The Australian Bubble Tea market is estimated to be worth USD 17.5 million by 2025 and is projected to reach a value of USD 58.4 millionby 2035, growing at a CAGR of 12.8% over the assessment period 2025 to 2035.

| Metrics | Values |

|---|---|

| Industry Size in 2025 | USD 17.5 million |

| Value in 2035 | USD 58.4 million |

| Value-based CAGR from 2025 to 2035 | 12.8% |

The bubble tea market in Australia can be referred to as the manufacture, distribution, and consumption of bubble tea- a Taiwanese-origination drink made mainly with tea, milk, fruits, and chewy tapioca pearls or other forms of topping, such as popping boba, taro balls, and coconut jelly.

Being usually chilled, bubble tea is now highly flexible and may offer a huge diversity of flavors and textures, providing a taste suitable for consumers. The bubble tea market in Australia is gaining prominence rapidly, essentially because of a younger, trend-conscious consumer.

It shares its advantages as an adaptation of traditional tea culture into fun, modern ingredients and is conducive for use in social parties or an informal consumption system. With increasing demand for customization and innovative flavors, the market is not only a key player in the food and beverage industry but also drives innovations in consumer behavior, health-conscious options, and lifestyle products. It also supports local businesses, driving employment in retail and hospitality sectors.

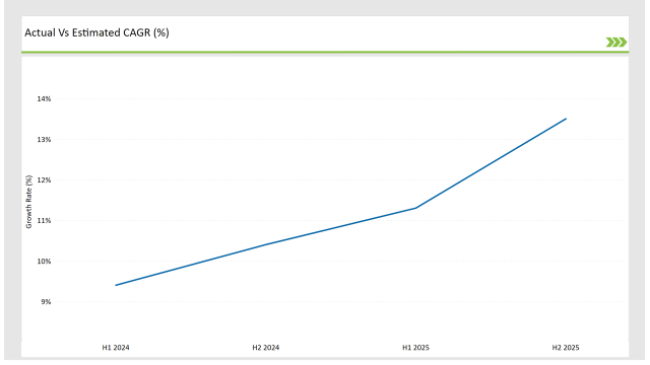

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Australian Bubble Tea market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Bubble Tea sector is predicted to grow at a CAGR of 11.3% during the first half of 2025, increasing to 13.5% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 9.4% in H1 but is expected to rise to 10.4% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 25 basis points in the second half of 2025 compared to the second half of 2024.

These statistics reflect the dynamically changing nature of the Australian bubble tea market and conditions such as changing regulations, shifting consumer preferences, and innovation in natural colorants. The semiannual analysis would prove to be useful for those looking to be better-positioned for the expected growth while addressing any specific type of challenge within the market.

Understanding these trends is crucial for companies aiming to stay competitive and align their offerings with both market demands and emerging industry shifts.

| Date | Development/M&A Activity & Details |

|---|---|

| September 2024 | Allen's, one of Australia's most iconic confectionery brands, collaborated with Chatime to launch a range of limited-edition bubble tea inspired by Allen's Party Mix. The flavors were Pineapple Fruity, Milk Bottles Frozen, and Bananas Milk Tea - all the great Allen's classic candy flavors but in Chatime's signature bubble tea offerings. |

| August 2024 | CoCo Bubble Tea has established its new store at Hollywood Plaza in Salisbury Downs, South Australia. The store offers milk, fruit, seasonal teas, and coffee brews, and it features indoor seating and interactive elements such as token-taking claw machines. |

Flavor Innovation and Customization: Shaping the Future of Bubble Tea

In Australia, flavor innovation and product customization lead the evolution in the bubble tea market. Customers, especially the millennials and Gen Z, like to try unique and new combinations of flavors. While the popular tea-based flavor options are always green tea and black tea, Australian consumers test more exotic ones such as matcha, taro, passion fruit, lychee, and even a hybrid option - salted caramel and lavender-infused tea.

The rise of these flavors, usually combined with other toppings, creates a very dynamic market, no longer limited to conventional tastes. Toppings such as popping boba, coconut jelly, and taro balls are now being paired with more adventurous tea blends to cater to diverse palates.

Health-Conscious Adaptations: Meeting Consumer Demands for Better-for-You Options

Bubble tea was usually consumed and known as something quite rich; however, today in the Australian market, this scenario has become upside-down due to rising health concerns, thus most bubble tea brands have resorted to introducing low sugar content and lower-calorie with a more nutritional aspect, while there are lots of conscious customers about what they put inside their stomach.

One of the new variations they could offer is "superfood" bubble teas, which can blend antioxidants, probiotics, or other health-boosting ingredients. Not only will such a trend appeal to health-conscious consumers, but it will also open bubble tea up to a wider audience: fitness enthusiasts, those on specific diets, and so on.

The more diversification in the market, the more such adaptations can serve as key differentiators for brands - drivers of their growth and consumer loyalty within such a health-focused market.

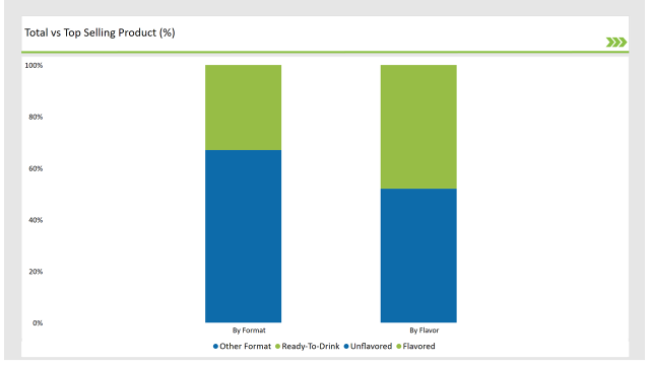

The flavored section of the Australian bubble tea market has shown to become the first trending item, influenced by a combination of cultural impact, changes in consumer preference, and growing demand for unique flavors. Even though milk tea and green tea are still among the dominant variants of traditional bubble tea, the market has gravitated more towards livelier, exotic, and flavorful options.

Matcha, passion fruit, taro, mango, and tropical fusion are now among the staples of flavoring for this market. In itself, that already tells much about how things have been altered.

The ready-to-drink segment has emerged as the driving force in the Australian bubble tea market, fueled by convenience needs and the desire for quick hassle-free beverage options. Convenience is something people yearn for, especially in this fast-paced society, as Australians, like people elsewhere in the world, seek drinks that are of quality yet easy.

Ready-to-drink bubble tea perfectly balances both the needs stated above because it combines the popular, indulgent flavors of bubble tea with the convenience of prepackaging and availability.The RTD segment targets mostly busy professionals, students, and young adults who want to enjoy the experience of bubble tea without having to wait in line or visit a store.

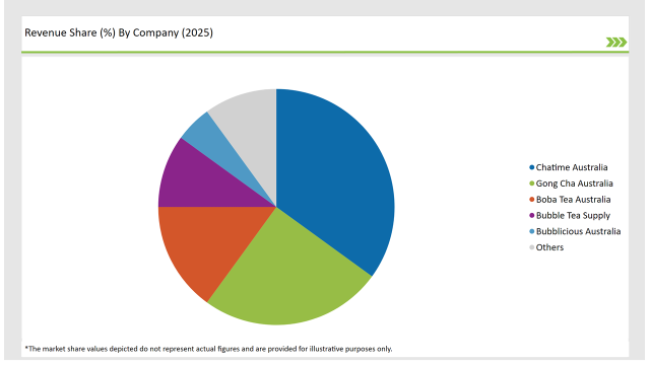

2025 Market share of Australia Bubble Teamanufacturers

Note: The above chart is indicative in nature

Tier 1 brands hold the highest position in the market, primarily due to strong marketing strategies, continuous promotions, and product availability at multiple locations. Large-scale operations with franchise models at multiple locations have also increased their market coverage. They utilize social media platforms and digital marketing the most in maintaining brand awareness and engaging the customer.

Tier 2 players are those in the Australian bubble tea market who establish themselves as regional players but are not on the same level as Tier 1 players when it comes to nationwide dominance. These brands will be operating primarily in specific cities or regions but are growing their customer base and brand awareness.

Tier 3 brands in the Australian bubble tea market are the emerging players or independent shops still in the growing phase. Brands generally operate on a small scale, targeting local markets or specific communities rather than strategic nationwide expansion. Many are family-run independent operations that have a fantastic niche focus on delivering quirky, premium products to a smaller but loyal customer base.

As per the format segment, the market is segregated into ready-to-drink, and ready-to-mix.

The industry includes various flavors such asflavored, and unflavored.

As per the toppings segment, the market is segregated into tapioca pearls, popping bob bursting bubbles, taro balls, and coconut jelly.

As per the distribution channel segment, the market is segregated into indirect salesand direct sales.

By 2025, the Australian Bubble Tea market is expected to grow at a CAGR of 12.8%.

By 2035, the sales value of the Australian Bubble Tea industry is expected to reach USD 58.4 million.

Key factors propelling the Australian Bubble Tea market include rising popularity of vegan and dairy-free alternatives, flavors and toppings diversification, increased presence of international bubble tea chains, and growing health consciousness and demand for healthier options.

Prominent players in Australia Bubble Tea manufacturing include Boba Tea Australia, Bubble Tea Supply Australia, Chatime Australia, Gong Cha Australia, Bubblicious Australia, Tapioca Express Australia, Bobatea Australia, Tapioca King Australia, Tea Zone Australia, and YOGO Boba Australia among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Australia Pallet Wraps Market Size and Share Forecast Outlook 2025 to 2035

Australia and South Pacific islands Tourism Market Size and Share Forecast Outlook 2025 to 2035

Australia Legal Cannabis Market - Size, Share, and Forecast 2025 to 2035

Australia Probiotic Supplements Market Trends – Growth, Demand & Forecast 2025–2035

Australia Chickpea Protein Market Outlook – Demand, Trends & Forecast 2025–2035

Australia Non-Dairy Creamer Market Outlook – Size, Demand & Forecast 2025–2035

Australia Chitin Market Analysis – Growth, Size & Forecast 2025–2035

Australia Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

Australia Non-Alcoholic Malt Beverages Market Insights - Trends & Forecast 2025 to 2035

Australia Food Testing Services Market Growth – Trends, Demand & Innovations 2025–2035

Australia Food Emulsifier Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Pulses Market Report – Trends, Demand & Industry Forecast 2025–2035

Australia Probiotic Strains Market Growth – Trends, Demand & Innovations 2025–2035

Australia Frozen Ready Meals Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Yerba Mate Market Growth – Trends, Demand & Innovations 2025–2035

Australia Sweetener Market Analysis – Size, Share & Forecast 2025–2035

Australia Food Service Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Yeast Extract Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Canned Tuna Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Calf Milk Replacer Market Outlook – Share, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA