The Australia Pulses market is estimated to be worth USD 5,122.8 million by 2025 and is projected to reach a value of USD 8,750.5 million by 2035, growing at a CAGR of 5.5% over the assessment period 2025 to 2035

| Attributes | Values |

|---|---|

| Estimated Australia Industry Size (2025) | USD 5,122.8 million |

| Projected Australia Value (2035) | USD 8,750.5 million |

| Value-based CAGR (2025 to 2035) | 5.5% |

The pulses market in Australia simply refers to the cultivation, production, processing, and export of such legumes as chickpeas, lentils, faba beans, and field peas. Pulses play a very important role in Australia's agricultural sector and constitute a significant proportion both of the domestic food supply and international trade.

The driving force of the market is largely demand for plant-based protein that has more recently taken a stronghold among many consumers in pursuit of their sustainable, healthy diet. A combination of favorable climates in regions like Queensland, New South Wales, and South Australia supports quality pulses.

Developed farm techniques and well-developed infrastructure for exports made Australia one of the world's highest exporters of pulses to markets like those in Asia, Europe, and the Middle East.

The pulses market in Australia has a multi-dimensional significance. On the domestic front, pulses enhance food security and are an essential crop for rotation, thereby ensuring better soil health and sustainability. Economically, pulses are a high-value agricultural product that increases farm incomes and supports local communities.

On the global front, Australia plays a vital role in addressing the rising demand for plant-based protein as interest in vegetarian and vegan diets increases.

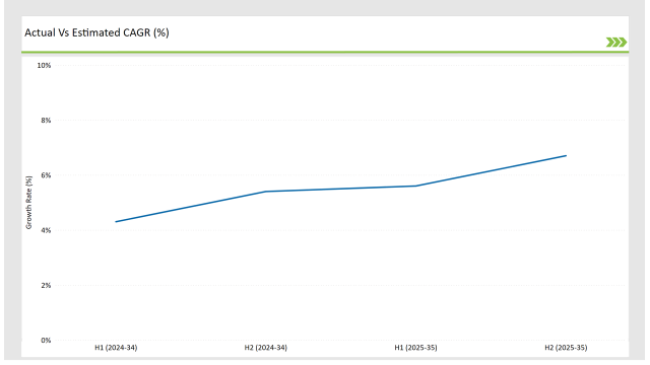

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Australian Pulses market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Pulses sector is predicted to grow at a CAGR of 5.6% during the first half of 2025, increasing to 6.7% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 4.3% in H1 but is expected to rise to 5.4% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 15 basis points in the second half of 2025 compared to the second half of 2024.

These figures reflect the dynamic and fluid nature of the Australian pulses market, which depends on factors like changes in consumer demand, changing food trends, and innovations in products based on pulses.

This bi-annual report provides critical insight for businesses in developing informed strategies that will allow them to seize the expected growth while addressing the complexities involved in the market. Maintaining an ear for these market directions, companies should be able to better position themselves ahead of the emerging demand and capitalize in the pulse space in Australia.

| Date | Development/M&A Activity & Details |

|---|---|

| 2023 | Essensis has introduced a range of pulse-based proteins that are developed from 100% Australian-grown pulses. Such proteins are used across bakery, snacks, cereals, meat alternatives, and extruded products for fine texture with high-quality amino acid profiles produced without chemical treatments. It can be considered natural and sustainably produced food inclusion. |

| 2023 | Ceres Organics Australia launched its Organic Pea Chips, kale chips, charcoal rice crackers, and sorghum pasta in order to address the increasing demand for different and health-conscious food items in Australia. This plant-based snack is an alternative offered to Australian consumers. |

Diversification of Pulse Varieties: Unlocking the Potential of Niche Crops

Australia Pulses market is currently witnessing increased interest in crop portfolio diversification away from traditional staples. Farmers and producers are starting to grow niche pulse varieties like lentils, chickpeas, and faba beans in a bid to fulfill changing consumer preferences and diversify product offerings for the market.

This is because pulse crops are noted to have unique nutritional profiles, culinary applications, and potential for value-added processing. Growing demand for niche pulse crops due to a health-conscious and searching for new food experiences by consumers might increase, providing opportunities for growers, processors, and manufacturers in foodstuffs to differentiate their products and find their entry into newer market niches.

Pulse varieties will be diversified in such a way that this would increase overall diversity of the Australia Pulses market, along with building its resilience by allowing the mitigation of risks from dominance through reliance on fewer crops.

Technological Advancements in Pulse Processing: Enhancing Efficiency and Quality

Increased adoption of advanced processing technologies in Australia Pulses has gained significant ground to enhance efficiency, quality, and innovation of their products. Pulse processors are making investments in the latest automation solutions and equipment to improve efficiency with a reduction in wastage and increased overall quality and consistency in their pulse-based products.

The technologies for automated sorting, cleaning, and packaging systems allow pulse processors to optimize their production processes, minimize labor dependency, and provide consistent, safe, and nutritious pulse-based products into the marketplace.

Advances made in innovative processing techniques, namely pulse fractionation and protein extraction, are new avenues for generating specialized pulse-based ingredients and added-value products because this is the day of growing requirements for plant-protein sources, functional food, and ingredients for food..

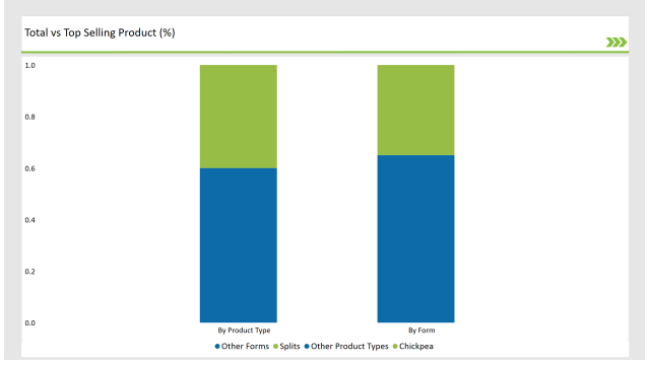

% share of Individual categories by Form and Product Type in 2025

The Australian market has also become the pulse leader with chickpeas. Being versatile and packed with nutrition and a wider consumer appeal, it has topped all other segments of products sold. Its popularity from canned chickpeas to flour to snack and even protein alternatives have shot up across Australia.

This trend is not only reshaping the pulse market but also positioning chickpeas as a key ingredient in both traditional and modern Australian cuisine. This explains the dominance of chickpeas because chickpeas constitute a staple part of a plant-based diet.

Their applicability to produce numerous products such as gluten-free chickpea flour used in baking and chickpea protein powder that is popular as a fitness supplement makes them extremely versatile and popular in various consumer markets.

The splits form is the market leader in the Australian pulse market because of its easy usage, cost-effectiveness, and diversified application in both domestic and export markets.

Pulses in split form, especially split peas, lentils, and chickpeas, are gaining increased demand as they have a relatively shorter cooking time, making them highly attractive to Australian consumers seeking convenience without losing their nutritional value.

The popularity of splits form is changing the way pulses are incorporated into both everyday meals and specialized food products across the country. Increasing needs are driven toward such products through health benefits created by pulses though in minimal preparation.

In Australia, the easy split pulse which makes its processing without a hassle while also easily cooked plays an essential position in the daily lives of more than one user in this great nation.

Note: The above chart is indicative in nature

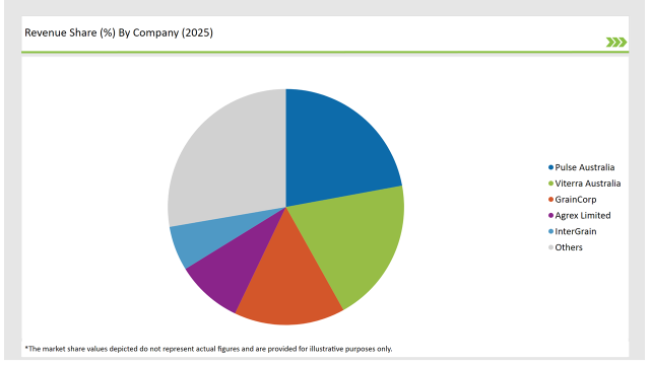

Tier 1 players are the well-established dominant companies with a high share in the domestic as well as the export market of Australia. They have large-scale operations, advanced processing capability and robust distribution networks, which makes them key influencers in the sector.

Tier 2 companies are strong regional players that focus on either specialized varieties of pulses or consumers' specific needs in the Australian market. While much smaller than the Tier 1 operators, these companies hold significant share and will be important for both diversification and expansion of the Australian pulse sector.

Tier 3 companies are smaller, emerging players that usually specialize in niche segments within the pulse market, such as organic pulses, niche pulse products, or regional varieties with a specific customer base. They can be local farmers, small processors, or new entrants seeking to carve out a presence in the highly competitive Australian pulse industry.

The industry includes various form type of whole, split, flour, grits, and flakes.

The industry includes various source type such as chickpea, lentils, yellow peas, pigeon peas.

As per the industry, the end-use application segment is bifurcated into business to business, household retail, food service, and institutional.

By 2025, the Australia Pulses market is expected to grow at a CAGR of 5.5%

By 2035, the sales value of the Australia Pulses industry is expected to reach USD 8,750.5 million.

Key factors propelling the Australia Pulses market include increasing popularity of convenient and quick-cooking pulse products, pulse integration into meat alternatives and plant-based foods, and shifting consumer preferences towards health-conscious food choices.

Prominent players in Australia Pulses manufacturing include Pulse Australia, Cargill, Olam International, Ceres Organics, Coorow Seeds, Viterra Australia, GrainCorp, Agrex Limited, Essantis, Wimmera Grain Company, and InterGrain, among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Australia Pallet Wraps Market Size and Share Forecast Outlook 2025 to 2035

Australia and South Pacific islands Tourism Market Size and Share Forecast Outlook 2025 to 2035

Australia Legal Cannabis Market - Size, Share, and Forecast 2025 to 2035

Australia Probiotic Supplements Market Trends – Growth, Demand & Forecast 2025–2035

Australia Chickpea Protein Market Outlook – Demand, Trends & Forecast 2025–2035

Australia Non-Dairy Creamer Market Outlook – Size, Demand & Forecast 2025–2035

Australia Chitin Market Analysis – Growth, Size & Forecast 2025–2035

Australia Bubble Tea Market Trends – Size, Share & Forecast 2025–2035

Australia Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

Australia Non-Alcoholic Malt Beverages Market Insights - Trends & Forecast 2025 to 2035

Australia Food Testing Services Market Growth – Trends, Demand & Innovations 2025–2035

Australia Food Emulsifier Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Probiotic Strains Market Growth – Trends, Demand & Innovations 2025–2035

Australia Frozen Ready Meals Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Yerba Mate Market Growth – Trends, Demand & Innovations 2025–2035

Australia Sweetener Market Analysis – Size, Share & Forecast 2025–2035

Australia Food Service Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Yeast Extract Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Canned Tuna Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Calf Milk Replacer Market Outlook – Share, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA