The Australia Fish Oil market is estimated to be worth USD 45.3 million by 2025 and is projected to reach a value of USD 233.3 million by 2035, growing at a CAGR of 17.8% over the assessment period 2025 to 2035

| Metric | Values |

|---|---|

| Industry Size (2025) | USD 45.3 million |

| Industry Value (2035) | USD 233.3 million |

| Value-based CAGR (2025 to 2035) | 17.8% |

The Fish Oil market in Australia represents the production, distribution, and consumption of oil extracted from fatty fish, mainly salmon, mackerel, and sardines, mainly for its high content of omega-3 fatty acids (EPA and DHA). Such essential fatty acids are very vital in supporting cardiovascular, cognitive, and joint health, making fish oil a very popular dietary supplement.

The steady rise in demand for fish oil in the Australian market is attributed to increasing health-consciousness, a growing aging population, and preference toward natural supplements over pharmaceutical ones.

Local brands such as Blackmores, Swisse Wellness, and Nature's Way have also supported market growth through their excellent products sourced from sustainable sources. The strong market emphasis on the sustainable sourcing of Australia also emphasizes the need to have certified responsibly harvested fish oil, thus a long-term stable market.

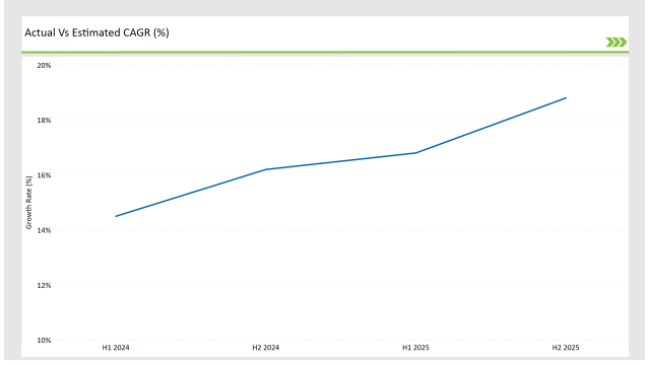

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Australian Fish Oil market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Fish Oil sector is predicted to grow at a CAGR of 16.8% during the first half of 2025, increasing to 18.8% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 14.5% in H1 but is expected to rise to 16.2% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 15 basis points in the second half of 2025 compared to the second half of 2024.

These figures reflect an Australian fish oil market that's dynamic and continues to evolve on account of regulation, consumer, and formulation change. This report is crucial in business strategy, particularly for planning around expected future growth while the complexities and the challenges of a sector are mitigated.

By understanding these trends, companies will be able to position themselves to take advantage of emerging opportunities and adapt to the evolving demands of the market.

| Date | Development/M&A Activity & Details |

|---|---|

| January 2024 | The Australian company PhytoLove introduced a plant-based omega supplement that comes from the seed oil of Buglossoides arvensis. The product is expected to offer a complete lipid profile, an alternative to traditional fish oil supplements. |

| October 2023 | Swisse Wellness announced its first "assessed listed" complementary medicine for the Australian market. The product, Swisse Ultiboost High Strength Krill Oil, is for mild to moderate osteoarthritis sufferers. Receiving "assessed listed" status from the TGA gives the product permission to make health claims, including alleviating knee pain and improving knee physical function in osteoarthritis patients. This development underlines Swisse's commitment to delivering scientifically validated health solutions to the Australian consumer. |

Shift Towards Targeted Health Solutions with Fish Oil Supplements

There is a marked trend towards personalization and targeting in health consciousness with Australians, and in fish oil supplement use in general. Customers are demanding products that can attack a host of health issues, from joint pain to heart health, mental clarity, and skin conditions.

Supplements containing high-potency, concentrated omega-3 oils, and advanced formulations with added vitamins or herbal ingredients, are gaining popularity in the market. This trend drives niche products, like omega-3 supplements tailored to cardiovascular health, cognitive support, or skin regeneration.

Fish oil supplements are not treated as an all-around product but as a specialized product taking care of the individual's health needs. The companies are reacting by launching new products with varied levels of EPA and DHA content and other functional ingredients, such as turmeric, collagen, or antioxidants, to boost their therapeutic values.

Growth of Omega-3 Fortified Foods and Beverages

Demand for omega-3 enhanced food and beverage items in Australia increases, considering growing functional foods as the driver in boosting demand due to greater wellbeing benefits for users. Incorporating fish oil in such common items like milk and other diary-related items; bar snackers and cereals prepared for breakfasts, in non-dairy and milk-replacer types including vegetable milk preparations.

These fortified products appeal to consumers who may not wish to take supplements but still wish to reap the benefits of omega-3 fatty acids. This trend follows the general trend of consumers' desire for convenience and multitasking in health. Food manufacturers innovate to put fish oil into products that consumers use regularly, so they can offer the combined benefit of nutrition and taste.

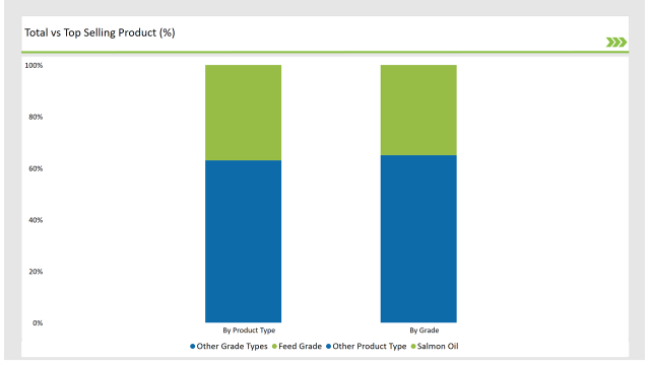

% share of Individual categories by Product Type and Grade in 2025

Salmon oil emerged as the front-runner in the Australian fish oil market due to the unique set of health benefits and consumer preferences for high-quality products, in addition to being applied in various markets.

Still, its increased demand is above health benefits since Australian consumers show more interest in premium and highly bioavailable supplements. The major reason why salmon oil leads is because people have awakened to the fact that its nutritional profile is much better than that of other fish oils.

The feed grade segment of fish oil leads the Australian market because of its critical role in the thriving aquaculture industry and the growing demand for high-quality animal feed. This segment is primarily due to the growing aquaculture industry, which has emerged as a key sector in addressing both domestic and international seafood needs.

Aquaculture in Australia is growing very rapidly, due to the rising demand for sustainable and high-protein food products. Feed grade fish oil with its high levels of omega-3 is one of the major contributors to growth rates, health, and overall quality of farmed fish. Furthermore, feed grade fish oil is increasingly used in other farm animals such as poultry, livestock, and pets, which are leading to cross-industry demand.

Note: The above chart is indicative in nature

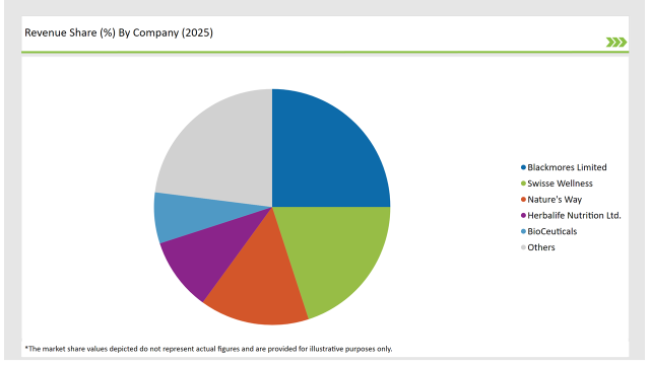

Tier 1 companies in Australian fish oil are the strongest industries, including the greatest market shares, prominent branding, and wide distribution. These are some of the most significant multinational firms and huge homegrown firms which have invested billions of money in R&D and production capacity along with trust on their consumers' minds.

Tier 2 players of the Australian fish oil market are smaller companies that specialize in niches. They mainly cater to a segment of consumer or premium offering that created niches for them. Product differentiation is experienced through niche-oriented products such as fish oil supplements for pets, sports nutrition, and detailed health issues concerning cognitive or eye health.

Tier 3 companies are smaller players or even start-ups focused on niche areas within the Australian fish oil market. Most of these firms focus on targeting regional markets or specific consumers, such as people looking for more affordable fish oil products or those of a certain exclusivity, for instance, krill oil and cod liver oil.

The industry includes various grade such as feed grade, food grade, and pharma grade.

The industry includes various product type such as salmon oil, tuna oil, cod liver oil, sardine oil, squalene oil, krill oil, anchovy oil, menhaden oil and others.

The industry includes various process such as crude fish oil, refined fish oil, and modified fish oil.

As per the end use segment, the market is segregated into aqua-feed, food and beverages, dietary supplements, cosmetic and beauty products.

By 2025, the Australia Fish Oil market is expected to grow at a CAGR of 17.8%.

By 2035, the sales value of the Australia Fish Oil industry is expected to reach USD 233.3 million.

Key factors propelling the Australia Fish Oil market include Expansion of the aquaculture industry driving feed grade fish oil consumption, innovations in fish oil extraction and purification technologies, growing consumer awareness of fish oil benefits for joint and skin health and rising demand for omega-3 supplementation in health-conscious consumers.

Prominent players in Australia Fish Oil manufacturing include Blackmores Limited, Swisse Wellness, Nature's Way, Nutraceutical Corporation, Herbalife Nutrition Ltd., PhytoLove, BioCeuticals, Cenovis, Healthy Care, Australian Fish Oil Company, and Nutra-Life, among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Australia Pallet Wraps Market Size and Share Forecast Outlook 2025 to 2035

Australia and South Pacific islands Tourism Market Size and Share Forecast Outlook 2025 to 2035

Australia Legal Cannabis Market - Size, Share, and Forecast 2025 to 2035

Australia Probiotic Supplements Market Trends – Growth, Demand & Forecast 2025–2035

Australia Chickpea Protein Market Outlook – Demand, Trends & Forecast 2025–2035

Australia Non-Dairy Creamer Market Outlook – Size, Demand & Forecast 2025–2035

Australia Chitin Market Analysis – Growth, Size & Forecast 2025–2035

Australia Bubble Tea Market Trends – Size, Share & Forecast 2025–2035

Australia Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

Australia Non-Alcoholic Malt Beverages Market Insights - Trends & Forecast 2025 to 2035

Australia Food Testing Services Market Growth – Trends, Demand & Innovations 2025–2035

Australia Food Emulsifier Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Pulses Market Report – Trends, Demand & Industry Forecast 2025–2035

Australia Probiotic Strains Market Growth – Trends, Demand & Innovations 2025–2035

Australia Frozen Ready Meals Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Yerba Mate Market Growth – Trends, Demand & Innovations 2025–2035

Australia Sweetener Market Analysis – Size, Share & Forecast 2025–2035

Australia Food Service Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Yeast Extract Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Canned Tuna Market Insights – Demand, Size & Industry Trends 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA