The Australia Food Emulsifier market is estimated to be worth USD 17.7 million by 2025 and is projected to reach a value of USD 53.3 million by 2035, growing at a CAGR of 6.4% over the assessment period 2025 to 2035

| Attributes | Values |

|---|---|

| Estimated Australia Industry Size in 2025 | USD 17.7 million |

| Projected Australia Value in 2035 | USD 53.3 million |

| Value-based CAGR from 2025 to 2035 | 6.4% |

Food emulsifier market, Australia is the share of ingredients that combine otherwise incompatible substances, like oil and water, in food and beverages. These Emulsifier are derived from plant or animal sources; lecithin, mono- and diglycerides, and other specialized agents like sorbitan esters and stearoyl lactylates. They are very crucial in ensuring texture, stability, and consistency among a range of processed foodstuffs such as dairy, baked products, confectionery items, beverages, and functional food.

In Australia, the role of food emulsifier is marked significantly in the dairy, bakery, and beverage sectors in terms of improving shelf life, taste, and texture uniformity. A significant demand for processed and convenient foods is on the rise; Emulsifier become pivotal in most product developments, particularly clean-label, allergen-free, and healthy offerings.

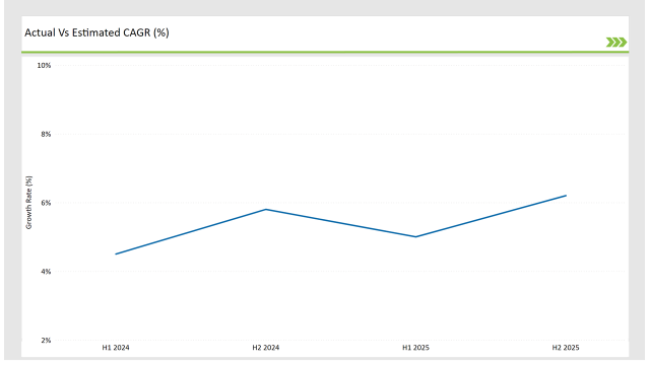

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Australian Food Emulsifier market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Food Emulsifier sector is predicted to grow at a CAGR of 4.5% during the first half of 2025, increasing to 5.8% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 5.0% in H1 but is expected to rise to 6.3% in H2.

This pattern reveals a decrease of 15 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 25 basis points in the second half of 2025 compared to the second half of 2024. These insights highlight the ever-changing landscape of the Australian food emulsifier market, shaped by factors like regulatory shifts, evolving consumer tastes, and advancements in emulsifier technologies.

This semi-annual overview is essential for companies looking to align their strategies with the expected growth trends while addressing the challenges and opportunities within the market. By understanding these key drivers, businesses can better navigate the complexities of the food emulsifier sector and position themselves for long-term success.

| Date | Development/M&A Activity & Details |

|---|---|

| November 2024 | Corbion demonstrated improvements to their AI-powered Listeria management algorithm, including additional capabilities to increase food safety. This breakthrough intends to give food makers with more effective methods for managing microbiological concerns, ultimately improving the safety and quality of emulsifier-containing goods. |

| 2023 | Vantage Food launched the SIMPLY KAKE emulsifier to address the rising demand for clean-label ingredients in Australia. This product provides a natural alternative to standard Emulsifier, appealing to health-conscious consumers who prefer goods with shorter ingredient lists. |

The Rise of Functional Foods and Nutraceutical Innovation

Growing health-conscious populations in Australia are the driving forces for functional foods and nutraceuticals, that is, food enhanced with added nutrients to offer health benefits over and above basic nutrition. Rising consumer awareness about the health benefits of functional ingredients such as probiotics, antioxidants, and omega-3 fatty acids has been driving products such as fortified snacks, beverages, and dietary supplements.

Emulsifier have a vital role to play in the stability and bioavailability of these added nutrients in functional foods. For example, Emulsifier can help blend fat-soluble vitamins or omega-3 oils together with water-based ingredients in fortified beverages or snacks.

Hence, the Australian market of Emulsifier is going to move higher with the demand for such specialized Emulsifier catering for these complex formulations. New Emulsifier are being developed with the aim of enhancing nutrient absorption, such as Emulsifier that will let probiotics survive during food processing and stay active in the final product.

Increasing Demand for Plant-Based Emulsifier in Dairy Alternatives

Sunflower lecithin or soy lecithin-based Emulsifier have become a prime ingredient in such alternative products. Consumers in Australia are more willing to buy dairy alternatives, mainly for health and ethical reasons with respect to the welfare of animals. The increase in demand for plant-based beverages and foods made Australian manufacturers invest in Emulsifier that will enhance the performance of their dairy alternatives while keeping the products clean and simple.

This trend is expected to impact the Australian market by opening up new product categories for emulsifier manufacturers, especially in the plant-based segment. Improvements will be focused by the manufacturers to improve functionality so that they deliver comparable characteristics like texture and stability, compared with the traditional Emulsifier, animal-based Emulsifier.

On the other hand, growth in consumption of plant-based foods is also seen as affecting local suppliers' strategy and products for more extended and diverse emulsifier markets..

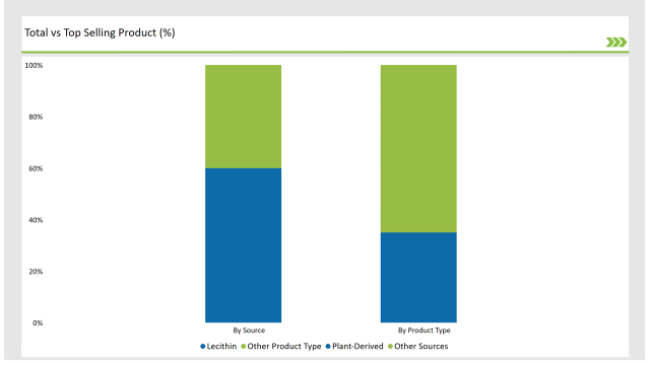

% share of Individual categories by Product Type and Source in 2025

Plant-derived Emulsifier have become the market leader in the Australian food emulsifier market, mainly due to a number of critical factors that are changing the nature of the country's food manufacturing industry. These factors are essentially driven by an increasing demand for plant-based food products, accompanied by consumer preference for healthier and more functional ingredients that correspond with the increasing awareness of dietary needs and food formulations.

As Australian consumers increasingly adopt plant-based diets, which range from vegan to vegetarian and dairy-free lifestyles, there is an increasing demand for plant-derived Emulsifier such as sunflower lecithin, soy lecithin, and palm oil derivatives. Their flexibility with the numerous formulations that they can fit into makes them even more attractive to Australian food manufacturers.

The lecithin segment has placed itself strongly in the emulsifier position, at least in the Australian food market, owing to versatility, performance, and versatility that can be spread across various food categories. Lecithin, derived from natural sources like soybeans and sunflower, is an essential emulsifier in many processed foods owing to texture, stability, and overall quality.

One main reason for this is the factor of dominance it holds in the Australian market for many reasons aligning with consumers and food manufacturer preferences. Lecithin is very effective in stabilizing emulsions, reducing viscosity, and improving the texture of products such as chocolates, bakery goods, spreads, and beverages.

In the Australian market, where a wide variety of food products is in demand, lecithin acts as an essential ingredient to ensure consistency and quality of products across these categories.

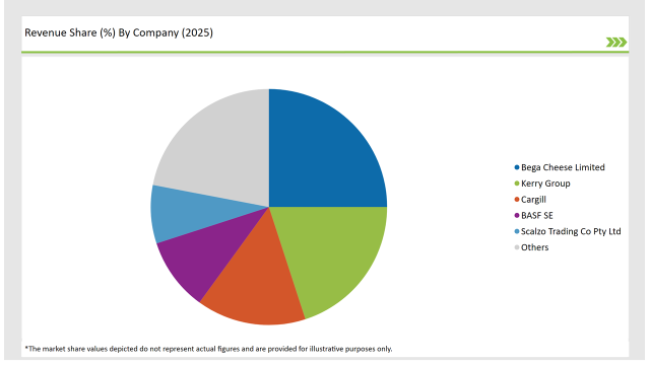

Tier1 big multinational corporations are the largest players in the food emulsifier market in Australia. They have an established presence in the local as well as the global market. They have a broad range of Emulsifier, catering to sectors such as bakery, dairy, beverages, and convenience foods. These players enjoy strong financial muscles, high-order research and development capabilities, and vast distribution networks.

Tier 2 companies in the Australian food emulsifier market include regional players. These are the players that provide more specific needs in the markets. They are strong in regions and can satisfy local food manufacturers with emulsifier solutions which are cost-effective and tailored to regional preferences.

Tier 3 players in the Australian food rmulsifier market are smaller emerging players that are mostly niche-market or regional specific. These companies are more agile and innovative and can respond very quickly to new trends in the food industry, such as the emergence of plant-based food alternatives or clean-label demands.

2025 Market share of Australia Food Emulsifier manufacturers

Note: The above chart is indicative in nature

The industry includes various product type of Food Emulsifier such as lecithin, mono & di-glycerides, sorbitan esters, polyglycerol esters, stearoyllactylates, others.

The industry includes various source such as plant-derived, and animal-derived.

As per the market, the application segment is segregated into bakeries, confectionaries, dairy products, functional foods, and others.

By 2025, the Australian Food Emulsifier market is expected to grow at a CAGR of 6.4%

By 2035, the sales value of the Australian Food Emulsifier industry is expected to reach USD 53.3 million.

Key factors propelling the Australian Food Emulsifier market include surge in protein-enriched and meal-replacement products, advancements in emulsifier technology and customization, and expansion for functional and nutritional foods.

Prominent players in Australia Food Emulsifier manufacturing include Scalzo Trading Co Pty Ltd., Davis Food Ingredients, Bega Cheese Limited, Oleo-Fats, Cargill, BASF SE, Kerry Group, Tri-Tech Chemical Company, Corbion N.V., Vantage Food, Florentia, Anzchem (ABFI) among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Australia Pallet Wraps Market Size and Share Forecast Outlook 2025 to 2035

Australia and South Pacific islands Tourism Market Size and Share Forecast Outlook 2025 to 2035

Australia Legal Cannabis Market - Size, Share, and Forecast 2025 to 2035

Australia Probiotic Supplements Market Trends – Growth, Demand & Forecast 2025–2035

Australia Chickpea Protein Market Outlook – Demand, Trends & Forecast 2025–2035

Australia Non-Dairy Creamer Market Outlook – Size, Demand & Forecast 2025–2035

Australia Chitin Market Analysis – Growth, Size & Forecast 2025–2035

Australia Bubble Tea Market Trends – Size, Share & Forecast 2025–2035

Australia Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

Australia Non-Alcoholic Malt Beverages Market Insights - Trends & Forecast 2025 to 2035

Australia Pulses Market Report – Trends, Demand & Industry Forecast 2025–2035

Australia Probiotic Strains Market Growth – Trends, Demand & Innovations 2025–2035

Australia Frozen Ready Meals Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Yerba Mate Market Growth – Trends, Demand & Innovations 2025–2035

Australia Sweetener Market Analysis – Size, Share & Forecast 2025–2035

Australia Yeast Extract Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Canned Tuna Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Calf Milk Replacer Market Outlook – Share, Growth & Forecast 2025–2035

Australia Fish Oil Market Growth – Trends, Demand & Innovations 2025–2035

Australia Fish Meal Market Report – Trends, Demand & Industry Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA