The Australia Non-Dairy Creamer market is estimated to be worth USD 113.6 million by 2025 and is projected to reach a value of USD 291.1 million by 2035, growing at a CAGR of 6.8% over the assessment period 2025 to 2035.

| Attributes | Values |

|---|---|

| Estimated Australia Industry Size in 2025 | USD 113.6 million |

| Projected Australia Value in 2035 | USD 291.1 million |

| Value-based CAGR from 2025 to 2035 | 6.8% |

The non-dairy creamers market in Australia is the production, distribution, and consumption of plant-based or synthetic cream substitutes, mainly used in beverages like coffee and tea and in cooking and baking. The creamers are formulated with plant-based ingredients like coconut milk, almond milk, oat milk, or soy protein and contain extra flavors and stabilizers for the feel and taste of dairy cream.

Being lactose-free, non-dairy creamers are appropriate for those suffering from lactose intolerance but increasingly have been aimed at vegans, vegetarians, and consumers looking for a healthier or allergy-free option.

The growth and demand in the Australian market arise from consumers looking for alternatives for plant-based, health-conscious, and sustainable food products. Furthermore, rising dairy allergy awareness, moral issues over treatment of animals and environmental issues pertaining to dairy farming is increasing the need for non-dairy creamers.

Apart from this, an increasingly premium-oriented food and beverages market with high coffee culture demand are also fueling the need in Australia. Innovations in flavor, functional ingredients, and packaging also add benefit to the market, thus catering to a larger demographic beyond dietary limitations. In other words, the non-dairy creamers have turned out to be a developing as well as changing segment of the food industry in Australia.

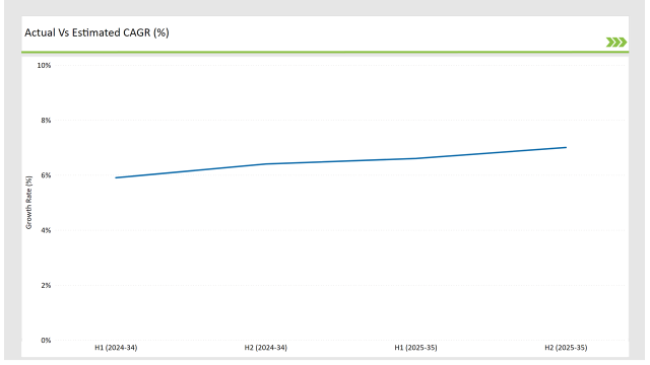

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Australian Non-Dairy Creamers market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Non-Dairy Creamers sector is predicted to grow at a CAGR of 6.6% during the first half of 2025, increasing to 7.0% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 5.9% in H1 but is expected to rise to 6.4% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

The Australian non-dairy creamers market landscape is dynamic, in a continuous flux of shifting consumer preferences, innovative developments, and evolving dynamics of the market. Key factors for this market include changes in product formulation, diet-related shifts, and a desire for diverse flavors in creamers, all contributing to this market growth.

This periodic analysis is helpful for businesses in sharpening strategies, tapping into emerging opportunities, and identifying challenges to efficiently overcome them and gain a competitive advantage in the marketplace.

| Date | Development/M&A Activity & Details |

|---|---|

| March 2024 | Califia Farms has introduced Organic Almond Creamers in Australia, marking its foray into the organic non-dairy creamer market. These creamers are USDA Certified Organic, devoid of gums and oils, and come in Lavender, Brown Sugar, and Vanilla tastes. |

| 2023 | Oatly, which is well-known for its oat-based goods, recently debuted oat milk and non-dairy creamers in Australia. These creamers meet the rising demand for plant-based alternatives, providing a creamy texture ideal for coffee and other drinks. |

The Coffeehouse Boom: Fueling Premium Non-Dairy Creamer Innovations

Australia's coffee culture is fast changing the non-dairy creamer market with a growing demand for premium, barista-style creamers that fit the café experience. Australians are proud of their coffee rituals, and specialty coffee shops are thriving in urban and regional areas. This has opened the door for specifically coffee connoisseur non-dairy creamers, providing superior frothing capability, rich mouthfeel, and flavor profile matching the nuances of coffee.

Brands have now been able to make a creamer that closely emulates the feeling and feel of dairy cream for lattes, cappuccinos, and flat whites. This trend has a two-pronged effect: first, non-dairy creamer companies are teaming up with cafes and coffee shops to market their products as alternatives in coffee shop menus. Second, retail sales of high-end non-dairy creamers are rising as consumers try to replicate the café experience at home.

Flavor-Centric Exploration: Regional Tastes and Indulgent Varieties

The multicultural demographic of Australia and adventurous palate are changing the face of non-dairy creamer marketplaces by introducing unique flavors that come from other cultures. Whether it is matcha or turmeric latte flavor, indulgent caramel, hazelnut, and vanilla flavor, consumers have a tendency toward products that will enhance the beverage experience with a bold or comforting flavor.Seasonal and limited-edition flavors fuel the trend, with excitement and driving impulse purchases.

The manufacturers can tap into this trend to build brand loyalty through personalization, for example, custom blends or DIY flavor kits. As a result, product portfolio diversification aside, flavor-based innovation promotes and fosters repeat purchase occasioning and increasing the consumer base for non-dairy creamers in Australia.

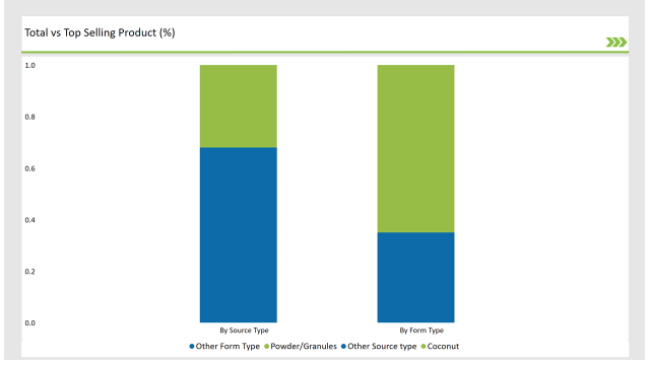

% share of Individual categories by Form Type and Source Type in 2025

The powder/granules segment dominates the Australian non-dairy creamer market in terms of unmatched convenience, versatility, and cost effectiveness. In a country dominated by busy lifestyles, powdered creamers have thus provided a hassle-free, long-shelf-life solution to consumers who demand ease of use. This format will benefit the office worker looking for a straightforward addition to the coffee and family consumers who may need a less expensive, mass option.

This is also the staple product among frequent travelers and outdoor enthusiasts in Australia because powdered non-dairy creamers are lightweight, easy to carry along, and blend with the increasing outdoor camping culture. Their versatility in reconstitution also makes them suitable for purposes beyond beverages, including baking and cooking, which appeals to health-conscious consumers to buy multipurpose products.

Coconut-based non-dairy creamers are currently at the forefront of the Australian market due to the uniqueness in their taste and flexibility to blend well with the taste preferences and healthy needs of Australians. Coconut cream has a rich, mild sweetness, blending with Australia's very lively coffee culture to become a popular option for plant-based alternatives among coffee drinkers.

Coconut-based creamers differ, because they infuse a refreshing taste that combines with a tang of the Pacific that most buyers associate with exotic beverage flavors or when incorporated into cooking.Australian health-conscious consumers mostly consume coconut products and have connected such products with a range of health benefits because the medium-chain triglycerides extracted from coconut act as an increasingly popular energy supplier among body fitness athletes.

Tier 1 cities like Sydney, Melbourne, and Brisbane tend to be highly dominated by non-dairy creamers due to their high population density, café culture, and the health-conscious urban consumer. They contain a major concentration of young professionals, expats, and millennials, who seek alternatives made from plants and innovative food products.

Tier 2 cities, which include Perth, Adelaide, and Hobart would be places where the market for non-dairy creamers would grow. These cities might not have a saturated specialty retailer presence but have a rising number of consumers who are increasingly influenced by urbanization trends.

Non-dairy creamers currently command very low and developing demand in Tier 3 markets, mainly the rural and remote regions of Australia. This is based on niche consumer bases with drivers like lactose intolerance or strict diets. The issue here remains that there is no significant accessibility for consumers as a result of minimal retail presence and transportation barriers.

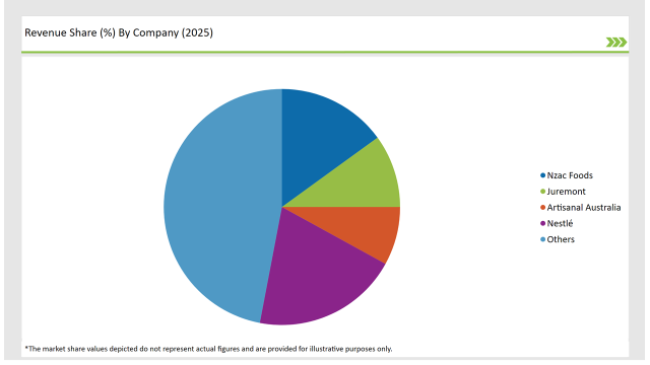

2025 Market share of Australia Non-Dairy Creamer manufacturers

The industry includes various form typeof Non-Dairy Creamers such as powder/granules, and liquid.

The industry includes various source type such as coconut, almond, soy, corn, and others.

The industry includes various flavor typeof Non-Dairy Creamers such as unflavored, french vanilla, chocolate, coconut, hazelnut, and others.

The industry includes various packaging typeof Non-Dairy Creamers such as sachets/pouches, canisters, bottles, and bags.

The industry includes numerousdistribution channel such as food service channels, hypermarkets / supermarkets, convenience stores, grocery stores, specialty stores, and online retail.

By 2025, the Australian Non-Dairy Creamer market is expected to grow at a CAGR of 6.8%

By 2035, the sales value of the Australian Non-Dairy Creamer industry is expected to reach USD 291.1 million.

Key factors propelling the Australian Non-Dairy Creamer market include increasing health-conscious among consumers, expanding vegan and plant-based lifestyles, innovations in flavors, and increasing demand for functional foods.

Prominent players in Australia Non-Dairy Creamer manufacturing include Nzac Foods, Juremont, Artisanal Australia, Nestlé, Danone, Kerry Group, Oatly, Cargill, Inc., and Ingredion among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Australia Pallet Wraps Market Size and Share Forecast Outlook 2025 to 2035

Australia and South Pacific islands Tourism Market Size and Share Forecast Outlook 2025 to 2035

Australia Legal Cannabis Market - Size, Share, and Forecast 2025 to 2035

Australia Probiotic Supplements Market Trends – Growth, Demand & Forecast 2025–2035

Australia Chickpea Protein Market Outlook – Demand, Trends & Forecast 2025–2035

Australia Chitin Market Analysis – Growth, Size & Forecast 2025–2035

Australia Bubble Tea Market Trends – Size, Share & Forecast 2025–2035

Australia Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

Australia Non-Alcoholic Malt Beverages Market Insights - Trends & Forecast 2025 to 2035

Australia Food Testing Services Market Growth – Trends, Demand & Innovations 2025–2035

Australia Food Emulsifier Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Pulses Market Report – Trends, Demand & Industry Forecast 2025–2035

Australia Probiotic Strains Market Growth – Trends, Demand & Innovations 2025–2035

Australia Frozen Ready Meals Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Yerba Mate Market Growth – Trends, Demand & Innovations 2025–2035

Australia Sweetener Market Analysis – Size, Share & Forecast 2025–2035

Australia Food Service Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Yeast Extract Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Canned Tuna Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Calf Milk Replacer Market Outlook – Share, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA