The Australian Frozen Food market is estimated to be worth USD 2,194.5 million by 2025 and is projected to reach a value of USD 6,060.5 million by 2035, growing at a CAGR of 10.7% over the assessment period 2025 to 2035

| Attributes | Values |

|---|---|

| Estimated Australia Industry Size in 2025 | USD 2,194.5 million |

| Projected Australia Value in 2035 | USD 6,060.5 million |

| Value-based CAGR from 2025 to 2035 | 10.7% |

The frozen food market in Australia makes up a big share of the country's food industry, influenced by consumer demands for convenience, longer shelf life, and more variety. During the last couple of years, the market has developed from mere traditional frozen vegetables, meat, and ready meals to health-conscious and premium items like organic, gluten-free, and plant-based frozen foods. This shift shows a growing awareness about nutrition by Australian consumers but still appreciates the time-saving benefits frozen foods provide.

Also, frozen food plays an essential role in diminishing the rate of food wastage as its preservation duration allows more customers to reserve larger amounts that cannot spoil; therefore, increasing the convenience element associated with the products and combining that with sustainable thinking. Improvements in freezers also make new frozen product ideas more readily viable for manufacture, driving additional market expansion.

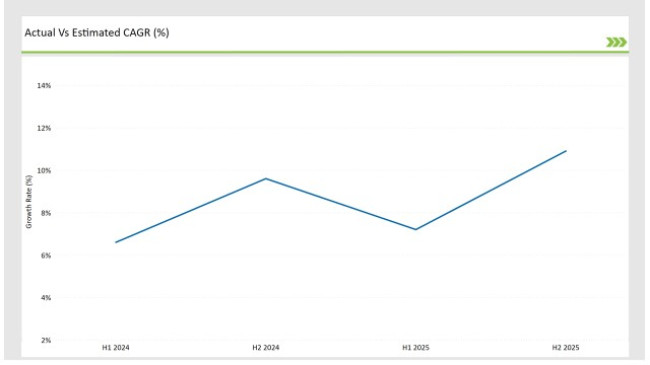

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Australian Frozen Food market. This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Frozen Food sector is predicted to grow at a CAGR of 7.2% during the first half of 2025, increasing to 10.1% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 6.6% in H1 but is expected to rise to 9.6% in H2. This pattern reveals a decrease of 15 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 25 basis points in the second half of 2025 compared to the second half of 2024.

These numbers reflect the evolving face of Australian frozen food companies, with variables like legislative reforms, changes in customer requirements, and developments in natural food coloration. These companies enjoy such a semiannual review as this gives them time to adjust their strategies in relation to anticipated growth while at the same time minimizing the market complications. It emphasizes the need of staying on top of these major variables in order to make informed decisions and keep ahead of the competition in an ever-changing sector.

| Date | Development/M&A Activity & Details |

|---|---|

| February 2024 | Ingham's, Australia's largest poultry producer, acquired a smaller frozen food company, Aussie Frozen Meals, to offer more products and strengthen its position in the ready-meal frozen market. |

| November 2023 | McCain Foods, the global frozen food major, unveiled a new state-of-the-art frozen potato processing plant in regional Victoria, Australia, to cater to the growing demand for frozen potato products across the country. |

Growth of Plant-Based Frozen Foods: Catering to Health and Dietary Preferences

The demand for frozen food has experienced a surge by the demand of plant-based food. Consumers switching to a diet that is largely vegetarian, vegan, or even flexitarian tend to look out for frozen foods and snacks catering to their requirements. With the trend of consumers moving toward plant-based meals, frozen food companies are widening their product portfolios to include plant-based burgers, frozen vegetables, ready-to-cook meals, or even plant-based protein sources such as soy, peas, and legumes.

The market impact of this trend is enormous because it gives firms an opportunity to increase their product ranges and gain a larger share of the health-conscious customer base. This approach reflects the bigger trend between Australian consumers desiring healthier substitutes for frozen prepared meals.

Technological Advancements in Freezing Methods: Elevating Frozen Food Quality

Innovation of freezing technology is the key factor for enhancing the quality and shelf life of frozen foods in the Australian market. Methods such as cryogenic freezing and rapid freezing preservate the taste, nutritional content, and even texture better. New freezing technologies ensure that food quality will not degrade, hence making frozen meals and snacks more attractive to consumers who have previously equated frozen foods with poor quality compared to fresh food options.

This trend could be a new turning point in the market so that the confidence in frozen products among consumers increases. Through better freezing technology, frozen foods can now offer some premium products that may be as good-tasting and nutritious as fresh ingredients. Consumers will be more willing to accept frozen meals, snacks, and vegetables knowing that such items are not only convenient but also retain their original freshness and flavor profiles.

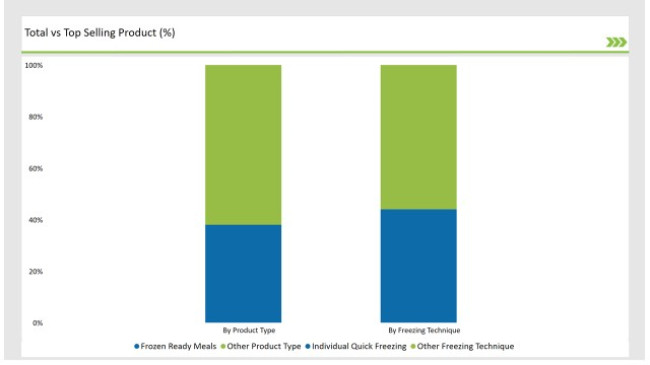

% share of Individual categories by Form Type and Source Type in 2025

Ready meals have risen to the top of the Australian frozen food industry, driven by increased demand for quick, simple, and economical meal alternatives. Australians continue to struggle to balance their hectic work schedules, family duties, and social engagements, which has increased the popularity of ready-to-eat frozen meals.

The main reason for the dominance of this segment is the ability to meet the needs of time-starved consumers who require hassle-free, nutritious meals that do not need extensive cooking or preparation. With these consumers looking for convenience solutions to assist them in managing their day-to-day activities, frozen ready-to-eat meals become convenient and appealing to them. Unlike some of the traditional frozen foods that may need other preparations, they are already cooked and ready to heat up, which is almost in line with modern Australian lifestyle.

The Individual Quick Freezing (IQF) technique has emerged as the most significant driver in the Australian frozen food market, setting the standard by way of preservation in quality, texture, and flavor of the product. Unlike traditional freezing methods, IQF rapidly freezes individual pieces of food so that all items are frozen separately instead of being clumped together. It retains the natural taste, texture, and nutrient content of food and is attractive for consumers and manufacturers alike.

Today, Australians value the quality of frozen food very much; increasingly, people get more particular about what to eat and not to eat. IQF serves as an alternative that negates the belief about the flavor and nutritional content that is usually lost in freezing food. The produce includes vegetables, fruits, seafood, and prepared meals. Upon thawing or cooking, such products yield a fresher, more vibrant taste.

2025 Market share of Australia Frozen Food manufacturers

Note: The above chart is indicative in nature

Tier 1 operators in the Australian frozen food market are large, well-established national and international brands that dominate the industry with regards to market share, reach of distribution, and variety of products. Their extensive portfolios cover all manner of frozen food categories from vegetables to meals, snacks, and desserts. Strong brand recognition and consumer loyalty further strengthen their position.

Tier 2 participants in the Australian frozen food market usually involve regional brands or niche companies that specialize in specific portions or subcategories within the frozen food sector. Because these niche companies like tier 2 participant’s benefit from the general trend of healthy eating and niche dietary preferences, they can gain space in the highly fragmented frozen food market.

Tier 3 for Australia is about small emerging brands and private label gaining the marketplace, including emerging private label solutions offering value-orientated products, that will provide an offering that usually focuses on providing wide-range-of-product categories in areas like frozen vegetables, pizza, and ready meals with affordability in mind.

As per the product type, the market is segmented into frozen ready meals, frozen seafood & meat products, frozen snacks & bakery products, frozen fruits & vegetables, and others.

As per the freezing technique, the market is segregated into individual quick freezing (IQF), belt freezing, blast freezing, plate freezing, and cryogenic freezing

As per the sales channel, the market is bifurcated into numerous channel including supermarkets/hypermarkets, convenience stores & independent retailers, online retail, food service/HoReCa, and others.

By 2025, the Australian Frozen Food market is expected to grow at a CAGR of 10.7%.

By 2035, the sales value of the Australian Frozen Food industry is expected to reach USD 6,060.5 million.

Key factors propelling the Australian Frozen Food market include increasing preference for premium and gourmet frozen meals, technological advancements in freezing and packaging methods, and rising popularity of health-conscious frozen food options.

Prominent players in Australia Frozen Food manufacturing include PFD Food Services, Ingham, Blue Seas Food Services, PMFresh, ChillFreeze Logistics & Storage, St George Smallgoods Pty Ltd., Nestlé S.A., Unilever PLC, General Mills Inc., McCain Foods Limited, and Conagra Brands Inc., among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Australia Pallet Wraps Market Size and Share Forecast Outlook 2025 to 2035

Australia and South Pacific islands Tourism Market Size and Share Forecast Outlook 2025 to 2035

Australia Legal Cannabis Market - Size, Share, and Forecast 2025 to 2035

Australia Probiotic Supplements Market Trends – Growth, Demand & Forecast 2025–2035

Australia Chickpea Protein Market Outlook – Demand, Trends & Forecast 2025–2035

Australia Non-Dairy Creamer Market Outlook – Size, Demand & Forecast 2025–2035

Australia Chitin Market Analysis – Growth, Size & Forecast 2025–2035

Australia Bubble Tea Market Trends – Size, Share & Forecast 2025–2035

Australia Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

Australia Non-Alcoholic Malt Beverages Market Insights - Trends & Forecast 2025 to 2035

Australia Pulses Market Report – Trends, Demand & Industry Forecast 2025–2035

Australia Probiotic Strains Market Growth – Trends, Demand & Innovations 2025–2035

Australia Yerba Mate Market Growth – Trends, Demand & Innovations 2025–2035

Australia Sweetener Market Analysis – Size, Share & Forecast 2025–2035

Australia Yeast Extract Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Canned Tuna Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Calf Milk Replacer Market Outlook – Share, Growth & Forecast 2025–2035

Australia Fish Oil Market Growth – Trends, Demand & Innovations 2025–2035

Australia Fish Meal Market Report – Trends, Demand & Industry Forecast 2025–2035

Australia Concrete Pump Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA