The Australian Canned Tuna market is estimated to be worth USD 46.6 million by 2025 and is projected to reach a value of USD 115.6 million by 2035, growing at a CAGR of 9.5% over the assessment period 2025 to 2035.

| Metrics | Values |

|---|---|

| Industry Size in 2025 | USD 46.6 million |

| Value in 2035 | USD 115.6 million |

| Value-based CAGR from 2025 to 2035 | 9.5% |

The canned tuna is the production, distribution, and sale of tuna packed in sealed cans that offer consumers the convenience of a long shelf life for a source of protein food. This category goes about in chunk light, chunk white, solid, and skipjack tuna but are usually sold in oil, brine, or spring water.

Canned tuna is a staple in Australian households because it is affordable, versatile, and convenient to prepare meals, from salads to sandwiches. The canned tuna market in Australia is significant because it is a primary source of affordable, sustainable protein. With a growing focus on health and nutrition among consumers, canned tuna is a low-calorie, high-protein alternative.

Furthermore, the strong fishing industry and well-established tuna canning practices in Australia contribute to the domestic supply. Some other environmental concerns affecting the market relate to overfishing and sustainability. Consumers increasingly choose brands that support responsible sourcing practices.

Besides, the increased adoption of online grocery shopping and changing food consumption habits create both challenges and opportunities for the canned tuna market as it adapts to evolving consumer preferences.

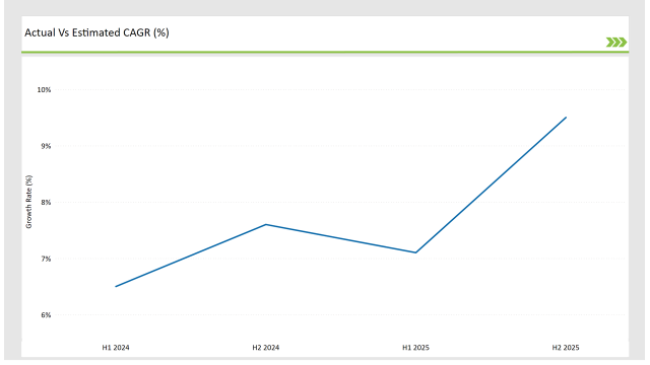

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Australian Canned Tuna market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Canned Tuna sector is predicted to grow at a CAGR of 7.1% during the first half of 2025, increasing to 9.5% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 6.5% in H1 but is expected to rise to 7.6% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

These figures are indicative of the dynamic and ever-changing landscape of the Australian canned tuna market, which is being influenced by changes in consumer behavior, product innovation, and developments in regulation. This bi-annual overview will be useful for businesses looking to align their strategies with expected market trends and make the most of opportunities for growth while overcoming challenges inherent in such a competitive industry.

Understanding the dynamics in question will allow the companies to move ahead and change with consumer needs and complexities within the market.

| Date | Development/M&A Activity & Details |

|---|---|

| December 2023 | Pavo and Heidi Walker, Mooloolaba have introduced Walkers Tuna, which sells albacore tuna responsibly sourced and packaged in a shelf-stable format. It is currently available at independent grocers, IGAs, and Harris Farm Markets, but plans to move into the major supermarkets. |

| 2023 | Little Tuna recognized for its sustainably fished tuna, has expanded its product line to include East Coast Tuna Co., which has 100% Australian line-caught albacore tuna. This new offering is packaged in handy 185g tins, making it more accessible to consumers. |

Convenience and Ready-to-Eat Tuna Products

Australia has seen sky rocketing popularity in ready-to-eat canned tuna products as its consumers seek comfort in convenient foods. Working individuals and busy family life are turning into a more demanding preference towards quicker, quicker meal solutions, hence increasing demands for single serve packs, flavored tuna bowls, and minimalist preparation meal kits.

These products allow the consumer to obtain a healthy meal with minimal efforts, in consonance with the trend of consumption driven by convenience.This is affecting the market considerably and pressing brands to innovate and diversify their offerings.

More consumer in Australia prepare meals or eat out of need for convenience over lunch, to which these readymade canned tuna products align. Companies are just starting to launch new flavors and combinations and easy-open packaging, such as tuna and pasta or vegetables.

Health-Conscious Consumers Seeking Omega-3 and Nutrient-Dense Products

As health-consciousness among Australian consumers continues to grow, food products that have health benefits above and beyond simple nutrition are being sought after more and more. This is most relevant to the canned tuna market, as increasingly, consumers look for products rich in omega-3 fatty acids, protein, and other nutrients essential for good health.

The awareness of the heart-healthy benefits of omega-3, which are abundant in tuna, is leading consumers to prioritize this type of food in their diets. In addition, growing health awareness has made the market for specialized tuna products such as low-sodium and tuna in spring water increasingly popular among health-conscious consumers.

This is bound to impact the Australian canned tuna market. It is very probable that more companies will continue investing in developing nutrient-rich health-centric products, so the share will be taken up by the brands that comply with the trend on health consciousness. This increases demand for 'functional, wellness-focused food options'.

% share of Individual categories by Product Type and Product Formin 2025

This primarily includes its flexibility, price, and nutritional content as the largest canned light tuna category in Australia, thus becoming a household name in most pockets. For one, the fact that light tuna, commonly made from skipjack or yellowfin, tends to be more palatable for a broader range of cooking uses is that it is less flavor intense and more delicate in texture than its white tuna counterparts.

Australians are becoming more healthy and fit in recent times; they prefer a lower calorie intake but higher in protein. A low-cost protein source is also light tuna that provides a great deal of omega-3 fatty acids, known to be healthy for the heart. As people are shifting to healthier yet more convenient meal alternatives, canned light tuna fits just right into modern diets - whether it's salad, sandwiches, or quick stir-fries.

The chunk form tuna segment prevails in the Australian market mainly due to its better texture and versatility in meeting meals preparatory needs. Chunk tuna, usually packed in water or oil, is a high-quality, protein-rich food product; it satisfies the consumer's need of adaptation to various culinary requirements.

The larger flakes have more texture and flavor associated with the nature of the fish, making them a better preference for those wishing to have as close to authentic tuna experience from the flake or shredded styles.Greater chunks provide more significant bites that are more enjoyable to be eaten at the table, which appeals well to consumers seeking a more indulgent but convenient meal.

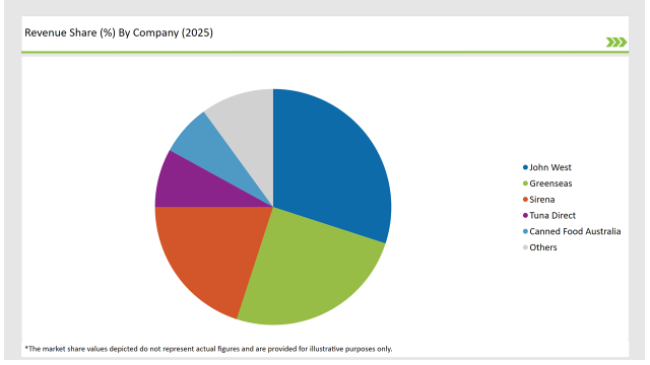

2025 Market share of Australia Canned Tuna manufacturers

Note: The above chart is indicative in nature

Tier 1 of the Australian canned tuna market is dominated by well-established brands that have long been synonymous with the product category. These brands enjoy good brand recognition and loyalty, as well as a vast distribution network, making it the preferred choice for a majority of customers. In most cases, their dominance in the market is attributed to their quality and consistent product offerings paired with heavy marketing undertakings.

Tier 2 forms of the canned tuna market include the emerging companies that have positioned themselves in unique niches of the market. Brands in the category. Often, these kinds of companies find niche markets they focus on the product types available or present niche value propositions distinct from the strong brands.

The niche players in tier 3 also include small companies that are smaller and newer than the market competitors. They typically target a subset of consumers due to their offerings of unique specialty canned tuna in line with niche tastes or consumer preferences, premium tuna varieties or tuna packaged uniquely with spices or flavors.

As per the product type segment, the market is segregated into canned white tuna, canned light tuna, and canned specialty tuna.

As per the flavor segment, the market is segregated into flavored, and unflavored.

As per the product form segment, the market is segregated into chunk, solid, flakes, and others.

As per the sales channel segment, the market is segregated into B2B/HoReCa, and B2C (hypermarkets/supermarkets, convenience stores, online retail, and others).

By 2025, the Australian Canned Tuna market is expected to grow at a CAGR of 9.5%.

By 2035, the sales value of the Australian Canned Tuna industry is expected to reach USD 115.6 million.

Key factors propelling the Australian Canned Tuna market include emerging focus on quick meal solutions and meal prepping, growing demand for tuna in meal kits and pre-packaged meals, and emphasis on omega-3 rich products in health trends.

Prominent players in Australia Canned Tuna manufacturing include John West, Greenseas, Sirena, Tuna Direct, Canned Food Australia, SPC, Woolworths, Coles, Bumble Bee Foods, Little Tuna, and Thai Union Group among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Australia Pallet Wraps Market Size and Share Forecast Outlook 2025 to 2035

Australia and South Pacific islands Tourism Market Size and Share Forecast Outlook 2025 to 2035

Australia Legal Cannabis Market - Size, Share, and Forecast 2025 to 2035

Australia Probiotic Supplements Market Trends – Growth, Demand & Forecast 2025–2035

Australia Chickpea Protein Market Outlook – Demand, Trends & Forecast 2025–2035

Australia Non-Dairy Creamer Market Outlook – Size, Demand & Forecast 2025–2035

Australia Chitin Market Analysis – Growth, Size & Forecast 2025–2035

Australia Bubble Tea Market Trends – Size, Share & Forecast 2025–2035

Australia Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

Australia Non-Alcoholic Malt Beverages Market Insights - Trends & Forecast 2025 to 2035

Australia Food Testing Services Market Growth – Trends, Demand & Innovations 2025–2035

Australia Food Emulsifier Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Pulses Market Report – Trends, Demand & Industry Forecast 2025–2035

Australia Probiotic Strains Market Growth – Trends, Demand & Innovations 2025–2035

Australia Frozen Ready Meals Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Yerba Mate Market Growth – Trends, Demand & Innovations 2025–2035

Australia Sweetener Market Analysis – Size, Share & Forecast 2025–2035

Australia Food Service Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Yeast Extract Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Calf Milk Replacer Market Outlook – Share, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA