The Australian Chitin market is estimated to be worth USD 6.0 million by 2025 and is projected to reach a value of USD 26.7 million by 2035, growing at a CAGR of 16.1% over the assessment period 2025 to 2035

| Metrics | Values |

|---|---|

| Industry Size in 2025 | USD 6.0 million |

| Value in 2035 | USD 26.7 million |

| Value-based CAGR from (2025 to 2035) | 16.1% |

The Australian chitin market is defined in terms of chitin's production, consumption, and trade; it is a bio-polymer mainly produced from the exoskeletons of crustaceans such as shrimp and crabs, fungi. It provides raw material for a number of products that would go into use within the food, pharmaceutical, agriculture, and cosmetics industries: namely, chitosan.

The chitin market in Australia appears to have ample potential due to the robust industry of seafood developed in that nation, particularly around areas of importance for crustacean farming and processing. Thus, in growing demand for ecologically friendly substitutes for synthetic polymers, a material such as chitin starts to find attention.

There is a demand for natural additives in food items as well as improvements in biomedical research that places chitin as an auspicious market in Australia. Also, rising emphasis on sustainable agriculture and growing demands to curtail plastic wastes add to augmenting relevance with solutions based on chitin. In essence, due to environmental trends, consumer demands for natural additives, and huge seafood and biotechnology sectors that Australia possesses, the demand is estimated to raise within the chitin market, Australian market.

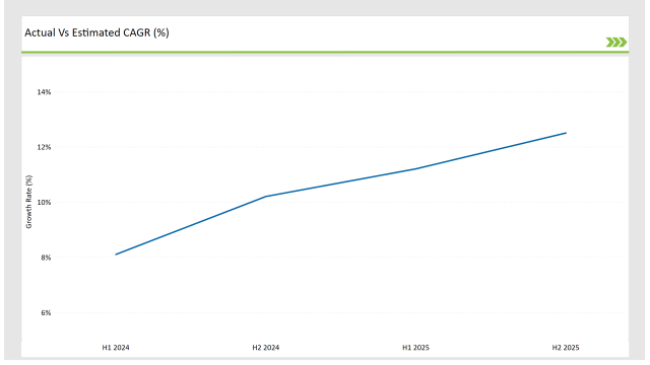

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Australian Chitin market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Chitin sector is predicted to grow at a CAGR of 11.2% during the first half of 2025, increasing to 12.5% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 8.1% in H1 but is expected to rise to 10.2% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

This brings to light the dynamic and continuously evolving nature of the Australian Chitin market, which changes according to shifts in consumer preferences, formulation technologies, and other regulatory changes. Business houses will require periodic understandings of such trends to enable the effective modification of strategies in the pursuit of innovation and a market growth trend. This is one of the tools that is quite useful in managing the market with all its intricacies, being ahead of competition.

| Date | Development/M&A Activity & Details |

|---|---|

| October 2024 | Australian farmer Ian Rew developed Flamingro , a BioGro -certified organic chitin-based biostimulant that boosts plant growth while controlling plant-parasitic nematodes. New Zealand field trials showed Flamingro could increase plant root mass and shoot growth by 26%. Formulated for the Australian environment, Flamingro is a dry product that does not clog irrigation systems. |

| 2023 | ChitogenX Inc. now formerly Ortho Regenerative Technologies Inc. recently stated to seek business of medical-grade chitosan sales as its new revenue stream. This new revenue stream was sought after after a commercially and regulatorily ready process within the company. The company also entered into a collaboration with the California Medical Innovations Institute for possible collaborative projects that will be advanced into proof-of-concept research programs using ChitogenX's solutions for regenerative medicine. |

Expanding Role of Chitin in Biomedical Applications

With Australia's healthcare sector investing in innovative therapies and medical treatments, chitin is slowly finding its niche in biomedical applications due to its biocompatibility and unique chemical properties. Growing interest in regenerative medicine and advanced wound care products is fueling the demand for chitin-based materials, especially chitosan, a derivative of chitin.

Positioned as a notable ingredient in the pharmaceutical and medical device industries, the acceleration of wound healing, prevention of infection, and promotion of tissue regeneration enabled by chitosan, this trend will impact the market by introducing a new demand for high-value chitin from sustainable, marine-based sources.

Chitin in Agriculture for Pest Control and Soil Health

The adoption of chitin in agriculture will change the Australian market by increasing the scope of application of chitin to crop protection and soil enhancing products. Given that farmers look for effective alternative chemical pesticides, chitin-based solutions offer an attractive option.

In addition, given the shift of agriculture towards diminishing synthetic chemicals usage, such requirements for such naturally occurring products are going to soar at a quick pace. Such a demand generated from the sector of agriculture shall lead to developing new requirements where innovations are inspired in applying chitin for better plant health management. Over time, this will lead to a more diversified chitin market where agricultural players will rely on chitin derivatives for pest control, plant growth promotion, and sustainable farming practices.

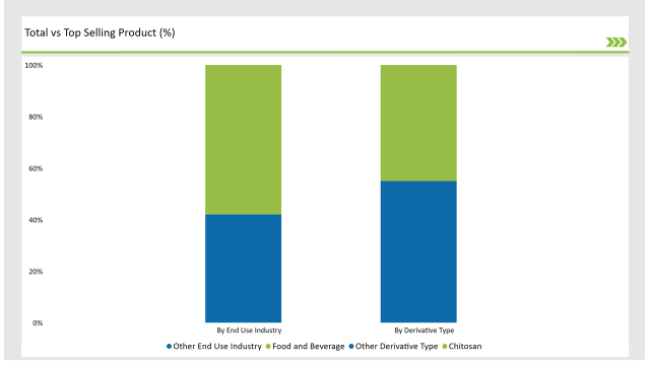

% share of Individual categories by Derivative Type and End Use Industry in 2025

The chitosan segment is a market leader in Australia because of its versatility in health, agriculture, and food processing. Acceptance of the product is gradually gaining momentum with chitosan being a derivative of chitin and the far-reaching benefits that it provides in areas that give emphasis to functional ingredients and natural solutions.

In agriculture, chitosan has become an important component in pest control and crop protection. This chitosan property of inducing plant's defense mechanism against pathogens is a treasure that is reliable for farmers looking for clean, non-toxic solutions for enhancing crop production.

As Australian farmers embrace integrated pest management, demand for chitosan in agricultural industries will be in biopesticides and plant growth enhancers. The segment does not only improve crop production but also satisfies the growing trend of using minimal artificial chemicals within agriculture.

Application of chitin as a fat substitute in low-calorie and weight management products has been one of the key factors that are contributing to the growth of chitin in the food and beverage market of Australia. Chitosan can bind dietary fats, which do not allow their absorption.

Australia's increasing interest among its consumers towards healthy food has given chitin this advantage. With more health-conscious Australians looking for ways to reduce calorie intake without sacrificing taste, the role of chitosan as a fat blocker in functional foods and beverages is driving demand for chitin-based ingredients.

Note: The above chart is indicative in nature

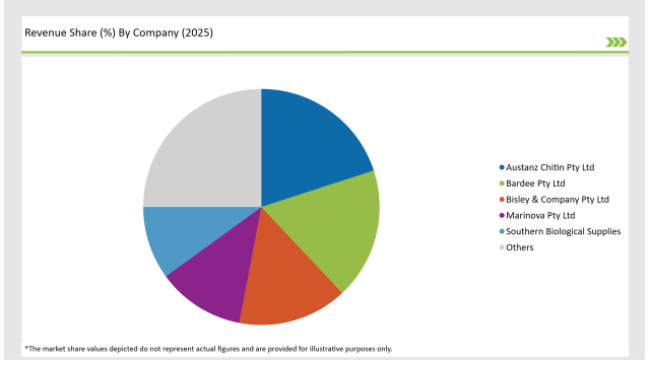

Tier 1 players in the Australian chitin market are known to have a significant market presence and large-scale operations with high investments in research and development. Such players are expected to operate across various sectors such as pharmaceuticals, food and beverages, and agriculture. They have a great distribution network, and they sell a comprehensive portfolio of chitin-based products that include chitosan to diverse industries for usage in functional food, health supplement, and biopesticides applications.

Tier 2 companies primarily focus on niche applications, sometimes targeting niche industries with innovative solutions based on chitin. Companies are also picking up the pace by targeting specific market requirements, such as the growing need for functional foods, health supplements, and natural agricultural solutions. They may not have the same kind of reach as Tier 1 players but are unique with specialized products or services that can cater to an extremely specific requirement in the food, health, or agricultural domains.

Tier 3 players include the small to regional market suppliers, which are smaller players, usually focusing their activity on chitin-based ingredients catering to these specific local markets or sectors. Also, they tend to have very low production capacities and sell their products directly to minor manufacturing sites or niche end-users.

The industry includes various derivative type such as glucosamine, chitosan, and others

As per the application segment, the market is segregated into food and beverages, agrochemical, healthcare, cosmetics and toiletries, waste and water treatment, andothers.

By 2025, the Australian Chitin market is expected to grow at a CAGR of 16.1%.

By 2035, the sales value of the Australian Chitin industry is expected to reach USD 26.7 million.

Key factors propelling the Australian Chitin market include evolving consumer preferences toward plant-based solutions, expanding role of chitin in waste reduction and recycling, government and industry support for biotech innovations, and rising demand for natural health products.

Prominent players in Australia Chitin manufacturing include Qingdao Yunzhou Biochemistry Co., Ltd., Zhejiang Golden-Shell Pharmaceutical Co., Ltd., Biopharm, Primex Ingredients ASA, Biotech Marine, Austanz Chitin Pty Ltd, Bardee Pty Ltd, Bisley & Company Pty Ltd, Marinova Pty Ltd, and Southern Biological Supplies, among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Australia Pallet Wraps Market Size and Share Forecast Outlook 2025 to 2035

Australia and South Pacific islands Tourism Market Size and Share Forecast Outlook 2025 to 2035

Australia Legal Cannabis Market - Size, Share, and Forecast 2025 to 2035

Australia Probiotic Supplements Market Trends – Growth, Demand & Forecast 2025–2035

Australia Chickpea Protein Market Outlook – Demand, Trends & Forecast 2025–2035

Australia Non-Dairy Creamer Market Outlook – Size, Demand & Forecast 2025–2035

Australia Bubble Tea Market Trends – Size, Share & Forecast 2025–2035

Australia Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

Australia Non-Alcoholic Malt Beverages Market Insights - Trends & Forecast 2025 to 2035

Australia Food Testing Services Market Growth – Trends, Demand & Innovations 2025–2035

Australia Food Emulsifier Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Pulses Market Report – Trends, Demand & Industry Forecast 2025–2035

Australia Probiotic Strains Market Growth – Trends, Demand & Innovations 2025–2035

Australia Frozen Ready Meals Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Yerba Mate Market Growth – Trends, Demand & Innovations 2025–2035

Australia Sweetener Market Analysis – Size, Share & Forecast 2025–2035

Australia Food Service Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Yeast Extract Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Canned Tuna Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Calf Milk Replacer Market Outlook – Share, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA