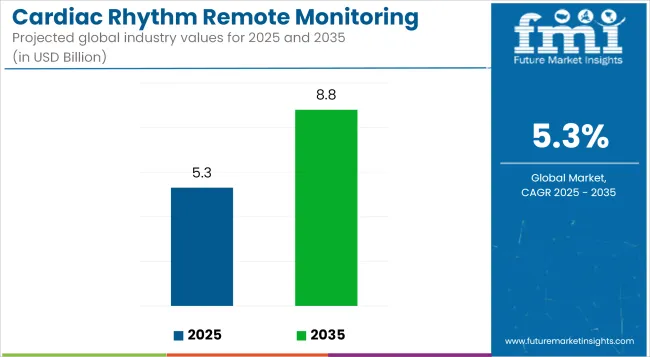

The Cardiac Rhythm Remote Monitoring Devices Market is anticipated to be valued at USD 5.3 billion in 2025 and is expected to reach USD 8.8 billion by 2035, registering a CAGR of 5.3%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 5.3 billion |

| Industry Value (2035F) | USD 8.8 billion |

| CAGR (2025 to 2035) | 5.3% |

The Cardiac Rhythm Remote Monitoring Devices market is witnessing a transformative shift, propelled by the integration of AI-driven diagnostics, cloud-based platforms, and the growing emphasis on outpatient care. Healthcare providers are increasingly adopting these devices to facilitate early detection of arrhythmias, reduce hospital readmissions, and enhance patient outcomes.

The transition from traditional in-clinic monitoring to remote, real-time surveillance is driven by the need for continuous cardiac data analytics and interoperability with electronic health records. This evolution is further supported by the rising prevalence of cardiovascular diseases and the demand for cost-effective, patient-centric solutions.

The market's growth trajectory is underpinned by technological advancements, such as wearable and implantable devices capable of long-term monitoring, and the expansion of telehealth services. These factors collectively position the market for sustained growth, as stakeholders prioritize innovations that enhance diagnostic accuracy and patient engagement.

Prominent players in the Cardiac Rhythm Remote Monitoring Devices market include Medtronic, Boston Scientific, Abbott, BIOTRONIK, and iRhythm Technologies. These companies are at the forefront of developing advanced monitoring solutions that combine hardware innovations with sophisticated software analytics.

In April 2025, LifeSignals launched the UbiqVue 2AYe Holter System, a single-use, wearable biosensor that records continuous 2-channel ECG and symptom data over a five-day monitoring period. "UbiqVue Holter is the first Holter system purpose‑built for the digital age, by stripping away workflow complexity, cost barriers, and other operational hurdles, it turns our vision of anytime, anywhere wireless patient monitoring from hospital beds to living rooms into a practical reality for population health delivery.” said Surendar Magar, co‑founder and CEO of LifeSignals.

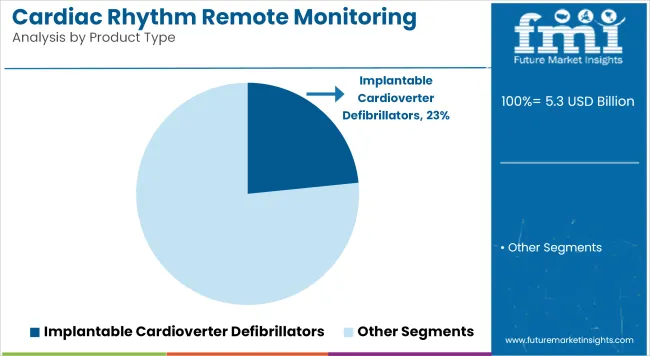

Implantable Cardioverter Defibrillators (ICDs) are estimated to account for 23.4% of the revenue share in 2025, making them the largest contributor by product type. This dominance is attributed to the increasing global burden of sudden cardiac arrest and life-threatening arrhythmias.

ICDs have been preferred for their proven ability to detect and correct abnormal rhythms instantly, improving survival outcomes in high-risk patients. Adoption has been further supported by strong guideline recommendations from cardiac societies in North America and Europe.

Additionally, ICDs are often equipped with remote monitoring capabilities, which allow for early detection of device- or condition-related complications. Reimbursement policies and government-funded programs in developed regions have also expanded patient access. These factors collectively have positioned ICDs as an indispensable component in modern rhythm management protocols.

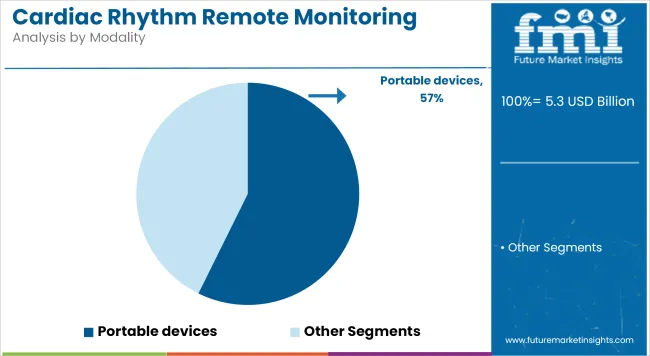

In 2025, portable devices are projected to hold a 57.3% revenue share, dominating the market by modality. Their widespread adoption has been driven by the demand for real-time monitoring in ambulatory and homecare settings.

These devices have been equipped with wireless technologies, enabling continuous ECG data transmission to healthcare providers. As a result, earlier diagnosis and management of arrhythmias have been made possible outside hospital environments. Increasing preference for wearable cardiac patches, mobile telemetry systems, and smartphone-linked monitors has also contributed to growth.

Furthermore, the COVID-19 pandemic accelerated the shift toward remote care models, reinforcing the utility of portable rhythm monitoring solutions. Improved patient compliance, comfort, and diagnostic accuracy have helped portable devices maintain their leading market position.

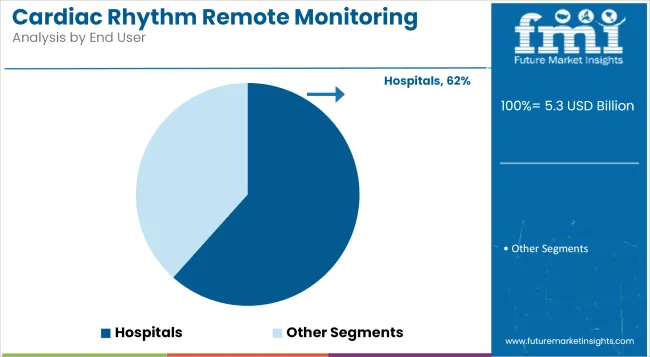

Hospitals are projected to command a 61.6% share of the market by end user in 2025, making them the leading delivery channel for cardiac rhythm remote monitoring devices. This trend has been shaped by the high volume of implantable device procedures performed in hospital settings, including ICD and CRT placements.

Hospitals have also been favored due to their ability to offer continuous telemetry and post-procedural monitoring through advanced infrastructure. Comprehensive access to electrophysiologists and multidisciplinary care teams further enhances device management and outcome tracking.

Moreover, partnerships with remote monitoring service providers have enabled hospitals to extend follow-up care beyond discharge. Reimbursement advantages and inclusion in clinical trials have also positioned hospitals as the preferred point of care for cardiac rhythm monitoring solutions.

Fragmented Data Integration and Interoperability Slowing Clinical Adoption Impeding Market Expansion

A core challenge limiting growth in the cardiac rhythm remote monitoring devices market is the lack of standardized data integration frameworks across healthcare systems. While advanced monitoring devices generate valuable rhythm intelligence, their interoperability with diverse electronic medical records (EMRs) remains inconsistent.

Hospitals and outpatient clinics often face integration delays due to mismatched data formats and proprietary software ecosystems, leading to underutilization of collected telemetry. This disconnect not only affects real-time clinical decision-making but also hinders scalable deployment across multi-site healthcare networks.

Additionally, smaller providers struggle to invest in IT infrastructure upgrades required to support continuous cardiac monitoring workflows. These barriers suppress the full clinical and economic utility of remote monitoring, particularly in mid-sized practices and resource-limited regions.

Until a unified data-sharing protocol becomes widespread, device manufacturers will face elongated onboarding cycles, reduced device usage rates, and missed opportunities for real-time, AI-supported rhythm management-stalling overall market acceleration despite rising demand.

Integration with Virtual Cardiology Networks and AI-Backed Diagnostic Services

The rising prevalence of decentralized cardiology care is opening new opportunities in the cardiac rhythm remote monitoring devices market. Virtual cardiology networks consisting of telecardiology hubs, app-based follow-ups, and cloud-connected diagnostics are emerging as high-utility distribution channels for remote monitoring systems.

These setups prioritize devices capable of continuous rhythm surveillance, automatic arrhythmia classification, and real-time data transfer to centralized dashboards. Particularly in regions like North America and Southeast Asia, private cardiac care platforms are actively onboarding AI-integrated monitoring tools to enable diagnostic-as-a-service models. These models not only increase access to rhythm analysis in under-served areas but also allow device vendors to monetize insights, not just hardware.

There’s also rising potential for subscription-based partnerships, where manufacturers bundle devices with predictive analytics, maintenance, and user support. As virtual-first cardiac care expands, these integrated solutions present high-value, scalable opportunities for vendors to go beyond transactional sales and position themselves as clinical data partners.

Market Outlook

The United States remains the most commercially mature market for cardiac rhythm remote monitoring devices, fueled by the nation’s aggressive adoption of digital cardiology services and chronic disease management platforms. Clinics, hospitals, and cardiology groups are prioritizing remote rhythm detection tools that integrate seamlessly into EMR systems and clinical dashboards.

AI-enhanced arrhythmia detection and real-time patient alerts are being used to improve care coordination and reduce rehospitalization rates. In addition, device providers are pushing innovations in wearable sensor comfort, wireless data syncing, and long-battery-life models. The rise of decentralized care, telecardiology, and at-home monitoring kits reflects the demand for more flexible patient engagement models.

Market Growth Factors

Market Forecast

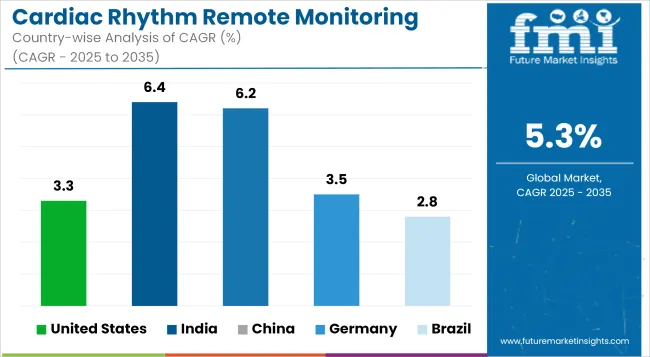

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.3% |

Market Outlook

India’s cardiac rhythm remote monitoring devices market is in a fast-growth phase, driven by the urbanization of healthcare and the expansion of private cardiology networks. The country is seeing rising demand for affordable, scalable monitoring solutions suited for high-volume cardiac outpatient loads.

Local manufacturers are developing cost-effective devices with simplified mobile connectivity and cloud backup to address infrastructure gaps. Meanwhile, telehealth adoption in tier-1 and tier-2 cities is enabling physicians to remotely track arrhythmias in post-operative and chronic care patients. The emphasis is on portable, user-friendly wearables that deliver uninterrupted rhythm data at a low operational cost.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 6.4% |

Market Outlook

China’s cardiac rhythm remote monitoring devices market is evolving quickly, backed by aggressive digital health infrastructure development and growing cardiovascular disease prevalence. Government incentives for AI-enabled medical devices are accelerating the introduction of smart ECG patches and handheld monitors.

Urban health tech startups and large hospital networks are experimenting with cloud-connected platforms that deliver continuous cardiac telemetry. Increasing demand from secondary cities has opened new channels for domestic device makers, who are focusing on producing affordable wearables optimized for local language apps and national data servers. The market is being shaped by a blend of public health strategies and consumer-driven demand for proactive cardiac diagnostics.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.2% |

Market Outlook

Germany represents a highly structured and quality-sensitive market for cardiac rhythm remote monitoring devices, with strong clinical emphasis on diagnostic precision and compliance with EU health tech regulations. Hospitals and specialist cardiology centers increasingly rely on CE-certified continuous rhythm monitoring tools integrated with hospital information systems (HIS).

The shift toward home-based cardiac care, especially for elderly patients, is boosting demand for devices with remote data transmission and clinician alert features. Germany’s centralized reimbursement policies further encourage providers to adopt long-term monitoring systems for high-risk cardiovascular patients as part of post-discharge care pathways.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.5% |

Market Outlook

Brazil is emerging as a potential key point in the Latin America cardiac rhythm remote monitoring devices market driven by private sector expansion and increasing emphasis on remote cardiac diagnostic. Mobile-connected ECG Monitor Adoption Trend Cardiologists working at private clinics and diagnostic centers have adopted mobile-connected ECG monitors at a higher pace.

More patients at risk of arrhythmias are now being monitored at home, alleviating the burden of hospital admissions and enhancing the delivery of chronic care. Access is being extended, particularly in urban and semi-urban areas, through local distributors working alongside international brands to provide user-friendly, wearable monitoring solutions.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 2.8% |

The global Cardiac Rhythm Remote Monitoring Devices Market is witnessing robust growth, driven by rising incidences of cardiovascular diseases, technological advancements in wearable and implantable devices, and increasing emphasis on remote patient management.

Major companies are focusing on innovation, AI-driven analytics, and integration with digital health platforms to gain competitive advantage. North America leads in market share, while Asia-Pacific shows high growth potential due to expanding healthcare infrastructure and adoption of remote monitoring technologies.

The market is segmented into Implantable Cardioverter Defibrillator (ICD) Devices, Implantable Defibrillator, External Defibrillator, Manual External Defibrillator, Automated External Defibrillator, Cardiac Resynchronization Therapy (CRT) Devices, Implantable Cardiac Monitors (ICMs), and Implanted Hemodynamic Monitor.

The market is segmented into Portable Devices and Non-Portable Devices.

The market is segmented into Long-Term Care Centers, Specialized Clinics, and Hospitals.

The Cardiac Rhythm Remote Monitoring Devices Market is analyzed across North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

The overall market size for cardiac rhythm remote monitoring devices market was USD 5.3 billion in 2025.

The cardiac rhythm remote monitoring devices market is expected to reach USD 8.8 billion in 2035.

Integration of AI-powered analytics into remote monitoring platforms is enhancing diagnostic precision, making these devices essential tools in modern cardiology workflows.

The top key players that drives the development of cardiac rhythm remote monitoring devices market are Medtronic, Abbott, Boston Scientific, BIOTRONIK and GE Healthcare.

Implantable cardioverter defibrillator (ICD) devices is expected to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cardiac Rehabilitation Market Size and Share Forecast Outlook 2025 to 2035

Cardiac Valvulotome Market Size and Share Forecast Outlook 2025 to 2035

Cardiac Ultrasound Systems Market - Trends & Forecast 2025 to 2035

Cardiac Biomarker Diagnostic Test Kits Market Analysis – Trends & Forecast 2025 to 2035

Cardiac Reader System Market Growth – Trends & Forecast 2019 to 2027

Cardiac Medical Device Market

Cardiac Assist Devices Market Growth – Trends & Forecast 2025 to 2035

Cardiac Surgery Devices Market Analysis – Trends & Forecast 2024-2034

Cardiac Ambulatory Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Cardiac Rhythm Management Market Insights - Trends & Forecast 2024 to 2034

Cardiac Rhythm Management Devices Market Size and Share Forecast Outlook 2025 to 2035

Cardiac Monitoring And Cardiac Rhythm Management Devices Market Size and Share Forecast Outlook 2025 to 2035

Intracardiac Echocardiography Market Insights - Growth & Forecast 2025 to 2035

Intracardiac Imaging Market Trends – Industry Growth & Forecast 2024-2034

Mobile Cardiac Telemetry System Market Size and Share Forecast Outlook 2025 to 2035

MRI-Guided Cardiac Ablation Market Size and Share Forecast Outlook 2025 to 2035

Continuous Cardiac Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Companion Animal Cardiac Drugs Market Size and Share Forecast Outlook 2025 to 2035

Biorhythmic Skincare Actives Market Size and Share Forecast Outlook 2025 to 2035

Circadian Rhythm Sleep Disorders Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA