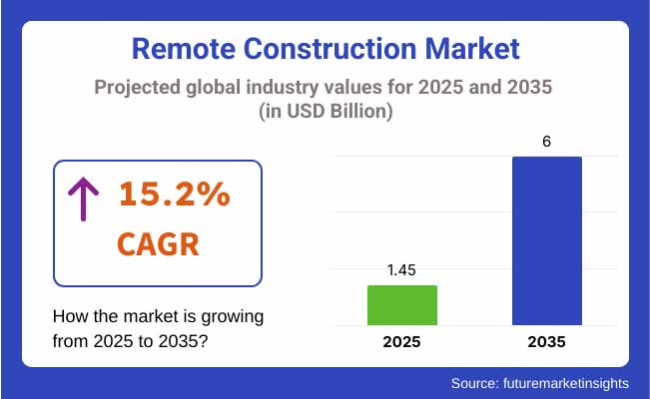

The remote construction market is estimated to be worth USD 1.45 billion in 2025 and anticipated to reach a value of USD 6 billion by 2035. Sales are projected to rise at a CAGR of 15.2% over the forecast period between 2025 and 2035. The industry is experiencing a profound change that could be attributed to technological progress, labor shortages, and the necessity of cost-efficient and effective construction solutions.

One of the main drivers of this transformation is automation and robotics that have significantly improved production rates and lowered human errors. These advances have already started to change the way projects are executed and overseen.

Need for construction in faraway places or hazardous areas has been particularly the main reason for the use of remote technologies. Because these areas often have dangers to human workers, construction methods are a good option for this. Additionally, the lack of skilled workers especially in going countries has urged the need for industries to incorporate such technologies.

Initial huge investments in advanced technologies such as drones, AI machines, and autonomous equipment are some of the major issues that small businesses face. The performance of remote technologies in extreme weather conditions and complex environments is also a question that arises regarding their long-term practicality and efficiency.

Cybersecurity is another challenge in the industry. The use of interlinked devices and web-based applications makes the companies prone to data breaches and system errors. These are really important for keeping the operations intact and effective, showing it is necessary for the sector to have the right cybersecurity steps in place.

The industry is constantly offering many chances mainly due to the progressive environmental concerns. Remote technologies can without difficulty minimize waste, energy consumption, and the environmental effects of construction projects. Quite the contrary, as the need for eco-friendly infrastructure keeps attracting more and more clients, remote construction methods are directly responsible for this in their development of the green urban setting.

Some of the trends that are budding and are associated with a remote construction might be the increased application of augmented reality (AR) and virtual reality (VR) for enhancing design visualization and collaboration. Moreover, the deployment of IoT devices for real-time equipment monitoring is now more common. The modular and offsite construction methods are also frequently favored, which, in turn, drives up the industry further.

The industry has witnessed a rising need for integration of technology, especially in automation, remote monitoring, and the use of drones. The manufacturers, being pioneers in creating these advanced technologies, have the topmost priority to ensure their solutions are extremely integrated and compliant with safety standards.

Distributors are concerned with keeping costs down while providing a consistent supply of construction equipment and materials to distant locations. Since these locations tend to have specific logistical issues, supply reliability is paramount for distributors to prevent project delays.

Contractors value technology integration and flexibility in projects since they require solutions that can adjust to diverse, most of the time challenging, settings. Scalability of projects through remote scaling with few onsite personnel is an essential aspect for cost-saving and effective solutions by contractors.

End users, who are usually project owners or investors, are mostly interested in industry demand and cost. Although safety and compliance are essential, the interest is more in getting the projects done on schedule and within budget.

Summary of notable developments in the market for 2024 and 2025

| Organization | Investment Value (USD Million) |

|---|---|

| Australian Government | USD 54 Million |

| UK Cabinet Office | USD 103,136 Million |

| Commonwealth Bank of Australia (CBA) | Not specified |

| Queensland Government | USD 530 Million |

In 2024 and early 2025, the industry saw several significant projects that increased efficiency, lowered costs, and addressed housing shortages. Prefabricated and modular homes are a key focus, both on the Australian Government's National Housing Accord, which has resolved to invest USD 54 million in prefabrication and modular homes over the next 12 months and on the agenda of several governments worldwide, as those jurisdictions seek to meet ambitious housing targets.

Other developments also point towards a similar strategic shift, including the UK Cabinet Office's USD 103,136 million framework contract for offsite construction, which indicates intent to drive the delivery of offsite solutions in the public sector.

The rise of financial institutions who are embracing the trend of prefabricated housing to get more people in homes sooner than before by developing conducive mortgage solutions (Commonwealth Bank of Australia) And areas including Queensland show that policy changes seek to deliver better procurement practices and value for money in big infrastructure projects.

These capabilities are indicative of a nascent movement in construction whereby the industry is embracing remote and offsite construction techniques to accelerate project delivery and respond to pressing infrastructure needs.

There has been a massive boom in the industry between 2020 and 2024 in the development of digital technologies, automation and modular construction methods. Other technologies such as Building Information Modeling (BIM), drones, and IoT-equipped machines have improved efficiency by enabling remote monitoring of a building project through real-time data analysis.

Since the outbreak of COVID-19, the trend towards remote project management and prefabricated construction service grew, reducing on-site labor force without affecting project continuity. Green-building practices including use of sustainable materials and energy-efficient building practices have also gained momentum. Governmental investment and private investment in infrastructure, especially outstanding in remote areas, has contributed to industry development.

Thus, the offsite construction industry is going to evolve even more in the next 2025 to 2035 decade with an added touch of artificial intelligence enablement, robotics and digital twin technology in place. Automation and machine learning will optimize processes and be cost effective.

In all fields, use of 3D printing in `building construction' is must, this technology will become more popular as it will provide a comparatively faster and cheaper building plan, very helpful for post disaster rebuilding plans and low cost housing development.

New developments in virtual reality (VR) and augmented reality (AR) will also allow for remote and collaborative planning and training. As the world continues to be increasingly sustainability-conscious, the use of net-zero energy buildings and circular construction will foray into that of the industry. Demand for this type of remote construction solutions will also see long-term growth in the near future as smart town planning and regulatory incentives take place.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Adoption rocketed as pandemic-induced demand for social distancing resulted in companies deploying remote project management software and site monitoring remotely. | Mass diffusion of end-to-end digital building ecosystems, benefiting from cloud systems, IoT, and robotics-based efficiency and accuracy. |

| Legislation mandated site safety and compliance checks remotely using digital means. | Increased compliance needs fueling automation reporting, online safety audits, and AI-driven risk analysis. |

| Drone and wearables use for inspections at sites and worker safety. | Advanced automation, autonomous equipment, and digital twins as part of construction processes. |

| First adaptation in planning and resource planning. | AI-based project life cycle management using predictive analytics for cost management and schedule optimization. |

| Stand-alone solutions with minimum integration platform-wise. | Smooth integration with ERP, BIM (Building Information Modeling), and smart sites with IoT-enabled construction. |

The global industry is ready for massive expansion because of the development of technology and automation, as well as the shortage of labor. Nonetheless, the possibilities of the industry might be affected by several risks such as technological constraints, regulatory issues, cybersecurity attacks, supply chain disruptions, and difficulties in employee adaptation.

One of the major risks in this industry equals technological intervention. Although technologies like drones, robotics, and autonomous machinery are transforming construction, the first capital investment and the technical expertise required for automation are high. The majority of the companies might face the challenge of using and maintaining the machines correctly, causing extra costs and operational inefficiencies.

An increasing threat of cybersecurity violations arises as the industry depends more on digital systems and data interchange. Construction sites that have remote operation techniques typically harness cloud-based systems, which among others are responsible for greater data theft or hacking incidents that can result in the wastage of money and the loss of sensitive information. The introduction of cybersecurity best practices, routine audits, and employee training will be crucial in this regard.

The risk of supply chain interruptions is also worth noting, mainly because of the reliance on the prompt delivery of equipment and materials. Logistics delays, raw materials shortage, etc., which are the parting reasons for the disrupted global supply chain can deliver a different outcome during the project period, such as delays and cost overruns. However, forming strategic partnerships with reliable suppliers and setting up alternative sources will support businesses' capacity to deal with any disruption.

Remote Construction Solutions Segment holds Dominating Market Share

| Component | Share (2025) |

|---|---|

| Remote Construction Solutions | 65.3% |

By 2025, the remote construction solutions segment will lead the industry with 65.3%, far ahead of the remote construction services segment, which will take 34.7% of the industry. Remote construction solutions are becoming industry-leading firms since they are more in need of high-end technologies that allow remote management and execution of construction work.

These include everything from drones, robots, and 3D printing to building information modeling (BIM) systems. Industry leaders Caterpillar, Komatsu, and Terex Corporation have since pioneered the development of remote-controlled machinery and equipment, thus reducing labor requirements on-site while being more efficient and safer.

Monitoring construction timelines, finances, and activities in real time without human intervention would necessitate the use of smart construction software and far-distance monitoring platforms.

The anomalous acceleration that remote solutions are attaining is the increasing digitalizing trend in the construction sector and the common wish to reduce human exposure to hazardous working conditions. The pace will continue to escalate as companies compete to attain the utmost productivity, safety of employees, and ease of operation. Remote construction solutions also enable real-time data collection and analysis, which ensures that project managers make well-informed decisions and simplify the construction process.

Conversely, remote construction services will hold 34.7% of the industry in 2025. Such services cover remote project management, virtual consulting, and remote site inspections, usually facilitated by technologies such as video conferencing and augmented reality. Bechtel, Jacobs Engineering, and WSP Global are some of the companies providing these services, helping clients remotely manage construction projects through digital platforms and communication tools.

Remote construction services are particularly useful in regions with limited access to skilled professionals or where on-site presence is not feasible, such as in the COVID-19 pandemic situation or in remote locations.

Remote Management Segment is Fastest Growing in the Market

| Application | CAGR (2025 to 2035) |

|---|---|

| Remote Management | 16.6% |

Between 2025 and 2035, the remote management application will witness the highest growth at a CAGR of 16.6%, followed by communications at a CAGR of 12%.

Through the use of technologies like artificial intelligence (AI) and cloud-based platforms, construction firms are able to track progress, monitor equipment and machinery, and manage resources in real-time without being physically present.

Significant players in such software include Trimble, Autodesk, and Hexagon, which offer advanced software that results in more effective remote management, thereby minimizing costs and risks and increasing the time needed overall to deliver the project. Increased demand for infrastructure projects on a large scale that spans remote or rugged locations and the push for construction operational efficiency are also fueling growth for this application.

In addition, remote management also becomes a crucial contributor to enhanced safety, enabling site inspections by supervisors and engineers, monitoring the performance of equipment, and identifying possible hazards without necessarily being on the site. This is especially vital in risky or hard-to-reach environments where site inspection cannot be undertaken or would be unsafe to conduct.

Communications, growing at a CAGR of 12%, will also witness significant growth with the growing requirement for secure and assured communication interfaces among project team members, contractors, and clients located at distant points. Remote communication interfaces like video conferencing, augmented reality (AR), and virtual reality (VR) facilitate real-time collaboration and decision-making, including on the farthest construction sites.

Lead firms like Cisco, Microsoft, and Zoom are enhancing the communication terrain in construction so that all participants remain connected every step of the way, independent of their geographic location. All these innovations enhance the ability to overcome the shortcomings of distance and varying time zones, thereby accelerating collaboration and the minimization of project delays.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 8.2% |

| UK | 7.5% |

| France | 6.8% |

| Germany | 7% |

| Italy | 6.3% |

| South Korea | 8% |

| Japan | 7.2% |

| China | 9.5% |

| Australia | 7.8% |

| New Zealand | 6.5% |

The USA industry is predicted to experience phenomenal growth at a CAGR of 8.2% from 2025 to 2035. Growth is mainly driven by rapid innovation in automation, construction technology solutions backed by IoT, and the surge in demand for smart infrastructure.

Large corporations are investing heavily in AI-powered remote construction equipment, minimizing labor dependence significantly and increasing efficiency. Apart from this, the government initiative towards the development of smart cities and infrastructure enhancement also boosts the industry's growth. The ongoing adoption of 5G technology also facilitates seamless connectivity for distant building works, adding to the industry opportunity.

The UK industry will register a CAGR of 7.5% from 2025 to 2035. Stringent environmental regulations and the emphasis on green buildings have the maximum impact on remote technology adoption in the nation. The government's drive to reduce carbon emissions has resulted in increased uptake of prefabrication and modular construction techniques, which are largely reliant on remote monitoring.

Moreover, the increasing labor shortage in the industry has led firms to invest in automated and robotic building solutions to guarantee efficiency and reduce project costs.

France is likely to achieve a CAGR of 6.8% in the industry during 2025 to 2035. Increased adoption of digital twin technology and artificial intelligence in the construction industry is one of the key growth drivers. Emphasis on building smart infrastructure and rigorous building codes facilitating automation of the construction process through France are also the key drivers.

In addition, development in the direction of reconstruction of cities and an increase in PPPs in the rebuilding of construction processes are providing remote construction solutions with new opportunities.

Germany's industry will advance at a CAGR of 7.0% through the forecast period. The nation's robust manufacturing and engineering prowess is the key driver of the industry growth. Germany is a leader in Industry 4.0, and its application in the construction sector has resulted in the development of highly automated building sites. In addition, the extra push towards energy-efficient building solutions, supported by government subsidies and incentives, is encouraging innovation in remote-controlled and AI-driven building machinery.

Italy's industry is projected to register a 6.3% CAGR from 2025 to 2035. The growth is on the basis of the increasing demand for infrastructure rehabilitation work, particularly in seismic zones. Demand for remote-controlled equipment is driven by the aging infrastructure in Italy and government spending on intelligent construction technology. The conservation focus of the country on heritage sites has also promoted precision-based remote construction techniques to preserve old monuments undamaged.

South Korea is anticipated to experience a CAGR of 8.0% over the industry forecast period. The country's strong focus on technology-based construction, particularly on smart cities and high-tech infrastructure, is primarily driving growth. The government leads efforts to adopt AI, robotics, and IoT in construction activities further to promote the development of the industry. Also, large South Korean corporations are investing in the direct production of autonomous building machines and drones to enhance building locations in terms of efficiency and safety.

Japan's industry is likely to grow with a CAGR of 7.2% from 2025 to 2035. With the declining Japanese workforce coupled with increasing building requirements, the sector is quickly placing automation and remote machinery as central components. The country has led the world in the application of robotics in construction, with the leading companies employing AI-powered excavators, cranes, and drones.

Additionally, Japan's vulnerability to natural disasters has led to the widespread utilization of remote technologies in disaster relief efforts and infrastructure support processes.

China is poised to witness the fastest growth in the industry during the forecast period at a CAGR of 9.5%. China's mass urbanization and infrastructural developments, such as the Belt and Road Initiative, are major drivers of this growth. Government smart construction policies and mechanization upscaling are making the industry expand in an integrated way.

China's pioneering leadership in AI and the spread of robots are also making incorporation in a seamless way possible for cutting-edge remote construction solutions in mass schemes.

The Australian sector is expected to develop at a CAGR of 7.8% throughout the 2025 to 2035 forecast period. Australia's vast and remote areas facilitate growth and construction, where operational efficiency makes it imperative to apply automation and remote technologies. The mining and energy sectors are major industries contributing to the demand for remote equipment. Investment in infrastructure development and digitalization initiatives by the Australian government is also leading the industry.

New Zealand's remote building sector is anticipated to advance at 6.5% CAGR through the forecast period. The nation's emphasis on earthquake-resistant infrastructure and sustainable building techniques is the chief growth impetus of the industry.

Digital building techniques such as Building Information Modeling (BIM) and distant monitoring systems are increasingly being utilized in the sector by organizations aiming to become more efficient at lesser capital expenditure. Furthermore, New Zealand's regulatory push towards more sustainable building materials is propelling the industry's adoption of automated and remote-controlled technologies.

The industry is growing competitive as the leading players utilize digital technologies to improve project management, remote site monitoring, and equipment operation. Major players currently merging include AI-driven analytics and cloud-based project management systems, as well as IoT-connected sensors, to carry out effective work operations with reduced dependence on labor and improve operation safety.

Industry leaders set up installations apart through automation, predict maintenance, and real-time data analytics in direct resource allocation and execution of a project. The partnerships between construction firms and technology providers are hastening the implementation of solutions that remote monitoring, drones for site surveillance, and AR/VR-based training can achieve in remote workforce management.

Those companies that adopt solutions for remote operations but that deliver the development as scalable, interoperable, and fortified by cybersecurity will be able to compete better.

Established companies grow through acquisition or cooperation with software developers, while startups and niche players pursue AI-based automation and robotics to modernize construction workflows. In addition, the competition comes with the revolution from Building Information Modeling (BIM) and twin technology, represented in modeling better presentations of development and simulations in real-time.

Compliance, data security, and effective integration with existing systems are such differentiators. Those solutions with added good support services and a well-scaled digital infrastructure are likely to dominate the industry. With the ambiguity of remote construction solutions, the success upon which the infrastructure will be built is based on technological advancements, interoperability, and adaptable environments for diverse projects.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Trimble Inc. | 20-25% |

| Topcon Corporation | 15-20% |

| Hexagon AB | 12-18% |

| Autodesk, Inc. | 10-15% |

| Oracle Corporation | 8-12% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Trimble Inc. | Provides cloud-based construction management tools, remote site monitoring, and GPS-based equipment tracking. Integrates IoT for real-time insights. |

| Topcon Corporation | Specializes in remote surveying and precision measurement solutions. Offers drone-based site inspection and 3D mapping tools. |

| Hexagon AB | Focuses on digital twins and autonomous construction solutions. Uses AI-driven analytics for project optimization. |

| Autodesk, Inc. | Offers Building Information Modeling (BIM) solutions that support real-time collaboration and remote project tracking. |

| Oracle Corporation | Provides cloud-based construction management software, integrating AI to improve project scheduling and risk management. |

Key Company Insights

Trimble Inc. (20-25%)

Trimble leads the industry with its end-to-end management solutions. The company integrates GPS technology, cloud-based collaboration tools, and IoT sensors to provide real-time insights into project performance.

Topcon Corporation (15-20%)

Topcon excels in remote surveying and precision measurement. Its solutions integrate GNSS (Global Navigation Satellite Systems) and drones for aerial site inspections, ensuring accuracy in large infrastructure projects.

Hexagon AB (12-18%)

Hexagon stands out with its focus on digital twins, virtual replicas of construction sites that update in real-time, providing a comprehensive view of site conditions. Hexagon’s Leica Geosystems offers laser scanning and AI-driven analytics to identify potential project risks early.

Autodesk, Inc. (10-15%)

Autodesk’s BIM 360 and Autodesk Construction Cloud have become essential tools for project management. These platforms enable real-time collaboration across teams, streamlining workflows from design to execution.

Oracle Corporation (8-12%)

Oracle’s cloud-based construction solutions, including Primavera P6 and Oracle Aconex, empower project managers to track progress, manage resources, and predict risks remotely. Oracle’s strength lies in its data-driven project management tools, which offer insights into cost overruns, scheduling delays, and safety risks.

Other Key Players (20-30% Combined)

In terms of component, the segment is categorized into remote construction solutions, remote construction services (planning & preparation, integration & deployment, consulting, support & maintenance, others).

In terms of application, the segment is classified into remote management, construction management, communications, and others.

In terms of end-use industry, the segment is categorized into construction, energy & utilities, mining, and others.

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & pacific, Middle East and Africa (MEA) have been covered in the report.

The industry is expected to reach USD 1.45 billion in 2025.

The industry is projected to grow to USD 6 billion by 2035.

China is expected to experience significant growth with a 9.5% CAGR during the forecast period.

The remote construction solutions segment is one of the most popular categories in the industry.

Leading companies include Trimble Inc., Topcon Corporation, Hexagon AB, Autodesk, Inc., Oracle Corporation, Procore Technologies, Bentley Systems, Faro Technologies, Bluebeam, Inc., and PlanGrid (Autodesk Subsidiary).

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by End-use Industry , 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by End-use Industry , 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by End-use Industry , 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by End-use Industry , 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by End-use Industry , 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by End-use Industry , 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by End-use Industry , 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by End-use Industry , 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Component, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End-use Industry , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End-use Industry , 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End-use Industry , 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End-use Industry , 2023 to 2033

Figure 17: Global Market Attractiveness by Component, 2023 to 2033

Figure 18: Global Market Attractiveness by Application, 2023 to 2033

Figure 19: Global Market Attractiveness by End-use Industry , 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Component, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by End-use Industry , 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by End-use Industry , 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by End-use Industry , 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by End-use Industry , 2023 to 2033

Figure 37: North America Market Attractiveness by Component, 2023 to 2033

Figure 38: North America Market Attractiveness by Application, 2023 to 2033

Figure 39: North America Market Attractiveness by End-use Industry , 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Component, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by End-use Industry , 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by End-use Industry , 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End-use Industry , 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End-use Industry , 2023 to 2033

Figure 57: Latin America Market Attractiveness by Component, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 59: Latin America Market Attractiveness by End-use Industry , 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Component, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by End-use Industry , 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by End-use Industry , 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by End-use Industry , 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by End-use Industry , 2023 to 2033

Figure 77: Europe Market Attractiveness by Component, 2023 to 2033

Figure 78: Europe Market Attractiveness by Application, 2023 to 2033

Figure 79: Europe Market Attractiveness by End-use Industry , 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by End-use Industry , 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by End-use Industry , 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by End-use Industry , 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by End-use Industry , 2023 to 2033

Figure 97: South Asia Market Attractiveness by Component, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 99: South Asia Market Attractiveness by End-use Industry , 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by End-use Industry , 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by End-use Industry , 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by End-use Industry , 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by End-use Industry , 2023 to 2033

Figure 117: East Asia Market Attractiveness by Component, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 119: East Asia Market Attractiveness by End-use Industry , 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Component, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by End-use Industry , 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by End-use Industry , 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by End-use Industry , 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by End-use Industry , 2023 to 2033

Figure 137: Oceania Market Attractiveness by Component, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 139: Oceania Market Attractiveness by End-use Industry , 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Component, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by End-use Industry , 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by End-use Industry , 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by End-use Industry , 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by End-use Industry , 2023 to 2033

Figure 157: MEA Market Attractiveness by Component, 2023 to 2033

Figure 158: MEA Market Attractiveness by Application, 2023 to 2033

Figure 159: MEA Market Attractiveness by End-use Industry , 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Remote Assist Headrest Market Size and Share Forecast Outlook 2025 to 2035

Remote Endarterectomy Devices Market Size and Share Forecast Outlook 2025 to 2035

Remote Electrocardiogram Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Remote Valve Tissue Expanders Market Size and Share Forecast Outlook 2025 to 2035

Remote Patient Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Remote Imaging Collaboration Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Remote Operated Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Remote DC Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Remote Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Remote Towers Market Size and Share Forecast Outlook 2025 to 2035

Remote AF Detection Tools Market Analysis Size and Share Forecast Outlook 2025 to 2035

Remote Vehicle Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Remote Home Monitoring Systems Market Size and Share Forecast Outlook 2025 to 2035

Remote Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Remote Learning Technology Spending Market Analysis by Technology Software, Technology Services, Learning Mode, End User and Region Through 2025 to 2035

Remote Sensing Services Market Trends - Growth & Forecast 2025 to 2035

Remote Cooled Cube Ice Machines Market – Advanced Refrigeration & Industry Growth 2025 to 2035

Remote Healthcare Market - Growth & Innovations 2025 to 2035

Remote Patient Monitoring Devices Market – Growth & Forecast 2024-2034

Remote Desktop Software Market Insights – Growth & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA