The Australian Bakery mixes market is estimated to be worth USD 1,029.2 million by 2025 and is projected to reach a value of USD 1,693.9 millionby 2035, growing at a CAGR of 5.1% over the assessment period 2025 to 2035.

| Metrics | Values |

|---|---|

| Industry Size in 2025 | USD 1,029.2 million |

| Value in 2035 | USD 1,693.9 million |

| Value-based CAGR from 2025 to 2035 | 5.1% |

The bakery mix market in Australia refers to pre-packaged ingredient blends used to produce bread, cakes, pancakes, and pastries, among other things. It include all of the necessary ingredients, such as flour, sugar, baking powder, and flavoring agents, these mixes offer businesses and customers a straightforward, time-saving method of producing, outstanding baked products.

These products are offered in formulations to suit every household baker or industrial bakery requirement and meet nutritional demands such as gluten-free, low sugar, and high-protein formulas.

The market is of prime importance in Australia, mainly because the country has high baking culture and changing consumer tastes for convenience and innovation in food preparation. As people are busier, their demand for ready-to-use solutions increases, and bakery mixes fill the gap between traditional baking and modern time constraints.

The segment also helps manufacturers meet more niche markets organic or allergen-free, which is highly in demand by growing consumers for healthier and more environmentally friendly food. This flexibility is what makes it such a strong force in the growing food industry of Australia.

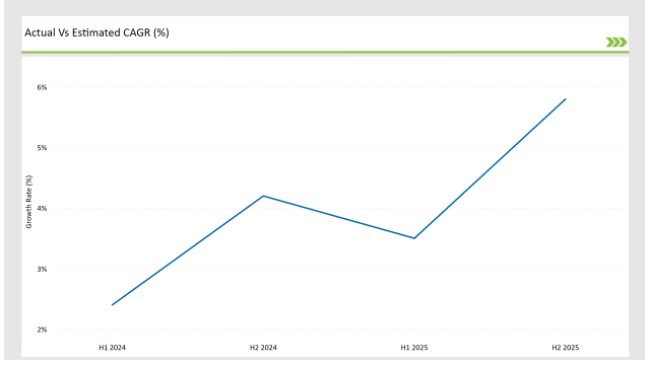

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Australian Bakery Mixes market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Bakery Mixes sector is predicted to grow at a CAGR of 3.5% during the first half of 2025, increasing to 5.8% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 2.4% in H1 but is expected to rise to 4.2% in H2. This pattern reveals a decrease of 10 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 15 basis points in the second half of 2025 compared to the second half of 2024.

These numbers demonstrate the dynamic movements in the Australian Bakery Mixes industry, which are being driven by factors such as changing customer preferences, legislative developments, and breakthroughs in natural mix formulations.

This bi-annual analysis provides critical information for firms wishing to alter their strategy, capitalize on growth possibilities, and solve market complexity. Understanding these trends will be critical for organizations trying to remain competitive and fulfill evolving customer preferences as the baking mix industry evolves.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | The biscuit manufacturer, Arnott's, announced the expansion of its gluten-free product line with an investment of USD 14 million to increase production capacities at its Adelaide facility. The initiative aimed to meet growing consumer demand for gluten-free products, where it was hoping for a 10% share of the sales of all biscuits coming from gluten-free products. |

| 2025 | Patties Food Group, owner of brands such as Four'N Twenty and Nannas, bought National Pies, Tasmania's oldest surviving business. That would help it to continue its production and the employment in the state, looking forward to increasing its future possibilities. |

Artisanal Infusion in Bakery Mixes

The trend of incorporating artisanal and gourmet aspects into bakery mixes is changing the Australian market. As consumers look for premium, bakery-style experiences at home, manufacturers are coming up with mixes that replicate the textures and flavors traditionally associated with artisanal bakeries.Sourdough bread mixes with living cultures, small-batch cake mixes with exotic flavors like wattleseed and finger lime, and rustic European-style loaves like ciabatta or brioche are among the offerings.

This is also a good appeal to the growing Australian taste for local and culturally resonant flavors, adding to the uniqueness of the market. The artisanal infusion trend will likely take bakery mixes from basic, mass-market products to gourmet essentials. It will open the door for higher price points from manufacturers, greater engagement with food enthusiasts, and further product differentiation. It also makes the experience of baking a creative and rewarding process for consumers.

Functional and Wellness-Focused Bakery Mixes

Functional bakery mixes, which promise specific health benefits beyond basic nutrition, are one of the more dynamic trends in Australia. Ingredients include ancient grains (quinoa, amaranth), plant-based proteins, and natural superfoods (matcha, chia seeds) for the wellness-oriented consumer.

Other products also feature gut-friendly additives such as prebiotics or adaptogens, in line with the growing focus on holistic health.This trend directly serves the increasing consumer demand for support for active lifestyle products, better mental well-being, and overall gut health improvement. Functional bakery mixes are something fitness enthusiasts and healthy families along with aging demographics need to upgrade to nutrient-dense alternatives beyond regular baked products.

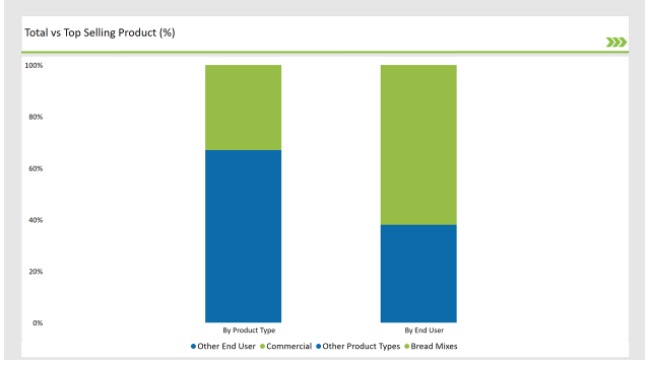

The bread mixes category outperforms others in Australia due of the increased cultural and personal importance of baking bread at home. Bread is more than simply a staple food; it is a creative and satisfying experience for many Australians who are rediscovering the pleasures of artisanal bread-making.

Bread mixes cater perfectly to this trend by offering a balance between ease and authenticity, allowing users to produce high-quality loaves with minimal effort while still feeling the satisfaction of crafting something from scratch. Modern bread mixes also have many varied choices, such as sourdough, rye, wholegrain, and gluten-free blends, that reflect healthier and gourmet preferences for types of bread.

Typically, they include living cultures, or very detailed fermentation instructions, so the consumer gets a sense of power over the baking process while producing professional-grade products.

The commercial baking segment in Australia prospers as it bridges the gap between artisanal quality and mass production very effectively. It is the leading market segment, which caters to the ever-growing demand of the nation for consistently high-quality baked goods in retail, hospitality, and foodservice industries.

Australian consumers increasingly look for gourmet experiences in their everyday lives, be it a premium sourdough loaf from the local café or an artisan-style pastry from a supermarket. Commercial baking fulfills these expectations through large-scale production of artisan-style products.

Commercial baking also fosters partnerships with QSRs, hotels, and gourmet cafes to provide a consistent supply of premium baked goods for the expanding foodservice industry. Because commercial bakeries can tailor their product offerings to meet each partner's needs, they can deepen their presence in the culinary supply chain.

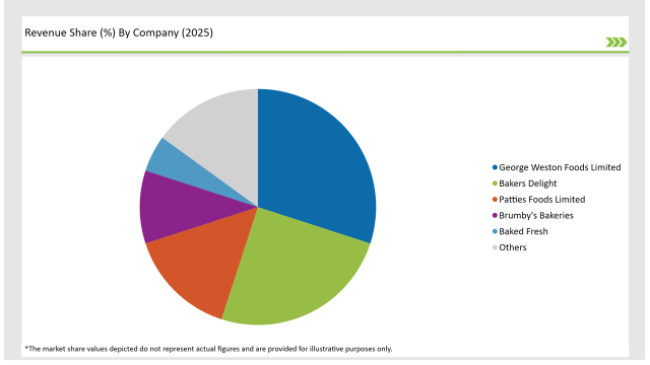

2025 Market share of Australia Bakery Mixes manufacturers

Note: The above chart is indicative in nature

Tier 1 of Australian Bakery Mixes involves dominant brands that have the market, distribution, and consumer recognition in the industry. The brands are well-established, and they have strong, nationwide retail presences; they also have huge resources to support product innovation and marketing.

Tier 2 players often take a more targeted, strategic approach, focusing on marketing and distribution to certain niches like as health-conscious consumers or home bakers who appreciate unusual flavor profiles or exotic ingredients. The capacity to respond swiftly to market changes and innovate in specific sectors offers them a competitive advantage.

Tier 3 are even smaller, emerging brands building up their market presence but offering unique value propositions that resonates with a specific set of consumers. These businesses rely, for the most part, on word of mouth and direct-to-consumer channels as they grow to build deep relationships with loyal customers.

As per the product typesegment, the market is segregated into cake mixes, bread mixes, pastry mixes, and cookie mixes, among others.

As per the end user segment, the market is segregated into household, retail chain, commercial, food service providers, and among others.

By 2025, the Australian Bakery Mixes market is expected to grow at a CAGR of 5.1%.

By 2035, the sales value of the Australian Bakery Mixes industry is expected to reach USD 1,693.9 million.

Key factors propelling the Australian Bakery Mixes market include expanding gluten-free and plant-based product offerings, rising popularity of low-sugar and keto-friendly mixes, demand for allergy-friendly and specialized bakery mixes, and increased awareness of ethical sourcing in bakery mix ingredients.

Prominent players in Australia Bakery Mixes manufacturing include George Weston Foods Limited, Tip Top Bakeries, Bakers Delight, Patties Foods Limited, Baked Fresh, Arnott’s, The Natural Confectionery Company, La Manna, Donut King, Brumby's Bakeries, and PureBred Bakery, among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Australia Pallet Wraps Market Size and Share Forecast Outlook 2025 to 2035

Australia and South Pacific islands Tourism Market Size and Share Forecast Outlook 2025 to 2035

Australia Legal Cannabis Market - Size, Share, and Forecast 2025 to 2035

Australia Probiotic Supplements Market Trends – Growth, Demand & Forecast 2025–2035

Australia Chickpea Protein Market Outlook – Demand, Trends & Forecast 2025–2035

Australia Non-Dairy Creamer Market Outlook – Size, Demand & Forecast 2025–2035

Australia Chitin Market Analysis – Growth, Size & Forecast 2025–2035

Australia Bubble Tea Market Trends – Size, Share & Forecast 2025–2035

Australia Non-Alcoholic Malt Beverages Market Insights - Trends & Forecast 2025 to 2035

Australia Food Testing Services Market Growth – Trends, Demand & Innovations 2025–2035

Australia Food Emulsifier Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Pulses Market Report – Trends, Demand & Industry Forecast 2025–2035

Australia Probiotic Strains Market Growth – Trends, Demand & Innovations 2025–2035

Australia Frozen Ready Meals Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Yerba Mate Market Growth – Trends, Demand & Innovations 2025–2035

Australia Sweetener Market Analysis – Size, Share & Forecast 2025–2035

Australia Food Service Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Yeast Extract Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Canned Tuna Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Calf Milk Replacer Market Outlook – Share, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA