The Australian Food Testing Services market is estimated to be worth USD 175.3 million by 2025 and is projected to reach a value of USD 688.1 million by 2035, growing at a CAGR of 14.7% over the assessment period 2025 to 2035.

| Attributes | Values |

|---|---|

| Estimated Australia Industry Size in 2025 | USD 175.3 million |

| Projected Australia Value in 2035 | USD 688.1 million |

| Value-based CAGR from 2025 to 2035 | 14.7% |

The food testing services market in Australia refers to the food industry that renders analytical testing for quality assurance with respect to contaminants, allergens, nutritional value, and acceptance of regulatory parameters. Food testing services will be very instrumental in ensuring quality and safety requirements of food coupled with compliance at local and international levels, according to FSANZ.

The testing processes include a broad spectrum of methods that ensure food products are safe for consumption as well as meet the expected standards for production and export, including microbiological analysis, chemical testing, and sensory evaluation.

Australia has emerged as a primary country for food export, it relies heavily on strict food safety protocols to maintain its credibility in the global markets. Increase in demand for transparency and organic products as well as in food integrity among consumers has further necessitated the requirement for more advanced testing. Food allergy awareness, contamination risks, and the need for correct labelling further boost the market.

Food testing services are of paramount importance to protect public health, support industry standards, and enhance consumer confidence in Australian food products both domestically and internationally in this highly regulated environment.

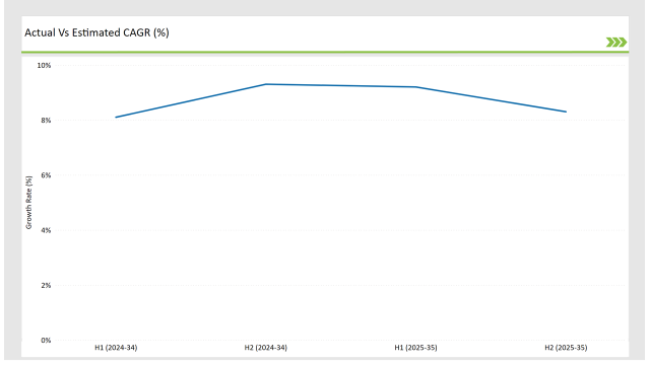

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Australian Food Testing Services market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Food Testing Services sector is predicted to grow at a CAGR of 14.2% during the first half of 2025, increasing to 15.3% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 11.1% in H1 but is expected to rise to 12.3% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

These figures reflect the dynamic and constantly changing nature of the Australian Food Testing Services market, influenced by factors such as changing regulatory requirements, shifting consumer demands, and technological advancements in testing methodologies.

The semi-annual breakdown is useful for businesses looking to align their strategies with market trends, allowing them to leverage anticipated growth opportunities and effectively address the challenges and complexities within the industry.

ALS Global is a Brisbane-based laboratory testing group that ventured into food testing. The company, in 2023, said that half-year underlying profit fell by 5% due to tough times for the miners in Australia and Latin America. It seems that its diversification into segments such as environmental, pharmaceutical, and food testing is on track toward reducing commodity dependency and gearing it toward diversified growth.

SGS Australia will provide professional analysis in ensuring and validating parameters of quality and safety at every stage of the food supply chain. The solutions ensure quality, safety, and integrity in food products, which utilize a network of food testing laboratories. It provides a full range of testing and labeling solutions for every stage of the food supply chain. Their experts can determine the presence and quantity of allergens in food products to ensure that they comply with regulatory requirements and protect consumer health.

Integration of Artificial Intelligence in Food Testing Processes

It brings a change in the analysis done by Australia's food testing laboratories by incorporating AI into their food testing services. It combines AI-based technologies with food testing through improving accuracy, eliminating human errors, and increasing throughput. This makes food testing labs discover contaminants, allergens, and inconsistencies through large datasets and machine learning predictions of emerging trends and food safety risks quickly.

AI can determine subtle changes in food products that may otherwise be overlooked, including trace chemicals or pathogens. It can also be used to enhance predictive analysis, helping manufacturers and food producers proactively address potential issues before they arise.

Increased Focus on Real-Time and On-Site Testing Solutions

Real-time and on-site food testing is among the significant emerging trends for services in Australia's food testing market. Proper development of portable testing apparatus and mobile laboratories allows manufacturers and producers to utilize in-situ solutions that will result in the speedy return of test results directly at production or processing locations. Such in-situ tests allow food manufacturers to identify contamination or quality degradation from the source instead of waiting for results from off-site laboratories.

The type of testing can allow food manufacturers to exert greater control over their process in ways that minimize large recalls and improve the safety of food products before they hit the consumer market. In addition, on-site testing does not require the transportation of samples to external laboratories, reducing both time and expenses. It harmonizes with the increasing demand for efficiency in the Australian food industry, particularly dairy, meat, and seafood industries, where rapid and accurate testing is critical to ensuring food safety and quality.

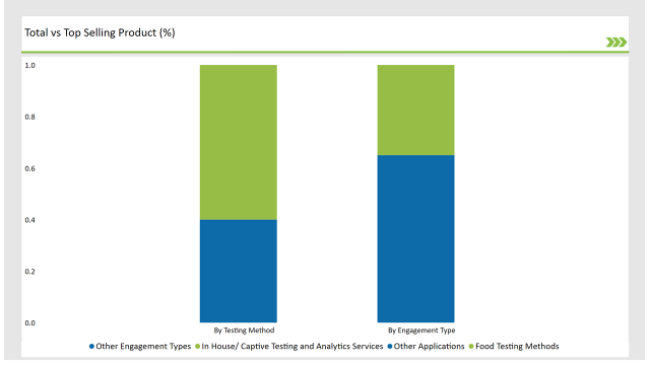

% share of Individual categories by Testing Methods and Engagement Type in 2025

The food testing methods segment is leading in Australia's market for food testing services because there is growing need for high precision, reliability, and adherence to very strict safety regulations. The nation remains one of the world's largest food products exporters, making it crucial that every product meets not only local but also international standards.

Increased awareness about the negative health impacts arising due to inefficient control measures on food safety is forcing manufacturers, retailers, and control bodies from governments to think of the most advanced pathogen testing methodology to minimize their risks. These enhanced test methods allow testing to be processed faster and returned with higher levels of accuracy than before, confirming that products released into the markets are safe.

In-house testing enables food manufacturers to test in real time, and thus the products are always under check, meaning their compliance with food safety standards. This makes it immediate without time lags as is experienced with external testing services, thus allowing quicker decision-making on product quality and safety.

For the Australian food market, which exports a large portion of its agricultural products, this ability to quickly verify food safety is crucial. It reduces the likelihood of product recalls, which is expensive and damages the reputation of the company, especially when dealing with international markets with strict safety standards.

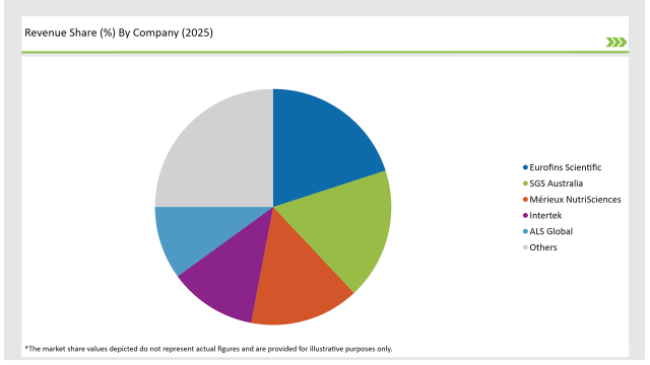

Australian food testing services Tier 1 players are large multinational companies with an extensive portfolio of services, with technologically advanced capabilities and thus with national operations market share. The major players include Eurofins Scientific, SGS Australia, and Intertek in their capability to provide a comprehensive food safety testing solution across a wide portfolio of food products.

Tier 2 players in the Australian food testing services market include established local players offering niche services in Australia and the Asia-Pacific. Some prime examples of such firms include Mérieux NutriSciences, ALS, and Bureau Veritas. These companies are well-positioned in the market by concentrating on the niches of particular food testing services, for example, microbiology, allergen testing, and certification services.

Tier 3 of the Australian food testing services market is mainly small, niche providers that have a focus on specialist niches within the food testing sector. These companies, in general, only serve specific regional or industrial requirements within Australia and typically offer highly focused services, such as food sensory analysis, small-batch testing, or unique tests on emerging food products like plant-based foods or functional ingredients.

2025 Market share of Australia Food Testing Services manufacturers

As per the food testing services market, the engagement type segment is bifurcated into In House/ Captive Testing and Analytics Services, and 3rd Party/ Independent Testing and Analytics Service Providers.

The industry includes various testing methods such as Dairy Products Testing Methods, Dietary Supplements Testing Methods, Food Testing Methods, Meat Testing Analysis, Plant Based, and Novel Food Testing Methods, and Animal Feed Testing Methods.

By 2025, the Australian Food Testing Services market is expected to grow at a CAGR of 14.7%.

By 2035, the sales value of the Australian Food Testing Services industry is expected to reach USD 688.1 million.

Key factors propelling the Australian Food Testing Services market include increasing consumer awareness of food allergens and contaminants, proliferation of e-commerce and direct-to-consumer food sales, rising incidences of foodborne illnesses and contamination, and technological advancements in testing methods and automation.

Prominent players in Australia Food Testing Services manufacturing include Eurofins Scientific, SGS Australia, Mérieux NutriSciences, Intertek, ALS, Romer Labs, TÜV SÜD Australia, Focus On Food, Leeder Analytical, and Labcorp, among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Australia Pallet Wraps Market Size and Share Forecast Outlook 2025 to 2035

Australia and South Pacific islands Tourism Market Size and Share Forecast Outlook 2025 to 2035

Australia Legal Cannabis Market - Size, Share, and Forecast 2025 to 2035

Australia Probiotic Supplements Market Trends – Growth, Demand & Forecast 2025–2035

Australia Chickpea Protein Market Outlook – Demand, Trends & Forecast 2025–2035

Australia Non-Dairy Creamer Market Outlook – Size, Demand & Forecast 2025–2035

Australia Chitin Market Analysis – Growth, Size & Forecast 2025–2035

Australia Bubble Tea Market Trends – Size, Share & Forecast 2025–2035

Australia Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

Australia Non-Alcoholic Malt Beverages Market Insights - Trends & Forecast 2025 to 2035

Australia Pulses Market Report – Trends, Demand & Industry Forecast 2025–2035

Australia Probiotic Strains Market Growth – Trends, Demand & Innovations 2025–2035

Australia Frozen Ready Meals Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Yerba Mate Market Growth – Trends, Demand & Innovations 2025–2035

Australia Sweetener Market Analysis – Size, Share & Forecast 2025–2035

Australia Yeast Extract Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Canned Tuna Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Calf Milk Replacer Market Outlook – Share, Growth & Forecast 2025–2035

Australia Fish Oil Market Growth – Trends, Demand & Innovations 2025–2035

Australia Fish Meal Market Report – Trends, Demand & Industry Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA