, especially in New South Wales and Queensland, where we’re seeing an acceleration in infrastructure.

Mobile concrete pumps are particularly well-suited for fast-paced environments where high volumes of concrete are poured over a wide and complex layout. Unlike static models, they do not require a permanent setup or extensive site preparation, which makes lead times shorter a critical factor in Australia’s rapid-fire construction time frames.

There’s also a strong link between the widespread use of mobile pumps and the operational challenges presented by Australia’s labour market. With the construction industry continuing to face skills shortages and builders feeling the pressure from rising costs, there is a need for machinery that can improve site productivity without needing to have specialist operators.

Enter mobile concrete pumps, closing this gap with rigs that include operator-friendly systems like remote control booms and adjustable outriggers, providing safe, accurate concrete placement with lighter crew involvement. These units also excel in multi-zone projects like roads, bridges, and suburban housing developments, where repositioning between pours must be fast and leave little trace on site.

Mobile pumps are also being utilized by contractors Australia wide, to meet the occupational health and safety regulations between site ergonomics and the reduction of manual handling. In cities where urban development is tightly packed, such as Melbourne and Perth, and access for construction can be hindered by neighbouring properties and road conditions, mobile pumps enable teams to perform high-rise and infill without creating a large footprint. Longer reach and compatibility with high-strength mixes also increases their value on multi-storey projects in the growing residential-commercial crossover segment.

Based on end use, the residential segment considers the leading end-use concrete pumps in Australia, backed by the nationwide drive to meet rising housing demand, particularly in urban and peri-urban areas. In additions to another wave of low- to mid-rise residential growth in Brisbane, Canberra, and Adelaide, these markets serve as bellwethers for urban sprawl driven by population growth, government subsidized housing, and migration.

It has become more common to use concrete pumps to accelerate foundation works, floor slabs, and vertical core construction, with mobile systems often preferred due to their capability to quickly pour in confined areas. Concrete pumps are vital for residential neighbourhoods that have narrow streets and limited access, as they help minimize disruption while maximizing construction efficiency.

The residential sector’s need for concrete pumping solutions is also driven by the proliferation of infill and dual occupancy developments in suburbs across Australia. As land availability shrinks and zoning rules change, builders face an increasing number of split-lot constructions, extensions and vertical additions projects that typically introduce logistical headaches for traditional delivery methods of concrete.

Concrete pumps offer an efficient process for pouring, especially in narrow or inclined lots, backyards and under-roof builds. With the extended reach of the boom, the builders can work over fences or narrow driveways, and placing them with great accuracy, without the need for transportation by hand for long distances. This has become particularly crucial in cities such as Sydney, where space limitations and noise constraints dictate how we undertake residential construction.

In addition to detached housing, Australia’s residential sector also encompasses a growing pool of apartment complexes, aged care and build-to-rent developments. In these contexts, the speed of construction, as well as project phasing, are crucial to investor returns and tenant on boarding.

Concrete pumps especially mobile and trailer-mounted systems enable developers to adhere to strict construction timelines by minimizing delays in concrete delivery and preventing the effects of weather or traffic interference. And as residential builders increasingly include precast and post-tensioned elements in designs, the necessity of equipment to provide fast, uniform concrete placement becomes all the more important. In this fast-moving, regulation-heavy segment, concrete pumps have evolved from a supporting act to the star of the show, as homes and communities from coast to coast are built out around this method. The integration of automation auxiliary systems is enhancing efficiency and precision across Australia's concrete pump market.

Continuous investment in infrastructure, real estate activity and improvement of mining-related construction are helping bolster the Australia Concrete Pump Market. The demand for concrete pumping for urban high-rise projects, highway upgrades, and tunnelling, mining and residential developments remains robust with booming activity in city centres including Sydney, Melbourne, Brisbane and Perth. Adoption of truck-mounted boom pumps, trailer pumps and line pumps is being driven by the trend toward faster, safer, and more labour-efficient placement of concrete.

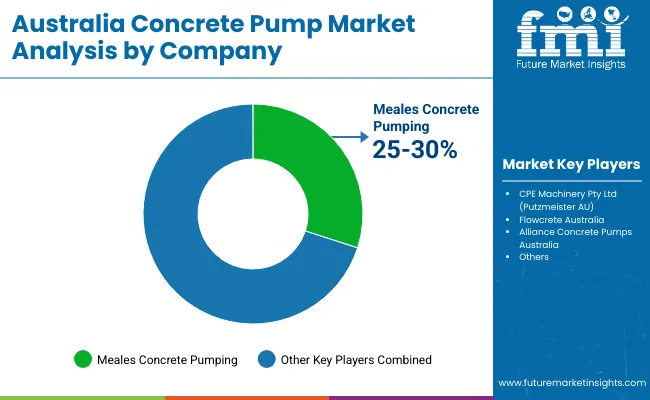

Market Share Analysis by Key Players

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Meales Concrete Pumping | 25-30% |

| CPE Machinery Pty Ltd (Putzmeister AU) | 18-22% |

| Flowcrete Australia | 12-16% |

| Alliance Concrete Pumps Australia | 10-14% |

| Others (DY Concrete Pumps, Zoomlion AU, small fleets) | 18-25% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Meales Concrete Pumping | Meales is Australia’s largest concrete pumping service provider, dominating infrastructure and mining sectors. With the country’s most extensive fleet, it supplies boom, line, and mobile pumps to major urban and remote construction sites. Its partnerships with Tier 1 contractors and deep experience in rail, high-rise, and LNG projects solidify its leadership across Queensland, Western Australia, and New South Wales. |

| CPE Machinery ( Putzmeister Australia) | As the exclusive distributor of Putzmeister , CPE Machinery offers advanced truck-mounted boom pumps, stationary pumps, and placing booms across Australia. It is recognized for technical expertise, German engineering standards, and long-term relationships with fleet operators and contractors. Its after-sales service, training, and fleet telemetry upgrades provide a major competitive edge. |

| Flowcrete Australia | Flowcrete serves mid- to large-scale civil projects across New South Wales and Victoria. The company is known for its agility, on-time deployment, and integration with ready-mix suppliers. It is frequently contracted for transport upgrades and urban development projects where manoeuvrability and reliability are critical. |

| Alliance Concrete Pumps Australia | Alliance focuses on durable, mid-range boom and line pumps ideal for urban construction and regional contracting. It appeals to smaller fleet owners and private contractors with competitive pricing and user-friendly equipment. Its market share has grown due to availability of local servicing and tailored pump configurations. |

The overall market size for fibre optic gyroscope industry analysis in Korea was USD 1,657.8 million in 2025.

Australia Concrete Pump Market is expected to reach USD 2,885.9 million in 2035.

The Infrastructure development, urban expansion, mining investments, and growing interest in automation and operator safety will drive the demand for Australia concrete pump market.

The top 5 cities which drives the development of Australia concrete pump market are Western Australia, Victoria, New South Wales, Victoria.

Residential Sector expected to grow to command significant share over the assessment period. Residential Sector expected to grow to command significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Australia Pallet Wraps Market Size and Share Forecast Outlook 2025 to 2035

Australia and South Pacific islands Tourism Market Size and Share Forecast Outlook 2025 to 2035

Australia Legal Cannabis Market - Size, Share, and Forecast 2025 to 2035

Australia Probiotic Supplements Market Trends – Growth, Demand & Forecast 2025–2035

Australia Chickpea Protein Market Outlook – Demand, Trends & Forecast 2025–2035

Australia Non-Dairy Creamer Market Outlook – Size, Demand & Forecast 2025–2035

Australia Chitin Market Analysis – Growth, Size & Forecast 2025–2035

Australia Bubble Tea Market Trends – Size, Share & Forecast 2025–2035

Australia Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

Australia Non-Alcoholic Malt Beverages Market Insights - Trends & Forecast 2025 to 2035

Australia Food Testing Services Market Growth – Trends, Demand & Innovations 2025–2035

Australia Food Emulsifier Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Pulses Market Report – Trends, Demand & Industry Forecast 2025–2035

Australia Probiotic Strains Market Growth – Trends, Demand & Innovations 2025–2035

Australia Frozen Ready Meals Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Yerba Mate Market Growth – Trends, Demand & Innovations 2025–2035

Australia Sweetener Market Analysis – Size, Share & Forecast 2025–2035

Australia Food Service Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Yeast Extract Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Canned Tuna Market Insights – Demand, Size & Industry Trends 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA