The Cardiac Assist Devices Market is projected to witness substantial growth from 2025 to 2035, driven by rising cardiovascular disease prevalence, technological advancements in cardiac support systems, and increased adoption of minimally invasive procedures. These devices are crucial in managing end-stage heart failure, bridging patients to transplantation, and providing long-term circulatory support.

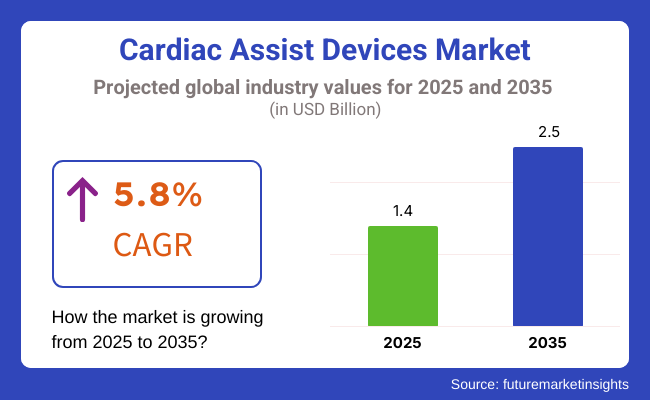

The market is estimated to be worth USD 1.4 Billion in 2025 and is expected to grow to USD 2.5 Billion by 2035, with a CAGR of 5.8% during the forecast period. The global increase in heart failure cases, aging population, and growing awareness about advanced treatment options are contributing to the market expansion.

The rising demand for left ventricular assist devices (LVADs), right ventricular assist devices (RVADs), and total artificial hearts (TAHs) highlights the market’s significant potential. Additionally, ongoing research in fully implantable and biocompatible cardiac assist solutions is expected to drive further adoption.

With the integration of AI-based monitoring systems, remote patient management solutions, and next-generation wearable cardiac support devices, manufacturers are focusing on enhancing efficiency, patient outcomes, and post-surgical monitoring. The shift toward non-invasive and percutaneous ventricular assist devices (VADs) is another trend shaping the market's future.

The Left Ventricular Assist Device (LVAD) and Intra-Aortic Balloon Pump (IABP) segments hold a significant share in the cardiac assist devices market, as cardiovascular specialists, heart failure centers, and hospitals increasingly rely on mechanical circulatory support (MCS) systems to enhance cardiac function, improve survival rates, and reduce hospital readmissions in patients with advanced heart failure.

These devices play a critical role in managing end-stage heart disease, post-cardiac surgery recovery, and high-risk percutaneous coronary interventions (PCI), ensuring long-term patient stability and improved quality of life.

Left Ventricular Assist Devices (LVADs) have emerged as a cornerstone in mechanical circulatory support (MCS) for patients with advanced heart failure, providing sustained cardiac output, reduced ventricular workload, and improved hemodynamic stability. Unlike temporary cardiac support devices, LVADs serve as long-term solutions, supporting patients awaiting heart transplants (bridge-to-transplant), those ineligible for transplants (destination therapy), and individuals recovering from acute heart failure episodes (bridge-to-recovery).

The growing incidence of end-stage heart failure (HF) has driven demand for LVAD implantation, as the shortage of donor hearts for transplantation necessitates durable, implantable cardiac assist devices to extend patient survival and maintain functional independence. Advanced LVAD models, featuring miniaturized pump designs, fully magnetically levitated rotors, and AI-powered hemodynamic sensors, have improved device longevity, reduced thrombosis risks, and enhanced patient mobility.

The expanding adoption of LVADs in heart failure treatment guidelines has increased healthcare provider awareness, procedural expertise, and reimbursement coverage for LVAD therapy, ensuring greater accessibility and patient eligibility for long-term cardiac support. Clinical studies indicate that LVAD implantation significantly reduces hospitalizations, improves exercise tolerance, and enhances quality of life in patients with reduced ejection fraction heart failure (HFrEF).

The development of fully implantable LVADs with wireless energy transfer technology represents a groundbreaking advancement in MCS, eliminating the need for percutaneous driveline connections, reducing infection risks, and improving patient lifestyle integration. Researchers continue to explore next-generation LVAD innovations, including bioengineered heart pumps, wearable LVAD controllers, and AI-driven heart failure progression monitoring, ensuring continuous market expansion.

Despite their life-saving benefits, LVADs face challenges related to surgical implantation complexity, anticoagulation therapy requirements, and device thrombosis risks. However, technological advancements in biocompatible LVAD coatings, non-invasive LVAD parameter adjustments, and wireless power transmission solutions are improving device safety, patient adherence, and long-term therapy success, ensuring sustained market growth for LVAD-based heart failure management.

Intra-Aortic Balloon Pumps (IABPs) have gained strong market adoption, particularly in acute heart failure, cardiogenic shock, and post-cardiac surgery hemodynamic stabilization, as healthcare providers seek minimally invasive, cost-effective mechanical circulatory support solutions for critically ill patients. Unlike LVADs, which provide continuous circulatory support, IABPs function as counterpulsation devices, enhancing myocardial oxygen perfusion, reducing left ventricular afterload, and improving cardiac output without direct cardiac intervention.

The widespread use of IABPs in interventional cardiology and cardiac surgery has fueled demand for balloon pump-assisted circulatory support in high-risk percutaneous coronary interventions (PCI), post-myocardial infarction (MI) recovery, and perioperative cardiac support during complex valve replacement surgeries. Portable, catheter-based IABPs allow for rapid bedside insertion in catheterization labs, emergency rooms, and intensive care units (ICUs), ensuring immediate hemodynamic stabilization in critically ill cardiac patients.

The growing prevalence of ischemic heart disease (IHD), acute coronary syndrome (ACS), and cardiogenic shock has further driven demand for IABP therapy as an adjunct to pharmacological heart failure management. Studies indicate that early IABP placement in cardiogenic shock patients improves coronary perfusion, preserves left ventricular function, and increases survival rates when used in combination with percutaneous coronary intervention (PCI).

The development of percutaneous, fully automated IABPs with intelligent pressure regulation and remote hemodynamic monitoring capabilities has improved device efficiency, physician control, and patient safety, ensuring optimized real-time cardiac support without continuous manual adjustments. Researchers continue to explore miniaturized IABP designs, balloon pump coatings for reduced clot formation, and AI-powered hemodynamic assessment algorithms, ensuring next-generation innovations in intra-aortic counterpulsation therapy.

Despite their clinical advantages, IABPs face challenges such as limited efficacy in patients with severe aortic regurgitation, contraindications in aortic dissection cases, and dependency on external drive units. However, advancements in catheter-based IABP placement techniques, hybrid IABP-LVAD therapy strategies, and AI-assisted balloon inflation timing optimization are improving device safety, efficacy, and broader clinical applicability, ensuring continued market growth for IABP-based cardiac assist therapy.

The transcutaneous and implantable modality types represent the largest market drivers, as healthcare providers seek versatile, patient-specific mechanical circulatory support solutions tailored to different stages of heart failure progression, acute cardiac events, and long-term cardiac rehabilitation.

Transcutaneous cardiac assist devices have become a primary intervention in acute cardiac failure management, cardiogenic shock, and high-risk interventional cardiology procedures, providing rapid, temporary circulatory support without requiring open-heart surgery. Unlike implantable devices, transcutaneous MCS systems offer flexible deployment options, allowing bedside initiation, catheter-based insertion, and extracorporeal circulation control in intensive care settings.

The growing adoption of extracorporeal membrane oxygenation (ECMO) and percutaneous ventricular assist devices (pVADs) has fueled market demand for transcutaneous cardiac assist solutions, enabling short-term cardiac and respiratory support in critically ill patients. Hybrid ECMO-IABP therapy strategies have improved survival rates in refractory cardiogenic shock patients, ensuring enhanced hemodynamic stabilization and myocardial recovery support.

The development of wireless, wearable transcutaneous cardiac assist devices has further expanded home-based cardiac rehabilitation, ambulatory heart failure management, and remote cardiac monitoring capabilities, reducing hospitalization rates and improving patient quality of life. Researchers continue to explore bioengineered wearable cardiac pumps, artificial heart development, and AI-powered transcutaneous hemodynamic control systems, ensuring next-generation advancements in non-invasive cardiac assist therapies.

Despite their clinical benefits, transcutaneous cardiac assist devices face challenges such as infection risks from prolonged catheter placement, limited long-term viability, and high procedural costs. However, advancements in catheter-based MCS miniaturization, AI-driven hemodynamic monitoring, and improved anticoagulation strategies are improving device safety, efficacy, and patient adherence, ensuring continued market expansion for transcutaneous cardiac assist solutions.

Implantable cardiac assist devices have gained strong market adoption, particularly in end-stage heart failure management, bridge-to-transplant therapy, and destination therapy applications, as heart failure specialists seek durable, life-extending mechanical circulatory support solutions. Unlike transcutaneous devices, implantable cardiac assist systems offer fully integrated, long-term cardiac augmentation, reducing dependency on external circulation control units.

The introduction of fully implantable LVADs with wireless power transmission technology has transformed heart failure management, eliminating the need for percutaneous driveline connections and reducing infection risks. Patients with implantable LVADs experience improved hemodynamic function, increased exercise capacity, and prolonged survival, ensuring enhanced long-term outcomes for heart failure patients.

Despite their life-saving potential, implantable cardiac assist devices face challenges related to surgical complexity, anticoagulation management, and limited patient eligibility criteria. However, emerging innovations in fully artificial heart technology, AI-powered implantable cardiac assist control systems, and biocompatible VAD coatings are improving device performance, safety, and long-term efficacy, ensuring continued growth for implantable cardiac assist therapies.

North America is expected to hold a dominant share in the cardiac assist devices market, supported by high healthcare expenditure, advanced medical infrastructure, and strong regulatory frameworks. The United States and Canada have been at the forefront of developing and adopting innovative cardiac assist technologies, primarily due to the rising prevalence of heart failure and growing organ transplant waiting lists.

The FDA's regulatory approvals for newer-generation LVADs, expanding reimbursement policies, and increased adoption of remote patient monitoring technologies have accelerated market growth. Furthermore, investments in artificial heart research and clinical trials for next-generation circulatory support devices are positioning the region as a hub for cardiac assist device innovation.

The emergence of AI-powered predictive analytics in cardiac care, along with the integration of telemedicine platforms for post-surgical patient management, is expected to drive further market expansion in North America.

Europe holds a significant market share, led by Germany, the UK, France, and Italy, where cardiovascular disease (CVD) rates are among the highest. The rising burden of heart failure and the growing number of elderly patients requiring long-term circulatory support are major factors fuelling demand for ventricular assist devices (VADs) and artificial hearts.

The European Union's (EU) emphasis on medical innovation, research in biocompatible implants, and funding for heart failure treatment programs is driving the adoption of next-generation cardiac assist devices. Additionally, improvements in healthcare reimbursement structures and access to advanced cardiac care in public healthcare systems are supporting market growth.

The development of compact, wearable, and battery-efficient cardiac assist devices, alongside the introduction of hybrid mechanical circulatory support solutions, is expected to create new opportunities for manufacturers in the region.

Asia-Pacific is projected to experience the fastest growth in the cardiac assist devices market, attributed to increasing incidences of cardiovascular diseases, growing medical device adoption rates, and expanding healthcare infrastructure. Countries like China, India, Japan, and South Korea are emerging as key markets due to rising healthcare investments and an increasing aging population susceptible to heart conditions.

The expansion of specialized cardiac care hospitals, government-funded initiatives to improve heart failure treatment, and increased awareness about advanced cardiac support options are driving the demand for VADs and implantable cardiac support systems. Moreover, ongoing collaborations between international medical device manufacturers and regional healthcare providers are facilitating access to innovative cardiac assist technologies in developing economies.

The adoption of AI-driven cardiac monitoring systems and cloud-based remote patient management solutions is further strengthening market growth, ensuring better post-implantation care and long-term monitoring for patients.

Challenges

High Cost of Cardiac Assist Devices: Advanced ventricular assist devices and artificial hearts are expensive, making accessibility a major challenge in developing economies.

Risk of Device-Related Complications: Infections, thrombosis, device malfunction, and stroke risks are major concerns that impact patient safety and regulatory approvals.

Stringent Regulatory Approval Processes: Strict compliance requirements for cardiac assist devices, particularly in regions like North America and Europe, can delay market entry and increase R&D costs.

Limited Organ Transplant Availability: The shortage of heart donors for transplant patients increases the reliance on cardiac assist devices, but long-term dependence on mechanical circulatory support remains challenging.

Opportunities

Advancements in Artificial Heart Technology: Next-generation fully implantable artificial hearts and bioengineered heart assist devices are opening new opportunities for long-term circulatory support solutions.

Growth in Minimally Invasive and Percutaneous VADs: The development of transcutaneous and minimally invasive cardiac assist solutions is expanding the market by reducing surgical complications and hospital stays.

AI-Driven Cardiac Monitoring and Predictive Analytics: The integration of AI-based analytics in cardiac care and remote patient monitoring platforms is improving early detection of device failures and patient outcomes.

Expansion of Telemedicine and Home Healthcare Solutions: The adoption of remote monitoring technologies for patients with implanted cardiac assist devices is supporting cost-effective and long-term patient management strategies.

Between 2020 and 2024, the cardiac assist devices market experienced substantial growth due to the rising prevalence of heart failure, cardiomyopathy, and coronary artery disease (CAD). The increasing incidence of end-stage heart failure (HF), coupled with a global shortage of donor hearts for transplantation, led to a surge in demand for ventricular assist devices (VADs), intra-aortic balloon pumps (IABPs), and total artificial hearts (TAHs).

Cardiologists and cardiothoracic surgeons relied on these mechanical circulatory support (MCS) devices to improve cardiac output and systemic circulation in patients awaiting heart transplants or those ineligible for transplantation.

Regulatory bodies such as the USA Food and Drug Administration (FDA), European Medicines Agency (EMA), and the American Heart Association (AHA) accelerated approvals for next-generation cardiac assist devices, focusing on long-term durability, infection prevention, and reduced chromogenic risks.

The integration of miniaturized, percutaneous, and wireless cardiac support systems improved patient mobility and reduced complications related to prolonged device implantation. Percutaneous ventricular assist devices (pVADs), such as Impella and TandemHeart, gained widespread adoption in acute myocardial infarction (AMI) patients and cardiogenic shock cases, ensuring short-term hemodynamic stabilization.

Technological advancements in magnetically levitated (MagLev) blood pumps, bioengineered cardiac support devices, and AI-driven hemodynamic monitoring enhanced device efficiency and patient outcomes. The development of wearable and remotely monitored VADs enabled clinicians to track real-time cardiac function and optimize pump settings, reducing the risk of device-related complications such as thrombosis, infection, and mechanical failure.

Additionally, improvements in power transmission technologies, including wireless transcutaneous energy transfer (TET) systems, eliminated the need for external driveline cables, reducing the risk of driveline infections-a major concern in long-term VAD therapy.

Despite advancements, the market faced challenges such as high costs, limited accessibility in developing regions, and the need for lifelong anticoagulation therapy in VAD patients. Many heart failure patients, particularly in low- and middle-income countries, struggled to afford advanced mechanical circulatory support devices. Moreover, the complexity of device implantation, long-term management, and risks associated with pump thrombosis, stroke, and gastrointestinal bleeding continued to pose challenges.

However, as next-generation fully implantable cardiac assist devices, AI-enhanced remote monitoring solutions, and bioengineered heart tissues advanced, cardiac assist therapy became more effective, minimally invasive, and accessible to a broader patient population.

Between 2025 and 2035, the cardiac assist devices market will undergo transformative advancements driven by biomechanical engineering, AI-powered cardiac support systems, and regenerative medicine. The evolution of smart, bio-integrated cardiac assist devices, AI-driven hemodynamic optimization, and fully implantable artificial hearts will redefine heart failure management, bridge-to-transplant solutions, and long-term circulatory support therapy.

The development of autonomous, AI-powered VADs will enable real-time adaptive hemodynamic regulation, automatically adjusting blood flow rates and pump speeds based on physiological demands. AI-enhanced sensor-based VAD monitoring systems will track biomarkers of heart function, oxygenation levels, and thrombosis risk, providing early warnings of device malfunctions and optimizing treatment protocols.

Quantum computing-powered patient-specific cardiac modelling will improve personalized device programming, ensuring optimal cardiac support while minimizing complications.

The widespread adoption of bio printed, bio hybrid, and tissue-engineered artificial hearts will eliminate the reliance on mechanical blood pumps, reducing the need for lifelong anticoagulation therapy and mechanical wear-related failures. Scientists will develop 3D-bioprinted cardiac scaffolds, integrating living cardio myocytes and endothelial cells, allowing the creation of functional, patient-specific heart structures for long-term heart failure management. The introduction of gene therapy-enhanced cardiac tissue regeneration will further delay or eliminate the need for mechanical circulatory support in early-stage heart failure patients.

Wireless, fully implantable energy transfer systems for cardiac assist devices will become the standard, eliminating external driveline cables and significantly reducing infection risks and hospital readmissions. Next-generation wearable and bioelectronic cardiac support devices, powered by self-charging nanogenerators and biocompatible energy-harvesting materials, will provide non-invasive, continuous circulatory support without requiring surgical implantation.

AI-assisted telecardiology and remote VAD management platforms will further improve long-term patient monitoring, allowing clinicians to adjust device settings remotely and optimize therapy based on real-time patient health data.

Regenerative medicine will play a pivotal role in the future of heart failure treatment, with advancements in stem cell-derived cardiomyocyte transplantation, gene-edited cardiac tissue engineering, and AI-driven regenerative therapy modelling. Scientists will develop personalized, patient-specific biotherapeutics capable of reversing heart muscle degeneration and restoring native cardiac function, reducing dependence on mechanical circulatory support devices.

The integration of CRISPR-based gene editing and AI-assisted regenerative heart modelling will enable early intervention and disease modification strategies, preventing the progression of heart failure in high-risk patients.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Regulatory agencies accelerated approvals for miniaturized VADs, next-generation TAHs, and AI-driven hemodynamic monitoring devices. |

| Technological Advancements | VADs and artificial hearts integrated magnetic levitation, remote monitoring, and percutaneous circulatory support for improved outcomes. |

| Industry Applications | Cardiac assist devices were widely used in heart failure management, bridge-to-transplant therapy, and cardiogenic shock treatment. |

| Adoption of Smart Equipment | Hospitals, heart failure clinics, and transplant centres relied on wearable hemodynamic monitoring, AI-assisted cardiac support programming, and remote VAD tracking. |

| Sustainability & Cost Efficiency | High device costs, frequent hospital readmissions, and limited availability of donor hearts impacted treatment affordability. |

| Data Analytics & Predictive Modelling | AI-driven real-time VAD function tracking, thrombosis risk prediction, and hemodynamic adaptation algorithms optimized device efficiency. |

| Production & Supply Chain Dynamics | Market challenges included supply chain disruptions, high production costs for cardiac assist devices, and limited donor heart availability. |

| Market Growth Drivers | Growth was driven by rising heart failure prevalence, increasing demand for donor heart alternatives, and advancements in mechanical circulatory support. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-powered autonomous cardiac assist device regulations, bio printed heart transplantation guidelines, and remote VAD monitoring compliance frameworks will redefine patient management. |

| Technological Advancements | Fully autonomous AI-driven VADs, bioengineered heart scaffolds, and quantum computing-based cardiac failure modelling will revolutionize mechanical circulatory support. |

| Industry Applications | Expansion into bio hybrid artificial hearts, AI-driven regenerative cardiology, and fully implantable wireless circulatory assist devices will reshape the industry. |

| Adoption of Smart Equipment | Wireless energy transfer-enabled artificial hearts, AI-powered cardiac biometrics monitoring, and bioelectronic circulatory assist devices will enhance long-term heart failure therapy. |

| Sustainability & Cost Efficiency | AI-driven cost-optimized heart failure therapy, self-sustaining bio hybrid heart implants, and decentralized circulatory support systems will improve accessibility and sustainability. |

| Data Analytics & Predictive Modelling | Quantum-assisted cardiac disease modelling, AI-powered predictive heart failure intervention, and real-time bio hybrid heart regeneration analytics will enhance predictive healthcare. |

| Production & Supply Chain Dynamics | AI-optimized cardiac assist device manufacturing, decentralized bioengineered heart tissue production, and block chain-enabled VAD component supply chains will improve global availability. |

| Market Growth Drivers | The rise of AI-powered cardiac support robotics, gene therapy-enhanced heart regeneration, and smart bio hybrid circulatory assist devices will drive future expansion. |

The Cardiac Assist Devices Market in the United States is experiencing steady growth, driven by the rising prevalence of heart failure, advancements in mechanical circulatory support systems, and increasing adoption of minimally invasive cardiac assist technologies. The American Heart Association (AHA) estimates that over 6.2 million adults in the USA suffer from heart failure, creating a significant demand for ventricular assist devices (VADs), intra-aortic balloon pumps (IABPs), and total artificial hearts (TAHs).

One of the key market drivers is the rising number of patients awaiting heart transplants, as VADs serve as both a bridge-to-transplant (BTT) and destination therapy (DT). The United Network for Organ Sharing (UNOS) reports over 3,500 patients on the heart transplant waiting list annually, further driving demand for long-term mechanical circulatory support devices.

The adoption of minimally invasive cardiac assist devices, such as percutaneous ventricular assist devices (pVADs), is increasing in high-risk percutaneous coronary intervention (PCI) procedures, improving survival rates and post-operative recovery.

Additionally, leading manufacturers like Abbott, Medtronic, and Abiomed are investing in next-generation heart pumps, integrating AI-based remote monitoring and real-time hemodynamic assessment technologies to enhance patient management.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.1% |

The Cardiac Assist Devices Market in the United Kingdom is growing due to rising cardiovascular disease burden, increasing adoption of mechanical circulatory support (MCS) devices, and government initiatives to improve cardiac care.

Heart disease remains one of the leading causes of mortality in the UK, with the British Heart Foundation reporting that 7.6 million people live with heart or circulatory conditions, creating strong demand for ventricular assist devices (VADs), intra-aortic balloon pumps (IABPs), and total artificial hearts (TAHs).

The UK’s National Health Service (NHS) is investing heavily in advanced cardiac care technologies, expanding access to ventricular assist device implants and mechanical circulatory support programs in specialized heart centres. The growing preference for minimally invasive VADs in high-risk cardiac patients is leading to the adoption of percutaneous heart pumps and temporary assist devices in catheter-based interventions.

Additionally, the emergence of AI-powered predictive analytics for heart failure management is improving post-implantation monitoring and patient outcomes.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.7% |

The Cardiac Assist Devices Market in the European Union is expanding due to increasing government initiatives for heart failure management, rising adoption of VADs, and advancements in artificial heart technologies. The EU’s Horizon Europe Program, with €5 billion allocated for cardiovascular research and medical device innovation, is fostering developments in long-term MCS devices, heart pump miniaturization, and AI-driven cardiac monitoring solutions.

Germany, France, and Italy are leading in cardiac assist device adoption, with specialized heart failure centres integrating next-generation VADs and total artificial heart (TAH) systems for end-stage heart failure patients.

The rising number of elderly patients with severe heart conditions is driving increased use of destination therapy (DT) VADs, reducing dependence on heart transplants.

Additionally, the development of bioengineered heart pumps and hybrid circulatory support devices is expanding treatment options for patients with complex cardiovascular conditions.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.8% |

The Cardiac Assist Devices Market in Japan is growing due to the aging population, increasing prevalence of heart failure, and government-backed investments in cardiovascular research.

Japan has one of the oldest populations in the world, with over 28% of citizens aged 65 and above, leading to a higher incidence of heart failure and end-stage cardiovascular diseases. The Japanese government has allocated ¥400 billion (USD 3 billion) for cardiovascular innovation, promoting the development of smaller, more efficient cardiac assist devices, including implantable left ventricular assist devices (LVADs) and percutaneous heart pumps.

The adoption of AI-powered hemodynamic monitoring and real-time heart failure prediction models is improving post-implantation management and early risk detection.

Additionally, the expansion of Japan’s robotic-assisted surgical programs is facilitating less invasive implantation of ventricular assist devices (VADs), reducing recovery times and post-surgical complications.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.0% |

The Cardiac Assist Devices Market in South Korea is expanding due to rising cardiovascular disease rates, increasing adoption of AI-driven cardiac monitoring, and strong government investments in medical device innovation.

South Korea’s Ministry of Health and Welfare has committed USD 1.9 billion to cardiovascular research, supporting next-generation ventricular assist devices and smart cardiac monitoring systems. The growing incidence of heart failure and coronary artery disease is driving increased adoption of percutaneous ventricular assist devices (pVADs) for high-risk PCI procedures.

The integration of AI-powered analytics in heart failure risk prediction is improving VAD patient monitoring and reducing hospital readmissions.

Additionally, the development of miniaturized and portable cardiac assist devices is expanding access to mechanical circulatory support for a broader patient population.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.1% |

The cardiac assist devices market is expanding due to increasing demand for mechanical circulatory support solutions in heart failure management, rising cases of cardiovascular diseases (CVDs), and advancements in minimally invasive cardiac therapies.

Companies are focusing on next-generation ventricular assist devices (VADs), total artificial hearts (TAH), and percutaneous heart pumps to enhance cardiac function, improve patient survival rates, and reduce hospitalization duration. The market includes global leaders and specialized cardiovascular device manufacturers, each contributing to technological advancements in long-term and short-term heart support systems.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Abiomed, Inc. (Johnson & Johnson MedTech) | 15-20% |

| Medtronic plc | 12-17% |

| Abbott Laboratories | 10-14% |

| Berlin Heart GmbH | 7-11% |

| Getinge AB (Maquet Cardiovascular) | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Abiomed, Inc. (Johnson & Johnson MedTech) | Develops percutaneous heart pumps (Impella series) for temporary cardiac support in high-risk PCI and cardiogenic shock patients. |

| Medtronic plc | Specializes in left ventricular assist devices (LVADs), total artificial heart (TAH) solutions, and extracorporeal life support (ECLS) systems. |

| Abbott Laboratories | Manufactures HeartMate 3 LVADs and CentriMag acute circulatory support systems, optimizing mechanical circulatory assistance for heart failure patients. |

| Berlin Heart GmbH | Provides EXCOR pediatric and adult ventricular assist devices (VADs) for long-term bridge-to-transplant and recovery. |

| Getinge AB (Maquet Cardiovascular) | Offers intra-aortic balloon pumps (IABPs) and extracorporeal membrane oxygenation (ECMO) devices for cardiac and respiratory support. |

Key Company Insights

Abiomed, Inc. (Johnson & Johnson MedTech) (15-20%)

Abiomed leads the cardiac assist devices market, offering Impella percutaneous heart pumps designed for high-risk PCI, acute heart failure, and cardiogenic shock. The company integrates AI-driven monitoring and catheter-based heart support solutions.

Medtronic plc (12-17%)

Medtronic specializes in LVADs, TAH systems, and extracorporeal life support devices, providing long-term heart failure management solutions. The company is advancing in wearable and minimally invasive cardiac assist technology.

Abbott Laboratories (10-14%)

Abbott develops HeartMate 3 LVADs, CentriMag acute circulatory support, and ECMO-compatible devices, focusing on next-generation heart pump technology for bridge-to-transplant and destination therapy.

Berlin Heart GmbH (7-11%)

Berlin Heart manufactures EXCOR pediatric and adult VADs, specializing in long-term cardiac support for patients awaiting heart transplants. The company emphasizes customized assist devices for pediatric heart failure treatment.

Getinge AB (Maquet Cardiovascular) (5-9%)

Getinge provides IABPs, ECMO systems, and cardiac support solutions, ensuring enhanced myocardial recovery and respiratory support in critical care settings.

Several medical device firms contribute to advanced cardiac assist technologies, AI-powered monitoring systems, and non-invasive heart failure management solutions. These include:

The overall market size for cardiac assist devices market was USD 1.4 billion in 2025.

The cardiac assist devices market is expected to reach USD 2.5 billion in 2035.

The demand for cardiac assist devices will grow due to the rising prevalence of heart failure, increasing geriatric population, advancements in medical technology, and growing adoption of minimally invasive procedures, driving the need for effective circulatory support and improved patient outcomes.

The top 5 countries which drives the development of cardiac assist devices market are usa, uk, europe union, japan and south korea.

Left ventricular assist devices (lvad) and intra-aortic balloon pumps (iabp) drive market to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Modality Type, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Modality Type, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Modality Type, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 13: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 15: Western Europe Market Value (US$ Million) Forecast by Modality Type, 2018 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 17: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 19: Eastern Europe Market Value (US$ Million) Forecast by Modality Type, 2018 to 2033

Table 20: Eastern Europe Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 21: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 23: South Asia and Pacific Market Value (US$ Million) Forecast by Modality Type, 2018 to 2033

Table 24: South Asia and Pacific Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Modality Type, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 29: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 31: Middle East and Africa Market Value (US$ Million) Forecast by Modality Type, 2018 to 2033

Table 32: Middle East and Africa Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Modality Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End-User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Modality Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Modality Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Modality Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 17: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Modality Type, 2023 to 2033

Figure 19: Global Market Attractiveness by End-User, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Modality Type, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by End-User, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Modality Type, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Modality Type, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Modality Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 37: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 38: North America Market Attractiveness by Modality Type, 2023 to 2033

Figure 39: North America Market Attractiveness by End-User, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Modality Type, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by End-User, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Modality Type, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Modality Type, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Modality Type, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Modality Type, 2023 to 2033

Figure 59: Latin America Market Attractiveness by End-User, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) by Modality Type, 2023 to 2033

Figure 63: Western Europe Market Value (US$ Million) by End-User, 2023 to 2033

Figure 64: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 69: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 70: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 71: Western Europe Market Value (US$ Million) Analysis by Modality Type, 2018 to 2033

Figure 72: Western Europe Market Value Share (%) and BPS Analysis by Modality Type, 2023 to 2033

Figure 73: Western Europe Market Y-o-Y Growth (%) Projections by Modality Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 75: Western Europe Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 76: Western Europe Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 77: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 78: Western Europe Market Attractiveness by Modality Type, 2023 to 2033

Figure 79: Western Europe Market Attractiveness by End-User, 2023 to 2033

Figure 80: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 82: Eastern Europe Market Value (US$ Million) by Modality Type, 2023 to 2033

Figure 83: Eastern Europe Market Value (US$ Million) by End-User, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 89: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 90: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 91: Eastern Europe Market Value (US$ Million) Analysis by Modality Type, 2018 to 2033

Figure 92: Eastern Europe Market Value Share (%) and BPS Analysis by Modality Type, 2023 to 2033

Figure 93: Eastern Europe Market Y-o-Y Growth (%) Projections by Modality Type, 2023 to 2033

Figure 94: Eastern Europe Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 95: Eastern Europe Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 96: Eastern Europe Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 97: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 98: Eastern Europe Market Attractiveness by Modality Type, 2023 to 2033

Figure 99: Eastern Europe Market Attractiveness by End-User, 2023 to 2033

Figure 100: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) by Modality Type, 2023 to 2033

Figure 103: South Asia and Pacific Market Value (US$ Million) by End-User, 2023 to 2033

Figure 104: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 109: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 110: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 111: South Asia and Pacific Market Value (US$ Million) Analysis by Modality Type, 2018 to 2033

Figure 112: South Asia and Pacific Market Value Share (%) and BPS Analysis by Modality Type, 2023 to 2033

Figure 113: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Modality Type, 2023 to 2033

Figure 114: South Asia and Pacific Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 115: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 116: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 117: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 118: South Asia and Pacific Market Attractiveness by Modality Type, 2023 to 2033

Figure 119: South Asia and Pacific Market Attractiveness by End-User, 2023 to 2033

Figure 120: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: East Asia Market Value (US$ Million) by Modality Type, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by End-User, 2023 to 2033

Figure 124: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 129: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 130: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Modality Type, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Modality Type, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Modality Type, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 137: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 138: East Asia Market Attractiveness by Modality Type, 2023 to 2033

Figure 139: East Asia Market Attractiveness by End-User, 2023 to 2033

Figure 140: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 141: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 142: Middle East and Africa Market Value (US$ Million) by Modality Type, 2023 to 2033

Figure 143: Middle East and Africa Market Value (US$ Million) by End-User, 2023 to 2033

Figure 144: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 149: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 150: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 151: Middle East and Africa Market Value (US$ Million) Analysis by Modality Type, 2018 to 2033

Figure 152: Middle East and Africa Market Value Share (%) and BPS Analysis by Modality Type, 2023 to 2033

Figure 153: Middle East and Africa Market Y-o-Y Growth (%) Projections by Modality Type, 2023 to 2033

Figure 154: Middle East and Africa Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 157: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 158: Middle East and Africa Market Attractiveness by Modality Type, 2023 to 2033

Figure 159: Middle East and Africa Market Attractiveness by End-User, 2023 to 2033

Figure 160: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cardiac Rehabilitation Market Size and Share Forecast Outlook 2025 to 2035

Cardiac Valvulotome Market Size and Share Forecast Outlook 2025 to 2035

Cardiac Ambulatory Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Cardiac Ultrasound Systems Market - Trends & Forecast 2025 to 2035

Cardiac Biomarker Diagnostic Test Kits Market Analysis – Trends & Forecast 2025 to 2035

Cardiac Rhythm Management Market Insights - Trends & Forecast 2024 to 2034

Cardiac Reader System Market Growth – Trends & Forecast 2019 to 2027

Cardiac Medical Device Market

Cardiac Surgery Devices Market Analysis – Trends & Forecast 2024-2034

Cardiac Rhythm Management Devices Market Size and Share Forecast Outlook 2025 to 2035

Cardiac Rhythm Remote Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Cardiac Monitoring And Cardiac Rhythm Management Devices Market Size and Share Forecast Outlook 2025 to 2035

Intracardiac Echocardiography Market Insights - Growth & Forecast 2025 to 2035

Intracardiac Imaging Market Trends – Industry Growth & Forecast 2024-2034

Mobile Cardiac Telemetry System Market Size and Share Forecast Outlook 2025 to 2035

MRI-Guided Cardiac Ablation Market Size and Share Forecast Outlook 2025 to 2035

Continuous Cardiac Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Companion Animal Cardiac Drugs Market Size and Share Forecast Outlook 2025 to 2035

Assisted Living Software Market by Deployment, Amenity Type, and Region-Forecast through 2035

Assisted Walking Devices Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA