The Australia Calf Milk Replacer market is estimated to be worth USD 11.2 million by 2025 and is projected to reach a value of USD 49.4 millionby 2035, growing at a CAGR of 16.0% over the assessment period 2025 to 2035.

| Attributes | Values |

|---|---|

| Estimated Australia Industry Size in 2025 | USD 11.2 million |

| Projected Australia Value in 2035 | USD 49.4 million |

| Value-based CAGR from 2025 to 2035 | 16.0% |

The demand for effective feeding solutions for young calves by the dairy farming industry drives the Australian market for Calf Milk Replacer (CMR). CMR products are formulated to replicate the nutritional profile of cow's milk, offering essential proteins, fats, carbohydrates, vitamins, and minerals. These replacers are of much importance in the Australian dairy sector as calf health and growth are a prime necessity to maximize milk production and ensure sustainability of the herd.

As more people are gaining awareness about the fact that proper nutrition of calves increases the productivity of the dairy sector in the long term, momentum is being given to the market. Australian farmers are using specifically designed CMR formulations to support calf immunity and growth rates with vigor, especially in cases where there is a failure or unavailability of maternal milk supply.

The utilization of CMR thus supports improved management practices as the feeding is strictly regulated to maintain uniformity in growth rate among calves.

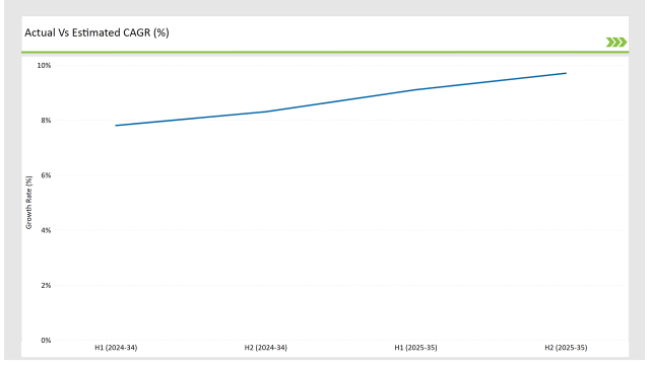

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Australian Calf Milk Replacer market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Calf Milk Replacer sector is predicted to grow at a CAGR of 10.1% during the first half of 2025, increasing to 11.2% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 8.8% in H1 but is expected to rise to 9.7% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

The dynamic and ever-changing trends of the Australian Calf Milk Replacer market are presented by these figures. Regulatory shifts, changing farmer preferences, and the development of new nutritional formulations can contribute to this changing scenario.

Thus, businesses seeking to adapt to the predicted market growth need a semi-annual analysis of such factors that could pose a challenge to their strategy. This breakdown helps stakeholders understand the complexity of the market and adapt to evolving demands, ensuring they remain competitive and responsive to both consumer and regulatory shifts in the CMR sector.

| Date | Development/M&A Activity & Details |

|---|---|

| May 2024 | Terragen MYLO is an Australian-made, liquid probiotic containing three strains of Lactobacillus bacteria. It has been shown to enhance calf health, rumen development, and rice in live weight gain in calves. |

| May 2024 | The MaxCare calf milk replacers range has been developed with careful attention to deliver the best possible growth, nutrition, and health support at the critical first weeks of life. There is the option of either the Essential, Premium, or Ultimate product according to performance requirements in light of specific calf needs. |

Increasing Demand for Premium Calf Milk Replacer Formulations

There is an increasing requirement in Australia for premium calf milk replacers formulated to promote calf growth and immunity. Premium products typically contain added probiotics, vitamins, and minerals promoting better health outcomes, especially for calves within intensive farming systems.

With its focus on herd quality improvement and increasing milk production efficiency, the Australian dairy industry is demanding such specific products. The increasing awareness among farmers of the significance of early-life nutrition to the long-term health and productivity of their herds is a strong motivator to invest in better CMR products.

More advanced CMR formulations with targeted nutrients, such as prebiotics for gut health or specific amino acids for muscle development, are also gaining acceptance.

Integration of Technology and Digital Solutions in Calf Rearing Practices

Integration of digital technologies and smart farming solutions into the Australian Calf Milk Replacer market. Advanced monitoring and tracking systems for better management and administration of calf milk replacers among dairy farmers. Use of IoT-enabled devices such as automated feeding systems, real-time monitoring sensors that help track data concerning consumption patterns and growth rates and general health status.

These digital solutions enable farmers to be more conscious, precise, and proactive to issues or discrepancies within the perfect feeding program of their calves. It will give these smart farm technologies integrated into the products of calf milk replacers predictive capabilities such that these may help farmers detect possible calf nutrition-related needs.

This trend toward digitalization and smart farming integration is expected to make calf rearing practices more efficient, precise, and traceable to ultimately contribute to the overall productivity and competitiveness of the Australian dairy industry.

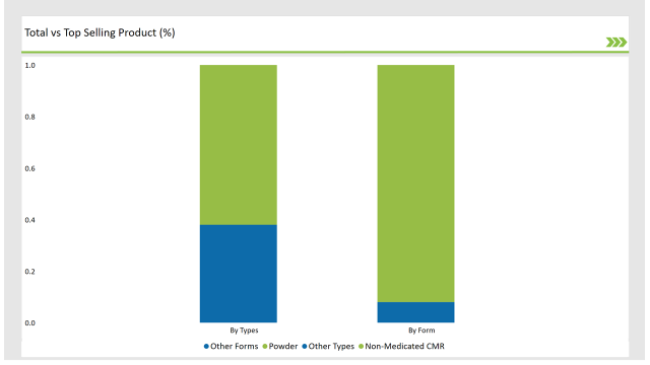

% share of Individual categories by Type and Form in 2025

The non-medicated calf milk replacer has found to be at the helm, dominating the market by the current transformation in dairy into more natural or health-oriented practice. Increasing demands from the sector of dairy agriculture in Australia about alternative choices toward medicated feed are raising voices as alarm with regard to livestock antibiotic intake use, concerning such long-term future effects.

Non-medicated CMR is safer for calf rearing compared to medicate one and it aligns with the industry's general desire to reduce its dependence on antibiotics and improve the welfare of calves. Hence, the manufacturers will focus even more on innovation in this area by improving the formulation of non-medicated CMRs to ensure best possible growth and performance of calves. This trend will impact the whole industry as it enables the production of better-quality milk and healthier herds.

The powdered CMR segment continues to dominate the Australian market as no one else matches it in convenience, cost-effectiveness, and flexibility for the dairy farmer. Compared with liquid products, powdered CMR is easier to store and possesses a much longer shelf life while providing the dairy farmer with a far greater amount of control in feeding.

These factors make it an excellent choice for the Australian dairy industry, where the large-scale operation and efficiency become the key determinant of competitiveness within both domestic and international markets. Most dairy farms, especially those in rural regions, use powdered formulations because of ease of storage and transport.

Liquid versions need to be kept in refrigeration and are generally more susceptible to spoilage, which is quite an important factor to consider for the Australian farmer in the event of lack of prompt access to infrastructure or resources in large quantities of liquid milk.

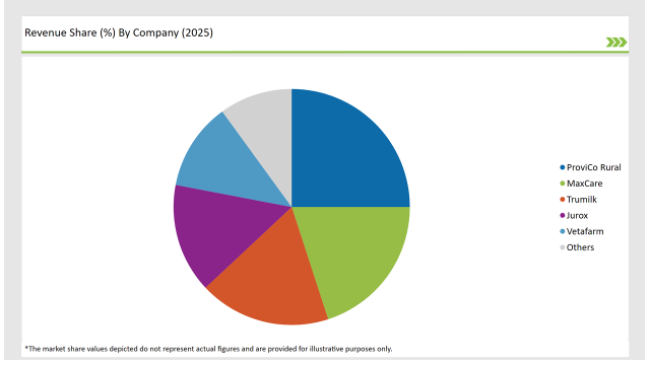

2025 Market share of Australia Calf Milk Replacermanufacturers

Note: The above chart is indicative in nature

Tier 1 players of Australian Calf Milk Replacer is dominated by leading manufacturers and premium brands, having a good market penetration due to the availability of strong market distribution channels. High financial and established brand base, strong reputation, and an excellent presence throughout the markets dominate business strategies by such players. Their products usually offer higher nutrition profiles compared with others and satisfy a growing need for premium, high-performance calf milk replacers.

Tier 2 in the Australian CMR market comprises regional and niche players, who service particular segments of the market but are still significant in size. The products of these companies are usually competitive, cost-effective, and suit smaller to mid-sized dairy farms or those that are looking for particular solutions. These companies normally do not offer as extensive a range of products and service coverage, but often target specific elements of calf nutrition like non-medicated or breed-specific formulations.

Tier 3 companies are smaller and emerging companies which still find their position in the market. They participate in local productions of CMR and may carry niche formulations unique to the product, as it gains increasingly higher demand amongst a niche market population searching for variants beyond the commonly formulated product type.

The industry includes various typeof Calf Milk Replacer such as medicated CMR, non-medicated CMR.

The industry includes various pet type such as powder CMR, and liquid CMR.

The industry includes numerousend users such as commercial dairy farms, individual farmers, and research & academic institutions.

The industry includes numerousdistribution channel such as direct sales/B2B, and retail/B2C.

By 2025, the Australian Calf Milk Replacer market is expected to grow at a CAGR of 16.0%.

By 2035, the sales value of the Australian Calf Milk Replacer industry is expected to reach USD 49.4 million.

Key factors propelling the Australian Calf Milk Replacer market include advancements in calf nutrition and formulation, technological integration in calf rearing practices, expansion of niche CMR products for specific breeds, and increasing focus on herd health and productivity.

Prominent players in Australia Calf Milk Replacer manufacturing include ProviCo Rural, MaxCare, Trumilk, Jurox, Vetafarm, Provimi (Cargill), Hubbard Feeds (Alltech), Royal FrieslandCampina, Trumilk CMR, Terragen, Nutreco N.V., and DeLaval, among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Calf Milk Replacers Market Size, Growth, and Forecast for 2025 to 2035

Analyzing Calf Milk Replacers Market Share & Growth Factors

UK Calf Milk Replacer Market Growth – Trends, Demand & Innovations 2025–2035

USA Calf Milk Replacers Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Calf Milk Replacer Market Insights – Demand, Size & Industry Trends 2025–2035

Europe Calf Milk Replacer Market Outlook – Share, Growth & Forecast 2025–2035

Latin America Calf Milk Replacer Market Insights – Size, Growth & Forecast 2025–2035

Pet Milk Replacers Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Goat Milk Replacer Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Australia Human Milk Oligosaccharides Market Analysis – Size & Industry Trends 2025-2035

Kitten Milk Replacer & Formula Market

Functional Milk Replacers Market Size, Growth, and Forecast for 2025 to 2035

Milk Froth Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Milk Carton Market Size and Share Forecast Outlook 2025 to 2035

Milking Automation Market Size and Share Forecast Outlook 2025 to 2035

Australia Pallet Wraps Market Size and Share Forecast Outlook 2025 to 2035

Milking Robots Market Size and Share Forecast Outlook 2025 to 2035

Milk Packaging Market Size and Share Forecast Outlook 2025 to 2035

Milk Clarifier Market Size and Share Forecast Outlook 2025 to 2035

Milk Homogenizer Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA