The Australia Fish Meal market is estimated to be worth USD 154.4 million by 2025 and is projected to reach a value of USD 356.0 million by 2035, growing at a CAGR of 8.7% over the assessment period 2025 to 2035

| Metric | Values |

|---|---|

| Industry Size (2025) | USD 154.4 million |

| Industry Value (2035) | USD 356.0 million |

| Value-based CAGR (2025 to 2035) | 8.7% |

Fish meal is a feed ingredient with high protein through the processing of fish and several by-products of fish formed as a powder. It is highly used in aquaculture, livestock, and the pet food industry because it is abundant in nutritional qualities such as essential amino acids, fatty acids, and minerals. This is because of the demand for sustainable feed, which is nutrient-rich, relating to this country's large-scale aquaculture and animal agriculture sectors.

The fish meal market in Australia is important for the following reasons. Firstly, it ensures the sustainable use of fishery by-products that would otherwise go to waste, thus enhancing the economic value of seafood processing industries.

Fish meal demand is further enhanced by the increasing trend of the world toward sustainable protein sources and goodwill for Australia in terms of high-quality seafood products. With aquaculture continuing to grow to answer both domestic and foreign needs, the fish meal market will remain an integral part of the larger agricultural and fisheries sectors.

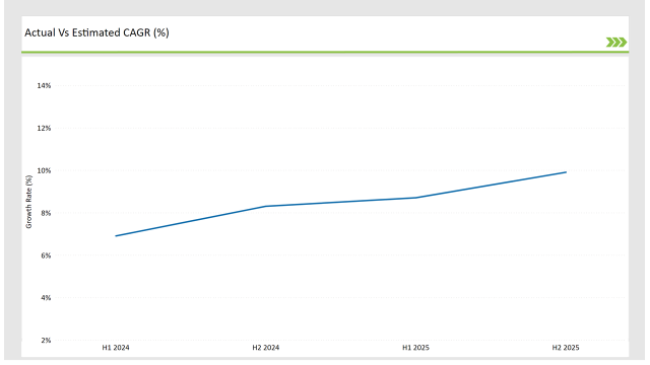

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Australian Fish Meal market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Fish Meal sector is predicted to grow at a CAGR of 8.4% during the first half of 2025, increasing to 10.2% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 7.2% in H1 but is expected to rise to 9.3% in H2.

This pattern reveals a decrease of 15 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

These insights show the dynamic and ever-changing landscape of the Australian fish meal market, driven by shifting industry trends, feed technology advancements, and changing demands from aquaculture and livestock sectors.

To strategize effectively, businesses must understand these factors, including innovations in feed formulation, market diversification, and emerging nutritional requirements. This semi-annual overview provides a framework for identifying growth opportunities while facing challenges within the market, which enables companies to align their operations with the changing needs of the industry.

| Date | Development/M&A Activity & Details |

|---|---|

| July 2024 | Aker BioMarine, a leading player in the marine ingredients business, announced it will sell its feed ingredients business, including krill meal, to a new joint venture. The strategic divestment would have an effect on the global supply chain of marine-based feed ingredients, possibly on the Australian market. |

| 2023 | Tassal Group Limited, Australia's largest vertically integrated seafood grower, processor, marketer, and seller, acquired MPA Fish Farms Pty Ltd and MPA Marketing Pty Ltd. The acquisition included Australia's only ocean-based barramundi farm at Cone Bay, Western Australia, securing over 50 local jobs in the Kimberley region. Tassal's entry into barramundi farming is likely to impact the fish meal market by increasing demand for specialized feed ingredients tailored to barramundi aquaculture. |

Precision Aquafeed Formulations: Driving Demand for Premium Fish Meal

Australian aquaculture producers rapidly introduce precision feed formulations to ensure the optimum health and growth of important species like salmon and prawns. Here, a fish meal market shift is being seen to meet the demand for high-quality fish meal that brings not only nutrient density but also profile consistency of protein and amino acids.

Precision feeding will also allow lowering feed conversion ratios while maintaining maximum output. Australian manufacturers are willing to pay a premium for fish meal that achieves high standards if producers refine their formulation.

Innovation in processing technology, such as enzymatic hydrolysis, would also improve digestibility and functional properties of the fish meal. This trend will strengthen investments in quality control and product development, which will encourage collaboration between fish meal producers and feed manufacturers.

Expansion of Integrated Supply Chains in Fisheries

Australia’s fisheries sector is witnessing a rise in vertically integrated supply chains, where companies control every stage of production, from fishing operations to fish meal processing. This trend ensures consistent raw material availability, cost efficiency, and streamlined logistics for fish meal production.

Key players, such as seafood processors and aquaculture firms, are investing in fish meal plants to transform processing by-products into high-value feed ingredients. The integration of supply chains helps reduce dependency on imports while ensuring traceability and transparency.

As Australian consumers and global markets increasingly value traceable products, integrated supply chains strengthen the competitive positioning of locally produced fish meal. This trend is set to boost the domestic fish meal industry's scalability, reduce operational risks, and encourage innovation in waste utilization processes.

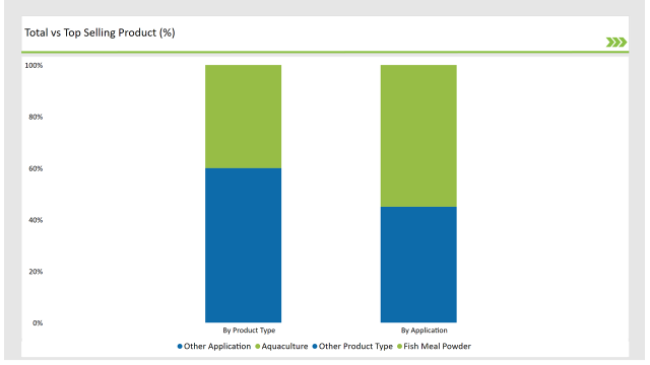

% share of Individual categories by Product Type and Application in 2025

The fish meal powder segment dominates the Australian market. It has unmatchable flexibility and adaptability in different applications of feeds. Powdered fish meal is mostly preferred by industries in aquaculture, livestock, and pet food because it has uniform texture, ease in mixing, and efficient delivery of nutrients.

The preference for such a product would be relevant especially in Australia due to the demands of precisely formulated diets on salmon, barramundi, and prawns within aquaculture. This characteristic is critical in aquaculture and livestock industries because feed quality affects growth rates, health, and overall yield.

The longer shelf life and ease of transportation of powdered fish meal also make it a convenient feed choice for manufacturers dealing with Australia's vast geography, reducing logistical problems and costs.

The aquaculture segment dominates the fish meal market in Australia because of its critical role in meeting growing seafood demands and supporting high-value species farming. As traditional fisheries approach sustainable catch limits, aquaculture has emerged as a scalable and reliable source of seafood production.

Fish meal is one of the greatest treasures in aquaculture: it has higher digestibility levels and essential amino acids and omega-3 fatty acids, that ensure the very best quality of growth, health, and all-round quality for fish farmed for human consumption.

Australian producers of aquaculture always stress top-grade seafood and demand highly-end feed formulation by using fishmeal as their fundamental ingredient. Modern feeding systems, especially automatic dispensers, further demonstrate the dependency of the aquaculture segment on fish meal through the precision delivered feed with the least waste possible.

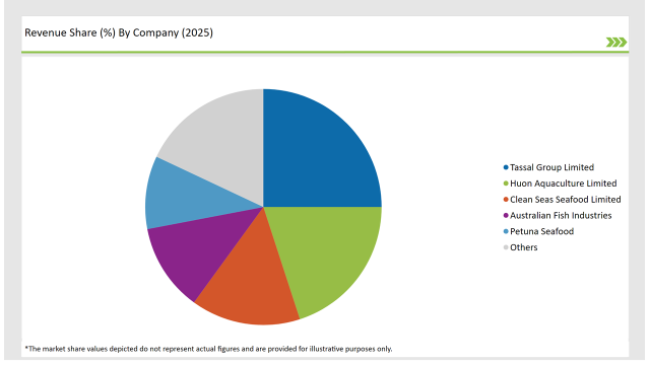

2025 Market share of Australia Fish Meal manufacturers

Note: The above chart is indicative in nature

Tier 1 companies in the Australian fish meal market are those which are large-scale, equipped with the most advanced processing technologies, and well established supply chains. Tassal Group Limited and Huon Aquaculture Limited are the best examples of this tier since they are vertically integrated, thereby able to produce fish meal from processing by-products without compromising quality and traceability.

Tier 2 companies are those mid-sized businesses that target segments in the fish meal market. Companies such as Clean Seas Seafood Limited produce fish meal for the regional aquaculture operations that require it. These companies have often focused on agility and responsiveness, producing specialized feed for niches like the prawn.

Tier 3 represents small-scale producers and emerging companies, including new start-ups and regional fish meal manufacturers. Such players sell their products to regional feed manufacturers or small aquaculture operations for use in their areas at reduced prices.

The industry includes various product type such as fish meal powder, fish meal pellet, fish oil, and fish protein hydrolysate.

The industry includes various sources such as wild-caught fish, farmed fish, bycatch and processing byproducts.

As per the application segment, the market is segregated into Aquaculture, Animal Feed, Pet Food, Fertilizers, and Nutraceuticals.

By 2025, the Australia Fish Meal market is expected to grow at a CAGR of 8.7%.

By 2035, the sales value of the Australia Fish Meal industry is expected to reach USD 356.0 million.

Key factors propelling the Australia Fish Meal market include Innovating fish meal production processes, adapting fish meal to changing species requirements, and leveraging global demand for premium Australian seafood.

Prominent players in Australia Fish Meal manufacturing Tassal Group Limited, Huon Aquaculture Limited, Clean Seas Seafood Limited, Australian Fish Industries, Aker BioMarine, Petuna Seafood, Seafarms Group Limited Marine Harvest Australia, Austral Fisheries, Oceanwatch Australia, and Fishmeal Australia, among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Australia Pallet Wraps Market Size and Share Forecast Outlook 2025 to 2035

Australia and South Pacific islands Tourism Market Size and Share Forecast Outlook 2025 to 2035

Australia Legal Cannabis Market - Size, Share, and Forecast 2025 to 2035

Australia Probiotic Supplements Market Trends – Growth, Demand & Forecast 2025–2035

Australia Chickpea Protein Market Outlook – Demand, Trends & Forecast 2025–2035

Australia Non-Dairy Creamer Market Outlook – Size, Demand & Forecast 2025–2035

Australia Chitin Market Analysis – Growth, Size & Forecast 2025–2035

Australia Bubble Tea Market Trends – Size, Share & Forecast 2025–2035

Australia Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

Australia Non-Alcoholic Malt Beverages Market Insights - Trends & Forecast 2025 to 2035

Australia Food Testing Services Market Growth – Trends, Demand & Innovations 2025–2035

Australia Food Emulsifier Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Pulses Market Report – Trends, Demand & Industry Forecast 2025–2035

Australia Probiotic Strains Market Growth – Trends, Demand & Innovations 2025–2035

Australia Yerba Mate Market Growth – Trends, Demand & Innovations 2025–2035

Australia Sweetener Market Analysis – Size, Share & Forecast 2025–2035

Australia Food Service Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Yeast Extract Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Canned Tuna Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Calf Milk Replacer Market Outlook – Share, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA