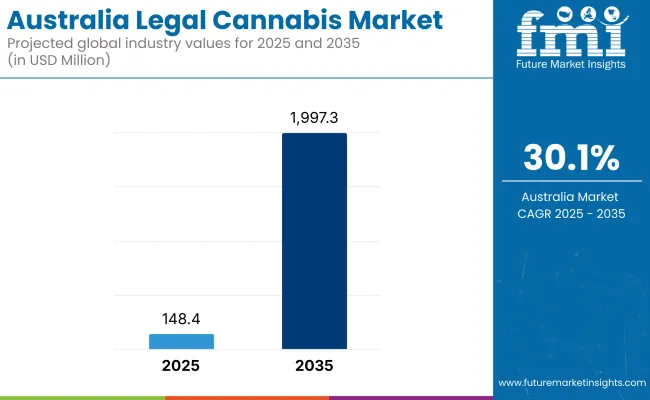

The Australia legal cannabis market is projected to grow from USD 148.4 million in 2025 to USD 1,997.3 million by 2035, reflecting a CAGR of 30.1%. This rapid growth is primarily fueled by the expanding acceptance of cannabis for medical and therapeutic use, as well as evolving regulatory frameworks that support controlled legal access. Rising patient awareness, an aging population with chronic conditions, and growing clinical research validating the efficacy of cannabis-based treatments are key drivers of market expansion.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 148.4 million |

| Projected Market Size in 2035 | USD 1,997.3 million |

| CAGR (2025 to 2035) | 30.1% |

Innovations in the cannabis sector are enhancing product diversity and delivery mechanisms. Modern offerings now include oils, capsules, sprays, edibles, and topicals, catering to various medical and lifestyle needs.

Advances in cultivation techniques such as controlled indoor farming and hydroponics are improving yield quality and consistency. Technology integration, including blockchain for supply chain transparency and AI-powered compliance tracking, is strengthening operational efficiency and regulatory adherence.

Government regulation is central to the market's development. In Australia, the Therapeutic Goods Administration (TGA) oversees the approval and classification of medicinal cannabis products. Legal cannabis must comply with Good Manufacturing Practices (GMP) and the Narcotic Drugs Act 1967, ensuring product safety, traceability, and controlled distribution. State-level regulations also influence patient access and prescribing protocols, with ongoing reforms aiming to balance public health concerns with market potential.

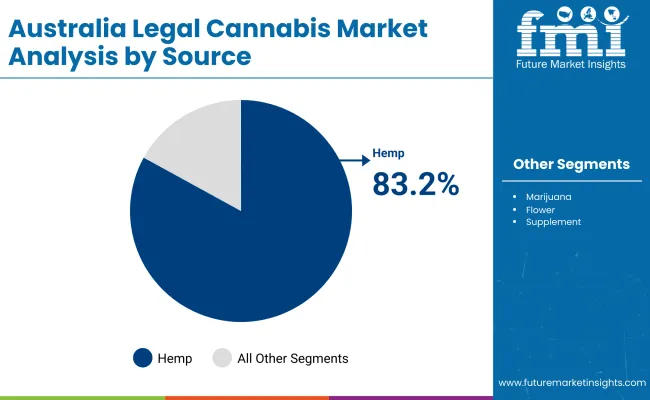

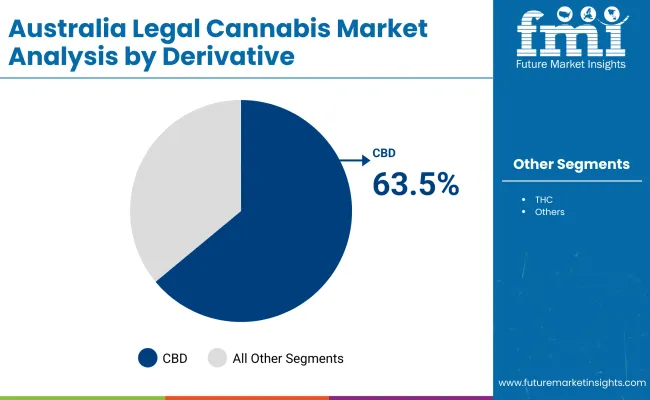

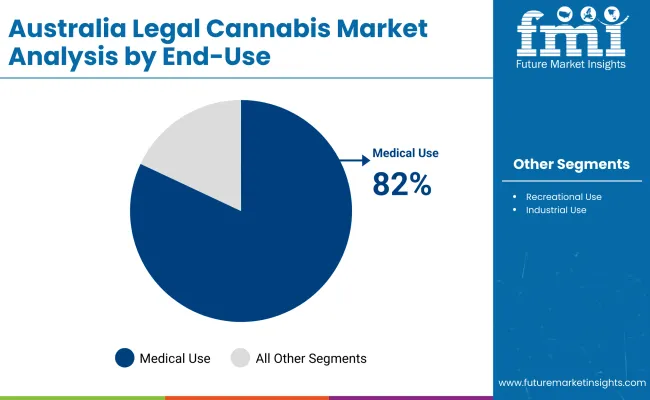

The legal cannabis market in Australia is expected to grow significantly, with a projected compound annual growth rate (CAGR) of 30.1% from 2025 to 2035. Hemp will dominate the source segment, accounting for 83.2% of the market. CBD is projected to lead the derivative segment with a 63.5% share, while the industrial segment will hold the largest share by end-use at 63.6%.

The Australia legal cannabis market is segmented by source into marijuana and hemp. By derivatives, the market includes CBD, THC, and others. Based on end-use, the market is divided into medical use, recreational use, and industrial use. Regionally, the market is analyzed across Eastern Australia, Southern Australia, Northern Australia, Western Australia, and Central Australia.

In terms of source, the hemp segment accounts for 83.2% share. Locally grown hemp is fueling innovation in industries like sustainable construction and eco-apparel. Hempcrete used in homes and buildings is celebrated for its insulation, durability, breathability, and fire resistance.

Hemp fibers are being incorporated into textiles and bioplastics, offering environmentally friendly alternatives to conventional materials. AgriFutures Australia and industry groups are investing in agronomic research, best-practice manuals, and processing infrastructure to support growth. These efforts aim to make hemp production economically viable and regionally distributed.

Based on derivative, the CBD segment registers 63.5% share. CBD (Cannabidiol) is growing in popularity in Australia due to increasing public awareness of its potential health benefits, easing regulatory restrictions, and rising demand for natural wellness products. As consumers seek alternatives to traditional pharmaceuticals, CBD is being embraced for its reported ability to support relief from anxiety, stress, chronic pain, insomnia, and inflammation conditions that affect a significant portion of the population.

One major driver behind CBD’s popularity is the regulatory shift. Since 2021, low-dose CBD products have been allowed to be sold over-the-counter in pharmacies (Schedule 3 classification), subject to approval by the Therapeutic Goods Administration (TGA).

In terms of end-use, the medical use segment captures 82% share. Medical cannabis enjoys growing acceptance within the clinical community, particularly for treating chronic pain, cancer therapy side effects, PTSD, and insomnia. Companies like ECS Botanics, Althea Group, and Cann Group have invested heavily in clinical-grade cultivation and GMP-certified manufacturing. These investments support a regulated and scalable supply chain tailored to medical demand.

Regulatory Ambiguity, High Entry Barriers, and Prescription Bottlenecks

The Australia legal cannabis market continues to be impacted by regulatory inconsistency across federal, state and territory jurisdictions. Although medicinal cannabis is legal through the Therapeutic Goods Administration (TGA) via the Special Access Scheme (SAS-B), access for patients is significantly impeded due to complicated prescription processes, limited GP training and no products available through pharmacies.

OTC CBD pathway still in limbo with no S3 products approved. High costs for licensing, cultivation, GMP compliance, and product testing create steep hurdles for start-ups and disincentive small-scale domestic innovation.

Domestic Market Expansion, Export Potential, and Health Consumer Demand

Australia’s federally legal cannabis industry is on track for mass-growth despite systematic hurdles, thanks to increasing public acceptance, potential therapeutic use cases, and international export markets. The ant nociceptive and anti-anxiety activity provide a perspective on new therapeutic applications.

With legislative pressure now building for adult-use legalization largely through public activism and political discoursethe stage is being set for a larger recreational market. Australia’s role as a global supplier of pharmaceutical-grade cannabis is further reinforced by the growing exports of GMP-certified medical cannabis to European and Asia-Pacific markets.

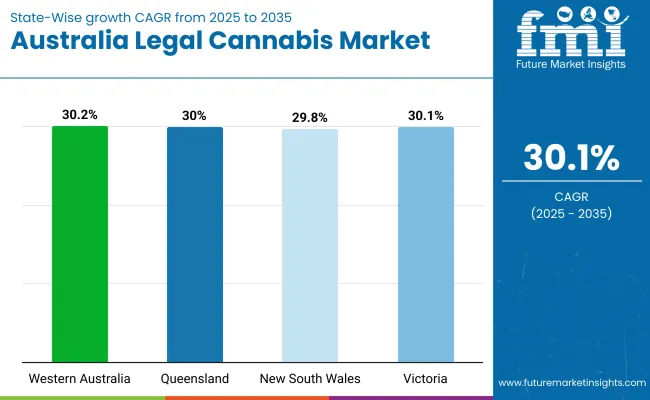

Driven by its arid climate, vast land availability, and its investment in cannabis agribusiness infrastructure, Western Australia is fast emerging as a leading cultivation and export hub. As licenses for the cultivation, research, and processing of medicinal cannabis continue to expand, companies across Perth and its perimeter are expanding greenhouse space and collaborating for global supply. And the state’s efforts to diversify its agriculture, shift towards biopharma production, and home grow is fuelling local demand for compliant cannabis eco-systems.

| Region | CAGR (2025 to 2035) |

|---|---|

| Western Australia | 30.2% |

Near Brisbane, Queensland is developing into a cannabis research and development and manufacturing powerhouse, largely around therapeutic cannabis, chronic pain and clinical trials. Biotech firms and universities based in Brisbane are working on THC and CBD formulations, while in the Sunshine State's rural areas indoor and outdoor growers are ramping up their operations. State support for agricultural technology parks and pharmaceutical innovation zones is helping speed commercialization of cannabis-based wellness and prescription-grade products.

| State | CAGR (2025 to 2035) |

|---|---|

| Queensland | 30.0% |

New South Wales is pioneering medical cannabis access programs, prescription volumes and pharmacy distribution networks, creating Australia's largest legal cannabis consumer base. Getting The Goods: Sydney and Newcastle is the home base for major players, providing telehealth cannabis consultations, dispensary services, and compliance-grade packaging with the flexible guidelines surrounding patient pathways and regulation set forth by the state government, the rapid adoption seen among chronic illness patients (such as chronic pain and epilepsy) has pushed the demand for cannabis oil, capsule and vaporizer- based products.

| State | CAGR (2025 to 2035) |

|---|---|

| New South Wales | 29.8% |

Victoria became the first Australian state to legalise medicinal cannabis, leading the nation in policy innovation, pharma-grade production and integration into public healthcare. GMP certified cannabis extraction, clinical research and product standardization leading companies are based in Melbourne. Victoria is set to be the long term leader in medical cannabis exports and precision therapeutics with the Government continuing to support the cannabis R&D drive with the Medicinal Cannabis Industry Development Plan.

| State | CAGR (2025 to 2035) |

|---|---|

| Victoria | 30.1% |

The Australia legal cannabis market is in a growth phase, supported by evolving regulatory frameworks and increasing public acceptance. Key players such as Cann Group Limited, Zelira Therapeutics, AusCann Group Holdings Ltd., Bod Australia, Althea Group, and others are focusing on developing high-quality medicinal cannabis products.

These include oils, topicals, and low-dose CBD formulations tailored for therapeutic use. Emphasis is placed on clinical-grade standards, pharmaceutical compliance, and controlled domestic cultivation. Companies are investing in research, patient education, and product innovation to expand their portfolios.

The market is also witnessing growing collaborations between healthcare providers and cannabis firms to enhance medical access. Strategic partnerships, contract manufacturing, and expanding export capabilities are strengthening Australia's global position in the medical cannabis sector.

Recent Development

The overall market size for Australia legal cannabis market was USD 148.4 million in 2025.

The Australia legal cannabis market is expected to reach USD 1,997.3 million in 2035.

The rising medicinal prescriptions for chronic pain, epilepsy, anxiety, and sleep disorders, alongside growing interest in CBD-based nutraceuticals and wellness offerings will drive the demand for Australia legal cannabis market.

The top 5 states which drives the development of Australia legal cannabis market are Western Australia, Queensland, New South Wales, Victoria, and Tasmania.

Marijuana is expected to grow to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Australia Pallet Wraps Market Size and Share Forecast Outlook 2025 to 2035

Australia and South Pacific islands Tourism Market Size and Share Forecast Outlook 2025 to 2035

Australia Probiotic Supplements Market Trends – Growth, Demand & Forecast 2025–2035

Australia Chickpea Protein Market Outlook – Demand, Trends & Forecast 2025–2035

Australia Non-Dairy Creamer Market Outlook – Size, Demand & Forecast 2025–2035

Australia Chitin Market Analysis – Growth, Size & Forecast 2025–2035

Australia Bubble Tea Market Trends – Size, Share & Forecast 2025–2035

Australia Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

Australia Non-Alcoholic Malt Beverages Market Insights - Trends & Forecast 2025 to 2035

Australia Food Testing Services Market Growth – Trends, Demand & Innovations 2025–2035

Australia Food Emulsifier Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Pulses Market Report – Trends, Demand & Industry Forecast 2025–2035

Australia Probiotic Strains Market Growth – Trends, Demand & Innovations 2025–2035

Australia Frozen Ready Meals Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Yerba Mate Market Growth – Trends, Demand & Innovations 2025–2035

Australia Sweetener Market Analysis – Size, Share & Forecast 2025–2035

Australia Food Service Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Yeast Extract Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Canned Tuna Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Calf Milk Replacer Market Outlook – Share, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA